PRESS RELEASE

For immediate release

(Houston, USA) – Tuesday, 28th August 2018 – The world’s most important oil growth region – the Permian Basin – will experience a setback with 345 completions likely to be deferred by the end of 2019 due to pipeline takeaway capacity constraints, according to a new US Drilling & Completion report from Westwood Global Energy Group (Westwood).

Westwood’s quarterly report provides an outlook for key US unconventional basins and contains historical and forecast views [2014-2022]. The report predicts that all the supply chain logistics and capital, which were allocated towards 345 expected completions, will now have to find either new buyers or be stored in a warehouse for a considerable period resulting in additional inventory and maintenance costs.

Westwood expects 2.5 million tons of sand and 5 billion gallons of water will be directly impacted by the deferred completions. Demand for 1.6 million horsepower for pressure pumping will evaporate in the second half of 2018 and $1.4 billion of CAPEX for completion operations will also be delayed or reallocated on other basins such as Eagle Ford, DJ Niobrara, Bakken, and MidCon.

“But, every cloud has a silver lining”, commented Todd Bush Vice President, Commercial at Westwood Global Energy Group. He explained, “Midstream industry, on the other hand, is experiencing a second heyday thanks to unconventional plays. Crude and NGLs need to be moved, often from areas with little or no infrastructure, so you can expect operators to be more creative to find and fund new projects to lessen the current constraint. We estimate $3.1billion in 2018 of CAPEX and $3.6 billion in 2019 will be spent on pipeline construction which equates to a 21% increase from 2017. This also confirms the urgency and the level of activity in the basin needed to alleviate pressure.”

The special report by Westwood quantifies the magnitude of the recent bottleneck in the Permian across the entire drilling and completion supply chain as a result of deferred completions. This includes, for example, expected rig count, forecast for wells drilled and completed by basin, drilled uncompleted wells (DUCs), hydraulic horsepower for the pressure pumping industry, along with frac sand, water and crew impacts by basin.

Westwood’s US Drilling & Completion Q3 2018 report is compiled using Energent and Westwood’s proprietary data. The report is available for purchase as a single report or as part of a subscription – https://www.westwoodenergy.com/product/us-drilling-completion-market-forecast-q3-2018/.

– Ends –

View the product page here

Issued on behalf of Westwood Global Energy Group by Flourish PR Ltd

An abridged executive summary is available for journalists only. For all media enquiries or to arrange an interview please contact: –

Flourish PR Press Office

Flourish PR Ltd

Tel: +44 (0)1628 882 610

Email: [email protected]

Notes to Editors

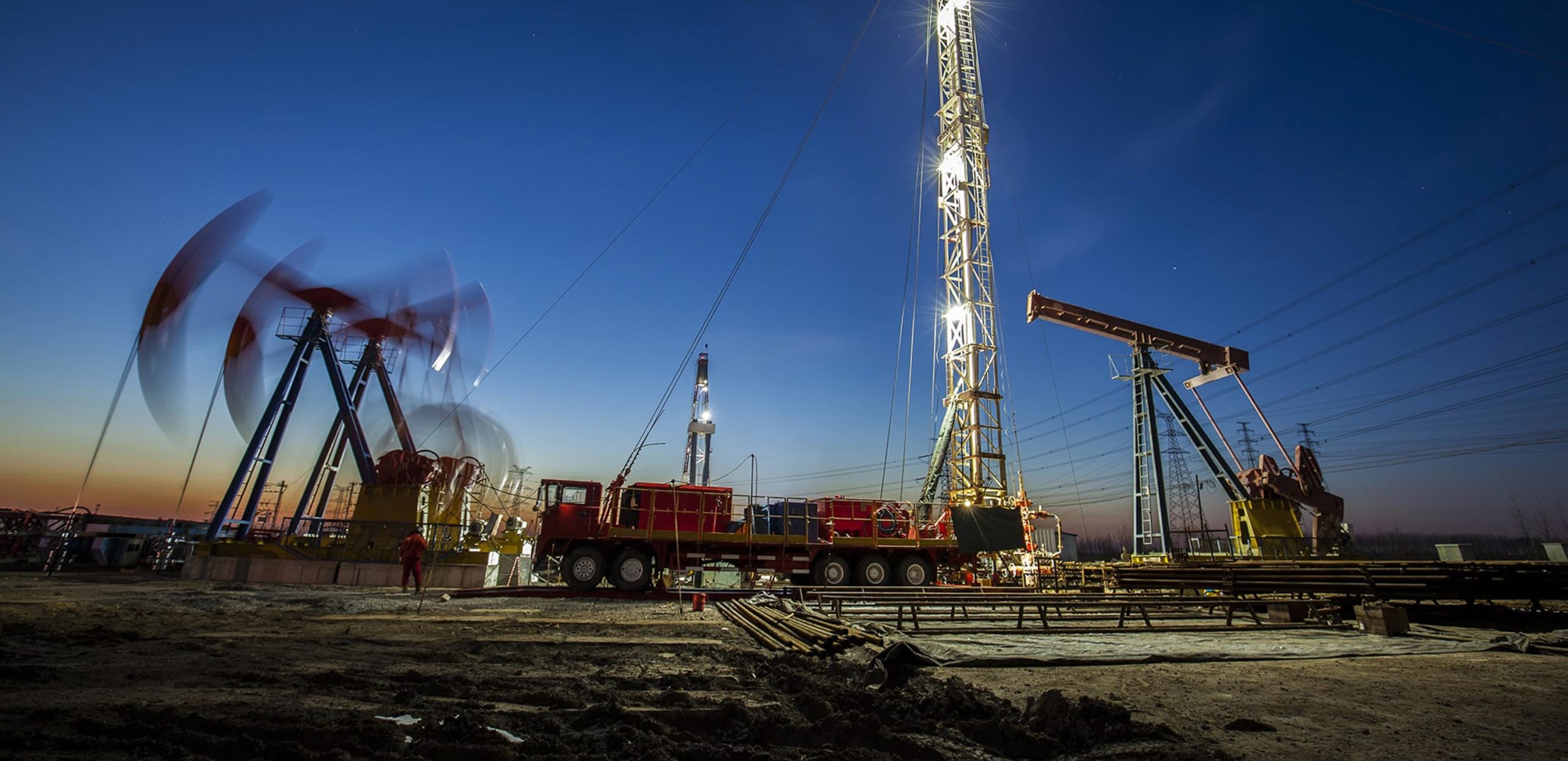

Below are graphs for inclusion if required. Photographs of Todd Bush are available on request. Please contact Flourish PR for more information.

1 The Permian Basin produces 3.4 million barrels of oil per day, approximately 46 per cent of light-tight oil production in the US. Over 500 E&P holdings, 60-75 pressure pumpers, and 13 frac sand companies are engaged in activities there. With 3,546 drilled but uncompleted wells (DUCs) as of Q2 2018 and improving well economics for E&Ps in the basin, the Permian is poised to continue growing.

About Westwood Global Energy Group (Westwood)

Westwood Global Energy Group is a leading provider of research, data analytics and consulting services to the global energy industry. Whilst we focus primarily on intelligence and insight for the worldwide exploration and oilfield services markets, our coverage also extends to the offshore renewables and power generation markets. Our analysis is independent, comprehensive and based on deep sector knowledge.

Westwood Global Energy was formed in January 2015 by Energy Ventures, an energy specialist private equity firm with a vision to build a leading player in the business intelligence and data analytics space. Following an active period of acquisitions, the group has combined the operations of Hannon Westwood, Richmond Energy Partners, Novas Consulting, Douglas-Westwood, Energent Group Software LLC, RigLogix, and JSI Services. Westwood Global Energy Group is headquartered in Aberdeen and has offices in London, Houston and Singapore.

To learn more, please visit www.westwoodenergy.com

About Energent

Energent Group is a market research firm focused on well life-cycle & frac market intelligence—how much sand operators use, who’s pumping, what they’re pumping. We help sales & marketing teams commercialize new products, work with up-to-date operator data, & track well completions in top U.S. shale plays. Energent became part of Westwood Global Energy Group in April 2017.