- A new market forecast launched today by Westwood Global Energy Group sets out a positive outlook for the US Drilling & Completions Market between 2018-2022, based on a number of oil price scenarios.

- Expenditure on completions is out-pacing rig expenditure growth as wells become longer and more complex.

- Under Westwood’s ‘consensus’ oil price expectations1, the US onshore market is likely to experience continued recovery and a period of sustained growth through to 2022.

- In the base case scenario, Oil Field Services (OFS) companies could benefit from expected expenditure of $554bn over 2018-2022, with completions accounting for the largest portion of spend.

(Aberdeen, UK) – Thursday, 12th October 2017 – Westwood Global Energy Group (Westwood), the energy market research consultancy, has published a new market outlook for the US Drilling & Completion Market for the period 2018-2022.

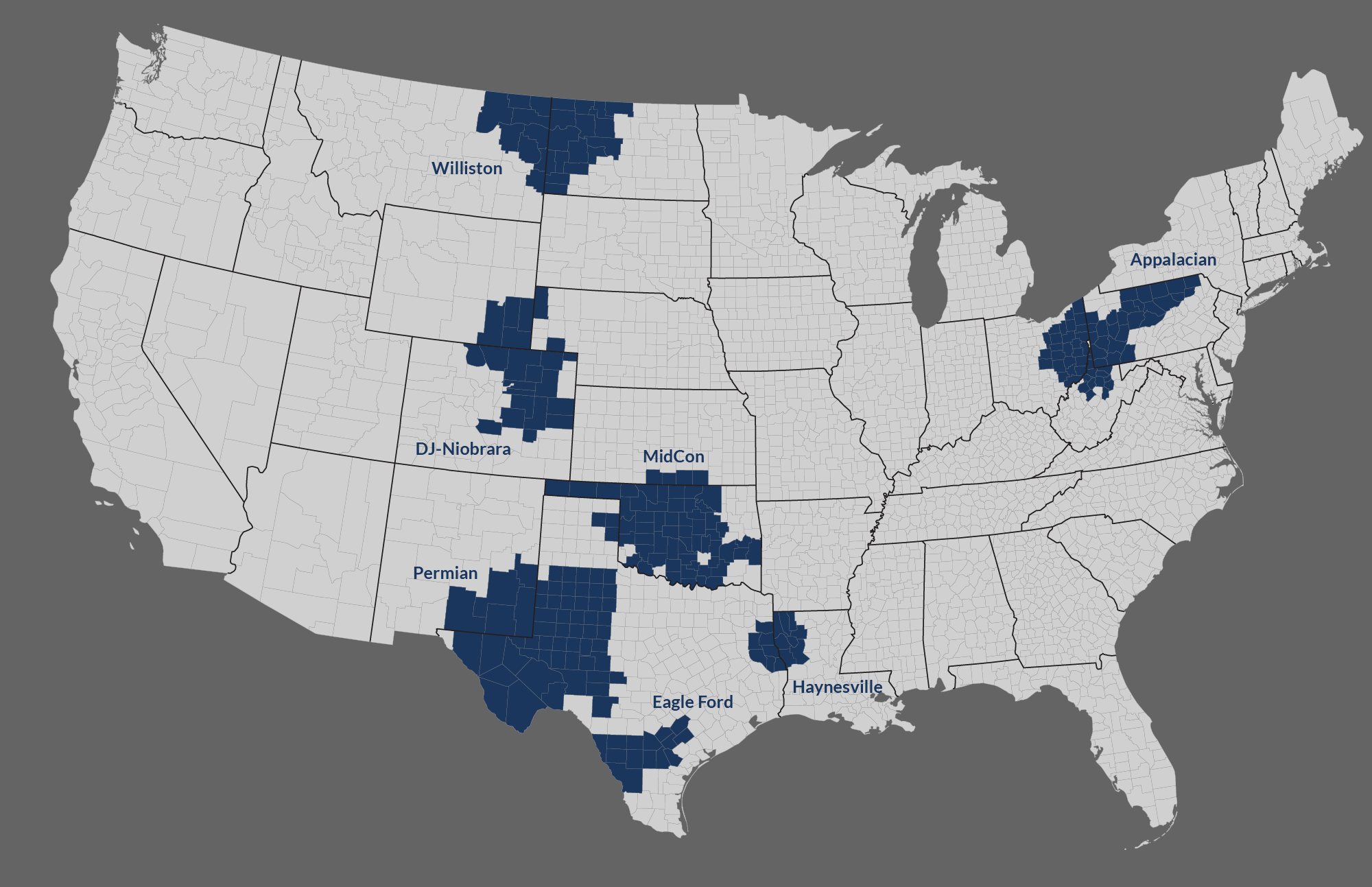

The report is the result of a collaboration between Westwood’s expert OFS team and its most recent acquisition – US energy market research company, Energent. Using Energent’s multi-million-well US onshore database, the report details activity and associated expenditure forecasts for six unconventional oil & gas plays: DJ-Niobrara, Eagle Ford, Haynesville, MidCon, Permian and Williston.

The report presents a detailed outlook for expected expenditure 2018-2022 across 17 key service and equipment lines such as tubing & casing, frac sand and pressure pumping. Importantly for OFS companies, it sees future expenditure weighted heavily towards equipment and services at the completions end of the market. For instance, in the DJ-Niobrara the average lateral length has increased 31 per cent to 8,114 ft over 2014- 2017. Meanwhile, completion expenditure will account for 64 per cent of overall Permian spending in 2017, up from 42 per cent in 2014.

All figures are based on an assessment of future oil prices that sees a gradual upwards increase within the $50-60/bbl range through to the end of the decade, before climbing to $68/bbl in 2022.

The report acknowledges that the market saw a particularly challenging period between 2014 and 2016 with a 79 per cent fall in drilling expenditure over the same period.

Looking forward, it projects a significant and strong period of growth and expenditure for the US onshore market between 2018-2022. Over the period, it expects a nine per cent annual growth rate in rig counts. And, of a total predicted expenditure of $554bn, it expects 66 per cent of it to be spent on completions (53 per cent in 2014) and 34 per cent on drilling (47 per cent in 2014).

Of the basins covered, it expects the Permian (in Western Texas and South East new Mexico) to account for 42 per cent of total forecast drilling and completions spend.

Steve Robertson, Head of OFS Research at Westwood Global Energy Group comments: “It’s time to re-think how we measure OFS industry activity in North America. This report shows that the rig count is becoming less relevant and where we should focus our attention is well completions.

“The volume of data available is vast, millions of wells, and the ability to combine in-depth data with powerful analytics tools provided by Energent has been an exciting and insightful process for our team. The nature of well completions has seen some considerable development in recent years and we continue to track the market and advise our clients with keen interest and unique insights.”

To purchase a copy of the US Drilling and Completion Market Forecast 2018-2022 visit: http://www.douglas-westwood.com/report/oil-and-gas/us-drilling-completion-market-forecast-2017/

– Ends –

For media enquiries please contact: –

Harriet Subramanian

Flourish PR Ltd

Tel: 01628 882 610 / 07949 626375

Email: [email protected]

Notes to Editors

1 Westwood’s ‘consensus’ oil price expectations are based on the Group’s analysis of 47 different oil price forecasts.

About Westwood Global Energy Group (Westwood)

Westwood Global Energy Group is a leading provider of research, data analytics and consulting services to the global energy industry. Whilst we focus primarily on intelligence and insight for the worldwide exploration and oilfield services markets, our coverage also extends to the offshore renewables and power generation markets. Our analysis is independent, comprehensive and based on deep sector knowledge.

Westwood Global Energy was formed in January 2015 by Energy Ventures, an energy specialist private equity firm with a vision to build a leading player in the business intelligence and data analytics space. Following an active period of acquisitions, the group has combined the operations of Hannon Westwood, Richmond Energy Partners, Novas Consulting, Douglas-Westwood, Energent Group Software LLC, and JSI Services. Westwood Global Energy Group is headquartered in Aberdeen and has offices in London, Houston and Singapore.

To learn more, please visit www.westwoodenergy.com

About Energent

Energent Group was formed in 2015 as a market research firm providing evidence based insight and research offerings for the US onshore market. The company’s information and analytics platform allows oilfield services companies and shale analysts to track U.S. operators and review regional drilling & completion activity. The company has focussed on providing actionable intelligence and insight to help business in the formation and execution of growth strategies and business development and support for sales and marketing teams commercialize new products, work with up-to-date operator data, & track well completions in top U.S. shale plays: Texas (Eagle Ford, Wolfcamp), North Dakota (Bakken), Colorado (Niobrara), and more.

Energent was acquired by the Westwood Group of companies in April 2017 with a view to supplying OFS companies, Exploration & Production companies, and market analysts with actionable intelligence on emerging trends and activity in the unconventional market.

Energent’s powerful platform and rich information analytics paired with Westwood’s market forecasting provides a strong proposition, offering a best-in-class solution for customers.