The Maria field in the Norwegian Sea came onstream a year ahead of schedule and ~$370m underbudget. The field has underperformed, triggering a 71% downward revision to the 207mmboe reserves at sanction, and 50% of the US$1.5 billion capital cost of the project being written off so far. Westwood benchmarking shows that Maria was under-appraised relative to its peers before the selection of a development concept. This is not the only case on the Norwegian Continental Shelf (NCS) and appraisal practice needs to improve if further disappointments are to be avoided.

Under Performing and Under Appraised

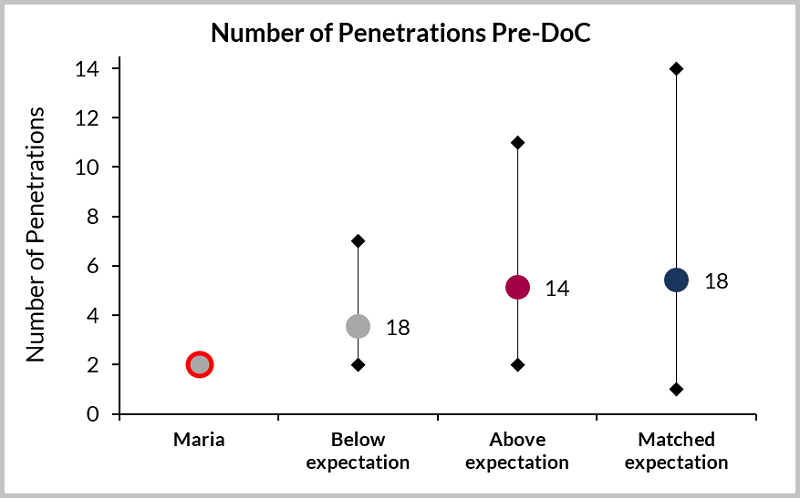

The appraisal drilling program at Maria has been benchmarked relative to its peers globally using the Wildcat appraisal project database. Appraisal analogue benchmarking shown in Figure 1, shows that prior to the declaration of commerciality (DoC), the reservoir at Maria had an anomalously low number of penetrations, increasing the probability of underperformance. Unanticipated reservoir complexity resulted in a lack of connectivity between producers and injectors and is cited by the operator as the cause of the underperformance at Maria. This was recognised in similar reservoirs in an adjacent field prior to the FID.

Not an isolated case

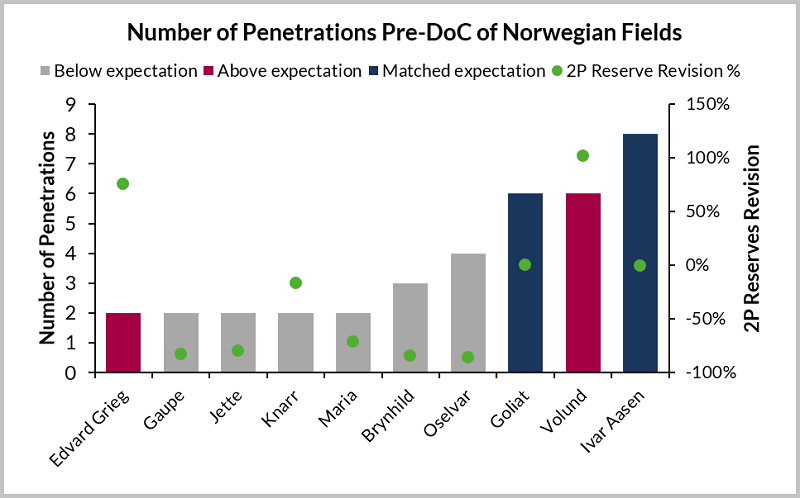

Maria is not the only example of a non-performing field on the NCS with an anomalously low number of penetrations prior to DoC and development concept selection. Figure 2 shows the number of penetrations of reservoirs in the Norwegian Continental Shelf (NCS) for Maria and 9 additional fields starting production since 2009, their performance and 2P reserve revisions as a percentage of sanctioned reserves. The data shows that eight out of the ten fields included in the dataset are non-performing. In addition, the chart shows that Maria and four other fields have all had downward reserves revision of >50%.

Are Lessons Being Learned?

Some companies do seem to be learning lessons from under-appraisal. Spirit Energy, who hold a 20% equity stake in Maria, is reported to have delayed submitting a development plan for the Fogelberg discovery in Norway, citing more complex reservoir than initially thought[1].

Maria was put on production ahead of schedule and under budget but has underperformed significantly due to unrecognised reservoir complexity and the lack of connectivity between producers and injectors. The Maria case study shows there is significant room for improvement in appraisal practices including embedding the learning from analogue fields in appraisal programme design.

Joe Killen, Analyst

[email protected]

[1]Upstream Article 28 March 2019 ‘Spirit ‘hits brakes’ on Fogelberg’