If the industry is out of the emergency room in 2017, it is not yet out of hospital. Even if oil prices recover further, explorers will need to focus on finding low cost oil and gas profitable to develop at $40 per barrel or less. Low cost oil will always find a market, never mind the current stranded assets mantra.

Finding costs need to be kept below $1–2/bbl, or perhaps a bit higher for near field discoveries where development costs are lower. Being the average explorer of the past few years will not be good enough – companies will need to believe they have the acreage portfolio, technology, people and processes to create value. This means an efficient exploration process with larger prospect portfolios and fewer, better wells targeting bigger prospects at higher commercial success rates.

It also means making discoveries that will not be stranded commercially or politically. In mature areas like the North Sea, it means exploring efficiently for oil and gas near late life fields to delay abandonment.

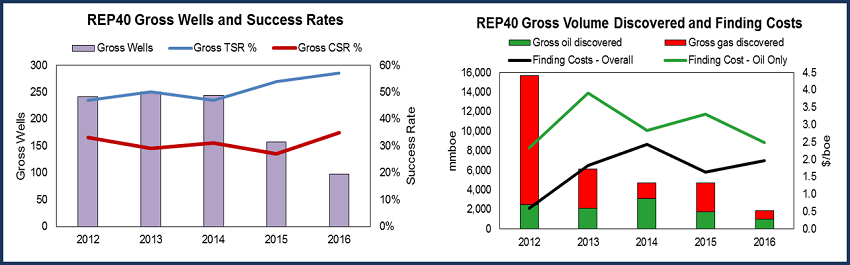

Left: REP40 benchmark companies gross wells drilled and success rates for the period 2012-2016 showing a drop in number of well penetrations, but an increase in success rates for 2016, implying greater pre-drill screening and selection of prospects. Right:, REP40 companies gross volume discovered for oil and gas with finding costs for oil only and overall hydrocarbons. Source: WILDCAT Database.

The industry is emerging leaner and fitter from this latest down-cycle, but it must be able to remain disciplined during the bull oil market to come (whenever that might be). Decreased competition means lower access costs for exploration acreage and more opportunity to create value from exploration for the accomplished explorer.

Andrew Hughes, Head of Research, Global Exploration

[email protected] or +44 (0)20 3794 5317

The eighth edition of the State of Exploration Report1 provides a detailed analysis of the exploration sector and the challenges it faces in 2017.

Westwood Global Energy Group (WGEG) has produced its eighth annual State of Exploration Report1, the definitive global benchmark for conventional oil & gas exploration, which covers 991 completed conventional wildcat wells at a total drilling cost of $43.5bn. The most detailed report of its kind, it spans five years of global high impact exploration and also benchmarks the performance of 40 international E&P companies.

- Westwood Global Energy Group (WGEG)’s annual State of Exploration report analyses the last five years of conventional oil & gas exploration and forecasts exploration drilling plans for 2017.

- The analysis confirms that 2016 saw a nine-year low in oil & gas exploration in both wells drilled and discoveries made.

- But it expects a brighter outlook with exploration efficiencies starting to deliver results.

- Conventional exploration can compete with North American unconventional oil and gas in full cycle breakeven costs.

- Decreased competition means lower access costs and greater opportunity for accomplished explorers, tempered somewhat by the lack of new oil plays to explore.

To arrange a demonstration of the latest WILDCAT data or to purchase the report, please visit Westwood Global Energy Group at https://www.westwoodenergy.com/research/wildcat/ or contact Rhona McFarlane at [email protected] (+44 (0)20 3794 5381).

1 The State of Exploration Report was originally produced under the name of Richmond Energy Partners, which is in the process of re-branding to its parent company, Westwood Global Energy Group.