11th December 2017

On November 28th, Weatherford announced that the U.S. Department of Justice approved the OneStim joint venture between Weatherford and Schlumberger. Earlier this year, Weatherford stated that it had exited the onshore pressure pumping market. According to Energent frac fleet data, Weatherford averaged two frac fleets early in 2017.

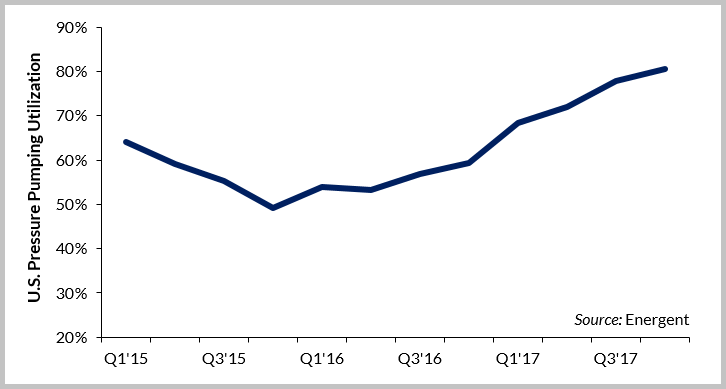

The OneStim JV combines the frac equipment and capabilities of SLB and Weatherford to create one of the largest pure-play pressure pumpers. OneStim is expected to IPO in 2018. Other pure-play pressure pumpers include BJ Services, FTSI, Liberty Oilfield Services, and ProPetro. Large integrated, pure-play, and regional pressure pumpers have seen frac fleet utilizations increase throughout 2017.

U.S. Pressure Pumping Utilization

U.S. Pressure Pumping Utilization

Source: Energent

E&Ps Challenge the Traditional Model

Does this represent a fundamental shift for the pressure pumping market? The traditional model of fully integrated well services providing the frac design, equipment, material, and performing the work may be at risk. Although some E&Ps do favor this turn-key solution, many E&Ps are trying to capture costs savings of direct sourcing of water, sand, chemicals, and logistics.

The confluence of several market conditions are challenging the traditional pressure pumper business model:

- Increased completion intensity (more stages, more water, more frac sand)

- Difficulty hiring and retaining people experienced in the field

- E&P direct sourcing materials, including sand, chemicals, and logistics

Talking to pressure pumpers, one often overlooked change is the lack of skilled people to add to the workforce. There are numerous stories of unplanned maintenance and non-productive time at the wellsite due to human errors. Along with the difficulty of adding people and frac crews, several companies cited increased repair and maintenance costs due to new inexperienced workforce.

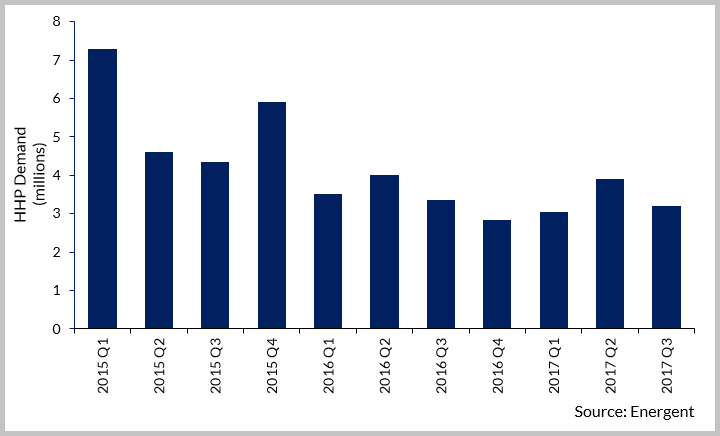

In addition, the higher intensity well completions require more horsepower demand per job with redundant horsepower available in case of pump failures. The current average hydraulic horsepower demanded per frac is near 45,000 HHP.

E&P operating practices will dictate horsepower requirements and pressure pumper selection across asset areas. For example, Anadarko Petroleum’s core areas are Niobrara and Delaware Basin. In 2016, Halliburton performed 42% of the frac jobs compared to 25% of the frac jobs in 2017. Meanwhile, Liberty, a pure-play pressure pumper, did no work for Anadarko in 2016 and 25% of the jobs in 2017.

Anadarko’s total HHP demand in Q2’17 is about 54% of the Q1’15 HHP demand of 7.2 million, but given the company’s drilling and completion outlook for the Niobrara and Delaware Basin, we expect Anadarko’s horsepower to return to 5 million HHP per quarter in 2018.

HHP Demand (millions)

HHP Demand (millions)

Source: Energent

For OneStim and Other Pressure Pumpers, the Time is Now

The higher rate, higher pressure frac jobs are common across the shale plays. E&Ps continue to test well completions with new frac designs, diverting technologies, frac sand variations, and mix of supplier services. The new company’s experience and history of pumping high intensity frac jobs across the shale plays will be paramount.

It’s not clear, yet, if OneStim will include the Schlumberger mines and Weatherford logistics facilities. If included, OneStim may be uniquely positioned to offer dedicated sources of lower cost, West Texas sand as a pure-play pressure pumper. For E&Ps direct sourcing sand, especially in the Permian and Eagle Ford, the regional sand and last mile logistics are integral to realizing well cost savings.

However, pressure pumpers are swift to adapt to the changing market. Many pressure pumpers are contracting sand from the regional mines and working towards last mile logistics. If Onestim is to become a leader, then the company must capture share from Halliburton, BJ Services, Patterson-UTI, and other innovative pressure pumpers.

Todd Bush, VP Commercial, North America Research

[email protected] or +1 (713) 714 4583