3rd August 2017

During the last sector boom leading up to 2014, the industry invested heavily in new equipment and infrastructure to support a level of activity that has yet to return. This has had and continues to have brutal implications for asset-heavy businesses, but particularly offshore, where the investment required to build a rig or a high-end construction vessel is measured in the hundreds of millions or even billions of dollars.

In the offshore sector there is simply far too much capacity in the industry that will not be absorbed even with a recovery to 2014 levels of activity. As a result, we are currently seeing heavily depressed vessel values, dayrates, and utilisation rates. Question is, at what point should we expect this to turn?

There are three key aspects of the recovery to consider; the state of the E&P companies, the global oil supply outlook, and the anticipated demand-side story.

E&P companies have responded swiftly to the downturn by curbing new investment, cutting costs internally, and pressuring the supply chain to do the same. Despite a modest recovery in oil prices over the last year, we still see the same internal focus on cost within our client base and lack of confidence in oil price growth in the near-term.

This is major challenge for the offshore sector. There will, of course, be a handful of exceptional discoveries that will be economic regardless of oil price swings. There will also be satellite discoveries for which much of the costly infrastructure required to produce (platforms, export pipelines) will be in place already and time to first oil is short.

The bulk of greenfield activity, however, will require E&P companies to have strong free cash flow for investment and an expectation of higher oil prices in the mid-term. This aversion to mid/long time oil price risk is why we see a dramatic recovery in short-lead time investments such as US tight oil, but not elsewhere in the industry.

Whilst many offshore-orientated businesses are outwardly positive about recovery, the fundamentals appear very challenging. There is inherent fragility in the recovery which may persist for several years.

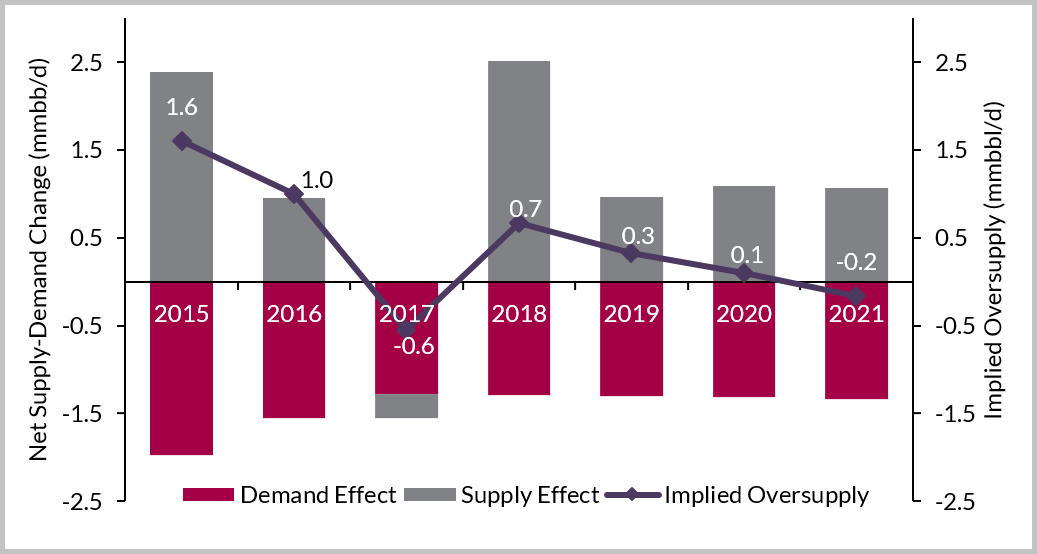

Oil price recovery is currently driven by OPEC cuts, which at the time of writing amount to some 1.42 mmbbl/d of output restriction. OPEC is currently operating in a disciplined manner but like many cartel structures has a history of doing the opposite.

Natural production decline has the potential to solve the over-supply problem but the data from the Westwood production tracker suggest that over-supply will actually return in 2018. This is due to the start-up of fields and coming to the market new production sanctioned prior to the downturn. This is in addition to the production gains through increased investment and activity in the US unconventional space.

Oil Supply/Demand Balance 2015-2021

Source: The Upstream Investment Outlook Report Q2 2017, Westwood Global Energy

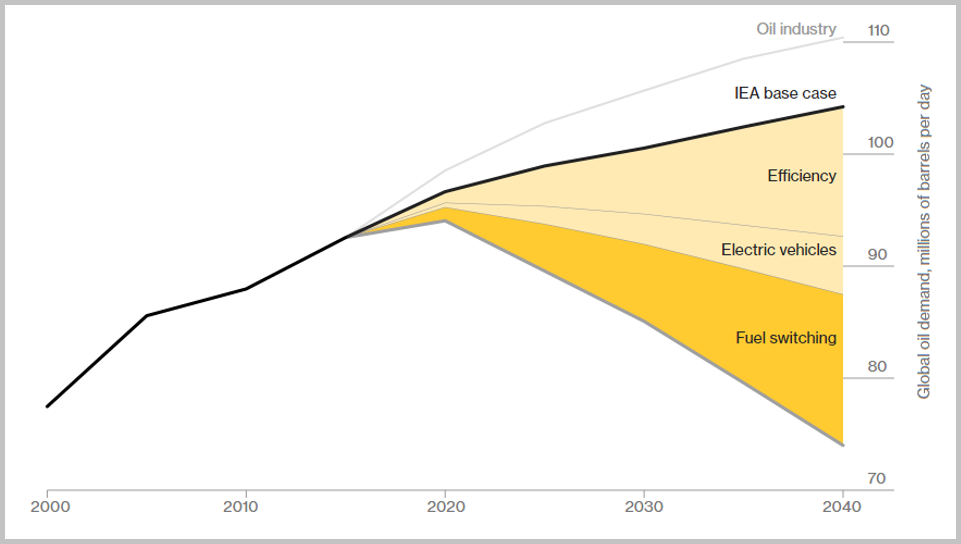

Similarly, it is difficult to draw a view of enhanced demand-side recovery. If anything, the world is being increasingly drawn towards the substitution of fossil fuels for alternatives. The cost per unit for renewable energy continues to follow a long-term downward trend and in some areas is becoming competitive with traditional energy sources.

Within hydrocarbon end users there has been a drive towards efficiency and substitution which may impact demand going forward. A recent Bloomberg article highlighted a potential bleak outlook for oil demand where, in one scenario, demand falls to less than 75 mmbbl/d by 2040.

Oil Demand Outlook

Source: IEA/Bloomberg, May 31, 2017

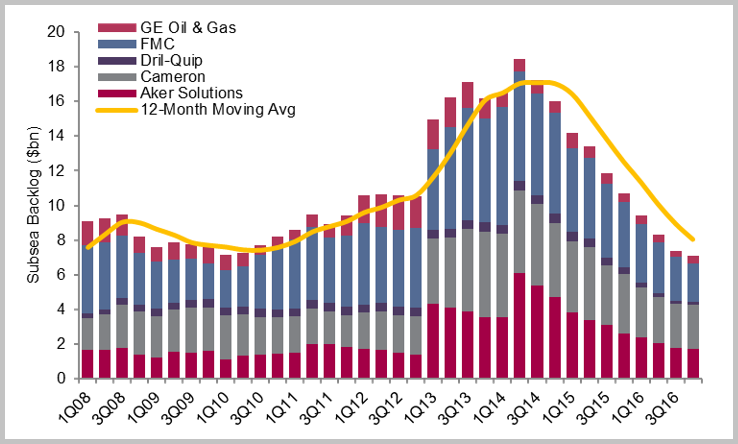

What then of the outlook for offshore expenditure? Many observers point to a long list of yet-to-be sanctioned projects and a backlog of activity. But the backlog of subsea activity has fallen rapidly to the lowest levels measured for over a decade. We must remember, it’s this backlog which has been supporting revenue and earnings across the group as projects sanctioned pre-downturn continue to progress.

Subsea Equipment Backlog 2008-2017

Source: Upstream Investment Outlook, Westwood Global Energy

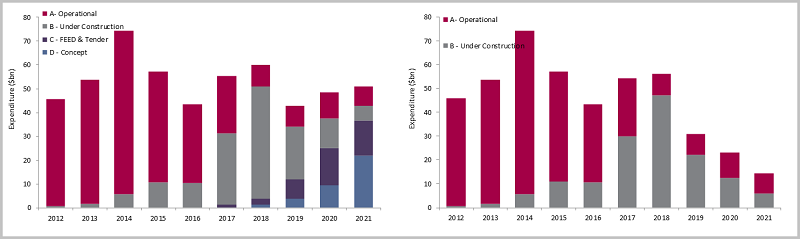

How bad can it get? Using data from Sectors, our online tool for tracking projects, production, and expenditure, we can evaluate the project spend by status. Currently we expect levels of offshore capital spend to range between $40-60 billion per year for the next five years, totalling $257 billion over the 2017-2021 period.

Offshore Capex 2012-2021 – Committed and Pre-FID vs Committed Only

Source: SECTORS, Westwood Global Energy

If we segment this spend by status, and assume that sanctioning of new offshore projects or those not yet past final investment decision or ‘FID’ grinds to a halt, the outlook is very different. From a peak in 2018 spend declines year-on year to reach $14 billion by 2021 and totals $179 billion for the 2017-2021 period.

Our industry is often unpredictable and external factors such as major interruptions to supply from political or weather-related events can shift the balance quickly. That said, any expectations of recovery based upon optimism or wishful thinking alone “it always bounces back” should be tempered by a reality check, and the very real possibility that the current recovery could take much longer to materialise, perhaps even bypass the offshore sector during the emerging cycle in favour of lower cost, lower risk basins.

Steve Robertson, Head of Research, Global Oilfield Services

[email protected]