31st July 2017

Publicly traded E&Ps and service companies are entering a Q2 earnings season anticipating a slowdown across the unconventional plays. In Halliburton’s (NYSE: HAL) second quarter earnings call Dave Lesar said, ”rig count growth is showing signs of plateauing and customers are tapping the brakes.” With oil prices under $50 per barrel and oil supply at record levels, expect a pullback in Permian, Eagle Ford, DJ-Niobara, and Bakken drilling activity. The steady increase of horizontal drilling rigs and infrastructure requirements in key areas of the Permian are causing DUCs to head north for summer.

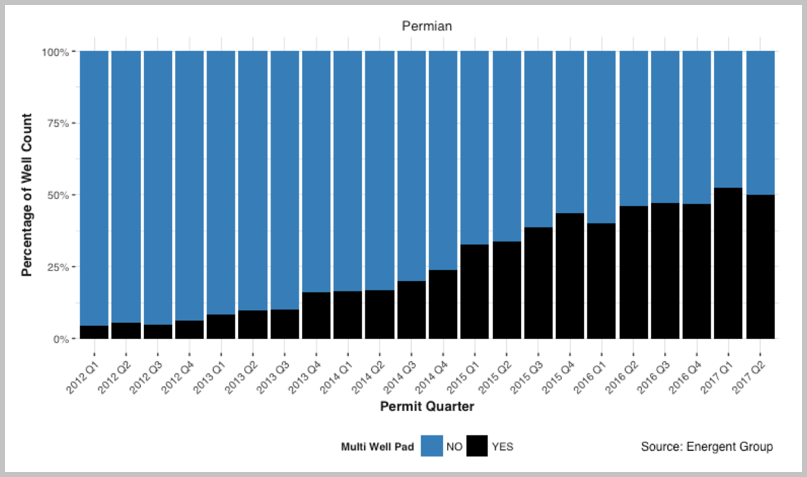

Horizontal rig activity in the Permian increased by 51% year to date in 2017, according to the latest Baker Hughes rig count. Throughout the year, drilling contractors brought back the best rigs and crews to meet E&Ps’ demand for more efficient drilling operations. Encana (NYSE: ECA), Apache Corporation (NYSE: APA), Chevron (NYSE: CVX), RSP Permian (NYSE: RSPP) and others have indicated a move or ramp-up in multi-well pad drilling. Encana (NYSE: ECA) expects to drive efficiencies with pad drilling and anticipates larger multi-well pads as a general rule in 2017.

Single-Well Verse Multi-Well Pads by Percentage

Multi-well pads have steadily increased quarter-over-quarter over the last two years. For many operators, the limiting factor is the lease size or acreage position to support the density of wells with long laterals.

Matador Resources (NYSE: MTDR) drills 1-mile laterals in the Delaware Basin. In the last year, the company drilled a 9-well pad averaging 5,025ft laterals and a 6-well pad averaging 4,830ft laterals targeting the Wolfcamp.

ExxonMobil (NYSE: XOM) used a NorAm Drilling Company rig to drill the first well of two on the Hurley 56-18 1H pad in Reeves county. This 5,479ft lateral well used multiple suppliers for 6 million pounds of frac sand. During the last 12 months in the Delaware basin, ExxonMobil drilled 2-well and 3-well pads with horizontal lateral lengths ranging from 4,500ft to 10,540ft.

Pad drilling offers numerous benefits, including reduced drilling cycle times and smaller surface footprints with the possibility for increased frac efficiencies and simultaneous operations. Other shale plays, including Bakken, DJ-Niobrara, and Haynesville, are more mature in the adoption of pad drilling. For example, over 85% of the wells drilled Bakken and 90% of wells in DJ-Niobrara are on multi-well pads.

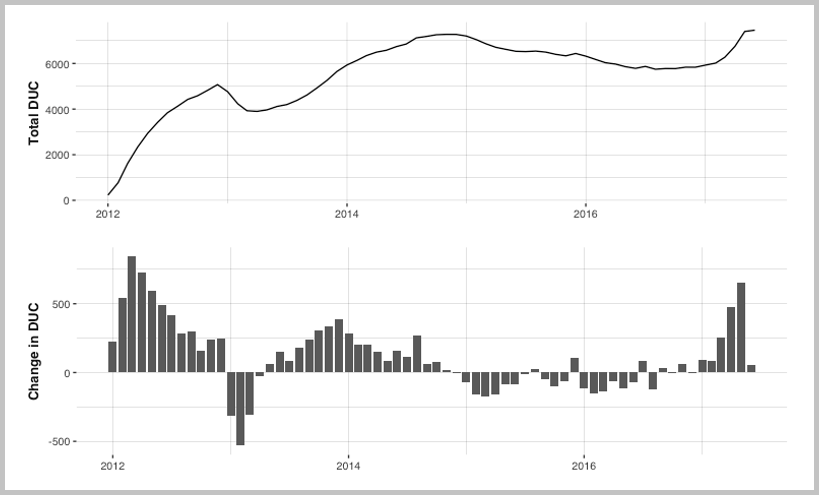

A side-effect of drilling multi-well pads is a longer put-on-production cycle time, since the first well drilled will not be producing until the last well is completed, in most cases. This additional time enhances the drilled, uncompleted well count or DUC.

Total DUC Count Compared to Change in DUCs

Nearly 54% of the DUC wells reside in the Permian Basin. Based on the last two years of permitted wells, Pioneer Natural Resources (NYSE: PXD), Concho Resources (NYSE: CXO), and Anadarko Petroleum (NYSE: APC) account for 15% of the DUC backlog in the Permian.

E&Ps will continue to adopt pad drilling in the Permian to gain efficiencies, reduce costs, and optimise assets. As pad drilling matures, E&Ps will strive to unlock efficiency gains throughout the supply chain, with integrated operations and logistics for the entire life-cycle of the well.

Recently, Saudi Arabia cut exports by 600kbbl/d to 6.6mmbbl/d to reduce global supply due to the ability of US unconventional producers to react to increased oil prices. With OPEC cuts and US E&P’s stalling rig count growth, the industry eagerly awaits signs of a rebalanced market.

Learn more about Energent’s basin, operator, and well benchmarking data and tools at www.energentgroup.com

Todd Bush, Energent (part of Westwood Global Energy Group)

[email protected]