What Does Increasing HHP Demand Mean for Pumpers?

The back half of 2018 witnessed more than a 4% decline in active horsepower (HHP) being removed from the field, driven by HHP oversupply, budget exhaustion, takeaway constraints, in addition to typical seasonal and weather impacts. However, Westwood forecasts a steadier 2019 demand scenario, resulting in potential market tightness at year’s end.

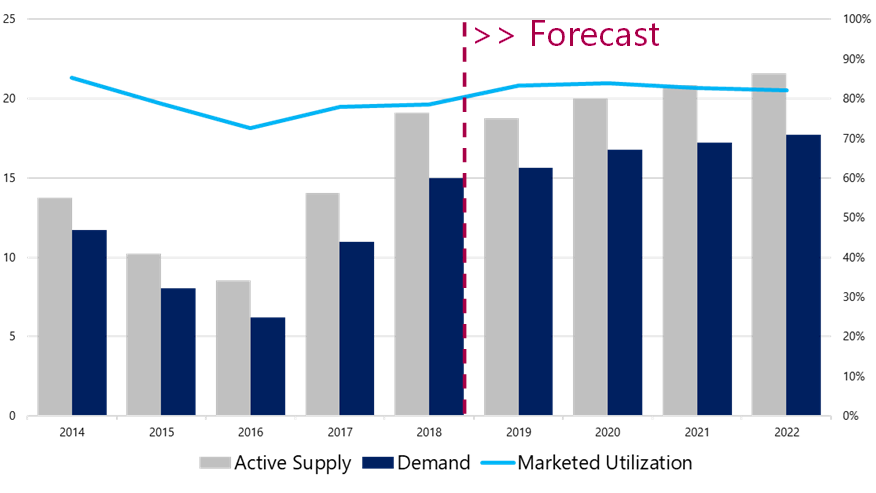

Figure 1: Historic HHP and crew counts from Q1’14-Q4-18. Forecasted HHP begins Q1’19 and ends Q4’22. WGE analysis assumes a $60 WTI in 2019, increasing as high as $67 from 2020-2022. Source: WGE analysis, company reports

Source: WGE Analysis.

Compared to Q4’18, Westwood estimates just over 200,000 HHP has been removed from active status during Q1’19 across the seven key US basins covered in this report – the Permian, DJ-Niobrara, Eagle Ford, Haynesville, MidCon, Williston, and Appalachia. This reduction is largely driven by the Permian Basin of West Texas and Southeastern New Mexico, which saw a 5% decline in active HHP during Q1’19.

However, the alleviation of the Permian bottleneck during H2’19 and the subsequent work down of the growing DUC backlog, will result in a boost in demand during Q4’19 in West Texas. Looking at the US, HHP demand is expected to increase during Q2’19. The result could indicate a tightening frac market moving in 2020, especially in the Permian.

The report illustrates a basin level supply/demand scenario—both historic and forecast—portraying total HHP capacity, active supply, HHP demand and marketed utilization. The report also includes a historic picture of crew counts, as well as leading financial indicators for market leading pressure pumpers. Additionally, the provided HHP data will display total HHP capacity, active HHP, total crews and active crews on a pumper and basin level view.

Disclaimer

This report has been prepared by Westwood Global Energy Group and all rights, whether pertaining to the body of this report or any information contained within it, are reserved. This report is confidential and must not be made available by you to any other person. The information contained in this report is intended for the sole use and benefit of clients of Westwood Global Energy Limited who subscribe to services permitting access to this report.

This report is based on Westwood Global Energy Group’s experience, knowledge, and databases as well as publicly available sources. No representation or warranty, whether express or implied, is made by Westwood Global Energy Group as to the fairness, accuracy or completeness of any information (whether fact or opinion) contained in this report. The information included in this report is subject to change and we do not undertake to advise you of any changes to such information. The report does not constitute (i) an offer or recommendation to buy or sell any securities; or (ii) investment, financial, legal, tax or technical advice. Westwood Global Energy Group does not accept liability in respect of any actions taken or not taken based on any or all of the information contained in this report, to the fullest extent permitted by law. Do not act upon the information contained in this report without undertaking independent investigations and assessments.