20th November 2017

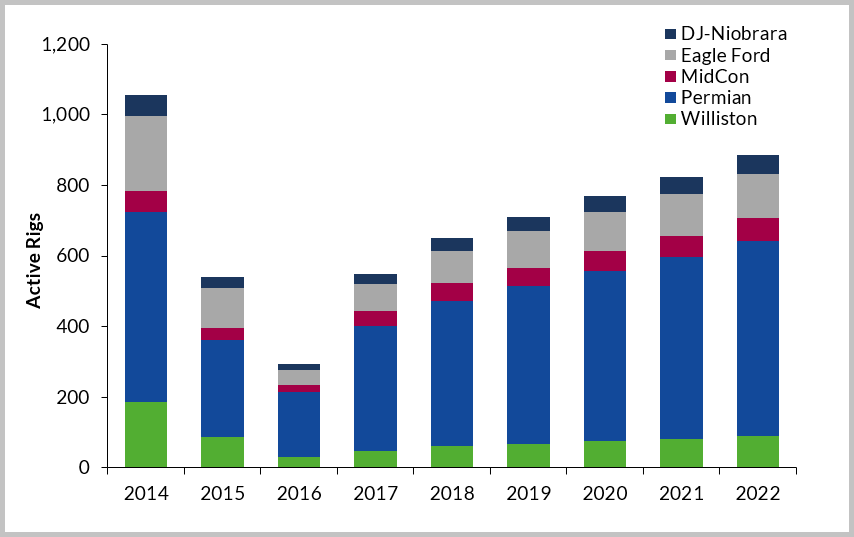

It is time to look beyond just the rig count as a measure of activity and production growth in the US tight oil plays. Westwood Global Energy forecasts an 18% increase in active rigs in 2018 but more rapid demand growth in certain service areas as operators focus on efficiency and delivering more for less.

North American E&P companies are under pressure from investors to focus on cash generation over pure growth. Many companies, particularly independents, have scaled back the pace and streamlined their future developments plans. Anadarko Petroleum recently announced that it would pursue a noteworthy share buy-back program rather than directing cash into drilling or acquiring assets, as well as reducing its 2018 capital programme compared to 2017.

Shale Oil Rig Forecast

Shale Oil Rig Forecast

Source: Westwood, Baker Hughes

Despite a relatively flat oil price outlook and implied modest growth (at best) for the total active rig count, there are underlying bright spots for materials and well services providers. The number of horizontal rigs, as a proportion of the total rig count, continues to grow and operators continue to add length to the horizontal sections of the wellbore.

The Permian has garnered much attention for the extreme lateral lengths and increasing frac stages, but other areas are seeing similar trends that are requiring more materials and services on a per well basis. For instance, in just over a year, proppant demand in the Permian has increased by 31%, while the Mid-Continent has seen an increase of 43%. Lateral lengths have increased significantly in the Mid-Continent region, with the Anadarko Basin having gone from 2,500 tons to nearly 4,500 tons of proppant per well in merely a year and a half. Devon has increased its proppant per well by 40% in the Anadarko to a staggering 8,500 tons per well. This represents substantial materials and services demand growth that far exceeds the common leading indicator of active rig additions – with no real end in sight.

Assuming well completions stay in pace with horizontal drilling activity, providers of materials from frac plugs to proppant or services from directional drilling to produced water management could see very healthy growth in demand. An increase in commodity prices to drive the well count up further would be the icing on the cake.

Andrew Meyers, Associate Director, North America Consulting

[email protected] or +1 (713)714 4883