Insights

WindLogix Offshore Wind Podcast – Episode 1: AR7 Wins, APAC Shifts & Europe’s Subsidy Reset

WindLogix Offshore Wind Podcast – Episode 1: AR7 Wins, APAC Shifts & Europe’s Subsidy Reset

WindLogix Offshore Wind Podcast

WindLogix Offshore Wind Podcast

Offshore Energy Data Dashboard

Offshore Energy Data Dashboard

Global Land Drilling Rigs Tracker

Global Land Drilling Rigs Tracker

Weekly Global Offshore Rig Count

Weekly Global Offshore Rig Count

RigLogix Offshore Rig News Roundup

RigLogix Offshore Rig News Roundup

Westwood Insight – Key Wells to Watch in 2026

Westwood Insight – Key Wells to Watch in 2026

Westwood Insight – Transocean and Valaris merger shakes up the offshore drilling industry

Westwood Insight – Transocean and Valaris merger shakes up the offshore drilling industry

Global Land Rigs Newsletter – 4Q 2025

Global Land Rigs Newsletter – 4Q 2025

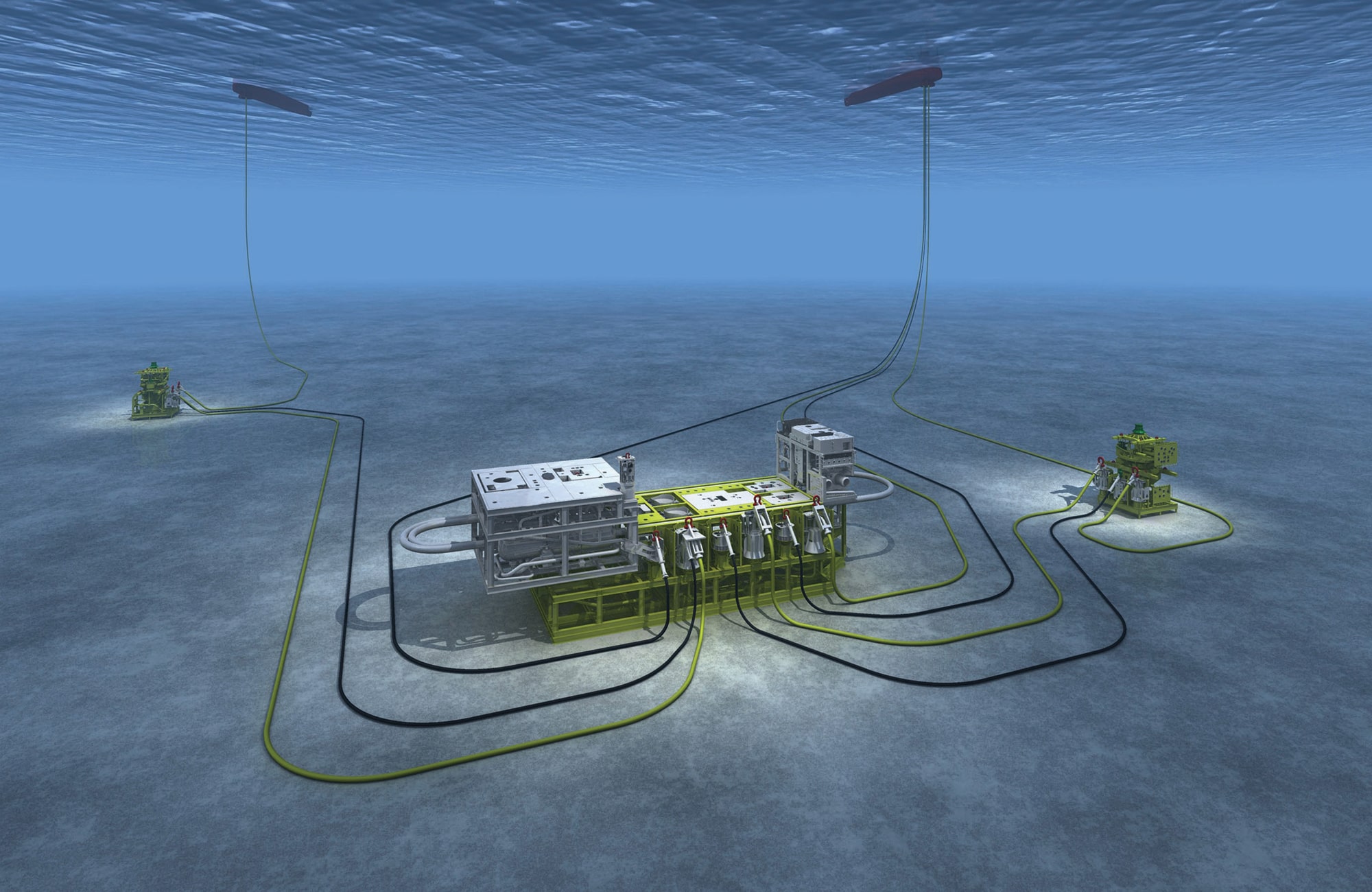

Global Subsea Tree Tracker

Global Subsea Tree Tracker

Westwood launches MarineLogix to deliver next-generation offshore vessel intelligence

Westwood launches MarineLogix to deliver next-generation offshore vessel intelligence

Offshore Wind in Numbers

Offshore Wind in Numbers

Brazil Offshore Rig Count

Brazil Offshore Rig Count

Hydrogen Compass – January 2026

Hydrogen Compass – January 2026

Hydrogen Compass

Hydrogen Compass

Westwood Insight – Demand for subsea equipment holds, but macro headwinds remain

Westwood Insight – Demand for subsea equipment holds, but macro headwinds remain

Energy Consulting Case Study – Sale of Severn Group to Valmet Corporation

Energy Consulting Case Study – Sale of Severn Group to Valmet Corporation

Westwood Insight – Analysing the record-breaking AR7 offshore wind results

Westwood Insight – Analysing the record-breaking AR7 offshore wind results

Westwood Insight – Geothermal opportunity for onshore drilling rigs

Westwood Insight – Geothermal opportunity for onshore drilling rigs

Hydrogen Retrospective 2025

Hydrogen Retrospective 2025

Westwood Insight – As 2025 challenges fade, offshore rig outlook brightens

Westwood Insight – As 2025 challenges fade, offshore rig outlook brightens

Wells & Production Outlook

Wells & Production Outlook

Offshore Energy Data Dashboard 2025

Offshore Energy Data Dashboard 2025

Weekly Global Offshore Rig Count 2025

Weekly Global Offshore Rig Count 2025

RigLogix Offshore Rig News Roundup 2025

RigLogix Offshore Rig News Roundup 2025

Westwood Insight – Five offshore wind themes to watch in 2026

Westwood Insight – Five offshore wind themes to watch in 2026

Hydrogen Compass – December 2025

Hydrogen Compass – December 2025

Global Land Rigs Newsletter – 3Q 2025

Global Land Rigs Newsletter – 3Q 2025

Global Subsea Tree Tracker 2025

Global Subsea Tree Tracker 2025

Westwood Insight – Those calling for more exploration may be disappointed

Westwood Insight – Those calling for more exploration may be disappointed

Westwood Insight – Oil and Gas Price Mechanism – Setting the right baseline

Westwood Insight – Oil and Gas Price Mechanism – Setting the right baseline

US Weekly Onshore Rig Count

US Weekly Onshore Rig Count

Energy Consulting Case Study – Exploration Portfolio Benchmarking

Energy Consulting Case Study – Exploration Portfolio Benchmarking

Westwood Insight – UKCS pipeline interconnectivity demonstrates the importance of a managed transition

Westwood Insight – UKCS pipeline interconnectivity demonstrates the importance of a managed transition

Global Land Drilling Rig Outlook

Global Land Drilling Rig Outlook

Hydrogen Compass – November 2025

Hydrogen Compass – November 2025

Westwood Insight – Asia Pacific offshore energy trends, challenges and opportunities

Westwood Insight – Asia Pacific offshore energy trends, challenges and opportunities

Asia Pacific Offshore Report

Asia Pacific Offshore Report

Hydrogen Compass – October 2025

Hydrogen Compass – October 2025

Westwood Insight – Finding offshore energy opportunities in volatile times

Westwood Insight – Finding offshore energy opportunities in volatile times

Energy Consulting Case Study – Carlyle Acquisition of FPSO Business

Energy Consulting Case Study – Carlyle Acquisition of FPSO Business

Hydrogen Compass – September 2025

Hydrogen Compass – September 2025

Westwood Insight – What does Mitsubishi’s exit mean for Japan’s offshore wind targets?

Westwood Insight – What does Mitsubishi’s exit mean for Japan’s offshore wind targets?

Westwood Insight – Which European hydrogen developers are aligning ambition with reality?

Westwood Insight – Which European hydrogen developers are aligning ambition with reality?

Hydrogen Compass – August 2025

Hydrogen Compass – August 2025

Global Land Rigs Newsletter – 2Q 2025

Global Land Rigs Newsletter – 2Q 2025

Westwood Webinars – High Impact Exploration – Key Wells to Watch 2025

Westwood Webinars – High Impact Exploration – Key Wells to Watch 2025

Saudi Aramco Rig Contract Suspensions & Terminations Report

Saudi Aramco Rig Contract Suspensions & Terminations Report

Westwood Insight – Top 10 offshore drillers enhance their market position

Westwood Insight – Top 10 offshore drillers enhance their market position

Hydrogen Compass – July 2025

Hydrogen Compass – July 2025

Energy Consulting Case Study – Rig Partnership Strategic Assessment

Energy Consulting Case Study – Rig Partnership Strategic Assessment

Westwood Insight – UKCS geological potential remains but sentiment shift is needed

Westwood Insight – UKCS geological potential remains but sentiment shift is needed

Hydrogen Compass – June 2025

Hydrogen Compass – June 2025

Westwood Webinars – The State of Exploration 2025

Westwood Webinars – The State of Exploration 2025

Energy Consulting Case Study – Land Rig Commercial Due Diligence

Energy Consulting Case Study – Land Rig Commercial Due Diligence

Westwood Insight – The State of Exploration 2025

Westwood Insight – The State of Exploration 2025

Westwood Insight – Unlocking the potential of floating offshore wind

Westwood Insight – Unlocking the potential of floating offshore wind

The State of Exploration 2025

The State of Exploration 2025

Westwood: Floating wind developers pull back due to slow progress and investment hurdles

Westwood: Floating wind developers pull back due to slow progress and investment hurdles

Floating Offshore Wind Survey 2025

Floating Offshore Wind Survey 2025

Hydrogen Compass – May 2025

Hydrogen Compass – May 2025

Energy Consulting Case Study – Oil and Gas Equipment in Geothermal Applications

Energy Consulting Case Study – Oil and Gas Equipment in Geothermal Applications

Global Land Rigs Newsletter – 1Q 2025

Global Land Rigs Newsletter – 1Q 2025

Westwood Insight – Rig retirements set to rise as utilisation falls to lowest level since 2021

Westwood Insight – Rig retirements set to rise as utilisation falls to lowest level since 2021

Hydrogen Compass – April 2025

Hydrogen Compass – April 2025

Energy Consulting Case Study – Sale of ROVOP to Edison Chouest

Energy Consulting Case Study – Sale of ROVOP to Edison Chouest

Westwood: Only 17% of EU hydrogen project pipeline expected to materialise by 2030

Westwood: Only 17% of EU hydrogen project pipeline expected to materialise by 2030

White Paper – Europe’s Hydrogen Future: How Much Is Realistically Achievable?

White Paper – Europe’s Hydrogen Future: How Much Is Realistically Achievable?

Westwood Insight – India anchored to hydrocarbon imports as forecast production falls short of demand

Westwood Insight – India anchored to hydrocarbon imports as forecast production falls short of demand

Westwood Insight – US Gulf drillship fleet heading into rough waters

Westwood Insight – US Gulf drillship fleet heading into rough waters

Westwood Webinar – Accelerating Offshore Wind Development

Westwood Webinar – Accelerating Offshore Wind Development

World Onshore Pipelines Market Forecast

World Onshore Pipelines Market Forecast

Westwood Insight – Deferred well P&A could add $5.5bn to UK decommissioning bill

Westwood Insight – Deferred well P&A could add $5.5bn to UK decommissioning bill

Energy Consulting Case Study – Assessment of Offshore Wind Target Market

Energy Consulting Case Study – Assessment of Offshore Wind Target Market

Hydrogen Compass – March 2025

Hydrogen Compass – March 2025

Westwood: Deferred well plug and abandonment could add $5.5 billion to UK decommissioning bill

Westwood: Deferred well plug and abandonment could add $5.5 billion to UK decommissioning bill

Westwood Webinar – Offshore Energy Services 1Q Briefing

Westwood Webinar – Offshore Energy Services 1Q Briefing

Global Land Rigs Newsletter – 4Q 2024

Global Land Rigs Newsletter – 4Q 2024

Hydrogen Compass – February 2025

Hydrogen Compass – February 2025

Energy Consulting Case Study – European Rig Arbitration

Energy Consulting Case Study – European Rig Arbitration

Westwood Insight – Key Wells to Watch in 2025

Westwood Insight – Key Wells to Watch in 2025

Westwood Insight – What should we expect for European hydrogen in 2025?

Westwood Insight – What should we expect for European hydrogen in 2025?

Westwood Insight – UK and Norway exploration and production outlook for 2025

Westwood Insight – UK and Norway exploration and production outlook for 2025

World Land Drilling Rig Market Forecast

World Land Drilling Rig Market Forecast

Westwood Insight – Five things to watch in offshore wind in 2025

Westwood Insight – Five things to watch in offshore wind in 2025

CCS Country Report – United Kingdom

CCS Country Report – United Kingdom

Hydrogen Compass – January 2025

Hydrogen Compass – January 2025

Westwood Insight – Offshore EPC contracting activity to remain buoyant in 2025

Westwood Insight – Offshore EPC contracting activity to remain buoyant in 2025

Energy Consulting Case Study – UK Carbon Storage Licence Round Review

Energy Consulting Case Study – UK Carbon Storage Licence Round Review

Westwood Insight – Offshore drilling upcycle continues, but 2025 will be a year of market corrections

Westwood Insight – Offshore drilling upcycle continues, but 2025 will be a year of market corrections

Offshore Energy Data Dashboard 2024

Offshore Energy Data Dashboard 2024

Weekly Global Offshore Rig Count 2024

Weekly Global Offshore Rig Count 2024

Westwood Insight – Over a fifth of all European Hydrogen projects stalled or cancelled

Westwood Insight – Over a fifth of all European Hydrogen projects stalled or cancelled

Energy Consulting Case Study – NW Europe CCS Landscape Review

Energy Consulting Case Study – NW Europe CCS Landscape Review

Hydrogen Compass – December 2024

Hydrogen Compass – December 2024

Westwood Insight – A mixed drilling outlook for the Americas but opportunities abound

Westwood Insight – A mixed drilling outlook for the Americas but opportunities abound

RigLogix Offshore Rig News Roundup 2024

RigLogix Offshore Rig News Roundup 2024

Global Subsea Tree Tracker 2024

Global Subsea Tree Tracker 2024

Global Land Rigs Newsletter – 3Q 2024

Global Land Rigs Newsletter – 3Q 2024

Energy Transition Now Podcast – Episode 40 “Decarbonizing building with CCUS”

Energy Transition Now Podcast – Episode 40 “Decarbonizing building with CCUS”

Energy Consulting Case Study – North Sea Offshore Wind Landscape Review

Energy Consulting Case Study – North Sea Offshore Wind Landscape Review

Westwood Insight – Global OSV fleet utilisation projected to reach 78% by 2027

Westwood Insight – Global OSV fleet utilisation projected to reach 78% by 2027

Hydrogen Compass – November 2024

Hydrogen Compass – November 2024

Energy Transition Now Podcast

Energy Transition Now Podcast

Westwood Insight – Impending shortage of jackups within ageing Asia Pacific fleet

Westwood Insight – Impending shortage of jackups within ageing Asia Pacific fleet

Energy Consulting Case Study – Global Offshore Wind Vessel Review

Energy Consulting Case Study – Global Offshore Wind Vessel Review

Hydrogen Compass – October 2024

Hydrogen Compass – October 2024

Westwood Webinar – How realistic is the Iberian hydrogen opportunity?

Westwood Webinar – How realistic is the Iberian hydrogen opportunity?

Westwood Insight – The North Sea semisub market may seem buoyant, but looks can be deceiving

Westwood Insight – The North Sea semisub market may seem buoyant, but looks can be deceiving

Youwind and Westwood: Announcement of integrated data services

Youwind and Westwood: Announcement of integrated data services

Global Offshore Drilling Rig Dayrate Forecast

Global Offshore Drilling Rig Dayrate Forecast

Hydrogen Compass – September 2024

Hydrogen Compass – September 2024

Westwood Insight – How the energy supply chain is adapting to offshore wind

Westwood Insight – How the energy supply chain is adapting to offshore wind

Westwood Webinars – Norway State of Exploration

Westwood Webinars – Norway State of Exploration

Offshore Wind CfDs Awarded in UK’s Allocation Round 6

Offshore Wind CfDs Awarded in UK’s Allocation Round 6

Westwood Insight – Navigating expectations for Iberian hydrogen

Westwood Insight – Navigating expectations for Iberian hydrogen

Energy Transition Now Podcast – Episode 39 “Turning waste into a carbon removals business”

Energy Transition Now Podcast – Episode 39 “Turning waste into a carbon removals business”

Westwood Insight – Namibia: The newest most promising deepwater rig demand hotspot

Westwood Insight – Namibia: The newest most promising deepwater rig demand hotspot

Global Land Rigs Newsletter – 2Q 2024

Global Land Rigs Newsletter – 2Q 2024

Westwood Insight – Can the East African Ruvuma-Rufiji Gas Basin help quench growing global LNG demand?

Westwood Insight – Can the East African Ruvuma-Rufiji Gas Basin help quench growing global LNG demand?

Hydrogen Compass – August 2024

Hydrogen Compass – August 2024

Westwood Insight – Norway State of Exploration 2014-2023

Westwood Insight – Norway State of Exploration 2014-2023

Westwood Webinars – A Game of Two Halves – Offshore EPC Contracting Gathers Pace in 1H 2024

Westwood Webinars – A Game of Two Halves – Offshore EPC Contracting Gathers Pace in 1H 2024

Westwood Insight – H&P’s $2bn deal to purchase KCA Deutag is a smart move

Westwood Insight – H&P’s $2bn deal to purchase KCA Deutag is a smart move

Hydrogen Compass – July 2024

Hydrogen Compass – July 2024

Westwood Insight – Saudi Aramco jackup suspensions and the story so far

Westwood Insight – Saudi Aramco jackup suspensions and the story so far

Westwood Insight – Resolving co-location conflicts between offshore wind, oil & gas, and carbon storage

Westwood Insight – Resolving co-location conflicts between offshore wind, oil & gas, and carbon storage

Westwood Webinars – The State of Exploration 2024

Westwood Webinars – The State of Exploration 2024

Westwood Insight – Top 10 offshore drillers catch the wave of rising demand

Westwood Insight – Top 10 offshore drillers catch the wave of rising demand

Hydrogen Compass – June 2024

Hydrogen Compass – June 2024

Energy Transition Now Podcast – Episode 38 “Driving forward the CCUS industry in the UK”

Energy Transition Now Podcast – Episode 38 “Driving forward the CCUS industry in the UK”

Westwood Insight – More realism in floating wind, as UK set to miss 2030 target by 90%

Westwood Insight – More realism in floating wind, as UK set to miss 2030 target by 90%

Westwood: High Impact exploration average discovery size declines and finding costs increase for the fifth consecutive year

Westwood: High Impact exploration average discovery size declines and finding costs increase for the fifth consecutive year

The State of Exploration 2024

The State of Exploration 2024

Westwood: Lack of technology standardisation, port investment and manufacturing capability major hurdles in unlocking future of floating wind

Westwood: Lack of technology standardisation, port investment and manufacturing capability major hurdles in unlocking future of floating wind

Energy Transition Now Podcast – Episode 37 “The role of CCUS in the UK’s decarbonisation”

Energy Transition Now Podcast – Episode 37 “The role of CCUS in the UK’s decarbonisation”

Westwood Insight – Can offshore wind make the shift from portfolio growth to value creation?

Westwood Insight – Can offshore wind make the shift from portfolio growth to value creation?

Hydrogen Compass – May 2024

Hydrogen Compass – May 2024

Energy Transition Now Podcast – Episode 36 “Assessing the status of global CCUS policy”

Energy Transition Now Podcast – Episode 36 “Assessing the status of global CCUS policy”

Global Land Rigs Newsletter – 1Q 2024

Global Land Rigs Newsletter – 1Q 2024

Westwood Insight – As dayrates continue north, could we see more energy companies buying offshore rigs?

Westwood Insight – As dayrates continue north, could we see more energy companies buying offshore rigs?

Houston Offshore Breakfast Briefing, April 2024 – Video On Demand

Houston Offshore Breakfast Briefing, April 2024 – Video On Demand

Regional Rig Movements 2020-2024

Regional Rig Movements 2020-2024

Westwood Insight – Global oil undersupply unlikely despite dramatic Saudi announcement

Westwood Insight – Global oil undersupply unlikely despite dramatic Saudi announcement

Westwood backs Americas offshore growth with new senior appointment

Westwood backs Americas offshore growth with new senior appointment

RigLogix Offshore Drilling Survey 2024

RigLogix Offshore Drilling Survey 2024

Westwood Webinar – 2024 Themes for Hydrogen in Northwest Europe

Westwood Webinar – 2024 Themes for Hydrogen in Northwest Europe

Westwood Insight – High impact exploration review of 2023 and outlook for 2024

Westwood Insight – High impact exploration review of 2023 and outlook for 2024

Westwood Insight – North Sea jackup utilisation hits 94% despite falling demand

Westwood Insight – North Sea jackup utilisation hits 94% despite falling demand

Westwood Insight – UK and Norway exploration and production outlook for 2024

Westwood Insight – UK and Norway exploration and production outlook for 2024

Westwood: US$353 billion in pre-FID offshore wind projects potentially at risk

Westwood: US$353 billion in pre-FID offshore wind projects potentially at risk

White Paper – The Need for a Risk-Based Assessment of the Offshore Wind Pipeline

White Paper – The Need for a Risk-Based Assessment of the Offshore Wind Pipeline

Westwood Insight – Six themes in 2024 that will shape the hydrogen and CCUS industries in Northwest Europe

Westwood Insight – Six themes in 2024 that will shape the hydrogen and CCUS industries in Northwest Europe

Westwood Insight – After offshore wind’s year of tactical retreats, who will seize the initiative in 2024?

Westwood Insight – After offshore wind’s year of tactical retreats, who will seize the initiative in 2024?

Global Land Rigs Newsletter – 4Q 2023

Global Land Rigs Newsletter – 4Q 2023

Global Subsea Tree Tracker 2023

Global Subsea Tree Tracker 2023

Offshore Energy Data Dashboard 2023

Offshore Energy Data Dashboard 2023

Westwood Insight – The offshore rig market recovery continues, but what’s in store for 2024?

Westwood Insight – The offshore rig market recovery continues, but what’s in store for 2024?

Weekly Global Offshore Rig Count 2023

Weekly Global Offshore Rig Count 2023

RigLogix Offshore Rig News Roundup 2023

RigLogix Offshore Rig News Roundup 2023

Westwood Insight – Global land rig demand to grow 14% in 2023-2027, driven by China and countries in the GCC

Westwood Insight – Global land rig demand to grow 14% in 2023-2027, driven by China and countries in the GCC

Westwood: UK’s sizeable carbon storage pipeline at risk due to project delays

Westwood: UK’s sizeable carbon storage pipeline at risk due to project delays

Westwood Insight – Despite sizable project pipeline, further delays could result in the UK missing CCS targets

Westwood Insight – Despite sizable project pipeline, further delays could result in the UK missing CCS targets

The UK’s 1st Carbon Storage Licensing Round Full Results Analytical Report

The UK’s 1st Carbon Storage Licensing Round Full Results Analytical Report

Energy Transition Now Podcast – Episode 35 “Enabling the Global Hydrogen Economy”

Energy Transition Now Podcast – Episode 35 “Enabling the Global Hydrogen Economy”

Energy Transition Now Podcast Series 6

Energy Transition Now Podcast Series 6

The Netherlands and Belgium well-placed to become Northwest Europe’s leading hydrogen import hubs with a collective 6.2Mtpa target

The Netherlands and Belgium well-placed to become Northwest Europe’s leading hydrogen import hubs with a collective 6.2Mtpa target

Westwood Insight – The Netherlands vs Belgium: Who will win the battle as Northwest Europe’s leading hydrogen import hub?

Westwood Insight – The Netherlands vs Belgium: Who will win the battle as Northwest Europe’s leading hydrogen import hub?

APAC Offshore Energy Services, October 2023 – Video On Demand

APAC Offshore Energy Services, October 2023 – Video On Demand

Energy Transition Now Podcast – Episode 34 “Electrolyser Challenges and Learnings”

Energy Transition Now Podcast – Episode 34 “Electrolyser Challenges and Learnings”

Global Land Rigs Newsletter – 3Q 2023

Global Land Rigs Newsletter – 3Q 2023

Energy Transition Now Podcast – Episode 33 “Hydrogen’s Role in the Future of the Gas Grid”

Energy Transition Now Podcast – Episode 33 “Hydrogen’s Role in the Future of the Gas Grid”

Westwood Insight – Operators offering 15-year rig deals as availability dries up

Westwood Insight – Operators offering 15-year rig deals as availability dries up

Westwood & WFO Webinar – Global Offshore Wind HY1 2023

Westwood & WFO Webinar – Global Offshore Wind HY1 2023

Energy Transition Now Podcast – Episode 32 “Funding Hydrogen Technology”

Energy Transition Now Podcast – Episode 32 “Funding Hydrogen Technology”

Westwood Insight – Scarcity of premium vessel supply as offshore demand continues to surge

Westwood Insight – Scarcity of premium vessel supply as offshore demand continues to surge

Liquids and gas production set to reach 173mmboepd by 2030, with 9% growth on 2022 levels

Liquids and gas production set to reach 173mmboepd by 2030, with 9% growth on 2022 levels

Westwood Insight – Rosebank development finally sanctioned

Westwood Insight – Rosebank development finally sanctioned

What happened in Taiwan’s Round 3 Phase 1 leasing round?

What happened in Taiwan’s Round 3 Phase 1 leasing round?

Creating Value in an Evolving UKCS, August 2023 – Video On Demand

Creating Value in an Evolving UKCS, August 2023 – Video On Demand

Westwood Insight – Rig dayrates have risen, so when are the new rig orders coming?

Westwood Insight – Rig dayrates have risen, so when are the new rig orders coming?

Westwood Insight – Nigeria’s oil and gas sector set to liven up with 140 new wells drilled year-on-year to 2030

Westwood Insight – Nigeria’s oil and gas sector set to liven up with 140 new wells drilled year-on-year to 2030

Nigeria’s oil and gas sector set to liven up with 140 new wells drilled year-on-year to 2030

Nigeria’s oil and gas sector set to liven up with 140 new wells drilled year-on-year to 2030

Westwood Insight – Will the UK realise its 2030 offshore wind target?

Westwood Insight – Will the UK realise its 2030 offshore wind target?

Westwood Insight – Impact of UK ETS reforms on the offshore oil and gas Industry

Westwood Insight – Impact of UK ETS reforms on the offshore oil and gas Industry

Westwood Insight – The growing significance of CPPAs in the offshore wind sector

Westwood Insight – The growing significance of CPPAs in the offshore wind sector

Energy Transition Now Podcast – Offshore Wind Series Review

Energy Transition Now Podcast – Offshore Wind Series Review

Energy Transition Now Podcast Series 5

Energy Transition Now Podcast Series 5

Westwood Webinars – Offshore Wind Market Update 1H 2023

Westwood Webinars – Offshore Wind Market Update 1H 2023

Global Land Rigs Newsletter – 2Q 2023

Global Land Rigs Newsletter – 2Q 2023

Westwood Insight – Harsh environment semisub market sells out; dayrates approach $500K

Westwood Insight – Harsh environment semisub market sells out; dayrates approach $500K

WFO and Westwood: Announcement of knowledge partnership

WFO and Westwood: Announcement of knowledge partnership

Energy Transition Now Podcast – Episode 30 “Achieving Sustainability in Offshore Wind”

Energy Transition Now Podcast – Episode 30 “Achieving Sustainability in Offshore Wind”

Energy Transition Insights – Energy Transition themes in the UK and Norway

Energy Transition Insights – Energy Transition themes in the UK and Norway

Offshore wind CAPEX costs predicted to soar in light of inflation

Offshore wind CAPEX costs predicted to soar in light of inflation

White Paper – Tackling the Cost Inflation Challenge in Offshore Wind

White Paper – Tackling the Cost Inflation Challenge in Offshore Wind

Westwood Insight – The UK’s 1st Carbon Storage Licence Round

Westwood Insight – The UK’s 1st Carbon Storage Licence Round

Westwood Insight – Asia Pacific offshore rig supply shrinking and dayrates surging

Westwood Insight – Asia Pacific offshore rig supply shrinking and dayrates surging

Energy Transition Now Podcast – Episode 29 “Delivering Europe’s Offshore Wind Ambitions”

Energy Transition Now Podcast – Episode 29 “Delivering Europe’s Offshore Wind Ambitions”

Offshore Wind Cost Inflation Survey 2023

Offshore Wind Cost Inflation Survey 2023

Westwood Insight – The State of Exploration 2023

Westwood Insight – The State of Exploration 2023

The State of Exploration 2023

The State of Exploration 2023

Westwood Webinars – UK and Norway – The role of exploration in the energy transition

Westwood Webinars – UK and Norway – The role of exploration in the energy transition

Westwood Insight – GCC onshore drilling rig demand forecast for 25% growth by 2027

Westwood Insight – GCC onshore drilling rig demand forecast for 25% growth by 2027

MENA Onshore Drilling Rig Market Forecast

MENA Onshore Drilling Rig Market Forecast

Energy Transition Insights

Energy Transition Insights

Global Offshore Wind Market Report – 1Q 2023

Global Offshore Wind Market Report – 1Q 2023

Energy Transition Now Podcast – Episode 28 “The Role of Floating Vertical-Axis Wind Turbines”

Energy Transition Now Podcast – Episode 28 “The Role of Floating Vertical-Axis Wind Turbines”

Houston Offshore Breakfast Briefing April 2023 – Video On Demand

Houston Offshore Breakfast Briefing April 2023 – Video On Demand

Westwood Insight – ‘Wider benefit’ in offshore wind decision-making

Westwood Insight – ‘Wider benefit’ in offshore wind decision-making

Energy Transition Now Podcast – Episode 27 “Unlocking Offshore Wind in Southeast Asia”

Energy Transition Now Podcast – Episode 27 “Unlocking Offshore Wind in Southeast Asia”

A landmark year for CCUS in Northwest Europe

A landmark year for CCUS in Northwest Europe

Energy Transition Now Podcast – Episode 26 “Expanding offshore wind to emerging markets”

Energy Transition Now Podcast – Episode 26 “Expanding offshore wind to emerging markets”

Global Land Rigs Newsletter – 1Q 2023

Global Land Rigs Newsletter – 1Q 2023

Westwood Insight – FLNG market emerges from the doldrums, with $35bn EPC contract award value forecast 2023-27

Westwood Insight – FLNG market emerges from the doldrums, with $35bn EPC contract award value forecast 2023-27

Westwood Insight – Asian turbine OEMs: To be or not to be?

Westwood Insight – Asian turbine OEMs: To be or not to be?

Westwood Insight – UK fiscal regime to amplify North Sea rig exodus

Westwood Insight – UK fiscal regime to amplify North Sea rig exodus

Energy Transition Insights – Hydrogen scale-up: what’s priming the UK for success?

Energy Transition Insights – Hydrogen scale-up: what’s priming the UK for success?

Westwood Insight – Buyer beware when it comes to exploration farm-outs

Westwood Insight – Buyer beware when it comes to exploration farm-outs

Westwood Insight – Offshore rig scrapping lowest in years as recovery intensifies

Westwood Insight – Offshore rig scrapping lowest in years as recovery intensifies

Westwood Insight – UK and Norway exploration and production outlook for 2023

Westwood Insight – UK and Norway exploration and production outlook for 2023

Westwood Insight – Supermajor cashflow and the capex conundrum

Westwood Insight – Supermajor cashflow and the capex conundrum

Westwood Insight – Pacific Wind: California dreaming?

Westwood Insight – Pacific Wind: California dreaming?

Westwood Insight – Global marketed offshore rig utilisation to average 95% in 2023

Westwood Insight – Global marketed offshore rig utilisation to average 95% in 2023

Energy Transition Insights – Six key offshore wind themes to watch in 2023

Energy Transition Insights – Six key offshore wind themes to watch in 2023

Global Land Rigs Newsletter – 4Q 2022

Global Land Rigs Newsletter – 4Q 2022

Westwood Insight – 2022 High impact exploration drilling stable with improved performance despite a turbulent year

Westwood Insight – 2022 High impact exploration drilling stable with improved performance despite a turbulent year

RigLogix Offshore Rig News Roundup 2022

RigLogix Offshore Rig News Roundup 2022

Weekly Global Offshore Rig Count 2022

Weekly Global Offshore Rig Count 2022

Offshore Energy Data Dashboard 2022

Offshore Energy Data Dashboard 2022

Global Subsea Tree Tracker 2022

Global Subsea Tree Tracker 2022

Westwood Insight – Record levels of FPS throughput capacity to be sanctioned

Westwood Insight – Record levels of FPS throughput capacity to be sanctioned

Westwood Insight – The changing landscape of offshore wind subsidies

Westwood Insight – The changing landscape of offshore wind subsidies

Westwood Insight – INTOG: Right idea, wrong process?

Westwood Insight – INTOG: Right idea, wrong process?

Westwood Insight – North Sea semisub fundamentals improving but more rigs leaving region

Westwood Insight – North Sea semisub fundamentals improving but more rigs leaving region

Westwood Insight – Is offshore wind development in Mainland China sustainable without subsidy?

Westwood Insight – Is offshore wind development in Mainland China sustainable without subsidy?

OEUK Exploration Insight Report, supported by Westwood

OEUK Exploration Insight Report, supported by Westwood

Energy Transition Insights – What does the Global Energy Crisis mean for the Energy Transition?

Energy Transition Insights – What does the Global Energy Crisis mean for the Energy Transition?

Westwood Insight – Healthy demand and premium dayrates for low-emission rigs to 2026

Westwood Insight – Healthy demand and premium dayrates for low-emission rigs to 2026

Equinor drives low-emission rig adoption in Norway and Brazil with rest of the world slower off the mark

Equinor drives low-emission rig adoption in Norway and Brazil with rest of the world slower off the mark

Westwood Insight – Onshore O&G pipeline capex to total $369 billion 2022-2028 as world cries out for greater supply

Westwood Insight – Onshore O&G pipeline capex to total $369 billion 2022-2028 as world cries out for greater supply

Westwood Webinars – International Land Rigs Webinar Annual Report Review

Westwood Webinars – International Land Rigs Webinar Annual Report Review

Offshore wind opportunity soars with 135 GW of potential capacity available in leasing rounds

Offshore wind opportunity soars with 135 GW of potential capacity available in leasing rounds

Global Land Rigs Newsletter – 3Q 2022

Global Land Rigs Newsletter – 3Q 2022

Westwood Insight – The need for collaboration in New Energies projects

Westwood Insight – The need for collaboration in New Energies projects

Energy Transition Insights – Unpicking ONS 2022: the questions for oil and gas

Energy Transition Insights – Unpicking ONS 2022: the questions for oil and gas

Energy Transition Now Podcast – Episode 25 “Drilling in a low-carbon world”

Energy Transition Now Podcast – Episode 25 “Drilling in a low-carbon world”

Energy Transition Now Podcast Series 4

Energy Transition Now Podcast Series 4

Judge rules against GE selling Haliade-X offshore wind turbine in the US

Judge rules against GE selling Haliade-X offshore wind turbine in the US

Current pipeline of blue hydrogen projects projected to exceed 2030 targets in the UK

Current pipeline of blue hydrogen projects projected to exceed 2030 targets in the UK

Westwood Insight – Mainland China advances floating wind capacity to reach 477MW by 2026

Westwood Insight – Mainland China advances floating wind capacity to reach 477MW by 2026

Westwood Insight – Global onshore rig demand forecast for 24% growth by 2026

Westwood Insight – Global onshore rig demand forecast for 24% growth by 2026

World Land Drilling Rig Market Forecast 2022-2026

World Land Drilling Rig Market Forecast 2022-2026

Energy Transition Now Podcast – Episode 24 “Championing UK Offshore Wind”

Energy Transition Now Podcast – Episode 24 “Championing UK Offshore Wind”

Explaining voluntary carbon offsets

Explaining voluntary carbon offsets

Energy Transition Insights – Flexibility is key in a zero-carbon energy world

Energy Transition Insights – Flexibility is key in a zero-carbon energy world

Westwood Insight – UK CfD Auction: 7 GW supported, but price drop slows

Westwood Insight – UK CfD Auction: 7 GW supported, but price drop slows

Westwood Webinars – Norway State of Exploration 2012-2021

Westwood Webinars – Norway State of Exploration 2012-2021

Westwood Insight – High impact exploration on the rebound: Major frontier discoveries and the most wells since 2019

Westwood Insight – High impact exploration on the rebound: Major frontier discoveries and the most wells since 2019

Energy Transition Now Podcast – Episode 23 “Foresight in a Changing Energy World”

Energy Transition Now Podcast – Episode 23 “Foresight in a Changing Energy World”

Westwood Insight – Contractors in buoyant mood as five-year offshore EPC spend to total $276 billion

Westwood Insight – Contractors in buoyant mood as five-year offshore EPC spend to total $276 billion

Westwood Insight – APAC jackup utilisation ramps up, but maybe not for the right reasons

Westwood Insight – APAC jackup utilisation ramps up, but maybe not for the right reasons

Global Land Rigs Newsletter – 2Q 2022

Global Land Rigs Newsletter – 2Q 2022

Energy Transition Now Podcast – Episode 22 “Appreciating the role of climate science”

Energy Transition Now Podcast – Episode 22 “Appreciating the role of climate science”

Westwood Insight – Norway leads the way with emissions intensity and electrification projects

Westwood Insight – Norway leads the way with emissions intensity and electrification projects

Westwood Insight – Will onshore pipeline demand take off with rocketing oil prices and new energies?

Westwood Insight – Will onshore pipeline demand take off with rocketing oil prices and new energies?

Energy Transition Insights – Offsets: why you should look but not touch

Energy Transition Insights – Offsets: why you should look but not touch

Westwood Insight – Near 15GW of floating wind capacity expected online by 2030

Westwood Insight – Near 15GW of floating wind capacity expected online by 2030

Energy Transition Now Podcast – Episode 21 “Opportunities and challenges of floating offshore wind”

Energy Transition Now Podcast – Episode 21 “Opportunities and challenges of floating offshore wind”

Westwood Insight – Norway State of Exploration 2012-2021

Westwood Insight – Norway State of Exploration 2012-2021

Westwood Insight – Global active OSV fleet boosted by significant reactivations

Westwood Insight – Global active OSV fleet boosted by significant reactivations

Westwood Insight – UKCS on track to meet emissions targets but increasing pressure to address intensity

Westwood Insight – UKCS on track to meet emissions targets but increasing pressure to address intensity

Westwood Insight – The State of Exploration 2022

Westwood Insight – The State of Exploration 2022

Westwood Insight – Saudi Aramco saves the day for the jackup fleet

Westwood Insight – Saudi Aramco saves the day for the jackup fleet

Energy Transition Insights – Europe’s need for gas may not be the opportunity you expect

Energy Transition Insights – Europe’s need for gas may not be the opportunity you expect

Westwood Seminar Recording – “A North Sea of Opportunity”

Westwood Seminar Recording – “A North Sea of Opportunity”

Westwood Insight – Offshore rig utilisation up to 18% higher than typically reported

Westwood Insight – Offshore rig utilisation up to 18% higher than typically reported

Westwood Insight – Asia Pacific set for substantial 123% growth in offshore wind spend

Westwood Insight – Asia Pacific set for substantial 123% growth in offshore wind spend

Global Land Drilling Rig Dayrate White Paper

Global Land Drilling Rig Dayrate White Paper

Energy Transition Now Podcast – Episode 20 “Power-to-X”

Energy Transition Now Podcast – Episode 20 “Power-to-X”

Westwood Insight – Key offshore themes from 1Q 2022

Westwood Insight – Key offshore themes from 1Q 2022

Energy Transition Now Podcast Series 3

Energy Transition Now Podcast Series 3

Energy Transition Now Podcast – Episode 19 “Financing the Energy Transition”

Energy Transition Now Podcast – Episode 19 “Financing the Energy Transition”

Global Land Rigs Newsletter – 1Q 2022

Global Land Rigs Newsletter – 1Q 2022

The emerging Orange Basin oil province in Namibia – a new global hot spot for exploration

The emerging Orange Basin oil province in Namibia – a new global hot spot for exploration

Improving Consenting to Accelerate UK Offshore Wind Deployment

Improving Consenting to Accelerate UK Offshore Wind Deployment

Energy Transition Now Podcast – Episode 18 “The Energy Transition in Africa”

Energy Transition Now Podcast – Episode 18 “The Energy Transition in Africa”

Westwood bolsters rig market capabilities with new senior appointment

Westwood bolsters rig market capabilities with new senior appointment

Energy Transition Insights – A more secure energy transition

Energy Transition Insights – A more secure energy transition

Bloomberg Briefing – Global Offshore Rig Outlook with RigLogix

Bloomberg Briefing – Global Offshore Rig Outlook with RigLogix

Energy Transition Now Podcast – Episode 17 “Why PetChems won’t save oil demand”

Energy Transition Now Podcast – Episode 17 “Why PetChems won’t save oil demand”

Energy Transition Insights – Weighing up the buzz around biofuels

Energy Transition Insights – Weighing up the buzz around biofuels

Energy Transition Now Podcast – Episode 16 “The implications of an increasing dependency on data and technology”

Energy Transition Now Podcast – Episode 16 “The implications of an increasing dependency on data and technology”

Westwood Insight – Global Land Drilling Rig Activity Boosted as Oil Prices Break $100

Westwood Insight – Global Land Drilling Rig Activity Boosted as Oil Prices Break $100

Energy Transition Now Podcast – Episode 15 “What Antarctica tells us about climate change”

Energy Transition Now Podcast – Episode 15 “What Antarctica tells us about climate change”

Energy Transition Insights – Oil, gas and nuclear: the good, the bad and the ugly

Energy Transition Insights – Oil, gas and nuclear: the good, the bad and the ugly

Westwood Insight – Is The Drillship Market Really Sold Out For 2022?

Westwood Insight – Is The Drillship Market Really Sold Out For 2022?

Global Land Rigs Newsletter – 4Q 2021

Global Land Rigs Newsletter – 4Q 2021

Westwood Insight – RigLogix Advanced: Launch of the Global Offshore Rig Market Report

Westwood Insight – RigLogix Advanced: Launch of the Global Offshore Rig Market Report

Westwood Insight – Six key offshore wind themes to watch in 2022

Westwood Insight – Six key offshore wind themes to watch in 2022

Westwood Insight – 2021 High Impact Exploration – lowest discovered resource outside Russia for more than a decade

Westwood Insight – 2021 High Impact Exploration – lowest discovered resource outside Russia for more than a decade

John Douglas Westwood 1945-2022

John Douglas Westwood 1945-2022

Energy Transition Insights – Top seven energy transition trends to watch in 2022

Energy Transition Insights – Top seven energy transition trends to watch in 2022

RigLogix Offshore Rig News Roundup 2021

RigLogix Offshore Rig News Roundup 2021

Global Subsea Tree Tracker 2021

Global Subsea Tree Tracker 2021

Weekly Global Offshore Rig Count 2021

Weekly Global Offshore Rig Count 2021

Westwood Insight Special: Framing a business case for Hydrogen in Northwest Europe

Westwood Insight Special: Framing a business case for Hydrogen in Northwest Europe

Energy Transition Insights – COP26: the lessons for oil and gas

Energy Transition Insights – COP26: the lessons for oil and gas

WindLogix – US Offshore Wind Pipeline by State

WindLogix – US Offshore Wind Pipeline by State

Energy Transition Insights – Is natural gas a bridge too far in 2021?

Energy Transition Insights – Is natural gas a bridge too far in 2021?

Westwood Webinars – Offshore Rig Market Update 2021

Westwood Webinars – Offshore Rig Market Update 2021

Energy Transition Now Podcast – Episode 14 Series Review

Energy Transition Now Podcast – Episode 14 Series Review

Energy Transition Now Podcast Series 2

Energy Transition Now Podcast Series 2

Energy Transition Now Podcast – Episode 13 with Marek Kubik

Energy Transition Now Podcast – Episode 13 with Marek Kubik

Global Land Rigs Newsletter – 3Q 2021

Global Land Rigs Newsletter – 3Q 2021

Energy Transition Now Podcast – Episode 12 with Jamie Beard

Energy Transition Now Podcast – Episode 12 with Jamie Beard

Westwood Webinars – 4Q 2021 Macro Outlook

Westwood Webinars – 4Q 2021 Macro Outlook

Energy Transition Now Podcast – Episode 11 with Kentaro Hosomi

Energy Transition Now Podcast – Episode 11 with Kentaro Hosomi

Energy Transition Insights – How to ensure hydrocarbon infrastructure still has value

Energy Transition Insights – How to ensure hydrocarbon infrastructure still has value

What is the Energy Transition?

What is the Energy Transition?

Energy Transition Now Podcast – Episode 10 with Siobhan Clarke

Energy Transition Now Podcast – Episode 10 with Siobhan Clarke

Westwood Webinars – Focus on Offshore Wind, with Subsea UK

Westwood Webinars – Focus on Offshore Wind, with Subsea UK

Energy Transition Now Podcast – Episode 9 with Duncan McLachlan & Safina Jivraj

Energy Transition Now Podcast – Episode 9 with Duncan McLachlan & Safina Jivraj

Africa E&P Summit 2021, Video on Demand

Africa E&P Summit 2021, Video on Demand

Westwood Webinars – International Land Rigs – A Road to Recovery

Westwood Webinars – International Land Rigs – A Road to Recovery

Energy Transition Insights – ESG performance: just what are investors looking for?

Energy Transition Insights – ESG performance: just what are investors looking for?

Global land rigs demand on a path to 30% increase by 2025 from nadir of 2020

Global land rigs demand on a path to 30% increase by 2025 from nadir of 2020

Global Exploration and Appraisal Reports

Global Exploration and Appraisal Reports

Energy Transition Insights – Direct air capture: a vital negative emissions technology or a distraction?

Energy Transition Insights – Direct air capture: a vital negative emissions technology or a distraction?

Explaining direct air capture (DAC) and the energy transition

Explaining direct air capture (DAC) and the energy transition

Key Considerations for Newbuilds in the Offshore Wind Installation Vessel Market

Key Considerations for Newbuilds in the Offshore Wind Installation Vessel Market

Energy Transition Survey Results

Energy Transition Survey Results

Westwood Webinars – 3Q 2021 Macro Outlook

Westwood Webinars – 3Q 2021 Macro Outlook

Westwood Webinars – Subsea Opportunities Europe, with Subsea UK

Westwood Webinars – Subsea Opportunities Europe, with Subsea UK

Energy Transition Now Podcast – Episode 8 with Dominic Emery

Energy Transition Now Podcast – Episode 8 with Dominic Emery

Energy Transition Now Podcast Series 1

Energy Transition Now Podcast Series 1

Energy Transition Now Podcast – Episode 7 with Emeliana Rice-Oxley

Energy Transition Now Podcast – Episode 7 with Emeliana Rice-Oxley

Energy Transition Insights – The green barrel: added confusion or a serious proposition for the transition?

Energy Transition Insights – The green barrel: added confusion or a serious proposition for the transition?

Energy Transition Now Podcast – Episode 6 with Clara Altobell

Energy Transition Now Podcast – Episode 6 with Clara Altobell

Energy Transition Now Podcast – Episode 5 with Grete Tveit

Energy Transition Now Podcast – Episode 5 with Grete Tveit

Pipeline installations spend to increase by c. 10% to $45 bn in 2021

Pipeline installations spend to increase by c. 10% to $45 bn in 2021

Offshore Support Vessels Webinar

Offshore Support Vessels Webinar

Energy Transition Now Podcast – Episode 4 with Jo Coleman

Energy Transition Now Podcast – Episode 4 with Jo Coleman

Westwood Webinars – APAC Offshore Market Overview, with Subsea UK

Westwood Webinars – APAC Offshore Market Overview, with Subsea UK

Energy Transition Insights – Geothermal: could the UK be the key to wider markets?

Energy Transition Insights – Geothermal: could the UK be the key to wider markets?

Explaining geothermal energy and the energy transition

Explaining geothermal energy and the energy transition

Net Zero by 2050 – implications for the upstream oil and gas sector of the IEA’s roadmap

Net Zero by 2050 – implications for the upstream oil and gas sector of the IEA’s roadmap

Energy Transition Now Podcast – Episode 3 with Julien Perez

Energy Transition Now Podcast – Episode 3 with Julien Perez

The State of Exploration 2021

The State of Exploration 2021

Westwood Webinars – Offshore Wind Outlook

Westwood Webinars – Offshore Wind Outlook

Integrated E&Ps rapidly accelerate offshore wind market share

Integrated E&Ps rapidly accelerate offshore wind market share

Record number of FPSO licenses set to expire in 2022

Record number of FPSO licenses set to expire in 2022

Energy Transition Now Podcast – Episode 2 with Iman Hill

Energy Transition Now Podcast – Episode 2 with Iman Hill

Westwood Webinars – State of Exploration 2021

Westwood Webinars – State of Exploration 2021

Energy Transition Insights – Clean hydrogen: today’s reality or tomorrow’s dream?

Energy Transition Insights – Clean hydrogen: today’s reality or tomorrow’s dream?

Energy Transition Now Podcast – Episode 1 with William Day

Energy Transition Now Podcast – Episode 1 with William Day

Why is hydrogen important to the Energy Transition?

Why is hydrogen important to the Energy Transition?

Drilling & Well Services Spotlight

Drilling & Well Services Spotlight

Westwood Webinars – Five Year Exploration Outlook

Westwood Webinars – Five Year Exploration Outlook

Westwood Webinars – Subsea Opportunities Latin America, with Subsea UK

Westwood Webinars – Subsea Opportunities Latin America, with Subsea UK

Offshore wind FIDs to skyrocket 57% outside China by 2022

Offshore wind FIDs to skyrocket 57% outside China by 2022

Westwood Webinars – 2Q 2021 Macro Outlook

Westwood Webinars – 2Q 2021 Macro Outlook

Farm-out market in 2020: Deal flow at all time low but success rates from wells drilled at a 5 year high

Farm-out market in 2020: Deal flow at all time low but success rates from wells drilled at a 5 year high

Automation – key driver for premium Middle East onshore rig day rates

Automation – key driver for premium Middle East onshore rig day rates

US E&Ps to Focus on Completions and Finish Drilled Uncompleted Wells

US E&Ps to Focus on Completions and Finish Drilled Uncompleted Wells

Drillship Utilization Surpasses Pre-Pandemic Levels, But Still Room For Improvement

Drillship Utilization Surpasses Pre-Pandemic Levels, But Still Room For Improvement

Westwood Webinars – Appraisal Hits & Misses

Westwood Webinars – Appraisal Hits & Misses

Why explorers are not targeting more gas in response to the Energy Transition

Why explorers are not targeting more gas in response to the Energy Transition

Westwood Webinars in 2021

Westwood Webinars in 2021

Scaling Renewables: the converging world of Oil & Gas and the Clean Energy Supermajors

Scaling Renewables: the converging world of Oil & Gas and the Clean Energy Supermajors

Westwood Webinars – A Tale of Two Shelves

Westwood Webinars – A Tale of Two Shelves

Offshore EPC investment primed for a rapid bounce-back in 2021

Offshore EPC investment primed for a rapid bounce-back in 2021

Westwood Webinars – Westwood’s 1Q 2021 Macro Outlook

Westwood Webinars – Westwood’s 1Q 2021 Macro Outlook

Westwood Webinars – Key Wells to Watch 2021

Westwood Webinars – Key Wells to Watch 2021

2020 High Impact Exploration and 2021 Key Wells to Watch

2020 High Impact Exploration and 2021 Key Wells to Watch

Global Subsea Tree Tracker 2020

Global Subsea Tree Tracker 2020

E&P capital expenditure – what is the outlook for 2021?

E&P capital expenditure – what is the outlook for 2021?

UK and Norway Exploration and Production Outlook for 2021

UK and Norway Exploration and Production Outlook for 2021

Offshore Wind Turbine Evolution

Offshore Wind Turbine Evolution

Westwood Webinars – Stalled Resources

Westwood Webinars – Stalled Resources

Westwood Insight – Tracking the environmental impact of the oil and gas supply chain

Westwood Insight – Tracking the environmental impact of the oil and gas supply chain

Westwood Events – The True Cost of Exploration in Africa

Westwood Events – The True Cost of Exploration in Africa

The opportunities for collaboration and synergy between the UK offshore oil & gas and wind sectors

The opportunities for collaboration and synergy between the UK offshore oil & gas and wind sectors

Drillship Attrition – Lifetime revenue vs construction cost a different way to view potential retirements

Drillship Attrition – Lifetime revenue vs construction cost a different way to view potential retirements

Stalled Resources – how big an opportunity is it?

Stalled Resources – how big an opportunity is it?

Premier Oil – reverse takeover by Chrysaor

Premier Oil – reverse takeover by Chrysaor

Westwood Webinars – Westwood’s 3Q Macro Outlook

Westwood Webinars – Westwood’s 3Q Macro Outlook

Westwood appoints Head of Energy Transition

Westwood appoints Head of Energy Transition

BP fleshes out what net zero in 2050 means for its upstream business

BP fleshes out what net zero in 2050 means for its upstream business

Westwood Webinars – How has the UK and Norway E&P sector reacted to the oil price crash – 6 months on?

Westwood Webinars – How has the UK and Norway E&P sector reacted to the oil price crash – 6 months on?

Westwood Webinars – World Oilfield Equipment Outlook

Westwood Webinars – World Oilfield Equipment Outlook

Westwood Webinars – H1 Review: Key wells to watch

Westwood Webinars – H1 Review: Key wells to watch

Westwood Webinars – US Frac supply chain outlook

Westwood Webinars – US Frac supply chain outlook

Westwood Webinars – EMEA – High Impact Exploration and Supply Chain Outlook

Westwood Webinars – EMEA – High Impact Exploration and Supply Chain Outlook

World Land Drilling Rig Market Forecast 2020-2024

World Land Drilling Rig Market Forecast 2020-2024

Westwood Webinars – International Land Rigs – Market Update

Westwood Webinars – International Land Rigs – Market Update

Increased Frac Activity Visibility with Westwood’s SatScout

Increased Frac Activity Visibility with Westwood’s SatScout

Westwood Webinars – APAC Offshore Market Update

Westwood Webinars – APAC Offshore Market Update

Westwood Webinars – Drilling & Well Services Outlook

Westwood Webinars – Drilling & Well Services Outlook

Westwood Webinars – Offshore Energy Services Market Update

Westwood Webinars – Offshore Energy Services Market Update

Westwood Webinars – Offshore Rig Market Update

Westwood Webinars – Offshore Rig Market Update

The oil market continues its cautious rally but more uncertainty lies ahead

The oil market continues its cautious rally but more uncertainty lies ahead

Westwood Webinars – Offshore Mexico – a promise yet to be fully realised

Westwood Webinars – Offshore Mexico – a promise yet to be fully realised

Westwood’s NW Europe Exploration Time-Lapse

Westwood’s NW Europe Exploration Time-Lapse

Westwood Webinars – Westwood Macro Outlook Q2 2020

Westwood Webinars – Westwood Macro Outlook Q2 2020

Protected: Westwood Webinars – EV Portfolio Macro Outlook

Protected: Westwood Webinars – EV Portfolio Macro Outlook

The Art of Adaptability

The Art of Adaptability

Westwood Webinars – North Sea Exploration Performance

Westwood Webinars – North Sea Exploration Performance

North Sea Exploration Performance

North Sea Exploration Performance

Westwood Webinars – Summer Series

Westwood Webinars – Summer Series

BP’s Exploration asset write down highlights diverging views on the future of oil and gas

BP’s Exploration asset write down highlights diverging views on the future of oil and gas

Westwood Webinars – High Impact Appraisal Hits and Misses

Westwood Webinars – High Impact Appraisal Hits and Misses

The State of Exploration 2020

The State of Exploration 2020

Westwood Webinars – Onshore Insights: World Pipeline Outlook

Westwood Webinars – Onshore Insights: World Pipeline Outlook

Westwood’s Offshore Data Cycle

Westwood’s Offshore Data Cycle

Westwood Webinars – The State of Exploration 2020

Westwood Webinars – The State of Exploration 2020

Global Land Rigs Weekly Newsletter

Global Land Rigs Weekly Newsletter

Westwood Webinars – Frac Sand and Horsepower Update

Westwood Webinars – Frac Sand and Horsepower Update

Podcast: James West and Terry Childs on offshore drilling fundamentals for 2020, April 2020

Podcast: James West and Terry Childs on offshore drilling fundamentals for 2020, April 2020

Westwood Webinars – The Impact of DHIs on Exploration Success

Westwood Webinars – The Impact of DHIs on Exploration Success

Westwood Webinars – Offshore Insight: APAC Supply Chain

Westwood Webinars – Offshore Insight: APAC Supply Chain

Westwood Webinars – Using satellite imagery for activity analysis

Westwood Webinars – Using satellite imagery for activity analysis

Westwood Webinars – Offshore Insight: North Sea

Westwood Webinars – Offshore Insight: North Sea

Westwood Webinars – Clastic Stratigraphic Traps

Westwood Webinars – Clastic Stratigraphic Traps

Down but not out – high impact exploration to fall up to 35% in 2020

Down but not out – high impact exploration to fall up to 35% in 2020

Westwood Webinars – International Land Rigs

Westwood Webinars – International Land Rigs

Westwood Webinars – Searching for Super Basins

Westwood Webinars – Searching for Super Basins

Westwood Webinars – Spring Series

Westwood Webinars – Spring Series

Sub-$30/bbl WTI drastically alters the US unconventional supply chain

Sub-$30/bbl WTI drastically alters the US unconventional supply chain

Thom Payne on cuts, storage and short-term oil price

Thom Payne on cuts, storage and short-term oil price

The current challenges for the UK and Norway in the face of COVID-19

The current challenges for the UK and Norway in the face of COVID-19

The Offshore Rig Market – At $30 Oil Offshore Drillers May Be Out of Options

The Offshore Rig Market – At $30 Oil Offshore Drillers May Be Out of Options

Why excelling in stratigraphic trap exploration is now the key to top quartile performance

Why excelling in stratigraphic trap exploration is now the key to top quartile performance

2020: More offshore EPC spending but competitive pricing remains the norm?

2020: More offshore EPC spending but competitive pricing remains the norm?

Improved exploration success rates for DHI supported wells

Improved exploration success rates for DHI supported wells

The Impact of DHIs on Exploration Performance

The Impact of DHIs on Exploration Performance

Podcast: James West and Terry Childs on offshore drilling fundamentals for 2020, January

Podcast: James West and Terry Childs on offshore drilling fundamentals for 2020, January

Exploration in 2020 – The transition is yet to start

Exploration in 2020 – The transition is yet to start

Drone attacks, OPEC production cuts and global energy demand weigh on Saudi Aramco IPO

Drone attacks, OPEC production cuts and global energy demand weigh on Saudi Aramco IPO

Protected: Singapore Offshore Market Update 2019 – Video On Demand

Protected: Singapore Offshore Market Update 2019 – Video On Demand

Westwood releases joint white paper with PPI

Westwood releases joint white paper with PPI

Outside mature plays, explorers need to find more than 200 mmboe for deepwater standalone oil developments

Outside mature plays, explorers need to find more than 200 mmboe for deepwater standalone oil developments

Argentina’s Vaca Muerta to provide the cornerstone for rising rig demand in Latin America, despite economic woes

Argentina’s Vaca Muerta to provide the cornerstone for rising rig demand in Latin America, despite economic woes

Qatar Petroleum leads a new wave of NOC investment in international exploration

Qatar Petroleum leads a new wave of NOC investment in international exploration

EV Private Equity invests in Enhanced Drilling

EV Private Equity invests in Enhanced Drilling

2019 high impact discoveries already exceed whole of 2018, but it’s back to gas

2019 high impact discoveries already exceed whole of 2018, but it’s back to gas

Westwood releases the US Frac Sand Outlook white paper

Westwood releases the US Frac Sand Outlook white paper

Westwood Press Release Frac Sand White Paper

Westwood Press Release Frac Sand White Paper

U.S. Gulf Drillship Market Picking Up Steam

U.S. Gulf Drillship Market Picking Up Steam

New entrant E&P companies are key to the future of the UKCS, but they need to step up investment in new production

New entrant E&P companies are key to the future of the UKCS, but they need to step up investment in new production

DP World acquires Topaz Energy & Marine

DP World acquires Topaz Energy & Marine

Are there really 4,000 DUC’s in the Permian? There might be less than you think.

Are there really 4,000 DUC’s in the Permian? There might be less than you think.

The opportunity and threat posed by US shale water

The opportunity and threat posed by US shale water

Steve Robertson interviews Matt Adams on the latest RigLogix white paper

Steve Robertson interviews Matt Adams on the latest RigLogix white paper

Did Keane and C&J jump start pressure pumping M&A?

Did Keane and C&J jump start pressure pumping M&A?

RigOutlook – A Quantitative Forecast for the Offshore Rig Market

RigOutlook – A Quantitative Forecast for the Offshore Rig Market

Success from high impact drilling badly needed to revive flagging exploration performance in Norway

Success from high impact drilling badly needed to revive flagging exploration performance in Norway

Supermajor Oil Companies Lead the Way in High Impact Exploration

Supermajor Oil Companies Lead the Way in High Impact Exploration

Weld Overlay Joins The Party As Corrosion Resistant Pipe Under-Capacity Threatens Project Scheduling

Weld Overlay Joins The Party As Corrosion Resistant Pipe Under-Capacity Threatens Project Scheduling

Accelerating rig activity signals game-change as rig rates are on the up

Accelerating rig activity signals game-change as rig rates are on the up

Momentum Returns to Rig Markets – Are We About to See a Recovery in Dayrates?

Momentum Returns to Rig Markets – Are We About to See a Recovery in Dayrates?

Maria project write off puts Norway appraisal practices in the spotlight

Maria project write off puts Norway appraisal practices in the spotlight

Eagle Ford Water Disposal Due Diligence

Eagle Ford Water Disposal Due Diligence

New well highlights from Permian, Williston, Eagle Ford, and Haynesville

New well highlights from Permian, Williston, Eagle Ford, and Haynesville

RigLogix Roundup, April 18, 2019

RigLogix Roundup, April 18, 2019

West African Rig Market: A Slow-Burn Recovery

West African Rig Market: A Slow-Burn Recovery

Floating Production: will the HHI/DSME mega-merger turn the tide and allow South Korea to claw back market share from China and Singapore?

Floating Production: will the HHI/DSME mega-merger turn the tide and allow South Korea to claw back market share from China and Singapore?

RigLogix Roundup, April 5, 2019

RigLogix Roundup, April 5, 2019

Offshore Rig Supply – Rebalancing The Market

Offshore Rig Supply – Rebalancing The Market

Frontier success sparks the exploration farm-out market into life

Frontier success sparks the exploration farm-out market into life

RigLogix Roundup, March 22, 2019

RigLogix Roundup, March 22, 2019

Oil & Gas UK Business Outlook 2019

Oil & Gas UK Business Outlook 2019

NW Borneo Exploration – In search of new frontiers

NW Borneo Exploration – In search of new frontiers

RigLogix Roundup, March 15, 2019

RigLogix Roundup, March 15, 2019

RigOutlook – A Quantitative Forecast for the Offshore Rig Market

RigOutlook – A Quantitative Forecast for the Offshore Rig Market

Northwest Europe MODU Market: Could 2019 Demand Exceed Availability?

Northwest Europe MODU Market: Could 2019 Demand Exceed Availability?

Evolution of Permian pad drilling: cube development and the pad complex in drilling factories

Evolution of Permian pad drilling: cube development and the pad complex in drilling factories

Subsea Production Systems – 2019 a tipping point?

Subsea Production Systems – 2019 a tipping point?

Crushing the Market with 225 Million Tons of Frac Sand Supply

Crushing the Market with 225 Million Tons of Frac Sand Supply

Hess, EOG, Equinor & Hunt complete new uncon wells

Hess, EOG, Equinor & Hunt complete new uncon wells

2019 high impact exploration starts with a bang

2019 high impact exploration starts with a bang

Permian jumps 15% in horsepower demand in 4Q 2019

Permian jumps 15% in horsepower demand in 4Q 2019

High impact Glengorm discovery heralds a big year for exploration in NW Europe

High impact Glengorm discovery heralds a big year for exploration in NW Europe

Well highlights from Haynesville, Marcellus, & Williston

Well highlights from Haynesville, Marcellus, & Williston

US Drilling and Completions Set to Exceed 20,000 Wells in 2019

US Drilling and Completions Set to Exceed 20,000 Wells in 2019

S-92 In Focus: A Census of the Heavy Helicopter Sector

S-92 In Focus: A Census of the Heavy Helicopter Sector

New utilisation figures reveal S-92 helicopters are ahead of the curve

New utilisation figures reveal S-92 helicopters are ahead of the curve

Significant Glengorm discovery shows that high impact discoveries are still possible in the UK North Sea

Significant Glengorm discovery shows that high impact discoveries are still possible in the UK North Sea

2018 Global Offshore Rig Market Recap

2018 Global Offshore Rig Market Recap

What to watch out for in 2019 in E&P

What to watch out for in 2019 in E&P

NW Europe Exploration Farm-in* Drilling Performance 2012 – 2018

NW Europe Exploration Farm-in* Drilling Performance 2012 – 2018

“No Technology Silver Bullet for Norway’s Oil & Gas Industry” – Westwood

“No Technology Silver Bullet for Norway’s Oil & Gas Industry” – Westwood

New well highlights from Bone Spring, Haynesville, & Eagle Ford

New well highlights from Bone Spring, Haynesville, & Eagle Ford

The Helicopter Market – A Manufacturer’s Perspective

The Helicopter Market – A Manufacturer’s Perspective

Light at The End of The Tunnel for The Offshore Rig Fleet

Light at The End of The Tunnel for The Offshore Rig Fleet

6% Decline in Permian Well Completions Based on Westwood’s SatScout

6% Decline in Permian Well Completions Based on Westwood’s SatScout

Offshore Helicopters – Helitech 2018 and Beyond

Offshore Helicopters – Helitech 2018 and Beyond

New well highlights from Eagle Ford, Spraberry, Haynesville, SCOOP/STACK and Bakken

New well highlights from Eagle Ford, Spraberry, Haynesville, SCOOP/STACK and Bakken

UK exploration momentum is building, but can it be sustained?

UK exploration momentum is building, but can it be sustained?

Government and regulators need to be “more realistic” about UK oil & gas potential – Westwood

Government and regulators need to be “more realistic” about UK oil & gas potential – Westwood

Westwood Global Energy Group launches daily Permian Basin monitoring capability with SatScout

Westwood Global Energy Group launches daily Permian Basin monitoring capability with SatScout

Surge Energy, EOG Resources, and Antero well updates

Surge Energy, EOG Resources, and Antero well updates

Delaware, Eagle Ford, Bakken, and SCOOP new well highlights

Delaware, Eagle Ford, Bakken, and SCOOP new well highlights

New well highlights from Bakken, Marcellus and Anadarko

New well highlights from Bakken, Marcellus and Anadarko

Pressure pumpers fall prey to efficiency

Pressure pumpers fall prey to efficiency

The proppant demand dichotomy in Appalachia super laterals

The proppant demand dichotomy in Appalachia super laterals

Super laterals trending in the US Northeast

Super laterals trending in the US Northeast

Central Texas frac sand mine hours drop 10%

Central Texas frac sand mine hours drop 10%

Permian traffic accidents up 17% in 2018

Permian traffic accidents up 17% in 2018

Has Anadarko cracked the code in the DJ Basin?

Has Anadarko cracked the code in the DJ Basin?

In-basin sand report: new winkler mines change frac sand landscape

In-basin sand report: new winkler mines change frac sand landscape

West Texas inSANDity continues in the Permian

West Texas inSANDity continues in the Permian

Permian sand mines add 35 million tons of frac sand by summer 2018

Permian sand mines add 35 million tons of frac sand by summer 2018

Is history repeating in the US pressure pumping market?

Is history repeating in the US pressure pumping market?

Schlumberger-Weatherford JV could challenge Halliburton

Schlumberger-Weatherford JV could challenge Halliburton

A shortage of frac sand will bring supply chain challenges

A shortage of frac sand will bring supply chain challenges

Larger volumes and integrated operations key for frac sand suppliers

Larger volumes and integrated operations key for frac sand suppliers

The frac crew conundrum: when will activity return?

The frac crew conundrum: when will activity return?

Westwood Webinars – Offshore Insight: APAC Supply Chain