Quarterly Summary

Oil prices in 2Q 2024 trended broadly in line with 1Q, with Brent crude averaging US$85/bbl this quarter, up slightly from an average of $83/bbl in 1Q 2024. Oil prices rose to $93/bbl in April 2024 following heightened geopolitical tensions between Israel and Iran before retreating over fears of slower-than-expected global oil demand growth. Furthermore, concerns arose when the OPEC+ bloc announced in June 2024 that it would begin to roll back its 2.2mmbpd voluntary cuts from September 2024.

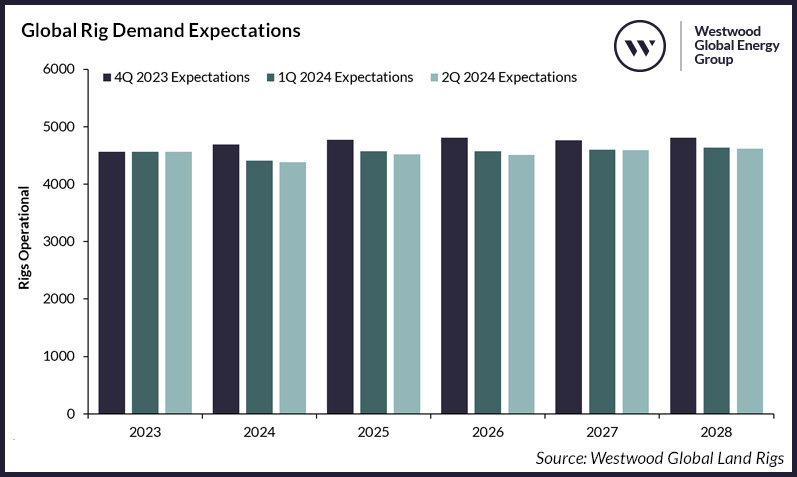

Global Rig Demand Expectations

Source: Westwood Global Land Rigs

For 2024, Westwood predicts global rig demand at 4,384 rigs, down 1% from our 1Q 2024 outlook and 7% below our 4Q 2023 expectation due to the continued effect of stagnant oil prices and high service costs. US activity remained constrained in 2Q, but this is expected to be at, or near, the bottom point for activity, with rig demand expected to average around 3% higher through the second half of 2024 when compared to 1H. Beyond 2024, rig activity in the US, as well as other key areas for rig demand such as Russia, is forecast to remain well below historic levels. This will counterbalance strong growth in areas such as China and the Gulf Cooperation Council (GCC). Between 2025 and 2028, an average of 4,559 rigs are expected to be operational, slightly below the 4,595 rigs in our 1Q 2024 forecast.

Land rig contracting saw several significant awards, especially in the GCC region. This was led by Saudi Aramco awarding 23 rig contracts for drilling work on unconventional gas projects in Saudi Arabia, with the majority of rigs planned for phase two of the Jafurah field in Saudi Arabia. The contracts were valued at a combined US$2.4bn and were confirmed at a signing ceremony in June 2024.

Ben Wilby

Senior Analyst, Onshore Energy Services

[email protected]

Deborah Yamba

Research Analyst, Onshore Energy Services

[email protected]