Energy Transition Now - Episode 7 with Emeliana Rice-Oxley

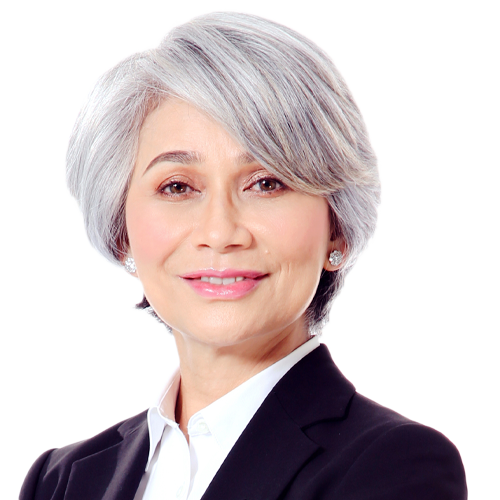

This week, Emeliana Rice-Oxley, Vice President, Exploration in Upstream Business PETRONAS joins the podcast.

Graeme Bagley, Westwood’s Global Head of Exploration & Appraisal also joins this episode, as the discussion with Emeliana leads through the future of oil and gas exploration in the light of the Energy Transition, and role of National Oil Companies (NOCs) within this. Emeliana walks us through Petronas’ three-pronged strategy of maximising cash generators, expanding its core business and stepping out (into new energies). The conversation moves onto the implications this has for the exploration community, with a continued focus on value, lower cost and faster pace, but also the emphasis on a lower carbon footprint. Emeliana then addresses the broader role of the exploration function in areas such as CCS and Geothermal and speaks to the challenge of retaining and attracting the necessary talent.

If you can spare two minutes, we are also conducting a short survey to understand your thoughts on the energy transition and what you would like to hear and see more of. Click here to take the survey.

About Emeliana

Emeliana Rice-Oxley was appointed Vice President, Exploration in Upstream Business PETRONAS since April 2014. She holds a Bachelor of Science in Geology from University of South Carolina, United States of America (USA) and is also a graduate of the Advanced Management Program (AMP) from Harvard Business School.

Emeliana started her career with the Royal Dutch Shell Group (Malaysia) in Jan 1986. From a biostratigrapher to a seismic interpreter, she led numerous regional geological studies. She also enjoyed a short cross assignment in HR. She returned to Malaysia from UK in Jan 2001 to steer prospect maturation and assurance activities. She became the Exploration Portfolio and Planning Manager for the Asia Pacific region and subsequently moved to the USA in August 2006 as team leader for the prolific Brazilian Campos and Santos basin. In 2010, she took the role of Hydrocarbon Maturation Manager for the Onshore US and Latin America.

She joined PETRONAS in 2012 because she wanted to contribute to make a difference to the talents and exploration business in PETRONAS. Emeliana led various transformation efforts to deliver PETRONAS long-term growth strategy. She has been instrumental in placing PETRONAS on the global exploration stage with key entries into the prolific oil basins of the Americas, with a dominant position in Mexico and strategic entries into the US offshore and Brazil. The business transformation of PETRONAS exploration and her push for gender equality earned her the recognition of 2019 Female Executive of the Year and she made the 2020 Global Influencers 275 List by the Asia Pacific Energy Assembly and Women’s Energy Council.

Emeliana currently serves as Director of PETRONAS Gas Berhad and Board member of PETRONAS Management Training Sdn. Bhd. She is also a Board member of numerous PETRONAS Carigali Overseas private limited companies. She is an Advisory Board member for the Women’s Global Leadership Conference. She is a frequent speaker at various international energy and leadership conferences.

She values the diversity that women bring in leadership and business thinking and is a strong advocate for equal opportunities and creating awareness on unconscious gender bias at the workplace. Her resilience has made her the champion of PETRONAS Leading Women Network (PLWN) and a council member of the Malaysia Women in Energy. She is also passionate about developing PETRONAS future leaders and avidly supports PETRONAS Leaders Develop Leaders programme.

DL: Hello, everyone. I’m your host, David Linden, the Head of Energy Transition for the Westwood Global Energy Group, and you’re listening to Energy Transition Now where we discuss what the transition really means for the oil and gas and the broader energy industry. And in a first for this podcast, I’m joined by a co-host in the shape of my colleague, Graeme Bagley, Westwood’s own Head of Exploration and Appraisal.

GB: Hello, everybody.

DL: Great to have you here, Graeme, one of the reasons for having Graeme on with me is because today we want to speak a bit more about the future of exploration and also about the role of an NOCs – national oil companies – within that. These are two hugely important topics when considering the changing shape of the upstream oil and gas industry. Now, importantly, our excellent guest for today is Emiliana or Emi Rice-Oxley, the VP for Exploration at Petronas, the Malaysian NOC. Emi started her career in Shell in 1986, where she held numerous technical and managerial roles in upstream across Asia, Europe and the Americas. She then joined Petronas in 2012 and became the VP of Exploration in 2014, where, amongst other things, she’s been instrumental in placing Petronas on the global exploration stage. Emiliana is also either serves as a director or sits on the board of several Petronas subsidiaries. She’s particularly passionate about gender diversity, equal opportunity and creating awareness of unconscious bias in the workplace, which has gained her a broad recognition, including as one of the top 275 global female influencers by the Women’s Energy Council, amongst others. Emi, it’s a great honour to have you on the podcast, welcome.

ERO: Thank you, David, and thank you for the invitation. It’s a privilege to be talking to both you and Graeme today.

DL: Wonderful. Thank you. What some people might not know is that I guess Petronas is Malaysia’s single largest company and together with the fact that it’s a shareholder in the Malaysian government means that whatever Petronas does has a big impact, I think, both at home and in Asia and increasingly, I guess, further afield as well. Therefore, I think it was exciting to see some of the announcements and commitments that Petronas has made in its contribution particularly at home, but also in the energy transition more broadly. So, Emi, to get us started could you walk us through what is Petronas’ approach to the energy transition?

ERO: Thank you, David. Petronas started its sustainable development journey way back in 2001. Our ambition then was driven by our commitment to provide affordable and reliable energy while balancing climate change. Today, energy transition is becoming a core part of any oil and gas company’s strategic direction. And with the accelerated pace of energy transition, we believe it is important that we future proof the organisation. And that is why in Petronas we have our three pronged strategy of maximising our cash generators, expanding our core business and stepping out. Now, this was put in place since 2018 to help us focus on growth, particularly in stepping out, which is really diversification of our business with stronger commitment to sustainability. Now, what this means, David, is that we acknowledge that oil and gas is still our core business and it is our main cash generators. This part of the business needs to be managed well, so it will continue to generate cash, which will enable us to step out into clean energy space. And we have been expanding our renewable energy portfolio in recent years, especially in solar energy. And I see this will continue. This is very much aligned with our purpose as a progressive energy and solutions partner, enriching lives for a sustainable future. And lastly, Petronas declared our aspiration to achieve net zero carbon emissions by 2050 last year. This means strengthening our responsibility to produce affordable and reliable energy whilst balancing it with greater climate action with our Petronas carbon commitment, we will continue to mitigate emissions, leveraging on our operational excellence whilst increasing energy efficiency through reduction of hydrocarbon flaring and venting and fuel gas usage from our operations. And, of course, beyond responsible operations, we have to find ways to remove CO2, given our gas rich portfolio, many with high CO2, through carbon capture and storage. And of course, we look to carbon offsets through renewables and nature based solutions for any residual emissions. So, these are some of the things that we’re doing in our role to fulfil a net zero carbon emissions.

DL: Very interesting. Just so I understand though, a lot of what companies that have set in their ambitions are saying, that oil and gas will be a core to their future. And I can see why that’s important. As you say, it’s a cash generator, but different companies are taking different approaches in terms of the trajectory of oil and gas. So, some are saying, you know what, we’re going to go cut oil and gas production by 40 percent, for example, in the next decade. And others are saying, look, we continue to grow because hydrocarbon demand is going to be required. It is important to the growth of our business. What is the shape of that look like in Petronas going forward? Is it still 90 percent oil and gas for the foreseeable future? Or is it also something that will eventually need to a decline?

ERO: In Petronas, as we’ve maintained a position that oil and gas is still a substantial part of the energy mix, at least for the next few decades. And we’re not alone in this. In fact, in your earlier podcast with Iman Hill, which, by the way, I enjoyed listening to David, Iman highlighted one of IEA scenarios which predicts that oil and gas will account for 46 percent of global energy supply in 2040. Recognising that oil and gas will still play a dominant role in the future energy mix, our oil and gas business more than ever must be able to deliver sharper performance. Decarbonisation of our core oil and gas operations whilst remaining financially resilient is key in moving towards a lower carbon future. In Malaysia, we will continue to monetise to increase the value and to maximise the return arising from Malaysia’s oil and gas resources, and at the same time ensure its long term business sustainability. This is because as you as you clearly pointed out, David, in Malaysia, we are in a unique situation we’re both the operator and the regulator. So, how big will oil and gas be as we diversify our portfolio? I wish I can give you specific numbers, David, but I’m afraid you will have to be content with what I shared earlier. We will, however, watch for signpost, observe our customers as we transition towards 2050. I think what’s important is that as an organisation, Petronas have the agility and can move adequately to change when we need to do so.

DL: Super. Very interesting. Thank you. And how does, I mean, I might know the answer to this already listening to you, but how does the, how does your net zero ambition differ maybe to some of your competitors out there? So, we’ve touched on this a little bit, but the supermajors and maybe know your specific context of where you are versus where some of the others are, some of your competitors are. How are you looking at this maybe slightly differently?

ERO: In so far as commitment to net zero ambition, I don’t think we’re too different from many supermajors, David, because I mentioned earlier that Petronas also made a declaration to net zero carbon emissions by 2050. However, we are an NOC, this is the main difference with any IOC because of this, our energy transition journey, our path to get to 2050, will therefore be different. This is because, as you pointed out as well, our shareholder, our stakeholders, our portfolio and our geographic focus are different from theirs. And as you as you well know, David, the pace of energy transition varies based on region. In OECD countries with all the policy and regulation that favour clean energy, I can understand why the pace and strategy for transition by IOCs like Shell and BP are more aggressive. However, the NOC or for NOCs regardless from any region, their main role to maximise the value of the country’s oil and gas resources, is always held as an utmost priority. And for Petronas, we intend to fulfil this role for Malaysia whilst ensuring, and this is important, while ensuring our long term business, sustainability and commitment to a lower carbon future.

GB: OK, so thank you, Emi, that’s really interesting again. Now, we’re both explorers, and for many people think about exploration has been the lifeblood of the oil and gas industry. There’s a lot of concern being raised about the future of exploration given the energy transition. I wonder if you could maybe elaborate on Petronas’ exploration strategy and how it may be changing in response to the world that’s changing around us today.

ERO: Thank you, Graeme. It’s really great to be talking about exploration now. As I said, Petronas is committed to its long term exploration strategy with an enhanced focus on Malaysia without impacting its international growth aspirations. What will certainly be different going forward is an enhanced attention to low carbon operations and not only for exploration, but also development. We recognise that we must be more sustainable to meet societal expectations. So, in upstream, very much in line with what I shared earlier, we will focus on being not only a safe but also a low cost, low carbon business. We will improve the efficiency of our operations. We committed to zero flaring by 2030 and zero venting by 2024. And as I said earlier, we will reduce combustion in our oil and gas operations offshore. Now, we’ve also made a commitment to a monumental project to deploy CCS technology at our Kasawari development with first injection plan in 2025. And this is part of a greater strategic plan for CCS across depleted gas fields in Malaysia with a total 46TCF of storage volume identified. So, there’s even bigger potential to expand this volume if aquifers and depleted oil fields are considered. So, in short exploration as the upstream growth engine for Petronas will take all these developments that we’ve been talking about externally into consideration when allocating capital to exploration projects. So, when we’re talking about our strategy, our exploration strategy was established in 2017 and remain intact today, we will pursue selective frontier opportunities for material resources. We will explore to fill in Malaysia and regional core and expand our heartlands. And lastly, we are focused and disciplined in execution, leveraging the proven strength of our people in technology, in deepwater and integrated gas. And over the past years we have entered the Americas, for example, Mexico, Brazil, US GOM as well as West Africa. And we’ve made impactful discoveries in Mexico, in the US GOM and earlier this year in Indonesia, which we must bring to production quickly. Now, given the low oil price and the future energy demand that favour cleaner and cheaper energy sources, upstream and exploration needs to be competitive. And so, to remain important and relevant, because as we move into, say, 2030 or 2050, we just need to be, as I said earlier, a safe, resilient, low cost and low carbon business. So, for exploration, the focus on value, lower cost and faster pace, which are really not new, however, are becoming more amplified as the emphasis on lower carbon footprint as we continue to explore and progress on our journey towards energy transition.

GB: So that’s interesting Emi, that sounds as though, at least in the immediate medium term, exploration won’t be doing very much, very differently in terms of the processes that you go through, in terms of the portfolio selections you make. But you may have a slightly longer term view on what the implications of success in that exploration programme might be. Is that correct or is there anything that you think your team will be doing differently in the short term?

ERO: Differently. Well, exploration simply needs to demonstrate all the things that I said earlier, right? So, we continue to deliver value in line with energy transition requirements to the business, whether it’s five years or 10 years from now. So, I’m not going to repeat all of that again, what I said earlier, but I like to talk about next gen. You probably think about this, which next gen is Petronas’ exploration technology plan that aims to enhance and accelerate our ability to deliver sustainable and profitable return from our investment. It is an integrated geology and geophysics initiative designed to provide data driven solutions from basin to reservoir scale. And this is important so that we can maximise accuracy while minimising uncertainty. And you know how important that is in exploration, Graeme, especially if we are to show the value from exploration investment. Digital programme, organisational ability and innovative projects are the three primary elements in next gen, we use advanced technologies that focus on workflow, efficiency and collaboration in what I call a continuous and evergreen base into reservoir loop. You may be wondering why I think next gen is different from what we’ve done and maybe even what others have been doing in the past. Well, it’s high end computer processing and storage capacity on cloud and a collaborative, and this is key, a collaborative platform across multiple disciplines. It is, it’s not just about data or analytics. It’s about transforming our processes the way we think our culture to its openness of information, collaborating to solve problems and make better decisions. And by leveraging the latest innovation, say machine learning, artificial intelligence and cloud computing, next gen will lead us to better recognition of exploration opportunities on the global scale, enhanced commercial success, and reduce the time from basin entry to a well location from years to months. So, we can do things at pace effectively and efficiently. So, maybe differently, if you will, Graeme.

GB: So do you think that next gen, Emi, will change the way that we make exploration decisions? What do you think the criteria will be for making portfolio decisions on which wells to drill, which countries to enter? Given the change in the energy transition and given the availability of technology such as next gen?

ERO: Next gen will certainly help us. However, I believe the criteria for exploration do not change. It always starts with the best basin, the best play, the best rocks, best fluids and best fiscal terms. And of course, access to markets. However, we now need to pay even more attention to pace. Faster turnaround, not just for faster returns, but also to minimise emissions faster. And that’s where next gen can help us, because that’s one of the intent to increase the pace of what we’re doing. We also need to pay more attention to lower the overall carbon footprint in terms of the composition and quality of the fluid or gas which can lead to higher cost and emissions. For example, high CO2 gas fields will require carbon sequestration and these costs more and longer to develop, not to mention any residual emissions that needs to be addressed. So, again, next gen can assist us there because it can help us since we’re doing the integration and the collaboration that I said, at a platform that, where we can all share data together and make better decision based on all the information that we have. So, exploration opportunities that can be monetised quickly if you take that into account with low development and operating costs as well as risk, will put us in better position to compete in the supply space in the future. Otherwise, it will be really hard to justify for us to do exploration. So, this, of course, means better and early integration not just within exploration, but also with our development colleagues even before we drill our prospects.

GB: I see, so perhaps in the past has been a lot of discussion about the relative merits of volume based exploration rather than value based exploration. So, what I’m hearing now is you’re bringing in a third leg to that, which is about the longer term emissions footprint of any development in a success case, is that correct?

ERO: Absolutely. Absolutely. That’s what we’re doing, looking at the whole value chain, the whole life cycle.

GB: Great. Great. Thank you. So, what about the future for exploration? And do you think that the, you know, the world is changing, and that the role of geopolitics might, for instance, have a role in where we choose to explore? Are the criteria for exploration going to be different in different parts of the world? In Asia compared to the Americas, compared to Africa, for instance?

ERO: You know, Graeme, we all know that tackling climate change is a global endeavour, which is going to be a really big challenge. We also know that different countries will respond differently to the pressure from the Paris agreement, for example, as one can read in their individual nationally determined contributions to the agreement. This means that some countries or region will be more lenient towards upstream activities, but at the end, it is Petronas’ responsibility to uphold its standards at a global scale. So, my answer would be no, for geographic base set of criteria. As I explained earlier, it is all about the rocks, the fluids, the fiscal terms, as well as exploration maturity when deciding on new investments. And this criteria will be applied globally regardless of geographic location. Just like our HSSE standards are not geographically defined, and I believe other E&P companies that are equally committed to net zero emissions will hold a similar view because their commitment and accountabilities apply to the full spectrum of their activities, regardless of geography. Having said that, Malaysia will continue to carry an advantaged position for Petronas as we have a large integrated footprint in the country with many spinoff benefits to local industry and community,

GB: That’s very good to hear. Thank you, Emi. And another question, one thing we’ve been seeing recently in our analysis of high impact exploration globally across Westwood, is that we’re seeing the NOCs take a larger share of the exploration activity and budget, and perhaps the cost of some of the smaller and middle sized companies. Is that a trend that you see continuing, not just for Petronas, but for NOCs across the globe?

ERO: I believe so Graeme, because I think it is important, at least for Petronas, as part of pursue material resources strategy. High impact wells by definition have a high impact on the portfolio. So, as long as the impact is aligned with our strategy and investment criteria, including corporate net zero targets, we will pursue it. And I guess the same will hold true for other companies, other NOCs.

GB: Interesting. And again, similarly, we’ve often seen the NOCs partnering with the with the supermajors, often companies who have a lot of expertise and capability in certain areas, particularly delivering big high profile deepwater projects, for example, as the capability of the NOCs continues to grow, do you think we might see more partnerships and alliances between the NOCs from different countries?

ERO: I believe so, Graeme. It makes sense to always have the right partner that share similar geographic focus and strategy and to spread risk. And, of course, technology that you talk about in Malaysia and abroad, we are partners with their NOCs and we welcome the opportunity to grow that partnership. And with the inevitable transition, I foresee a gradual but significant change in the players landscape. We’ve seen some companies already announced that they will stop entry to new exploration areas of countries by certain years. So, this shift may open up more opportunities for some NOCs to increase their share of exploration activities, just like taking a large share of high impact exploration, as you pointed out earlier. So, given the overall changes to the landscape that we just talked about, alliances between NOC may not be too much of a surprise in the future.

GB: You very much see the withdrawal of some companies from high impact and frontier exploration as a potential opportunity for yourselves and perhaps other companies with a similar strategy?

ERO: Yes, so long as it meets, like I said earlier, the criteria that we’ve set and so long as it meets our net zero ambition.

GB: Of course.

DL: Interesting it’s fascinating listening to you both, because I’m obviously not an explorer, so I look at the world maybe slightly differently, or at least from a different angle. And listening to you both, you know, it sounds very much about, how do you manage an appropriate level of risk as well as the opportunity that’s there? And you see at the moment, you know, throughout the energy transition, when you’re looking at companies trying to build hydrogen or CCS ventures that they partner, they collaborate, to manage that risk. And that’s been something that’s been happening, I guess, in the exploration community over a number of years in other forms. But ultimately, it is about risk management. And, you know, you mentioned an IEA, the SDS one, sustainable development scenario earlier around, you know, there is a gap, there is a role for oil and gas to play, and explorer are there to fill that gap. We can’t simply go and use what we have now and fill that gap. But of course, the IEA also came out with a different scenario earlier this year. It’s a net zero, or one point five degree scenario, which had a pathway in it. And I’m sure everyone who’s listening to this will know, it was about, also saying one of its key milestones was to not need to go and explore any further. I guess the obvious question is, do you agree or disagree with that? But I’m sure that will be a pretty quick yes and no answer. What I really, I guess, interested in is how long a life do you think exploration actually has with that kind of rhetoric in the market?

ERO: You know, David, I expected you to talk about that particular IEA scenario. Now, I believe as we commit ourselves to be greener and reduce carbon emissions, we should, however, also acknowledge that fossil fuel will still play an important role over the next few decades, as we have yet to have a cost effective alternative for energy to fill up the demand currently being met by fossil fuel. And I believe the IEA report acknowledges this still when it says, there are many possible paths to achieve net zero CO2 emissions globally by 2050 and many uncertainties that could affect any of them. Therefore, exploration, I believe, still has a role to play, still has a job to do. Exploration is the means to maintain the energy supply and also options in a responsible way while the world transitions into new energy. And so most explorers like myself will say that we still have 20, maybe 30 years to go. But I think more importantly, David, is what do boards and key decision makers think? Because we’ve seen the impact of that for some players.

DL: Absolutely. And a lot of the initial net zero commitment, obviously, is a government commitment, not a corporate commitment. And it’s now requiring both corporate and government to work together to get there. But as you say, you’re putting in plans in place to evolve how you do exploration. Let’s say a traditional exploration isn’t changing too much really, since as you say 2017, the strategy you have. But more broadly, the obviously the energy transition also offers new opportunities for exploration to get involved and do other things. And you started to touch on some of these earlier. Could you maybe then talk about, while there is that energy transition, while exploration is being sort of tossed about, as what’s going to happen to it? What else is there that an exploration unit such as yours can actually be doing?

ERO: In Petronas, the exploration subsurface fraternity provides functional support to the whole organisation. So, we really are well positioned to support the ongoing efforts, say on CCS. I mentioned Kasawari earlier. It’s going to be the region’s largest offshore CCS project to be online in 2025. And we are also technically maturing CCS solutions for another gas development with target start up a year later. We’ve identified 46 TCF of storage volume, which we all need, which will need a lot of effort to turn into potential storage space sites. And the cool part of CCS, is the subsurface storage, which requires a lot of input from geoscientists. For example, on the suitability of the storage location, the reservoir formation, the caprock integrity. So, this is one area where geoscientists are broadening, certainly Petronas, broadening their traditional role beyond looking for hydrocarbon.

DL: Very interesting. And Graeme and I have the pleasure of talking to a number of players who are looking to look at things like CCS or geothermal and other areas as it is clearly in a great transferability of skills. And I’m sure we’ll touch on that in just a minute. But more broadly, then, if you think about Petronas, both as an exploration unit but also as a corporate entity that is going through its own transition, there is a lot of uncertainty around how you should allocate your capital. By capital, crudely, I’m talking about money as well as people, I guess. How is it that Petronas tries to manage some of that uncertainty? Do you have scenarios of those types of things in house that you use to say, look, this is how we stress test our portfolio, this is how we stress test our capital allocation and those things? Because ultimately it’s important how you think about where that capital goes to make sure you get the best returns for your shareholders.

ERO: Right, we cannot control the oil price, nor can we truly predict the pace of energy transition with certainty. As you pointed out, even the IEA says the NZE 2050 is a path and not the path to net zero emissions. So, there’s definitely a lot of uncertainty. But regardless which scenario Petronas refers to, exploration just need to focus on what we can control, which is really to ensure that we are disciplined and focussed in all our growth seeking activities. And I mentioned some of the criteria earlier, focussed on technical, commercial and operational excellence, so we can deliver profitable and sustainable return from our exploration investment, whether it’s five years from now or 10 years from now, continue to high grade our portfolio, accelerate the pace of our discoveries to production, because we can offer options to replace discoveries that are difficult and costly to develop with new, cheaper and lower carbon resources. This is one way we manage the uncertainty for exploration, and for Petronas, as I said earlier, we are of course, diversifying our portfolio and at the same time we will watch for signposting, observe our customers, and really be agile enough as an organisation to respond to the changes in the marketplace, given the uncertainty that we’ve talked about.

DL: Super thanks, Emi. So, certainly I think your point there around observing your customers, this is a really interesting one, because that’s precisely how, conversation I recently also had with Shell, was very much around how they think about their transition. And it’s not often what people think about is, what is your customer actually doing? What does your customer want? So, it’s very interesting to hear you say that. So, thank you.

GB: So Emi thinking now about the next generation of explorers and people working in the energy sector and obviously oil and gas has developed something of a dirty name over the last two or three years in particular, and we see many companies rebranding themselves with energy rather than oil and gas, for instance. And we’re talking about timeframes of 2040, 2050 for net zero across the planet, which may seem a long time to us today, but it’s perhaps only, you know, less than 30 years away, which is well within the working life of graduates who are leaving university today. And we understand that many graduates are thinking about going to should they really be investing in their careers in what could be a dying industry over the long term. So, how do you see the challenges reflected that impacting your ability to attract talent, and particularly in the geosciences where people might be thinking, well, I might not have a job in 10, 15 years’ time, why should I go into that particular industry?

ERO: Indeed, indeed, it’s getting difficult or more challenging to attract new talent, I do agree. However, for Petronas, as I said in the beginning, Petronas is a progressive energy and solutions partner, enriching lives for a sustainable future. That is our purpose. And we believe we are part of the solution to find cleaner, affordable, reliable and sustainable energy that the world needs. And so, this is the narrative, we will and must share our purpose, that is, in order to continue to attract and retain talent. And given the importance of our human capital to the successful implementation of our strategy, whether it’s growing our core business or stepping out into new energy and new business, we pay attention to the full spectrum of how we attract, develop and manage our talents. Take capability, development and learning, for example, we have consciously shifted from the traditional prescriptive learning to a more adaptive and self-directed learning with opportunities for upskilling and career development. This is to align with the agility of the future workforce that we need, not just in traditional hydrocarbon oil and gas, but also in renewable energy. So, that’s very much a line, and also to empower our talents to chart their own path for capability, development and mobility. This is a valuable proposition to retain our talent. So, sharing our bigger purpose for a sustainable future and giving them the opportunity to grow and fulfil that purpose are some of the things we do to attract and retain talent. And I can share a bit more on how we repurpose, if you wish, our talents, if you want to?

GB: Yes. Yes, please. I know that’s happening in many, many companies at the moment.

ERO: It’s right. And in Petronas, we call this retooling our human capital, Graeme. In light of the challenges and opportunities we see, the entire organisation needs to be up skilled with agile enterprise approach and with focus on innovation to enable business ideas to be tested, launch and scaled up. And we have the space and platform in Petronas to build innovative and entrepreneurship capabilities and to problem solve with pace. This is because both our traditional core and our new or step out business, which I mentioned in our conversation earlier, need to have the right talent to be excellent in their execution and also innovation to either challenge existing norm or to do something completely new. However, focus for our core business is on strengthening our workforce’s core competencies, whether it’s technical, functional or leadership. For new business, our focus is mostly on getting the right talent, with the right skill, with the right skills to do something we have not done before. Hence, we are looking into potential reskilling where adjacent skills may be available. And I mentioned earlier about our geoscientists broadening into CCS for example. And so that’s, those are the kind of upskilling, reskilling that we’re doing. And to do all these HR is transforming our whole ecosystem to help us better manage and support our talent development and create better experience for them. And lastly, and this is very important, we have a culture that promotes diversity and inclusion to allow these talents, no matter what they’re doing, traditional core business or new business, to thrive and grow in any role that they take on.

GB: That’s just fabulous to hear, Emi. And I’m just thinking for students now leaving school and going to university, how do you see the discipline mix changing over the next 10 to 15 years? What technical disciplines do you see the industry needing more of, or perhaps needing less of to where we are today?

ERO: I think it’s more in the technical space of new energy, whether it’s in renewables, whether it’s in solar, wind, hydrogen, I think those are the areas that probably a lot of us are also still trying to get on board and trying to explore. So, those may be, skill sets, that’s probably needed. However, I still believe geoscience have a role to play, and I talked earlier about, you know, now you’re not looking for hydrocarbon, you’re not looking to extract. You’re actually trying to put back CO2, for example, into the reservoir. It’s the converse of that. But equally, you need to use geoscience experience in that. There’s also geothermal, for example, where there is possibility to do that. And of course, if you go beyond the traditional oil and gas, if you’re into mining for precious minerals to support energy transition, because we need some of those precious minerals for EVs and all that, there’s also a role that geoscientists can play

GB: That’s really good to hear. I know, I work closely with several universities across Europe, and I’m sure the students there will be very glad to hear that there is an opportunity for them in some fabulous companies, including Petronas, going forward for the next 10, 20 years. So, that’s really good. David?

DL: Yeah, thank you. I mean, just to add to that as well, I think it is worth mentioning that there are more people than jobs, in what I would call the new energy space at the moment as well. So, there’s a lot of people saying they want to enter the space. But realistically, you know, hydrogen won’t really get anywhere until 2030 onwards. CCS will be similar, et cetera, et cetera. And so, you have to be a little bit careful in your own career planning as well, that you don’t say, I want to do all these things and not actually what makes up 90 percent of the current energy mix. And maybe forget about that, that some of these things are going to take a long time to come to fruition. And so need to get the balance right. It’s the same for talent as it is for the energy mix. It’s a transition as such. Super, thank you, Emi, that that was really interesting and thanks for joining us today and to help talk us through, you know, specifically what Petronas is doing both in the energy transition and on exploration. I think what you certainly said there resonates with a number of, well, current explorers, but also, I think the industry as a whole. There’s certainly some complex dynamics in play. So, it was good to hear it from someone who’s working on these things day to day.

ERO: Thank you, David and Graeme, it has been a pleasure talking to both of you today.

DL: And thank you also for Graeme for joining today. And it’s been good to have a co-host. Appreciate your time and thanks everyone else for listening. Hope you certainly enjoyed it. Please make sure you subscribe. Give us a rating and share with your friends. Talk to you next time.

Copyright and Reproduction

This website contains material which is owned by or licensed to Westwood Global Energy Group. This material includes, but is not limited to, the design, layout, look, appearance and graphics. You may not modify, reproduce or distribute the content, design or layout of the Website, or individual sections of the content, design or layout of the Website, without our express prior written permission. For media enquiries, please contact [email protected]