August 2025

Policy Push vs Project Reality

July saw a striking contrast between ambitious policymaking and the continued drag on hydrogen project delivery. Although governments in Germany, the UK and the EU have taken steps to speed up planning approvals, clarify regulations and unlock funding, infrastructure projects are still facing delays, and cancellations continue to occur. From new national legislation to final investment decisions and revised subsidy schemes, this month underscores the growing tension between policy acceleration and market execution.

This edition of Hydrogen Compass has been authored by Giulia Cannatelli ([email protected]). Please do share any comments or feedback you might have. The next edition will be published in September.

Policy Acceleration: Governments Step In

Governments are clearly signalling that the hydrogen rollout must pick up speed. Germany’s Ministry for Economic Affairs proposed a Hydrogen Acceleration Act, aiming to fast track planning and approval processes for hydrogen projects, including electrolysers, pipelines and import terminals by granting them overriding public interest status – a legal designation that prioritises these projects in planning processes and shields them from certain legal challenges. The law would also include CCS-enabled hydrogen, signalling a pragmatic shift to encompass climate-neutral options amid stalled deployment.

The UK government announced it will publish an updated hydrogen strategy in autumn 2025 – its first major revision since 2021 – to improve and fast-track delivery against its 10GW by 2030 target. The update will be accompanied by a refreshed low-carbon hydrogen strategy and plans for future subsidy rounds. While the first hydrogen allocation round (HAR 1), backed only 125MW, upcoming HAR 3 and HAR 4 rounds are expected to allocate up to 1.5GW in total, alongside new support for hydrogen transport, storage and industrial decarbonisation. The UK has also launched a consultation to allow up to 2% hydrogen blending into the national gas grid, a step up from the current 0.1% cap. While this would provide a limited offtake route for electrolytic hydrogen projects, the government has clarified that the aim is not decarbonisation but rather to act as an “offtaker of last resort” – offering a guaranteed offtake for producers struggling to secure commercial buyers due to delays in dedicated hydrogen infrastructure or insufficient demand from end-users.

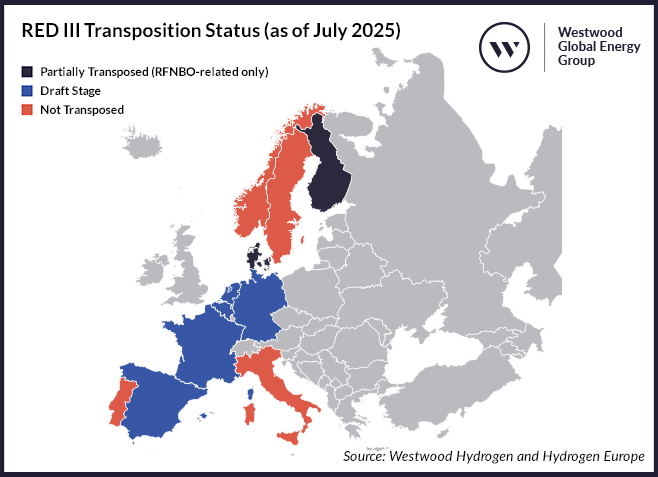

At EU level, RED III non-compliance triggered legal action against 26 member states, illustrating how policy ambition still outpaces national implementation. RED III requires countries to transpose renewable hydrogen targets for transport and industry into national law by the 21 May deadline. The European Commission is allowing a two-month window for countries to respond and implement the mandates. Only Denmark was excluded from proceedings, having passed partial legislation including a 0.9% RFNBO transport fuel mandate. Although Denmark did not introduce the required 42% industrial hydrogen mandate, the Commission may have deemed its subsidy regime sufficient to meet the target — or judged that its industrial profile did not warrant a mandate. Meanwhile, Finland did claim partial compliance, and Spain, France and the Netherlands have draft laws pending, but none have been formally finalised or notified to the Commission.

RED III Transposition Status (as of July 2025)

Source: Westwood Hydrogen and Hydrogen Europe

Note: Westwood’s Hydrogen solution currently covers Belgium, France, Denmark, Germany, the Netherlands, Norway, the UK, Spain, Portugal, Italy, Sweden and Finland.

Separately, the European Commission published its Delegated Act on low-carbon hydrogen, introducing complex GHG accounting rules and strict methane thresholds. While welcomed for bringing regulatory clarity, the act has also drawn criticism for being overly bureaucratic and potentially deterring investment.

Project Delivery: Progress and Setbacks

Despite regulatory momentum, delivering projects continues to show uneven progress. Air Liquide made a final investment decision in July on the ELYgator project, a €500mn, 200MW electrolyser in Rotterdam. Backed by Dutch and EU funding, the project is on track for commissioning by 2027 and will supply hydrogen to TotalEnergies and other industrial users.

By contrast, the Hydric project in Puertollano, Spain – once set to deliver 200MW – has been cancelled by Repsol and RIC Energy after feasibility studies found it economically unviable. Although Repsol had been lined up as the sole offtaker and the project has received public funding, the developers cited construction challenges and high costs as decisive factors.

Elsewhere Gasunie confirmed delays to its national hydrogen backbone, now postponed to 2033, with permitting and labour shortages driving costs from €1.5bn to €3.8bn. Spain’s Enagás admitted that the H2Med corridor may not be operational until 2032.

These bottlenecks reinforce that regulatory frameworks and incentives alone cannot deliver infrastructure. Timelines and permitting remain persistent challenges.

Targeted Funding: Supporting the Right Projects

Despite delivery risks, funding activity remains high, with several countries progressing auctions or direct subsidies. The table below highlights funding announcements from July:

| Country | Funding Scheme | Capacity Supported | Funding Value | Details |

| Netherlands | Large-scale hydrogen production using an electrolyser (OWE) | 602 MW | €700mn+ | 11 large-scale projects |

| Spain | EHB Auction-as-a-Service | 485MW | €373mn | 3 projects |

| France | National Support Mechanism | 388MW | €4bn total pot | Competitive dialogue phase launched |

| UK | HAR 1 | 125MW | undisclosed | 10 out of 11 projects have signed contracts |

| UK | Sustainable Aviation Fuel Fund | - | £63mn | 10 projects to produce hydrogen-derived e-fuels |

This month’s developments paint a picture of policy frameworks beginning to align with delivery needs, but with significant gaps in implementation, as illustrated by failure in transposing RED III into national law. Infrastructure, permitting and economic feasibility remain major obstacles. What is increasingly clear is that governments are aware of the need to move from vision to reality. But unless support is matched by decisive regulatory streamlining, local engagement and flexibility on rules such as RFNBO criteria, Europe’s hydrogen ambitions may continue to stall in the implementation phase.

Key European Project Watch

| Project | Update |

| Lingen Green Hydrogen | BP is set to launch a hydrogen open season on 16 July to gauge market interest in renewable hydrogen produced from its 100MW Lingen Green Hydrogen project at its Lingen refinery in northwest Germany. The project, supported by federal and regional funding, aims to produce 10-12,000 tonnes of RFNBO-compliant renewable hydrogen annually starting in the second half of 2027. Some of the hydrogen will replace grey hydrogen at the refinery, with the rest offered via offtake contracts for renewable transport fuels. |

| Electrolysis Corridor East Germany - Prenzlau | Enertrag has relocated its planned 130MW electrolyser project from Prignitz-Falkenhagen to Prenzlau, Brandenburg, due to changes in hydrogen infrastructure, including the cancellation of a promised connection to the hydrogen core network. The project, part of the EU’s Important Project of Common European Interest (IPCEI) scheme, is not new but has been shifted to a more viable site along the planned FLOW hydrogen pipeline. Enertrag still intends to develop capacity at Prignitz-Falkenhagen eventually, but Prenzlau offers existing infrastructure and better connectivity. |

| Fawley Green Hydrogen | Hy24, through its Clean Hydrogen Infrastructure Fund, have signed an MOU with Hynamics UK to co-develop and help finance the £300mn Fawley Green Hydrogen project, which was shortlisted under the UK’s Hydrogen Allocation Round 2 (HAR2). The project, led by Hynamics, will install 120MW of electrolyser capacity on ExxonMobil land to supply hydrogen to its Fawley refinery, the UK’s largest, providing over 20% of national aviation fuel. |

| H2 Teesside | The UK government’s Department for Energy Security and Net Zero (DESNZ) has asked BP to submit a Nitrogen Deposition Assessment for its 1.2GW CCS-enabled H2 Teesside project, to prove that it will not emit more than 1% of the ’critical load of nitrogen deposition’ on the project site. DESNZ stated that planning approval will not be provided for the project until the assessment has been submitted and approved. They have also asked BP to provide further evidence of its plans to connect to the National Gas Transmission’s proposed national hydrogen network, Project Union, which at present is no longer adequate. An 18 July deadline has been set for a response to DESNZ. |

| Barrow Hydrogen & Green Hydrogen 3 | Kimberly-Clark has signed two offtake agreements totalling £125mn with Carlton Power from their 17.77 MW(LHV) Barrow Hydrogen project and with HYRO’s 9.9 MW(LHV) Green Hydrogen 3 project. Kimberly-Clark, who owns brands including Andrex and Kleenex, will utilise renewable hydrogen to displace the natural gas currently used to produce steam at their paper mills. |

Giulia Cannatelli, Analyst – Hydrogen

[email protected]