Westwood’s Global Land Drilling Rigs Tracker

Each month Westwood’s onshore team provides a global update on onshore drilling rigs, with data sourced from and analysed using, Global Land Rigs. Bookmark this page for regular updates on onshore drilling rigs.

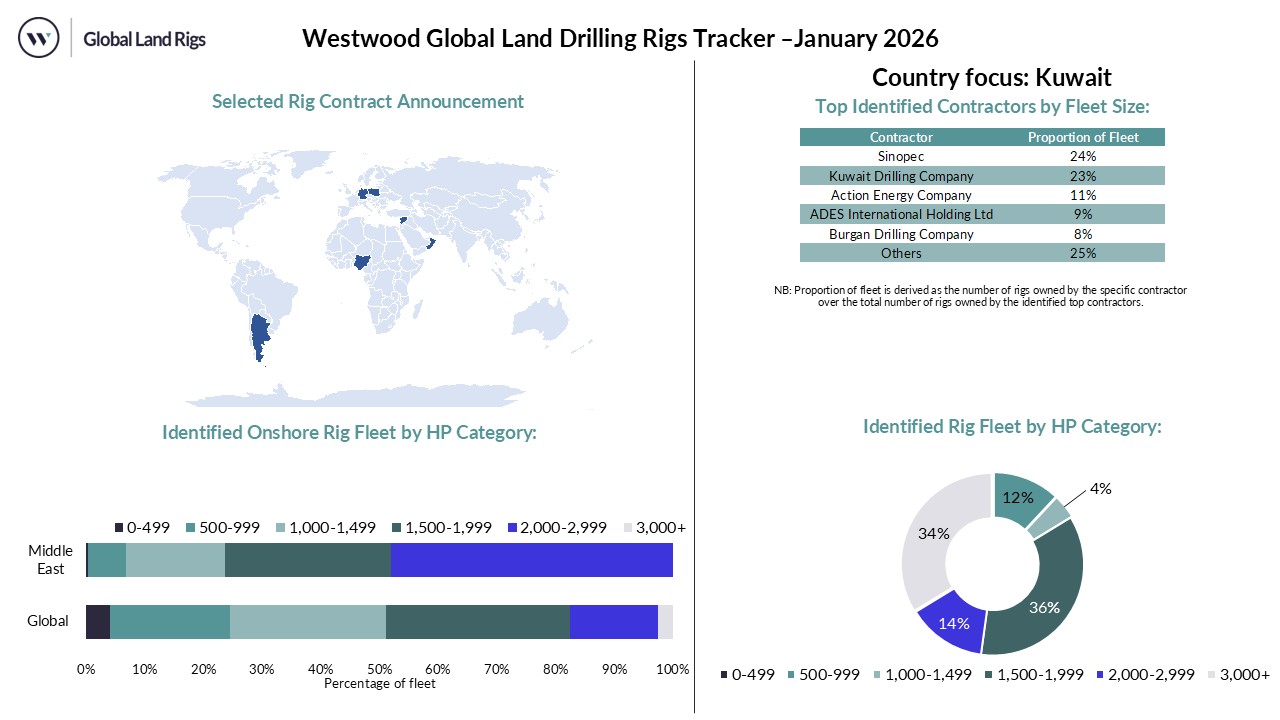

Updated – 24th January, 2026

- Elixir Energy spud the Lorelle-3 appraisal well in Australia’s ATP2056 area in the Taroom Trough on 26 January 2026. The well is being drilled using H&P’s 1,500 HP rig 648.

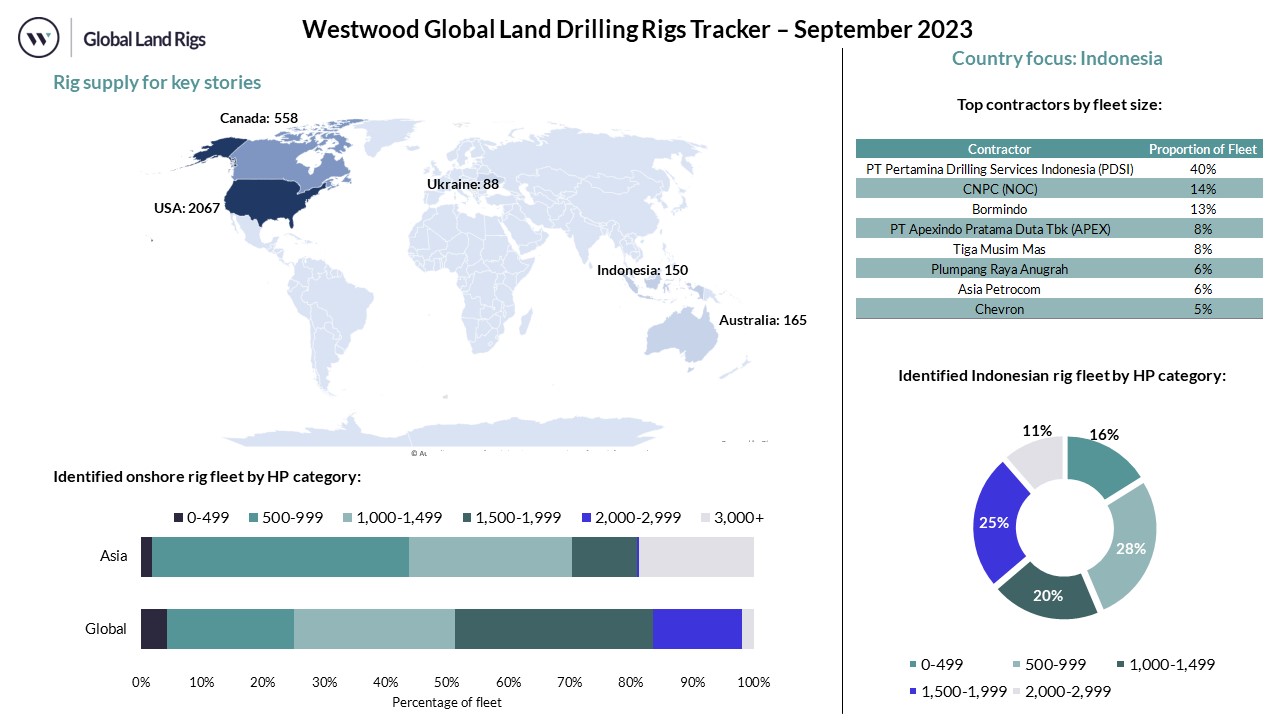

- PT Pertamina Hulu Energi completed drilling the SLW‑C4X development well in the mature Salawati field in Indonesia. The well was drilled to a total depth of 2,150 metres using PT Pertamina Drilling Services Indonesia’s (PDSI) 1,000 HP rig N80 B1/27 (PDSI #11.2/N80B-M). Since then, the well has recorded a daily production rate of 1,014 bpd.

- On 23 January 2026, Doyon Drilling’s 3,000 HP Doyon 26 rig tipped over during a rig move accident. The rig, which was the largest in North America, was under contract with ConocoPhillips in the Alaskan North Slope. Doyon Drilling is currently leading response and recovery efforts.

- Shivganga Drillers recently acquired 1,000 HP SGD Rig 54, which was reported to have been successfully transported from the US to India. The rig was part of Nabors’ US rig fleet and began drilling operations for Gujarat Natural Resources Limited (GNRL) on 21 January 2026.

NB: Additional information on drilling campaigns and spuds is available as part of a GLDR subscription

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

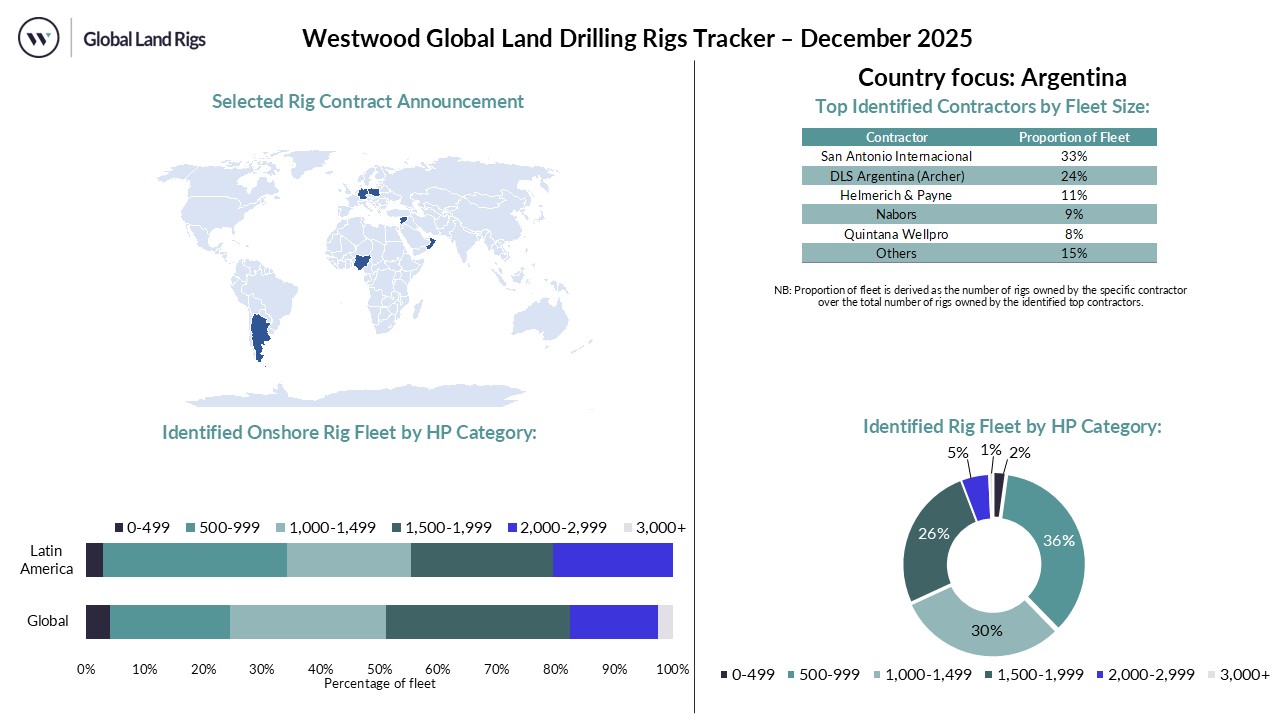

Updated – 24th December, 2025

- Star Energy Geothermal’s (SEG) newly acquired 1,500 HP Star Antasena rig began a drilling campaign at the SEG-operated Salak geothermal field in Indonesia. This is a HongHua-built drilling rig which is under an operation and management (O&M) services contract with Nabors.

- Beach Energy spud the first well of a 12-well development and appraisal campaign in the Western Flank oil-producing region of Australia’s Cooper Basin. Drilling is being conducted using Ventia’s 800 HP rig 101, targeting undeveloped reserves in the McKinlay, Namur and Birkhead reservoirs. This is the first spud in the region since 2023.

- Melbana Energy deferred drilling of the Amistad-11 well in Block 9, Cuba, to 2026 after Sonangol, its 70% block partner, failed to meet its cash call obligations. Melbana issued a formal Notice of Default to Sonangol and Sherritt International’s 750 HP rig 1, which was fully mobilised at the Amistad-11 well pad on 22 November 2025, has been instructed to demobilise as a cost reduction measure.

- The Government of Saint Lucia has opened an early market engagement for Integrated Drilling Services for the provision of a drilling rig to spud three slim-hole geothermal wells in Saltibus, Bell Plaine, and Fond St. Jacques. EOIs will be received until 7 January 2026.

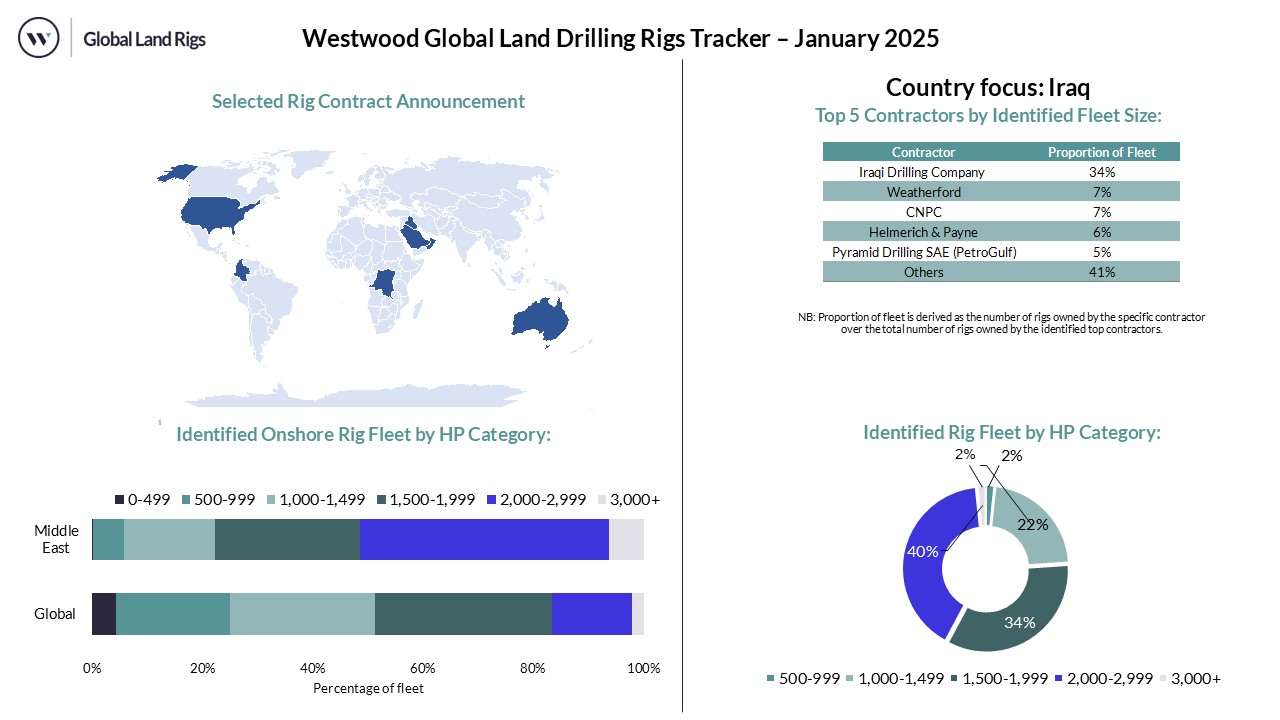

- DNO announced the resumption of drilling operations in Iraq’s Kurdish region, following a two-and-a-half-year drilling hiatus. The operator expects to begin an eight-well drilling campaign in the Tawke field in the week of 22 December 2025. DNO has mobilised DQE International’s rig 51 and its own Sindy-1 rig to carry out drilling, which will run through 2026.

- San Antonio International signed a strategic alliance with Precision Drilling to strengthen unconventional drilling development in Argentina’s Vaca Muerta shale play.

NB: Additional information on drilling campaigns and spuds is available as part of a GLDR subscription

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

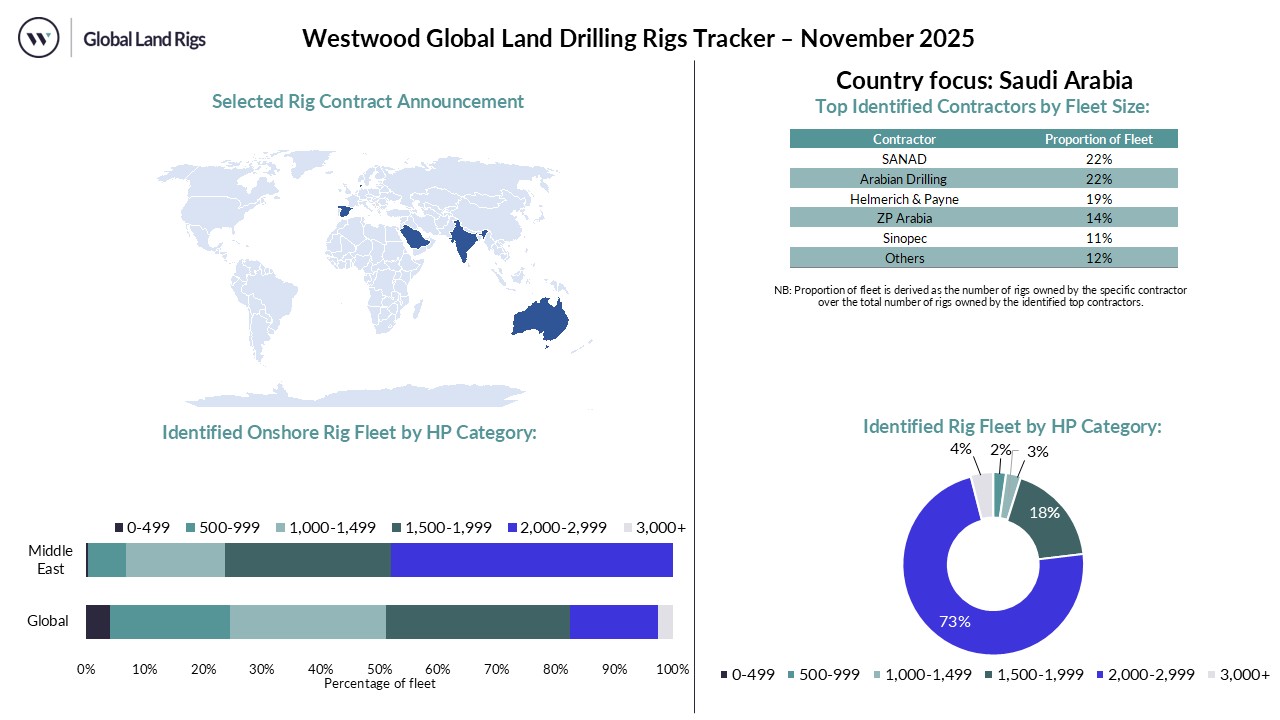

Updated – 24th November, 2025

- The Croatian Hydrocarbon Agency confirmed that the Vinkovci GT-1 geothermal exploration well in the city of Vinkovci in Croatia encountered a reservoir with temperatures of over 100 °C. This well was drilled to 2,700 metres using Crosco’s 1,000 HP National 402 rig as part of a research project. The agency is now engaged in drilling at the Zaprešić location before spudding additional wells in areas with confirmed resource potential.

- Melbana Energy began mobilising Sherrit International’s rig 1 (750 HP) to spud the Amistad-11 production well in Block 9, Cuba. The well will be drilled adjacent to the Alameda-2 well, the company’s most successful well to date. The Amistad-11 well is planned to be spudded before the end of November 2025, subject to final permitting. Completion and testing will follow, with the goal of bringing Amistad-11 online before year-end.

- Kuwait’s Action Energy Company AEC signed two Memoranda of Understanding (MoU) agreements to expand its drilling and oilfield services into the wider GCC market, as well as Iraq.

- The first agreement was signed with an undisclosed North American oil and gas services provider to collaborate on drilling, workover, and oilfield projects in Saudi Arabia and other GCC markets. This partnership will focus on deploying high-spec rigs and integrated well services with the potential formation of a joint venture.

- The second agreement was signed with an Iraqi oilfield services provider to jointly execute turnkey well drilling operations in Iraq. AEC will contribute its drilling and workover capabilities, while the Iraqi partner will offer oilfield services, logistics, and local support.

- ReconAfrica received approval to extend drilling at the Kavango West 1X exploration well in Namibia beyond its planned target depth of 3,800 metres. The well was spudded on 31 July 2025 and encountered multiple hydrocarbon indicators, with the operator receiving approval to continue drilling to approximately 4,200 metres. As of 7 November, the well had reached a depth of 4,158 metres using the 1,000 HP Jarvie-1 rig, which ReconAfrica owns.

- On 25 November 2025, Zenith Energy reported that it is finalising negotiations to sell its wholly owned ZEN-260 drilling rig, a 1,200 hp mechanical IDECO unit equipped with a TDS-350 BOWEN top drive system. Zenith has received two offers of approximately US$2 million for the rig, and it expects to complete the sale and receive payment by the end of 2025.

NB: Additional information on drilling campaigns and spuds is available as part of a GLDR subscription

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

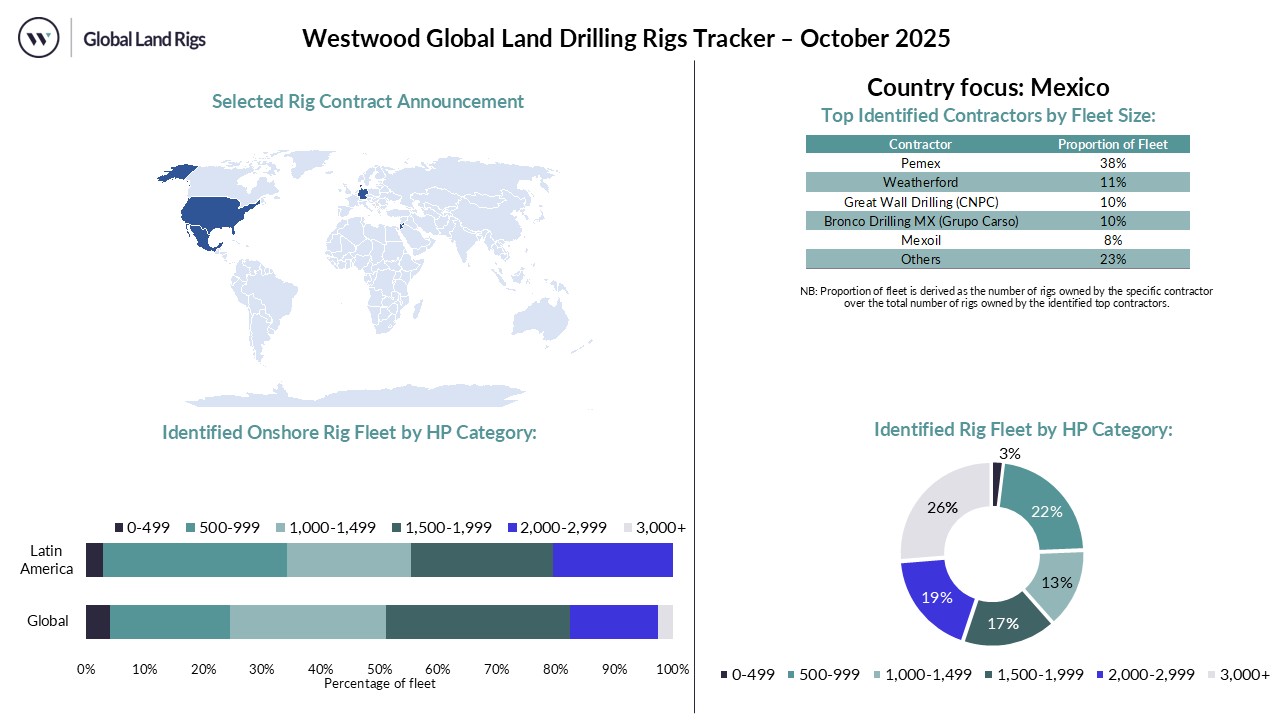

Updated – 24th October, 2025

- Neptune Energy commenced drilling of the Römerberg 10 well at the Römerberg-Speyer oil field in Germany. This is the 11th well to be spud at the field, and it is being drilled in partnership with Palatina GeoCon. Drilling is expected to last for three months, using Drillmec’s 1,500 HP rig VDD 370.

- PT Supreme Energy Muara Laboh began the drilling phase of the Muara Laboh Unit 2 Geothermal Power Plant project in West Sumatra, Indonesia. The project will entail the drilling of six to eight wells by the end of 2027 to supply 80 MW of electricity to approximately 435,000 households via the Sumatra grid. Drilling is being conducted using Plumpang Raya Anugrah’s (PRA) 2,000 HP rig 7.

- Drilling began at the first of three geothermal wells planned for the Svinica-Durkov site geothermal heating project in the city of Kosice, Slovakia. This well is being drilled using MND Drilling & Services’ (MND) 1,500 HP Bentec 350 rig. The operator plans to drill one production and two reinjection wells, each to depths of approximately 3,700 metres. Approximately US$14 million (EUR 12 million) was disbursed by the European Commission’s Just Transition Fund to support drilling costs.

- Sahara Group announced that it acquired seven new oil rigs in Nigeria to support a five-year crude production expansion plan. The contractor reports that several of these units are already operational, including the 2,000 HP L-Buba rig, which is engaged in gas drilling. All newly-acquired drilling rigs are expected to be operational by the end of 2025.

- Nabors’ 2,300 HP rig 269 completed drilling the first unconventional well for Cairn Oil & Gas in Barmer, India. The well was reported to have been drilled to a depth of up to 5,029 metres.

NB: Additional information on drilling campaigns and spuds is available as part of a GLDR subscription

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

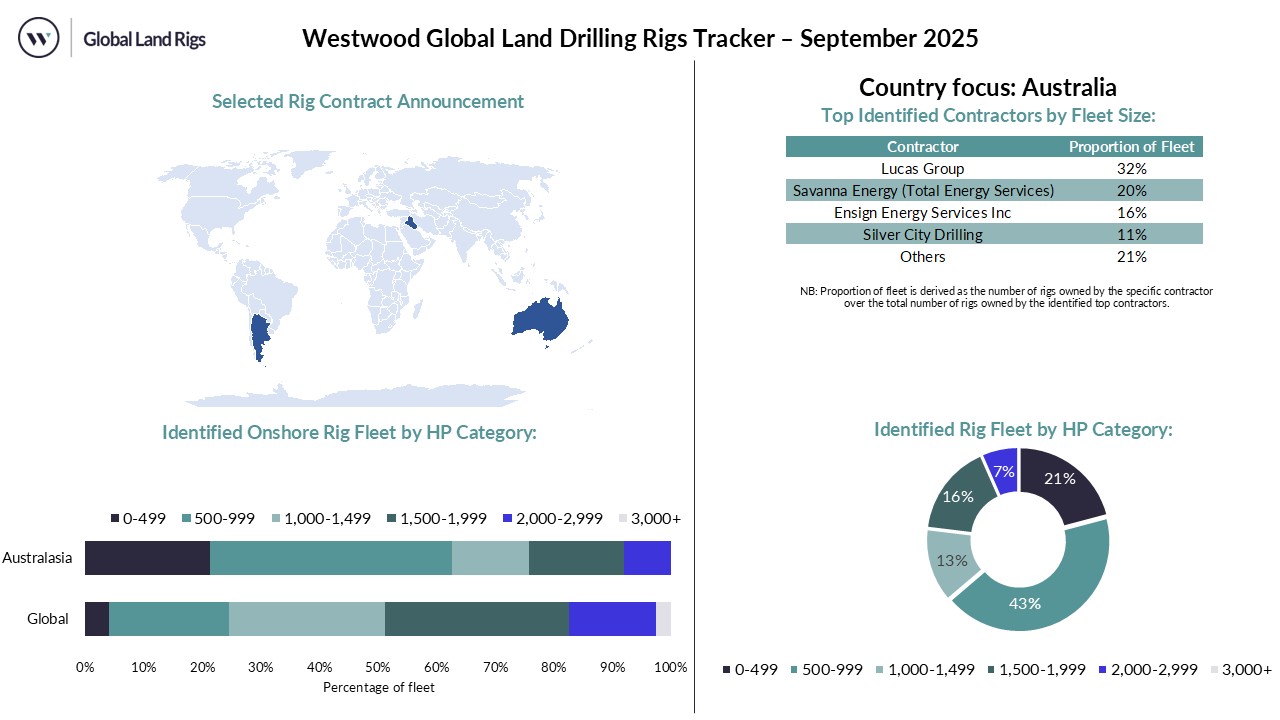

Updated – 24th September, 2025

- MAPNA Drilling Company’s rig, Noor 2, was deployed to the Sepehr field in Iran to support the second phase of the field’s development, which aims to increase the field’s production capacity to 81 kbpd. This is the fourth drilling rig to be deployed at the Sepehr and Jufair fields.

- The Croatian Hydrocarbon Agency spud the Vinkovci GT-1 geothermal exploration well in the Vinkovci area of eastern Croatia. Drilling is being conducted using Crosco’s National 402 rig, targeting a total depth of 2,500 metres.

- Bangladesh’s Executive Committee of the National Economic Council (ECNEC) granted Bangladesh Petroleum Exploration and Production Company Limited (BAPEX) the right to acquire a 2,000-horsepower drilling rig, valued at US$49 million. This rig will support gas exploration in the Bhola area as part of a broader plan to drill 56 wells and conduct 16 workovers by 2028. The Bangladeshi government will fund US$44 million of the rig cost, with the remaining US$5 million to be funded by BAPEX.

NB: Additional information on drilling campaigns and spuds is available as part of a GLDR subscription

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

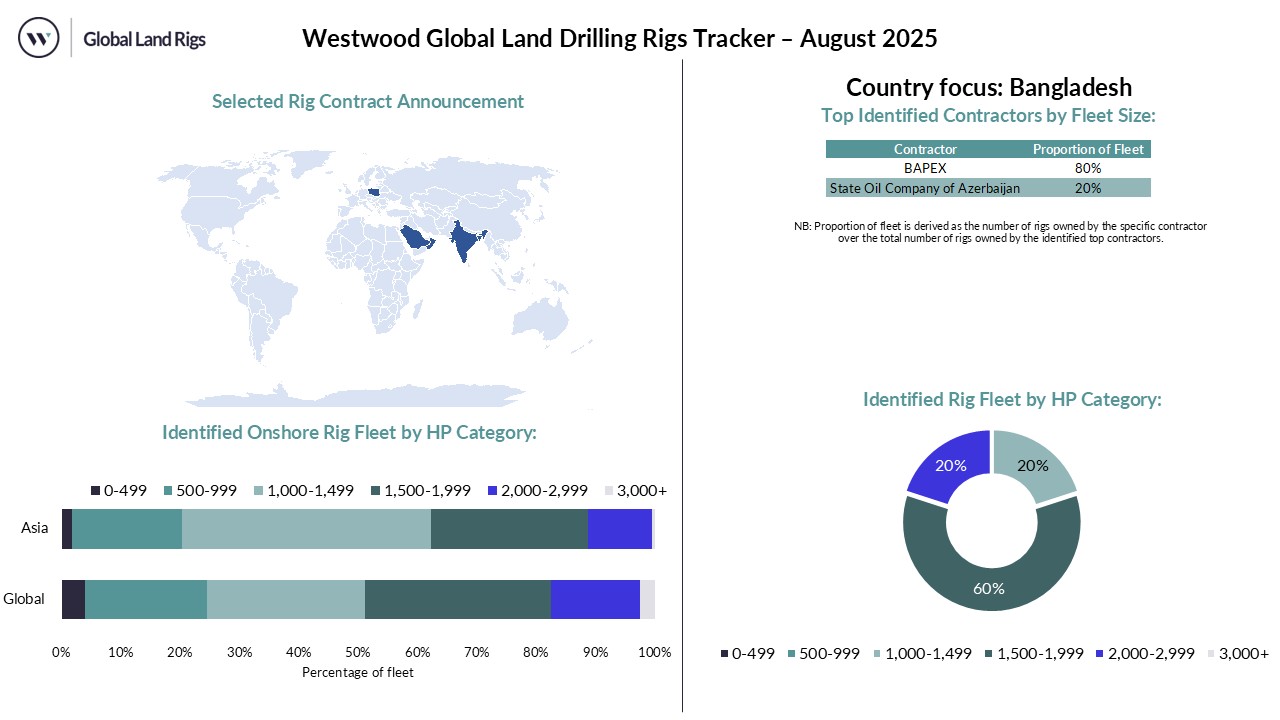

Updated – 26th August, 2025

- Egyptian Drilling Company completed a four-month refurbishment of its 1,500 HP rig 75. Key repairs and upgrades were undertaken on the rig’s mast and substructure, mud system, drilling equipment and power system, among others.

- On 4 August 2025, the Persian Oil and Gas Industry Development Company (POGID) began operating the first of two light drilling rigs it acquired for a total of US$18 million in Iran. These rigs will support drilling for the year 1404 “Investment for Production “incentive. The first rig, the POGID 501, began operating in the Yaran oil field.

- The National Iranian Drilling Company (NIDC) completed drilling the first of six development wells planned at the Iranian Yadavaran oilfield for the Petroleum Engineering and Development Company (PEDEC). Drilling of well 43 was conducted using the NIDC’s Fath 92 rig, while drilling of well 42, the second development well, is ongoing.

- Nabors completed a 35-day automation and technological upgrade of its 1,500 HP rig 992 in Colombia. The rig is set to return to drilling soon.

- On 8 August 202, RED Drilling rig 202 began re-entry of the Kinsau-1A well in Bavaria, Germany. The well was shut-in by Mobil in 1983 due to low gas prices, despite testing at over 24 mmscfd. So far, Abandonment plugs and kill mud have been drilled out to 1,002 metres with no anomalies, and the contractor is proceeding with pressure testing before resuming drilling operations to a total planned depth of 3,400 metres over a 30-day period.

NB: Additional information on drilling campaigns and spuds is available as part of a GLDR subscription

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

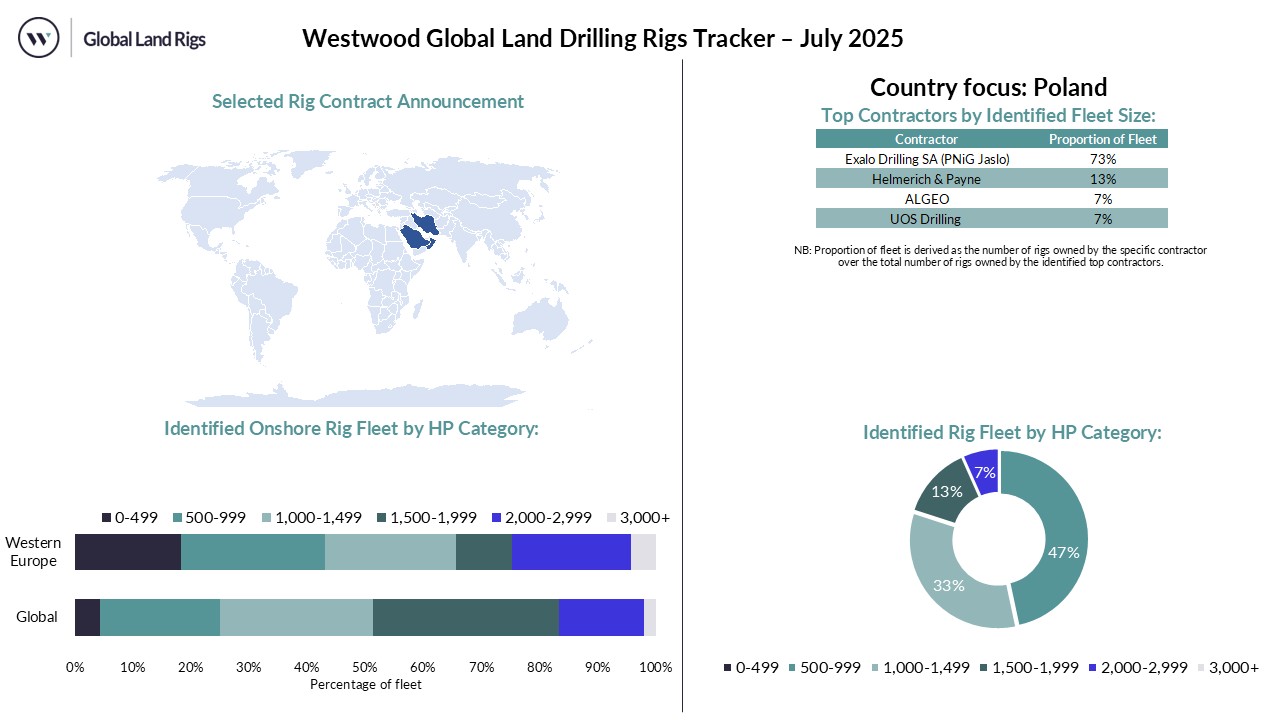

Updated – 26th July, 2025

- In July 2025, Touchstone Exploration announced results from the US$5 million Cascadura-5 (Cas-5) development well in Trinidad and Tobago’s Ortoire block. The well, which was spud on 4 June 2025, was drilled in 22 days to a total depth of approximately 2,140 metres (7,020 feet) using Star Valley Drilling’s 850 HP rig 205.

- On 22 July 2025, Pantheon Resources spudded the Dubhe-1 appraisal well in the Ahpun field in Alaska, USA. Drilling is being carried out using Nabors’ 105E rig, primarily targeting the SMD-B topset horizon.

- In Indonesia, Pertamina Hulu Rokan (PHR) announced the completion of the Bitangur (BIT)-001 exploration well in Southwest Papua. The well was spud in June 2025 and drilled to a depth of 945 metres in 40 days using the 1,500 HP PDSI #11.2/N80B-M rig. PHR also completed the LBK-INF12 infill development well in the Lembak field, which recorded an initial production flow of 1.8 kbpd and 0.3 kboepd (1.7 mmscfd) of gas. This well was drilled using the PDSI 1,500 HP rig #29.3/D1500-E.

- During the month under review, ADZ Energy announced it had completed drilling the Kincora-44 well in the Kincora gas field in Australia’s Surat Basin. The well was drilled using Silver City Drilling’s rig 24 and encountered gas-bearing zones in both the primary and secondary targets of the well. The rig has since been released.

- The Croatian Hydrocarbon Agency announced the spud of the Osijek GT-1 geothermal exploration well in Osijek. The well is being drilled using Crosco’s National 402 rig to assess the viability of using geothermal energy for heating and potentially agricultural purposes. The well is expected to be drilled and tested by September 2025. Drilling falls under Croatia’s National Recovery and Resilience Plan with a total budget of US$55.9 million (€50.8 million).

NB: Additional information on drilling campaigns and spuds is available as part of a GLDR subscription

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

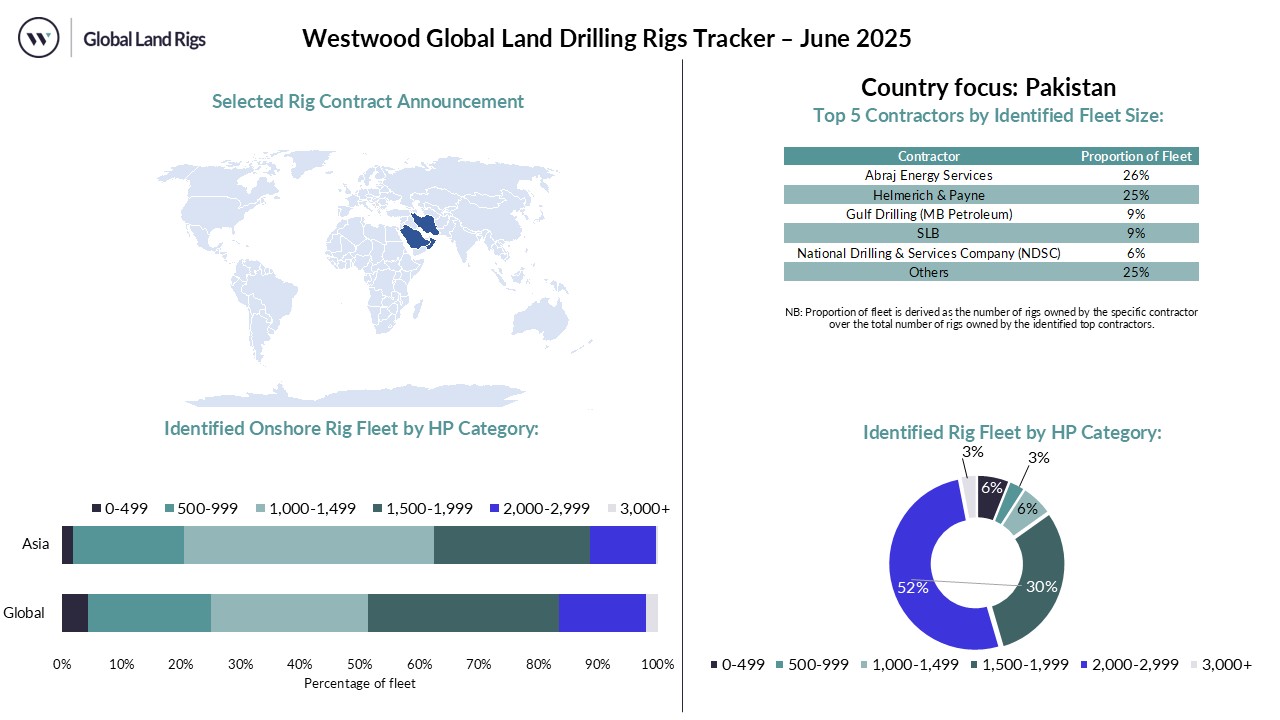

Updated – 26th June, 2025

- Egyptian Drilling Company (EDC) spudded Agiba Petroleum Company’s ROSA-N13 well in the Rosa field using EDC’s 1,500 HP rig 47. This is a horizontal well which targeted the field’s deepest carbonate Masajed reservoir in a 68-day drilling operation.

- On 8 June 2025, OMV spudded the 5,000 metres Wittau West Tief 1 exploration well in Austria’s Wittau oil and gas project. Drilling is being conducted utilising Exalo Drilling’s 2,000 HP rig 306 until November 2025. This exploration well aims to uncover further gas potential in the Wittau area.

- H. Angers Sohne spudded the first of six geothermal wells at the Laufzorn II geothermal heating project in Germany’s Grünwald municipality using its 2,146 HP Innova rig. All six wells are planned to be drilled to total depths ranging between 3,600 to 4,000 metres to provide heat to the Erdwärme Grünwald’s Laufzorn II geothermal heating plant. Drilling is expected to be completed by the winter of 2027-2028.

- PetroEcuador spuds the first of four infill development wells planned to increment production at Ecuador’s Block 44 by 2.5 kbpd. The Pucuna D 033 well, in the Pucuna field, is the first well spud using Sinopec’s 2,000 HP 191 rig. All four wells are planned to be drilled in approximately 45 days to a total depth of 4,572 metres.

- MB Well Services commenced a three-year well backfilling campaign for an undisclosed operator in Germany’s Altmark region using its 532 HP T-49 rig. This project involves plugging and abandoning 15 wells, observation, injection, and production wells with depths of up to 3,700 metres.

- Ukrgasvydobuvannya secured a USD$39.3 million (EUR€36.4 million) loan from the European Bank for Reconstruction and Development to replace and modernise its workover rig fleet. These new rigs will have a lifting capacity of 125 to 180 tons, compared to the current 80-ton capacity. With this fleet modernisation, Ukrgasvydobuvannya will have the ability to support production restoration at mature fields by performing more complex workovers and accessing deeper and technically challenging wells.

NB: Additional information on drilling campaigns and spuds is available as part of a GLDR subscription

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

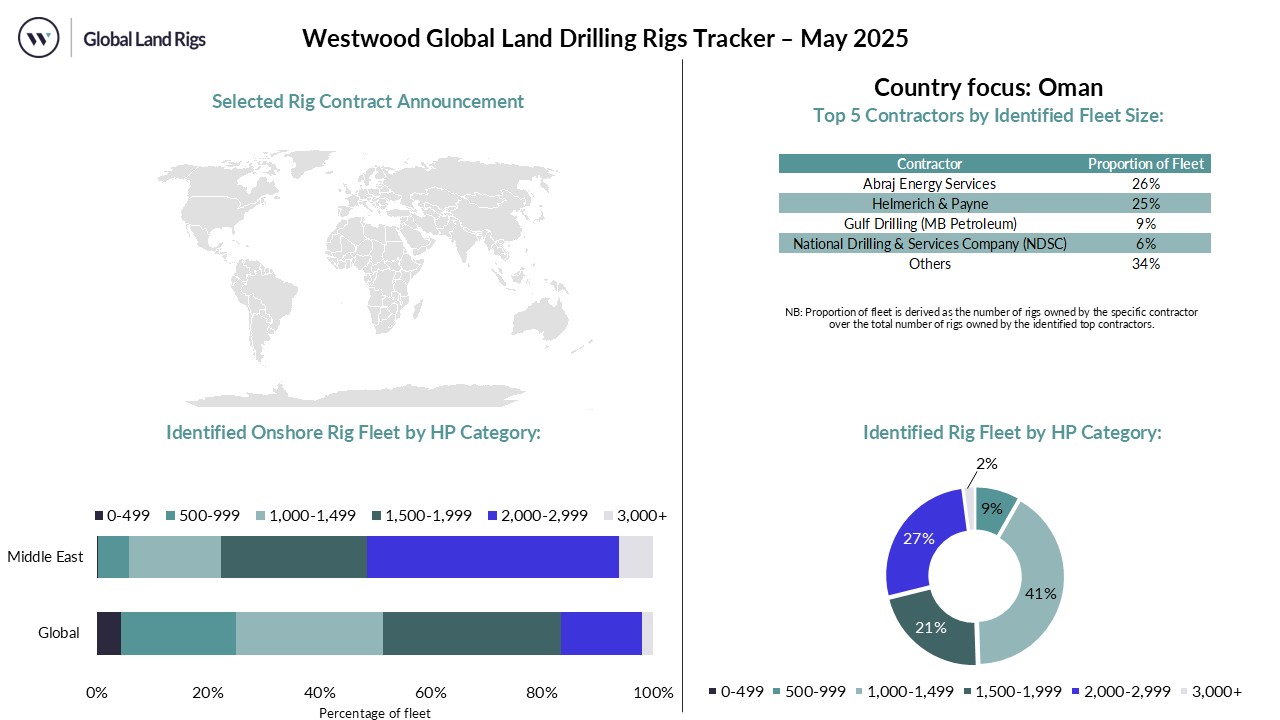

Updated – 26th May, 2025

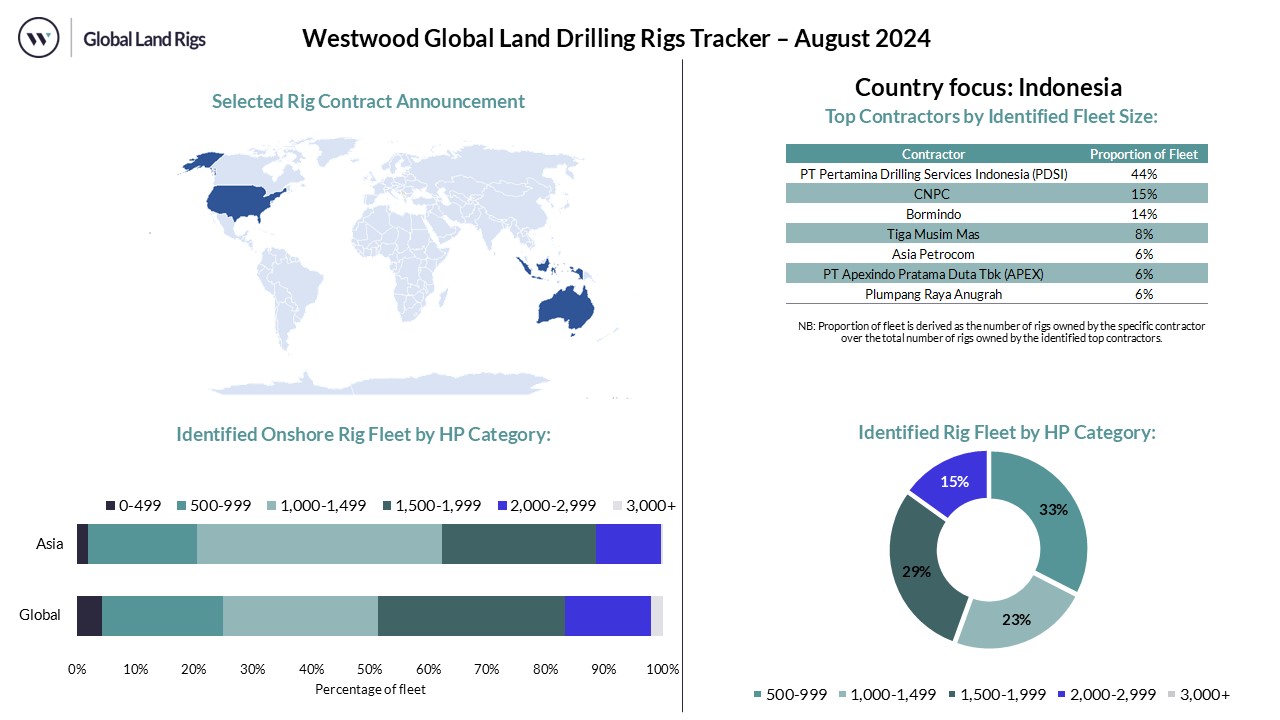

- On 14 May 2025, PT Pertamina Hulu Energi (Pertamina) spud the Sembakung Deep-001 (SBKD-001) oil and gas exploration well in Indonesia’s Tarakan Field, using Pertamina Drilling’s 1,500 HP PDSI#43.3/AB1500-E rig. The well is planned to be drilled to a total depth of 3,007 metres over 114 days. This is the only onshore exploration well planned to be drilled by Pertamina in 2025.

- On 12 May 2025, PECO Energy, a subsidiary of Pasargad Energy Development Company, spud the Jufair-10 development well in Iran’s Jufair field. This well is being drilled using Pasargad’s 2,000 HP rig 21 to a planned total depth of 4,311 metres to enhance oil production from the reservoir.

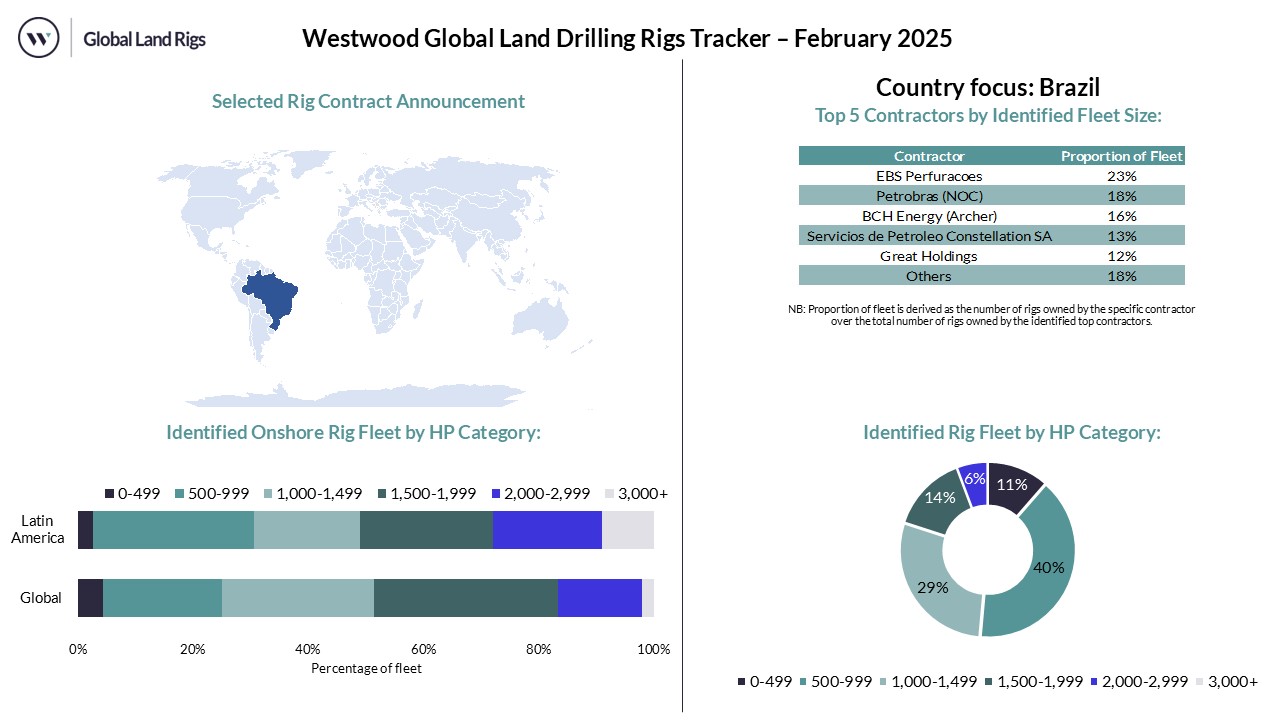

- On 9 May 2025, Petrobras resumed drilling activities in Bahia State, Brazil, after a six-year hiatus. The first spud was the 7-TQ-240D-BA well, which is being drilled in the Taquipe field using EBS Perfurações’ 600HP EBS-08 rig. This rig is part of the three drilling rigs contracted from EBS by Petrobras for drilling in Bahia state in early 2025. Over the next five years, the operator plans to drill 100 wells in Bahia state to boost production.

- Tacrom Services announced the sale of its drilling business to Foraj Sonde Videle (FSV) in Romania. With this, it transfers three drilling rigs as well as personnel and ongoing customer contracts.

NB: Additional information on drilling campaigns and spuds is available as part of a GLDR subscription

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

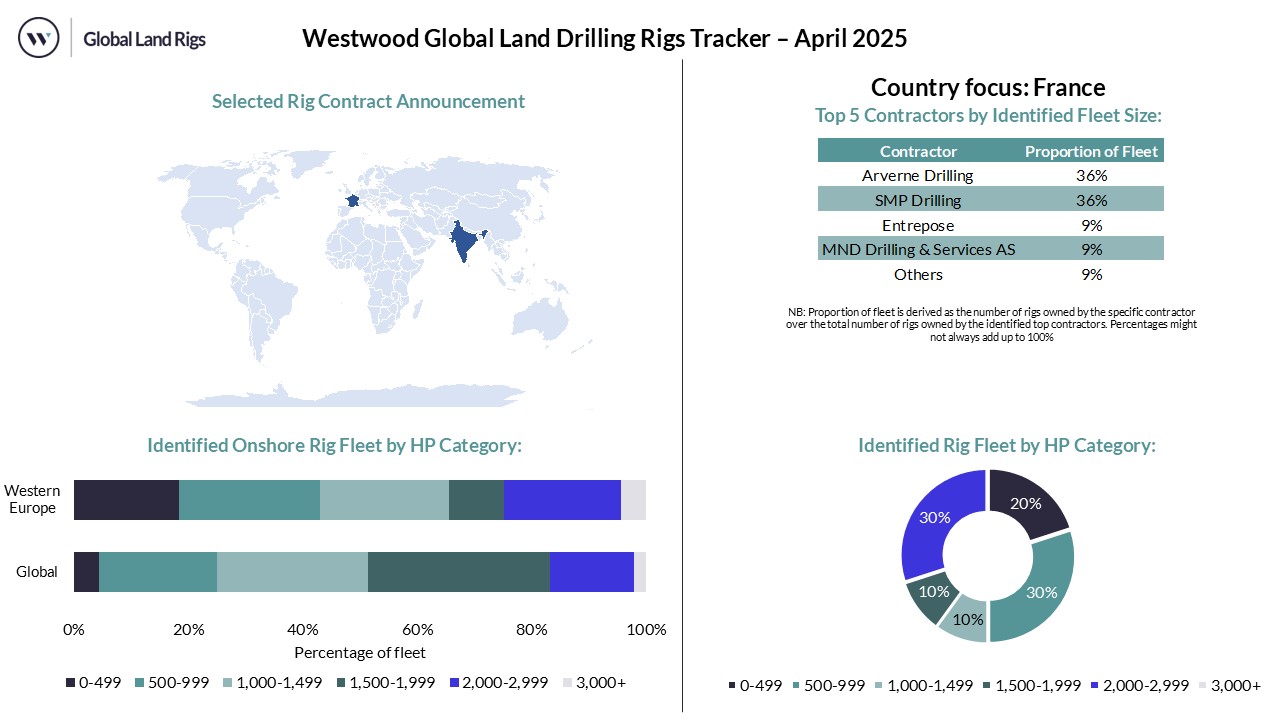

Updated – 26th April, 2025

- On 1 April 2025, Prairie Operating Co. began an 11-well development drilling programme in Colorado, USA. The first well was spud on the Rusch Pad in Weld County using Precision Drilling’s 1,200 HP rig 461. The well is anticipated to be completed in June 2025, ahead of an initial production in August 2025.

- On 12 April 2025, Triangle Energy spud the Becos-1 exploration well in Australia’s Perth Basin using Silver City Drilling’s rig 24. The well was drilled to a total depth of 1,107 metres on 18 April 2025 and was plugged and abandoned after failing to find commercially viable gas quantities.

- On 18 April 2025, HS Orka spud the first of a series of geothermal exploration wells in Krýsuvík, Iceland, using Iceland Drilling’s 1,350 HP Ooinn drilling rig. This well will be drilled to a total depth of 2,750 metres and is part of a multi-well drilling campaign aimed at understanding the geothermal resource potential in the Sveifluháls–Austurengjar area. Should the exploration campaign be successful, HS Orka will proceed with the construction of a geothermal power plant with an electricity capacity of 100 MW, able to supply heating for up to 50,000 people.

- Patterson-UTI’s 1,500 HP, rig 268, begun drilling for Phoenix Operating (Phoenix) on its Shivey 28 Well Pad in North Dakota, USA. Phoenix has contracted the rig to support its production expansion targets.

- Egyptian General Petroleum Company (EGPC) has started operating the first of three 1,000 HP drilling rigs to intensify drilling in the Gharib oilfields in Egypt. These rigs will support EGPC in drilling 75 wells, within the next twelve months, boosting production in Egypt’s Gharib oilfields by 7.5 kbpd.

- The National Iranian Drilling Company (NIDC) has announced a US$800 million investment to acquire 15 onshore drilling rigs in 2025. This investment is part of NIDC’s long-term strategy to enhance drilling efficiency and modernise its fleet and is likely to support its plan to drill up to 150 wells in 2025. It is unclear whether these will be newbuild rigs or existing units.

NB: Additional information on drilling campaigns and spuds is available as part of a GLDR subscription

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

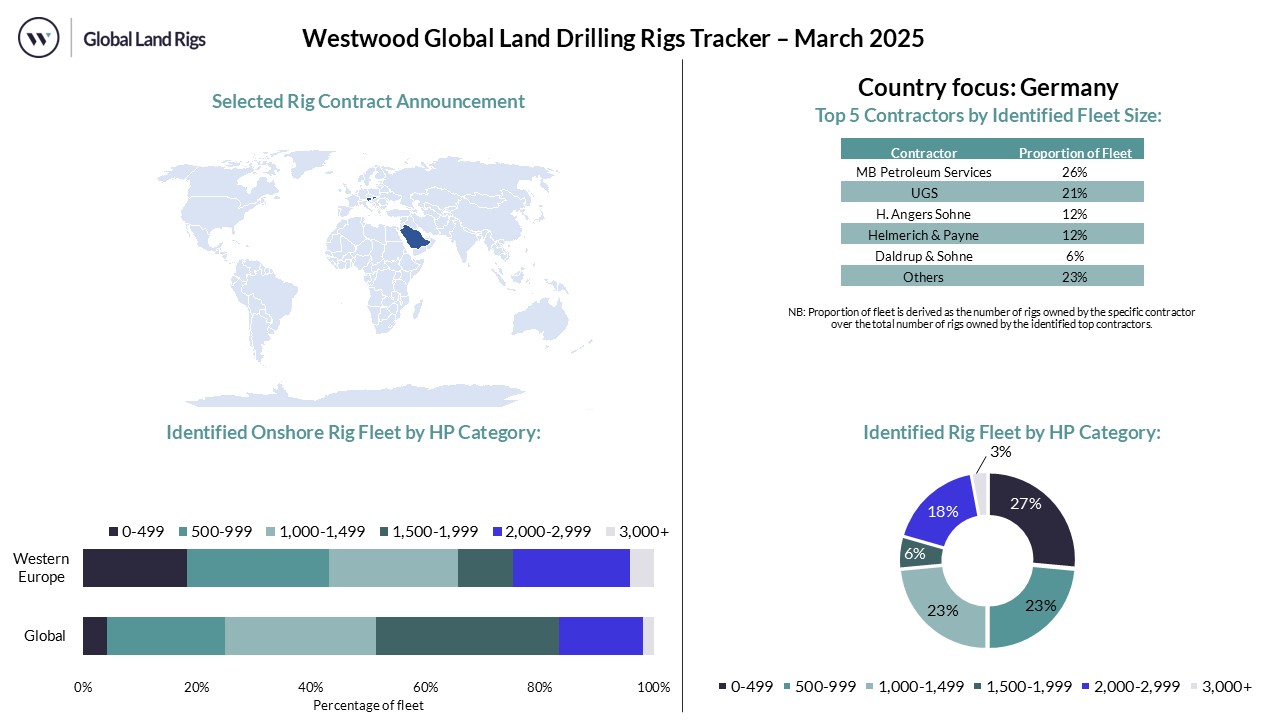

Updated – 26th March, 2025

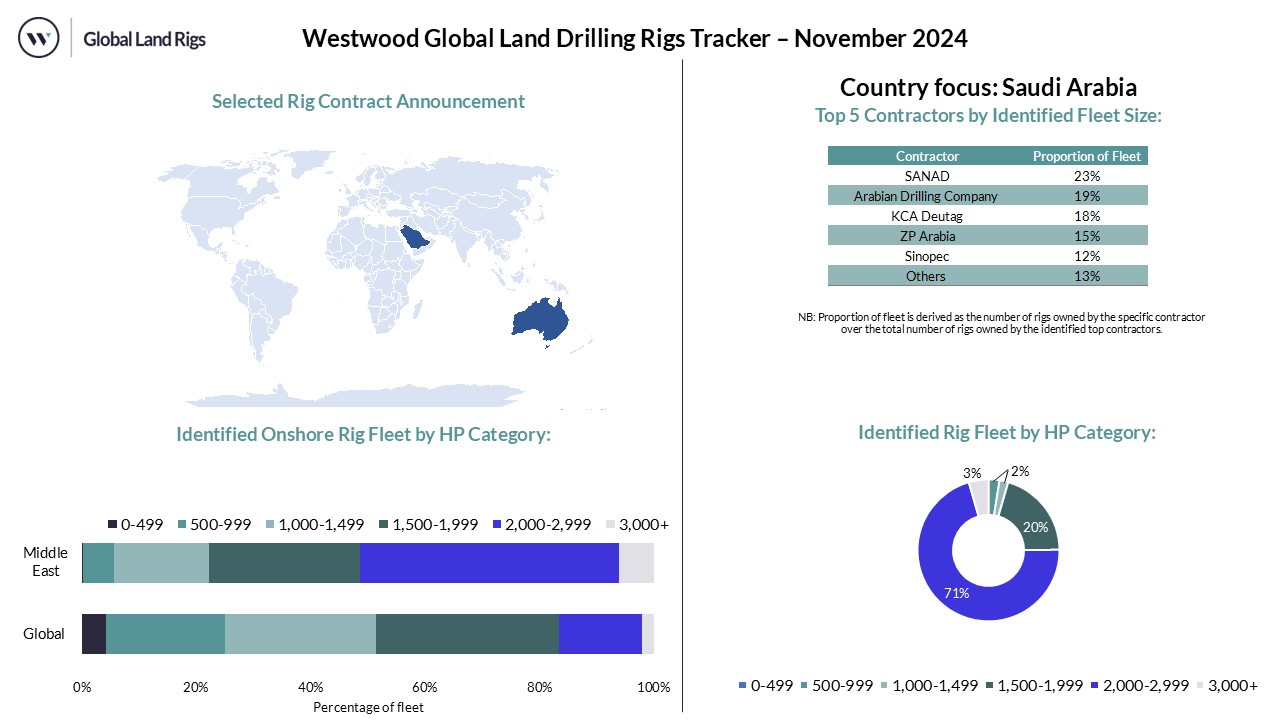

- KCA Deutag (KCA) renewed rig contracts with unnamed operators in Colombia and Saudi Arabia and signed a new rig contract in Iraq. This is part of a series of rig contracts across multiple countries for a combined value of US$497 million, equating to 35 rig years. These contract announcements were made prior to the closing of KCA’s acquisition by Helmerich & Payne.

- On 20 January 2025, Zephyr Energy commenced drilling of an extended lateral section at the State 36-2 LNW-CC-R (State 36-2R) well found in the Paradox Project, USA. Drilling is being conducted using Nabors, 1,500 HP, B29 rig.

- On 1 January 2025, Arrow Exploration (Arrow) completed drilling the Alberta Llanos-2 (AB-2) well in Colombia’s Tapir Block. This well was spud on 25 December 2024 using Petroworks’ 1,500 HP rig 160 and was drilled to a total depth of approximately 10,795 feet. The rig has now been moved to spud Arrow’s Alberta Llanos-3 (AB-3) well.

NB: Additional information on drilling campaigns and spuds is available as part of a GLDR subscription

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

Updated – 26th February, 2025

- Arrow Exploration (Arrow) announced on 5 February 2025 that it is mobilising Petroworks’ 1,500 HP PW-160 rig to the Carrizales Norte pad in Colombia’s Alberta Llanos field to drill three horizontal development wells. Once drilling is completed, the rig will be moved to spud the first exploration well in Columbia’s Mateguafa Oueste prospect.

- ORLEN announced a gas discovery in the Siedlemin field, located in Wielkopolska province, Poland. The well was drilled to approximately 3,000 metres using Exalo Drilling’s 1,200 HP, IRI 1200 #204 rig.

- On 17 February 2025, Neptune Energy (Neptune) spud the Adorf Z19 gas development well in Germany’s Adorf field. This well is expected to reach its planned total depth of 4,200 metres by May 2025 using a KCA Deutag (now part of H&P) rig. Once drilling is completed, the rig will move to spud Neptune’s Adorf Z20 gas well.

- On 20 February 2025, Zephyr Energy announced that it completed drilling at the State 36-2 LNW-CC-R well to a depth of 4,660 metres using Nabors 1,500 HP B29 rig. Zephyr plans to demobilise the rig once the well has been cased.

- On 4 February 2025, Vercana began mobilising its 2,500 HP V20 rig to the Phase One Schleidberg well site near Landau, Germany. The rig will be employed in its upcoming geothermal and lithium drilling project, with the spudding of the Schleidberg geothermal well expected in 2Q 2025.

NB: Additional information on drilling campaigns and spuds is available as part of a GLDR subscription

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

Updated – 26th January, 2025

On 21 March 2025, Vercana announced that its 2,500 HP V20 rig had been rigged up in preparation for a spud at the Schleidberg geothermal and lithium Phase One well site in Germany. Drilling is planned to commence in 2Q 2025.

On 12 March 2025, Nabors announced it completed the acquisition of Parker Wellbore, following an announcement in October 2024. This expands Nabors’ presence in international markets, adding 10 land drilling rigs across Asia, Latin America and North America to its fleet.

- During the month under review, Todd Energy completed and brought online the POW-05 well in the Pohokura gas field in New Zealand. This well was drilled to a total depth of 3,000 metres (m), with an 8,000 m lateral, using its 2,000 HP Big Ben land rig.

- KazMunayGas completed the drilling of the PZ-1 exploration well in Kazakhstan’s Kyzylorda region. The well was drilled to a total depth of 5,585 metres using KazPetroDrilling’s Discovery SL-2,500 rig in an operation that took almost 300 days to complete.

- Predator Oil and Gas completed the drilling of the MOU-5 well in Morocco’s Guercif licence. The well was spud on 3 March 2025, using Star Valley’s 1,00 HP rig 101 and took 10 days to reach total depth, including logging operations. The well confirmed the presence of the Domerian carbonate and has been suspended to allow for re-entry at a later date. Star Valley’s rig has been stacked at the MOU-5 location.

- On 19 March 2025, OMV began a drilling and workover campaign in its South Tunisia assets using Compagnie Tunisienne de Forage’s 1,400 HP rig 06.

NB: Additional information on drilling campaigns and spuds is available as part of a GLDR subscription

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

Updated – 26th December, 2024

- On 1 December 2024, Petrobakr Petroleum Company spudded the Arta 92 development well in Egypt’s Ras Gharib concession area using Egyptian Drilling Company’s 950 HP rig 64. The well is planned to be drilled to a depth of 1,219 metres (4,000 feet) and is anticipated to produce 350 bpd.

- On 4 December 2024, Strike Energy spud the Walyering East-1 exploration well in Australia’s Exploration Permit area EP447 using Ensign Energy Services’ 1,500 HP rig 970. This well targets the A to D Sands within the Cattamarra Formation.

- On 19 December 2024, the Libyan National Oil Corporation announced that Sirte Oil and Gas completed the drilling of the C353H horizontal development well, with a 900-foot horizontal section, in the Zelten oil field in Libya. The well was drilled using Larasco’s 1,700 HP rig 45, and it has now been put in production with a flow rate exceeding 2.3 kbpd.

- On 20 December 2024, Arverne Drilling (Arverne) announced that DrillDeep, its subsidiary with Herrenknecht Vertical (Herrenknecht), received the B18 rig in France. This is a 1,200 HP, 250-tonne drilling rig with the ability to drill deep geothermal wells with depths ranging between 500 and 3,000 metres in urban environments. The rig was co-designed by Arverne and constructed by Herrenknecht.

NB: Additional information on drilling campaigns and spuds is available as part of a GLDR subscription

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

Updated – 26th November, 2024

- On 11 November 2024, Pantheon Resources spud the Megrez-1 exploration well in Alaska’s North Slope, USA, using Nabors’ 2,000 HP 105E rig. Data collected from this well will be used to understand the reserve base of the Ahpun oil and gas accumulations.

- On 5 November 2024, Bear Drilling’s 1,400 HP rig 2 spudded its inaugural well for Tourmaline Oil Corp. in Canada’s Alberta Deep Basin. The rig was recently constructed by Electric Horsepower in Canada.

- On 18 November 2024, Empire Energy spudded the Carpentaria-5H (C-5H) well in Australia’s Beetaloo Basin. This well is scheduled to take 45 days to drill to a planned total depth of 3,000 metres using Ensign Energy Services’ 1,500 HP rig 965.

- On 25 November 2024, Falcon Oil & Gas spudded the Shenandoah S2-4H (SS4H) well which is part of the Shenandoah South Pilot Project in Australia’s Beetaloo Sub-Basin. This well will be drilled using Helmerich & Payne’s 1,500 HP Rig 469 to a total depth of 6,300 metres (10,000 ft) targeting the Amungee Member B-shale.

- GéoMalak has spud the first of two geothermal energy wells in the city of Malakoff, France, for the Malakoff Geothermal Network project. Drilling of these wells is expected to take three months, with both wells being drilled to a total depth of 1,800 metres using SMP Energies’ 2,000 HP Rig 106.

NB: Additional information on drilling campaigns and spuds is available as part of a GLDR subscription

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

Updated – 28th October, 2024

- Nabors entered into a definitive agreement to acquire Parker Wellbore (Parker). This acquisition is expected to close in early 2025, adding Parker’s nine onshore rigs to Nabor’s fleet as well as its casing, tubular rental and repair services.

- Honghua Group has manufactured and delivered a new drilling rig that will be employed in China’s Xinjiang Uygur autonomous region. This autonomous rig has a maximum drilling depth of 12,000 metres and a hook load capacity of 1,000 metric tons.

- Arabian Rig Manufacturing (ARM), a joint venture between NOV and Aramco, delivered rig-10 in Ras Al Khair, Saudi Arabia. The rig was commissioned by Saudi Aramco Nabors Drilling Company (SANAD) and is part of the 55 rigs that ARM plans to supply to the Middle Eastern and North African drilling markets by 2025.

- Buru Energy spud the Rafael Shallow 1 exploration well on 9 October 2024 in EP 428 in the Australian Canning Basin using Silver City Drilling’s rig 24. The well was drilled to a total depth of 1,203 metres however, no moveable hydrocarbons were encountered at the well; thus, it is now being plugged and abandoned.

- Serbia’s Naftna Industrija Srbije announced the acquisition of two new drilling rigs equipped with modular drilling robotic system facilities in a deal valued at approximately US$36.1 million (€33 million).

NB: Additional information on drilling campaigns and spuds is available as part of a GLDR subscription

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

Updated – 28th September, 2024

- ADX Energy (ADX) spud the Anshof-2A sidetrack oil appraisal well in Austria using RED Drilling & Services’ 1,250 HP E202 rig. Once drilling is complete, the rig will drill ADX’s Welchau-1 well.

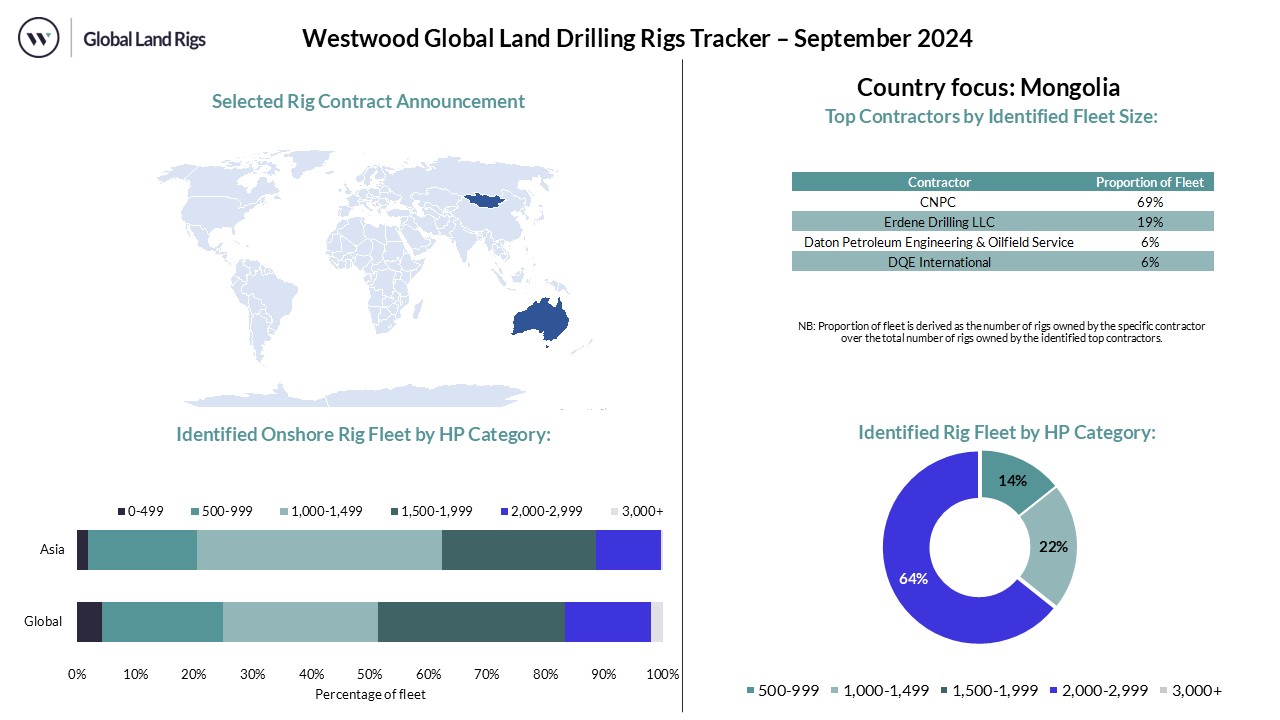

- Petro Matad spudded the Gobi Bear-1 exploration well in Block XX, Mongolia, using DQE International’s 30609 rig. Drilling is expected to take 20 days to reach a planned depth of 1,800 m. Additionally, it spudded the Heron-2 development well in the Tamsag Basin, also in Mongolia, using DQE International’s 40106 rig. Drilling is expected to take 30 days.

- Sichuan Honghua Petroleum Equipment spudded an 8,795 m deep exploration research well in the Xinjiang Uygur region, China, using the Crust-1 3000 HP rig. Drilling is being supported by the exploration and drilling engineering department at Jilin University and is expected to take three months instead of the customary six months for a 5,000-6,000 m well.

- The Iraqi Drilling Company (IDC) has completed drilling operations at the EBS-H-18 horizontal oil well at the East Baghdad South field in Iraq, using its 1,500 HP IDC rig 36.

NB: Additional information on drilling campaigns and spuds is available as part of a GLDR subscription

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

Updated – 28th August, 2024

- Falcon Oil and Gas spud the Shenandoah South 2H horizontal well in Exploration Permit 98 in the Beetaloo Sub-basin, Australia. Drilling of this well and the upcoming Shenandoah South 3H well will be carried out using Helmerich & Payne’s super-spec Flex 3 rig 469.

- Megha Engineering and Infrastructures Limited has delivered the new build 2,000 HP C3BR1 NG 2000-5 rig to ONGC to drill in its Rajahmundry development in India. The fully automated hydraulic rig is capable of drilling up to 6,000 metres and is equipped with a blowout preventer with a 5,000 PSI capacity. The unit was constructed under the ‘Make in India’ initiative and is part of the approximately US$722 million (Rs. 6,000 crore) 47 oil rigs ordered by ONGC in 2019.

- During the period under review, Petroworks’ PW-160, 1,500 HP rig spudded Arrow Exploration’s CNB HZ-5 horizontal well in Colombia. Once drilling is completed at the CNB HZ-5 well the rig will move on to drill Arrow Exploration’s CNB HZ-6 horizontal well and, subsequently, the Chorreron-1 exploration well in the Carrizales Norte field.

- Exalo Drilling’s 700 HP IRI Cabot 750 rig spudded the Sochaczew GT-2 geothermal well for Przedsiębiorstwo Energetyki in Poland. Drilling began on 15 August 2024 and is expected to be completed by 30 January 2025.

- In support of ThermaPrime’s Energy Development Corporation’s geothermal well expansion program in the Philippines, the company purchased three rigs, a 1,000 HP rig and two 1,500 HP rigs, from undisclosed sellers in the United States and the United Arab Emirates, respectively. With these new rig additions, the company’s fleet grows to five units from the two 2,000 HP rigs that it already owned in the Philippines.

- Red Drilling Services’ 1,250 HP E202 rig completed the drilling of Geo-Energie Jura’s 4,000 meter (m) Haute-Sorne Geothermal well in Switzerland. The well was spudded in May 2024.

NB: Additional information on drilling campaigns and spuds is available as part of a GLDR subscription

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

Updated – 28th July, 2024

- Drillmec delivered the 10th and final 3,000 HP land rig to Pemex under a two-year rig construction contract signed between both parties.

- Egyptian Drilling Company’s (EDC) Rig 65 is soon to arrive at the location to spud Apex International Energy’s SEMR-E1X exploration well in the Egyptian South-East Meleiha concession.

- Patterson-UTI reports 103 active rigs on average during the month under review. July started off strong, with 108 drilling rigs active in the first week. However, active rigs fell by 9% in the last week of the month, given that only 98 drilling rigs were reported to be in operation.

- On 7 July 2024, ReconAfrica spudded the Naingopo exploration well in Petroleum Exploration License 73 (PEL 73) Namibia using its Jarvie-1 drilling rig. The drilling campaign is expected to last 90 days, reaching a total depth of 3,800m.

- During the month under review, ADXEnergy announced that it will begin drilling the Anshof-2A side track oil appraisal well in September 2024 using Red Drilling Services’ 1,250 HP E202 drilling rig in Austria.

NB: Additional information on drilling campaigns and spuds is available as part of a GLDR subscription

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

Updated – 28th June, 2024

- On 6 June 2024, Zephyr Energy announced that drilling of the State 36-2R well was completed to a total depth of 10,290 feet (3,136 metres) in the Paradox Basin, USA. The company is now preparing to set a production liner across the Cane Creek reservoir section, after which Helmerich & Payne’s Rig 257, 1,500 HP, will be demobilised from the drilling site.

- On 3 June 2024, Beacon Energy announced that the SCHB-2 well in the Erfelden field in Germany is flowing at a poor and inconsistent rate. Thus, the well will be temporarily shut in to allow MND Drilling Services 1,150 HP, rig 40 to be demobilised, followed by a well clean-up operation to establish a long-term flow rate.

- During the period under review, Zion Oil & Gas began recompletion operations at the MJ-01 well in Israel. The rig crew has already demobilised and will begin repair and maintenance of its IL-1, 1,600 HP rig over the coming weeks. Following this, the rig’s critical components will be inspected and recertified prior to mobilising the unit back to the MJ-01 well location in an operation that is estimated to take up to three weeks.

- Arrow Exploration announced on 19 June 2024 that the CNB HZ-1 horizontal well in the Carrizales Norte (CN) field on the Colombian Tapir Block is now in production. This is the first of the four Ubaque horizontal wells planned for 2024. Petrowork’s PW-160, 1,500 HP land rig has been moved to the second cellar on the Carrizales Norte B Pad, where Arrow plans to drill a water disposal well (CNB-2) followed by the drilling of three additional horizontal wells on the B pad and finally the Baquiano-1 exploration well.

- Akita Drilling’s 1,500 HP rig number 26 spudded a well for Shell on 7 June 2024 in the west of Dawson Creek, British Colombia,

- Drilling is progressing at Geo-Energie Jura’s Haute-Sorne geothermal project in Switzerland. Red Drilling Services’ 1,250 HP rig E-202 has reached a depth of 1,820 metres, with a total depth of 4,000 metres targeted.

- Sound Energy announced on 25 June 2024 that after workover operations at the TE-6 and TE-7 gas wells, Star Valley’s 1,000 HP rig 101 had been released and demobilised from the Tendrara Production Concession. The rig is currently stacked at the TE-7 site.

NB: Additional information on drilling campaigns and spuds is available as part of a GLDR subscription

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

Updated – 28th May, 2024

- Latshaw Drilling has completed upgrades to its Rig 16, including boosting its power from 2,000 HP to 3,000 HP. The drawworks, engines, generators, and mud pumps have all been replaced. Additionally, Latshaw Drilling’s 1,500 HP Rig 43 commenced drilling with SM Energy in Texas, USA in May 2024.

- KCA Deutag has secured an additional US$45 million in project financing from Oman Arab Bank (OAB). This financial boost will support the construction of the remaining two of four new-build rigs, which are on track to be completed in 2024.

- Chariot Limited spud the RZK-1 and OBA-1 wells in the Loukos licence, Morrocco, on 3 and 20 May 2024 respectively. Star Valley’s 1,000 HP Rig 101 was utilised for drilling. Chariot Limited later announced a gas discovery from the OBA-1 well on 28 May.

- In Australia Vintage Energy spud the Odin-2 appraisal well on 15 May 2024, utilising SLB’s 1,200 HP rig 184.

- Arrow Exploration spud the CNB HZ-1 Well in the Tapir Block in Colombia using Petrowork’s1,500 HP PW-160 rig.

- Iraqi Drilling Company commenced drilling operations at the Majnoon Oil field in Iraq using its 3000 HP Rig 57.NB: Additional information on drilling campaigns and spuds is available as part of a GLDR subscription

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

Updated – 17th April, 2024

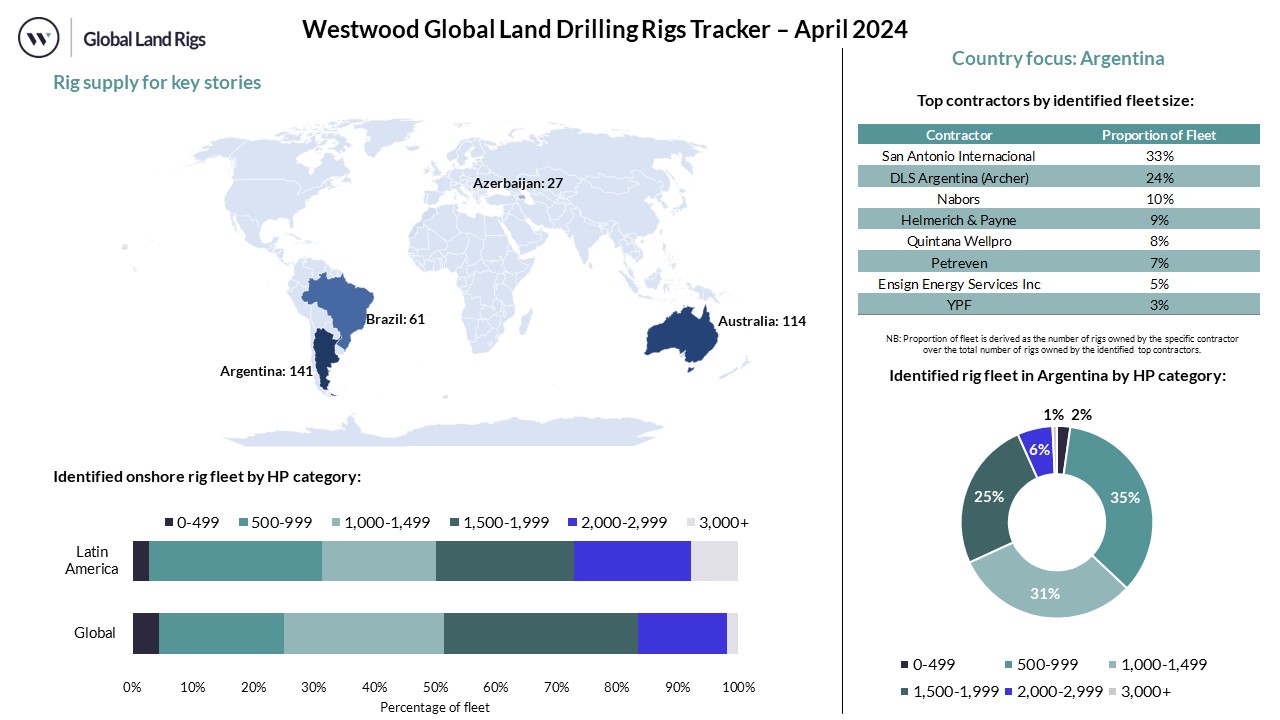

- Vista Energy has electrified Nabors 1,500 HP rig F-24, which is currently drilling in the Bajada del Palo Oeste block. This is the first rig to be electrified in the Argentinian Vaca Muerta shale play, and it is connected to the provincial electric grid using renewable energy sources.

- KCA Deutag has announced multiple contract awards valued at US$204 million for the provision of land rigs in Bolivia, Oman, Peru, and Saudi Arabia. In Oman, it secured contracts for five rigs valued at a combined total of US$181 million. These rigs will be operational for a combined total of 18 years. The company also secured three short-term extensions for rigs in Saudi Arabia in contracts worth US$16 million. In Latin America, the company was awarded a six-month rig contract extension valued at US$6 million in Bolivia. KCA also finalised two short-term workover contracts in Peru.

- Vintage Energy announced that the drilling of the Odin 2 and Odin 3 appraisal wells had been compromised by rainfall, which resulted in flooding and road closures in the Australian Cooper Basin in April 2024. Weather conditions prevented ground access, leading to disruptions in the timely arrival of freight equipment and site preparation. Such metrological conditions are anticipated to continue for several weeks; thus, the company now expects site preparation to commence in early May 2024, followed by the mobilisation of SLB’s 1,200 HP rig 184. Given this, the spud of the Odin-2 will be in May 2024.

- PetroReconcavo has been awarded a drilling contract by Seacrest Petroleo to provide a rig and associated drilling services in Brazil. The rig under contract will be used to accelerate Sacrest Petroleo’s restart of drilling of its 300 infill well drilling programme, the largest infill campaign in Brazil. PetroReconcavo has already mobilised a drilling rig ahead of the late April 2024 spud.

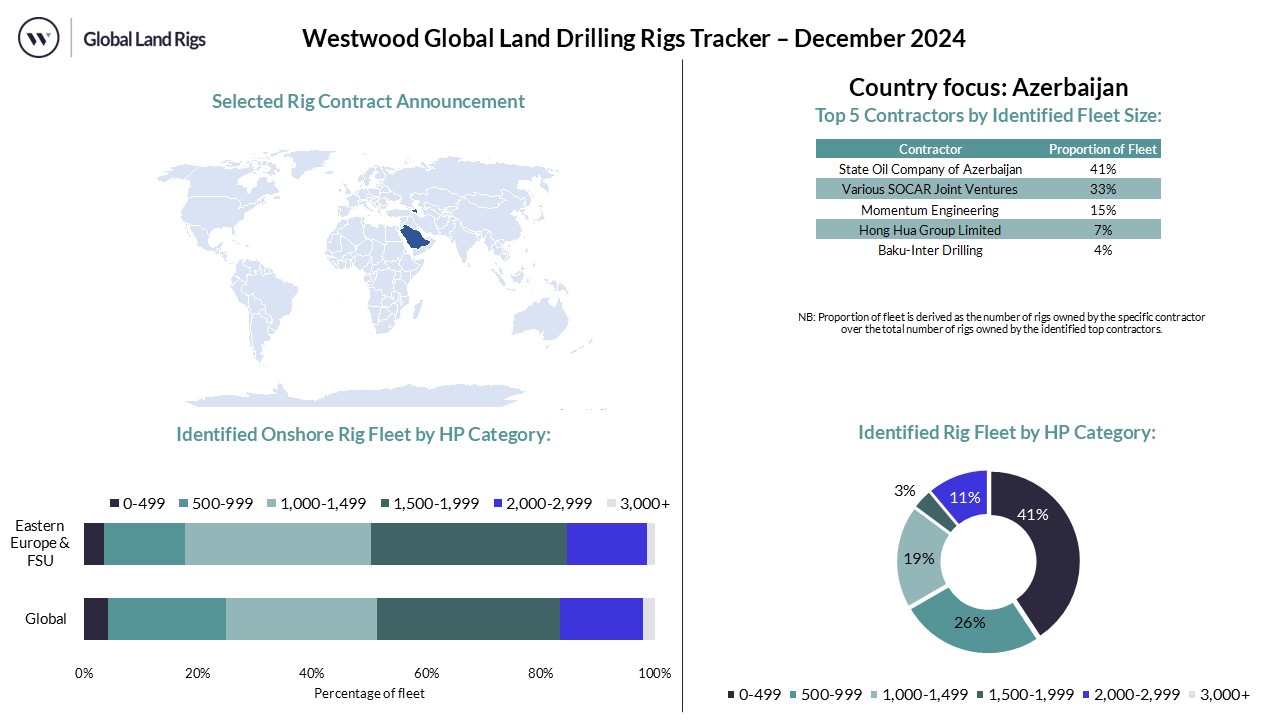

- SOCAR AQS has completed the drilling of three wells at the Buzovna-Mashtaga oil field operated by its subsidiary Azneft in Azerbaijan. Drilling was carried out by its own 1,540 HP HH 300 drilling rig and took 18 days to reach a total depth of 2,000 meters.

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

Updated – 20th March, 2024

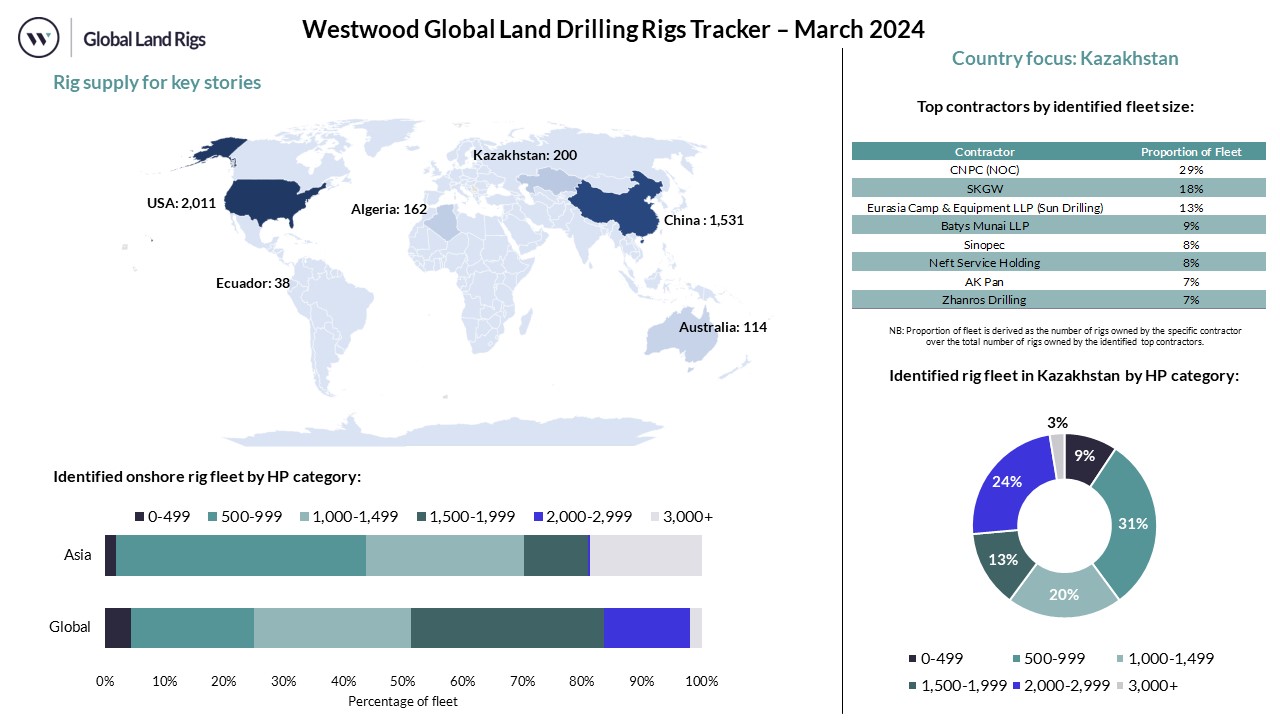

- NOC KazMunayGaz has announced plans to drill two exploration wells in Kazakhstan this year in a bid to attract foreign investment in the country’s oil and gas sector. The two wildcats will be drilled in the Turgay Paleozoy, and Karaton Podsolevoy blocks to a depth of approximately 5,500 metres.

- Petroecuador has commenced a drilling campaign in the Pucuna-Block 44 field. The company will begin rig mobilisation in mid-March 2024, ahead of an early April 2024 spud. Each of the four directional development wells is expected to produce 0.6 kbpd (total 2.4 kbpd), adding to the 8.5 kbpd currently being produced at the Palo Azul assets from 57 producer wells and five re-injectors.

- After 279 days of drilling, China’s National Petroleum Corp has crossed the 10,000 metres drilling mark with the Shendi Take-1 superdeep exploration well in the Xinjiang Uygur region. The vertical well spudded on 30 May 2023 is set to be drilled to a depth of 11,100 metres. Drilling has been challenging due to increasingly high temperatures (>200 degrees Celsius) and high pressures, with 26 drill bits and 1,060 drill stems utilised

- By late May 2024, Denison Gas expects to conclude its five-well drilling campaign, which began on 28 February 2024. The drilling campaign, located in the Denison North & South Project areas in Australia, includes exploration, appraisal and development wells targeting tight gas and coal seam gas. The horizontally drilled Punchbowl Gully-14 was the initial well drilled as part of the Denison South Project area program. Subsequently, a step-out appraisal well will be drilled in the Punchbowl Gully field, followed by two appraisal wells in the Denison North Project area and a dual lateral coal seam gas well in PL42. Ventia’s 800 HP rig 101 has been contracted for the drilling campaign with new gas feedstock intended to supply the domestic East Coast market.

- Santos is drilling across the Moomba & Gooranie fields in Australia. SLB rig 183 1,200 HP and Ensign’s 971 1,500 HP drilling units are under contract for drilling in the Moomba-328 and Moomba-339 across petroleum production licence (PPL) 7 and 9. Ensign’s rig 974 is also under contract in Gooranie-19 in PPL-20.

- Sonatrach Division Forage has signed a four-rig drilling contract with Nabors in Algeria. Drilling operations commenced in 1Q 2024, with four of Nabors PACE- F rigs drilling units under contract. Though the units were not named, each is equipped with an automated catwalk, a 500-ton AC Top Drive and an automation platform.

- Zephyr Energy has signed a new rig contract with Helmerich & Payne (H&P) to provide its 1,500 HP Flex 3 rig 257 to redrill the State 36-2 well in the Paradox Basin in the USA. The rig is currently finalising a drilling campaign in the Uinta Basin, and once this operation is completed, it will be mobilised to the State 36-2 well site ahead of the mid-April 2024 spud.

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

Updated – 20th February, 2024

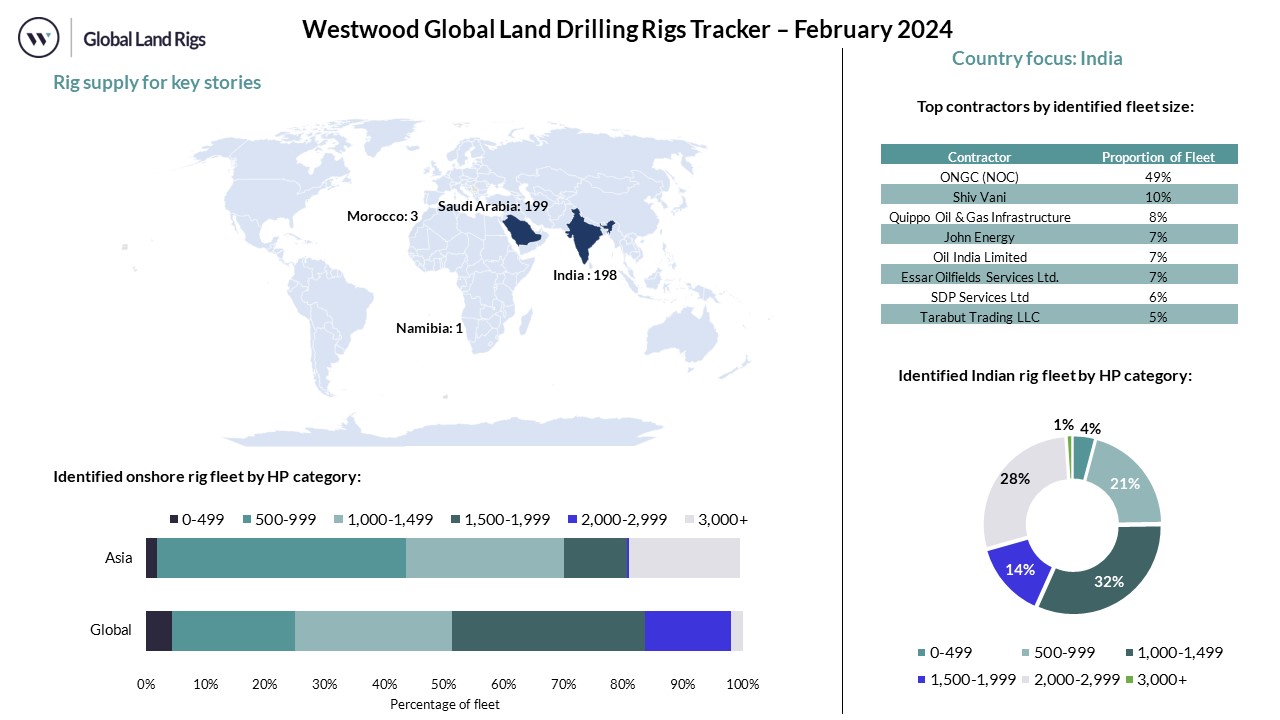

- Cairn Oil & Gas has announced that it will be spending up to US$4 billion on 25 onshore and offshore exploration wells in India over the next 12 to 14 months. Onshore targets include the RJ-ON-90/1 asset home to Mangala, the largest producing onshore oilfield in the country. Cairn’s CFO noted that the company currently has an exploration portfolio of some 62 oil and gas assets, of which 75% are onshore.

- Saudi Aramco awarded Arabian Drilling Company (ADC) a US$227 million contract for three land rigs with a duration of five years. Further to this, Aramco finalised a contract with Helmerich & Payne (H&P) for seven rigs. These units will be sourced from H&P’s idle super-spec FlexRigs, with the company planning to convert the rigs to walking configurations and installing necessary equipment for Saudi Aramco’s unconventional gas drilling programme.

- Predator Oil and Gas has been issued an extension for the Star Valley Rig 101 contract to drill the MOU-5 well in Morocco. The rig was contracted in 2022 and the extension will facilitate the drilling of the MOU-5 well, which is been planned for 1 April 2024 to 31 May 2024.

- ReconAfrica has announced that the first well of its back-to-back, multi-well drilling campaign in the Namibian Damara Fold Belt Prospect L will be spud in June 2024. Following this, the company will drill wells in either Prospect M or Prospect P. Surveying has been completed at all drilling locations, with demining completed at the Damara Fold Belt, where the company is currently preparing the well site access roads and drilling pad. It is assumed that ReconAfrica’s own 1,000 HP Jarvie 1 unit will be utilised for this upcoming drilling campaign.

- Taqa Geothermal and King Abdullah University of Science and Technology (KAUST) have spud Saudi Arabia’s first geothermal well to study the country’s geothermal energy potential. The K-GEP#1 shallow well was spud on 18 February 2024, and will be drilled to 400 metres for observation on the KAUST campus.

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

Updated – 19th January, 2024

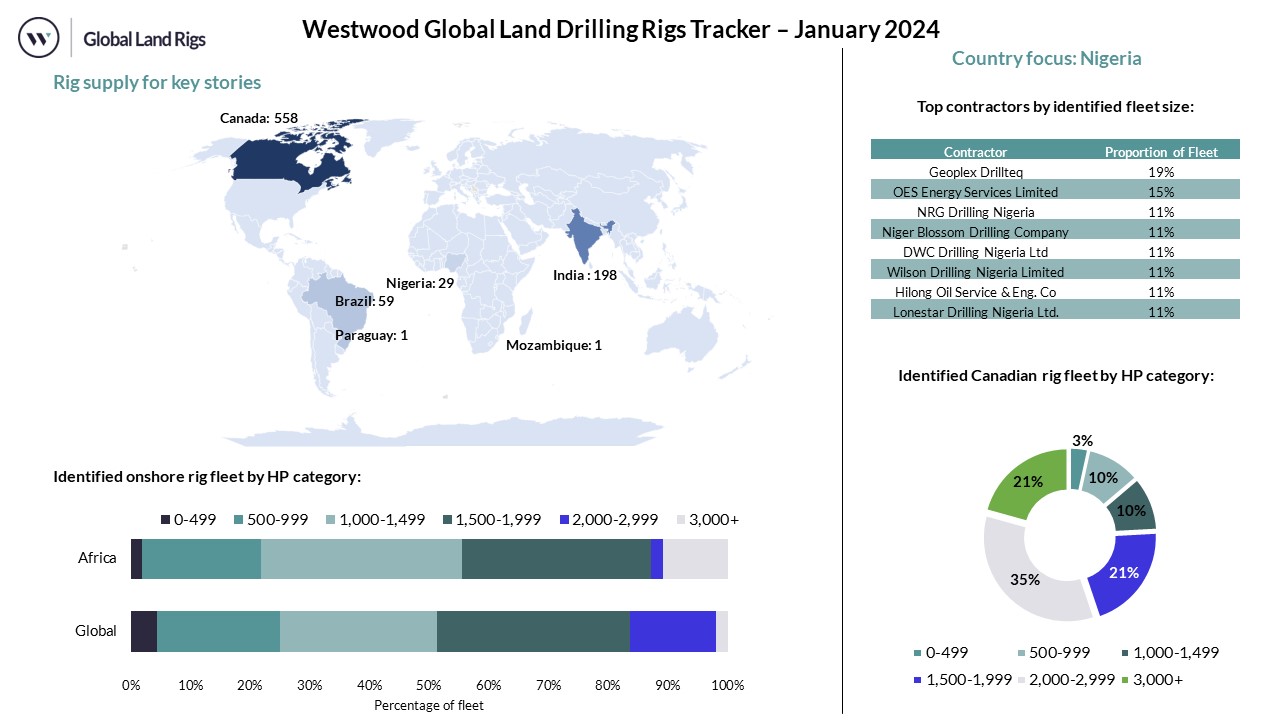

- Shell has announced an agreement to sell its Nigerian onshore subsidiary, Shell Petroleum Development Company of Nigeria Limited (SPDC), to Renaissance. The US$2.4 billion transaction, includes SPDC’s 15 oil mining leases for petroleum operations onshore and three petroleum operations in shallow water. Completion of the transaction is subject to approval by the Federal Government of Nigeria.

- Molecular Energies has spudded the Tapir X1 Exploration Well in the Pirity concession in Paraguay. This well was spud using a drilling rig contracted from President Energy and drilling is anticipated to take 45 days, with an intended total depth of 3,800 metres. This follows the Lapacho X-1 exploration well previously drilled in the concession, which failed to find commercially viable hydrocarbon resources.

- Astara Energy has acquired 100% ownership of Blackspur Oil Corp from Calima Energy in a US$56m (C$75 million) transaction. The sale entails the Brooks and Thorsby production assets in Canada and will be completed no later than 30 March 2024 pending approval from Calima Energy shareholders and the Canadian Competition Act.

- The Indian Ministry of Petroleum and Natural Gas has awarded 10 blocks in its Open Acreage Licencing Policy (OALP) Bid Round-VIII. There were 13 bids in all for the 10 blocks in the auction, which included two onshore offerings, the CB-ONHP-2022/1 and AS-ONHP-2022/1 blocks. The 10 blocks were awarded to four different companies, with ONGC being awarded the majority (seven). The ministry estimates that investments in awarded blocks for a committed exploration work programme are about USD$233 m.

- Aiteo Group has reportedly acquired the Mazenga licence in Mozambique’s Inhambane province. The licence covers an area of approximately 23,000 sq km and is expected to hold an estimated 19 tcf of gas. Aiteo Group has set out an exploration plan involving aeromagnetic and gravitational surveys as well as a reanalysis of all existing data.

- Eneva commenced the drilling of two wells in the Parnaíba and Amazonas Basins. The 1-ENV-50A-MA well is being drilled in block PN-T-134 in the Parnaíba Basin, while the ENV-51D-AM well is being drilled in block AM-T-85 within the Amazonas Basin. The 850 HP Great Holdings 120 and 105 units are being employed for these drilling operations.

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

Updated – 15th December, 2023

- Occidental Petroleum Corp. has finalised an agreement to acquire CrownRock in a US$12 billion cash and stock deal in the USA. The deal, which includes US$1.2 billion in debt, is expected to close in 1Q 2024, subject to regulatory approval transferring Crownrock’s 86,000 net acres in the Permian Basin to Occidental.

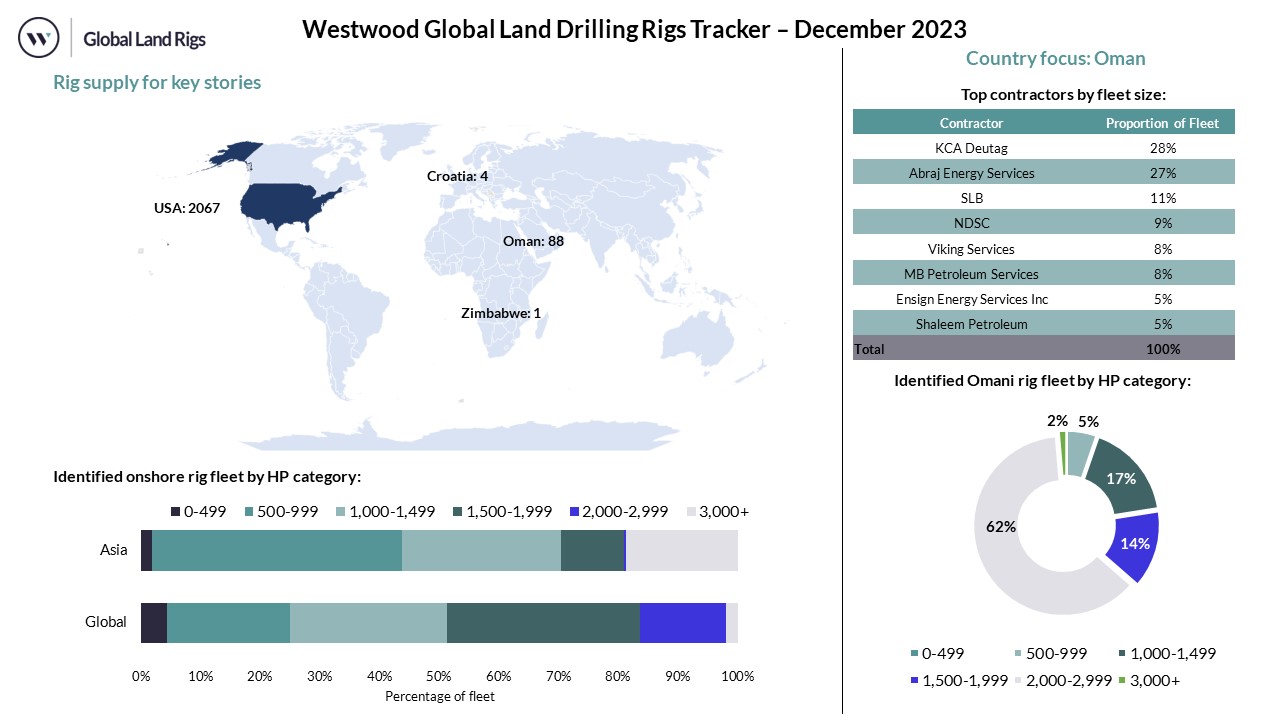

- Maha Energy has announced that it has divested its 65% working interest in Block 70, Oman, to Mafraq Energy. The deal, which could be worth as much as US$14m, involves a sale price of US$2m and an earnout of up to US$12m for actual produced volumes from the block. Mafraq Energy, which had a 35% working interest in the block prior to the acquisition, will assume full responsibility for the project and cover all costs from 1 December 2023. Maha Energy’s CEO stated that following the divestment, it will focus on strengthening its position in Latin America.

- Abraj Energy Services has signed a strategic partnership with TotalEnergies to drill two gas exploration wells in Block 12 in Oman. The partnership reflects TotalEnergies’ objective to expand their involvement to five upstream assets in Oman in 2024.

- Star Energy has announced that a drilling rig has been mobilised to a recently constructed well pad in the Ernestinovo Licence in Eastern Croatia. This rig will commence re-entry into the Ernestinovo-3 well, initially drilled in the 1980’s, to test the geothermal potential of the fractured metamorphic pre-Cenozoic formation. The re-entry, which is being conducted by local drilling company Crosco, is expected to last for approximately one month, with results expected to be released by late January 2024.Since the 1980’s, three deep exploration wells have been drilled in the Ernestinovo Licence, and data gathered from these operations indicates high temperatures and flow rates. Thus, the company believes that at an initial stage, the Ernestinovo Development Project could produce 10 MW of electricity utilising five to six wells.

- Invictus Energy has announced a gas discovery at the Mukuyu-2 well sidetrack in Zimbabwe. Exalo Drilling’s 1,200 HP rig 202 is continuing to drill the sidetrack, aiming for a total depth of approximately 3,400 m. Once total depth is reached, logging activity, including wireline formation testing and fluid sampling, will be undertaken before the final results are announced. The company also extended the contract for rig 202 for two years, until 2025, with the rig planned to be utilised to conduct drilling and testing campaigns in the Cabora Bassa Basin.

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

Updated – 7th November, 2023

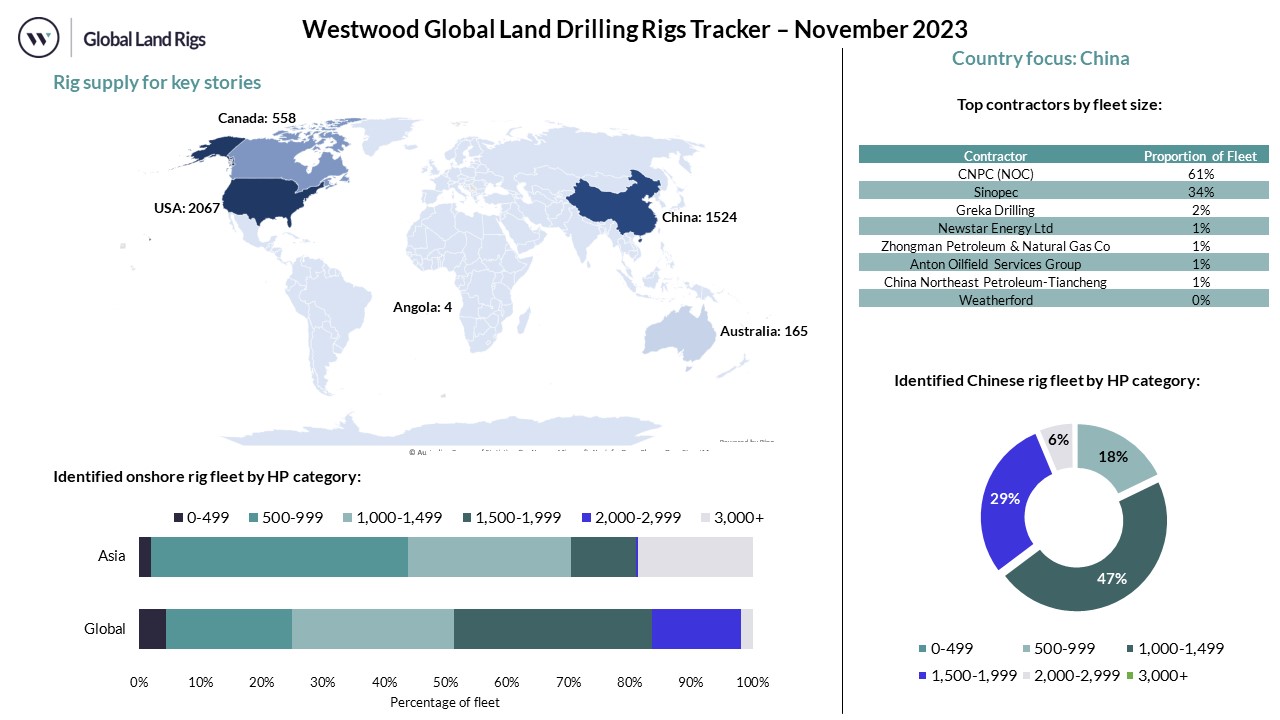

- Sinopec reported that on 26 October 2023 it completed drilling of Asia’s deepest onshore well, the Yuejin 3-3XC. Drilling commenced on 1 May 2023 and attained a total depth of 9,432 m in an operation that lasted for 177 days. This well is part of the Deep Earth 1 project in the Tarim Basin and the company hopes that this operation will lay the foundation for improved technologies and equipment manufacture to drill more ultra-deep wells (>10,000 m depth).

- China’s Ministry of Natural Resources (MNR) has announced an auction for exploration and development rights of 13 onshore blocks, covering a total of 12,860 sq km, in Xinjiang’s Tarim, Jungar and Turpan basins. Bidding closes on 7 December 2023 and bidders must be registered in China and have minimum net assets of 300 million yuan (US$41 million). The initial exploration period is five years with the possibility of a five-year extension. Within three months of securing the licence, the winning bidder must submit an exploration implementation plan to the MNR for regulatory filing.

- The Queensland Government has announced a new Frontier Gas Exploration Grant Programme to support exploration and appraisal activities in the Bowen and Galilee Basins. This is a two-year funding programme offering approximately US$ 13.5 mn (AUD$ 21.045 mn) to players and is aimed at boosting gas supply to the East Coast Australia market. Applications for gas grants close on 31 January 2024 with disbursements scheduled to terminate by the end of June 2025.

- The Angolan Upstream Regulator, ANPG, has received over 50 bids for onshore blocks in the Lower Congo (CON) and Kwanza (KON) Basins. Bids were submitted by twenty-two foreign and indigenous players, with CON 8 receiving ten bids and CON 2, 3 and 7 attracting 12 bids between them. In the Kwanza Basin, thirty-one bids were submitted between KON 7, KON 10, KON 13, KON 15 and KON 19. KON 1, 3 and 14, however, failed to attract bidder interest. Bids are currently being assessed by the ANPG which is encouraging domestic players participation in hopes of boosting declining oil production. Industry sources report that notable bidders include Afentra, Apex, Corcel, Etu Energias, Serinus Energy, Simples Oil, Sonangol and Tusker Energy.

- NOG has entered two definitive agreements, with separate private parties, for non-operated acquisitions in the Northern Delaware and Appalachian Basins. In the Northern Delaware Basin, the company placed a US$17.1 mn deposit to acquire approximately 3,000 net acres in the Lea and Eddy Counties in New Mexico. The Northern Delaware Basin assets include 13 net producing wells, a net well in process and an estimated 26.3 net undeveloped locations which are predominantly operated by Mewbourne Oil (~80%). This acquisition will close in 1Q 2024 with a 1 November 2023 effective date. The company also made an entry into the Appalachian Basin through acquisitions in the Jefferson, Harrison, Belmont and Monroe Counties in the Ohio Shale Play. These assets target the Point Pleasant/Utica Shale and are currently producing approximately 23 mmcfd (3.8 kboepd) with the company hoping for a slight increase in production in 2024. The deal is expected to close in 4Q 2024 with a 1 November 2023 effective date.

- Crescent Point Energy entered a US$2.25 bn agreement to acquire Hammerhead Energy, an O&G producer in the unconventional Alberta Montney formation in Canada. Although no definite closing date has been disclosed this cash and common share deal is expected to be sealed inclusive of US$455 mn in net debt. Crescent Point’s President and CEO, Craig Bryksa, highlights that the deal is expected to “provide significant value with premium drilling inventory, infrastructure ownership and scalable market access” positioning the company as the seventh largest E&P in Canada based on production volume from the Alberta Montney and Kaybob Duvernay plays. This deal will add 800 net drilling locations in the Alberta Montney formation to Crescent Point Energy’s portfolio.

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

Updated – 13th October, 2023

- ExxonMobil has officially announced the acquisition of Pioneer Natural Resources for US$59.5 billion. This all-share deal is expected to position ExxonMobil as the third-largest oil producer in the Permian shale basin, adding more than 850,000 net acres to the 570,000 net acres ExxonMobil holds in the Delaware and Midland basins. The deal is expected to complete in 1H 2024.

- TotalEnergies is set to sell its 31.23% working interest in the Canadian Fort Hills oil sands mining project to Suncor for US$1.07 Billion. The deal is scheduled to close by the end of 4Q 2023. TotalEnergies also announced that it has finalised the sale of its 50% stake in the Surmont asset to ConocoPhillips for approximately US$2.7 billion with approximately US$0.3 billion due in future contingent payments. This acquisition is effective from 1 April 2023.

- Elixir Energy is set to spud the Daydream-2 appraisal well in late October 2023 in ATP-2044-P, Australia. This well, part of the Grandis Gas Project, is intended to be drilled to a total depth of approximately 4,200 m targeting the Permian/gassy coal seam zones identified whilst drilling the Daydream-1 well.

- RH Petrogas spud the Karuka-1 wildcat using the GW-123 rig. The well, which will be drilled to a proposed total depth of approximately 3,170 m, is expected to take 50 days. The wildcat, located in the Kepala Burung PSC, is targeting a gas and condensate prospect in the pre-Tertiary section of the Salawati basin.

- 88 Energy highlighted that All American Oilfield’s 750 HP rig 111 has been contracted and is currently at the Hickory-1 well where long lead orders are underway prior to flow testing. Flow testing is expected to commence in early 1Q 2024 targeting the Basin Floor Fan reservoir as well as the SMD, Upper SFS and SFS formations. Contingent on a successful flow test of the Hickory-1 well the company will reevaluate the Icewine West Project after a mapping initiative identified a series of SMD prospects. 88 Energy also advanced that during CY2024 it plans to farm-out of Project Leonis where it is considering drilling an exploration well in early 2025/2026.

- Beach Energy has completed plugging and abandonment activity at the Marion-1 exploration well in the Eromanga Basin. This took place on 30 September 2023 following the spud on 24 September 2023, despite oil shows at the wells total depth. Subsequently, on 4 October 2023, the company spud the Bangalee South-1 well in PRL-99 utilising SLB’s,1,200 HP, 184 drilling rig.

- Ukrgazdobuvannya, a subsidiary of Ukraine’s NOC Naftogaz Ukrainy, has announced drilling and commissioning of five additional wells in September, adding approximately 3 kboepd. The five wells are in addition to 53 new wells drilled between January and August which have helped to increase the company’s output to 31 kboepd.

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

Updated – 19th September, 2023

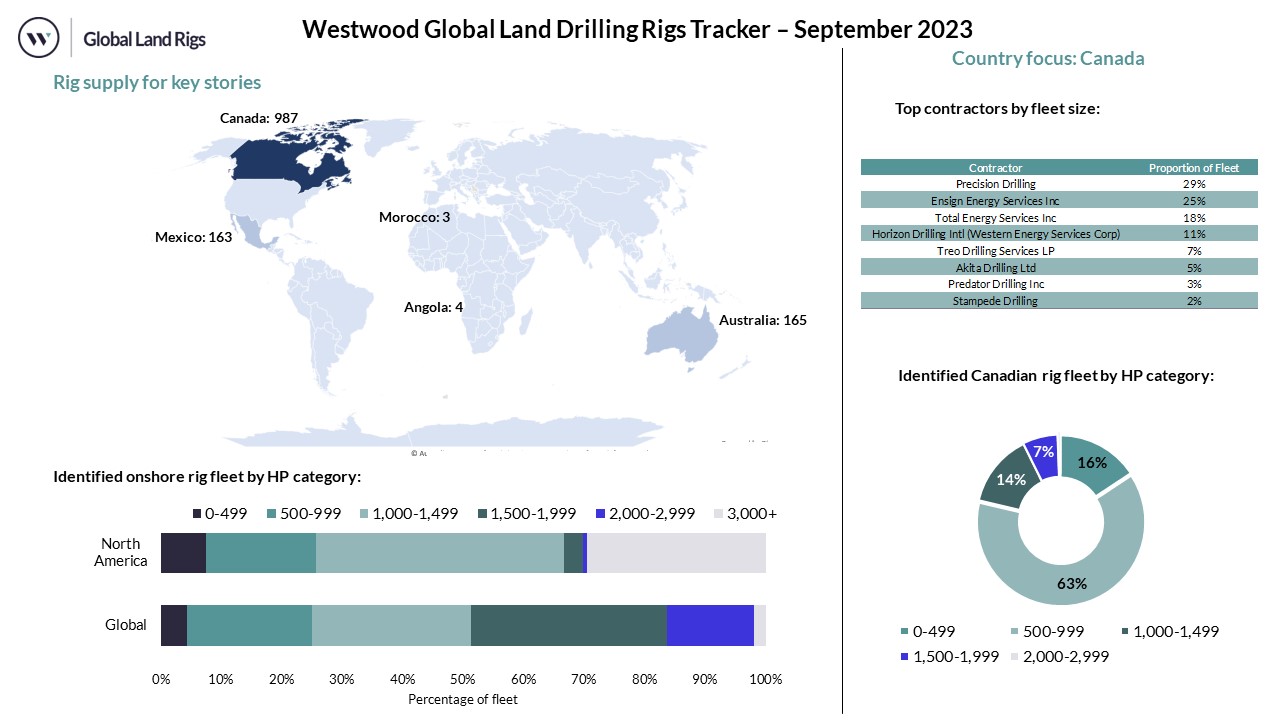

- Precision Drilling intends to acquire CWC Energy Services for US$103 mn. Precision’s CEO, stated that the transaction allows expansion of services in Canada and the US with high-quality rigs and field personnel. According to its 2Q financial report, CWC has a fleet of 138 service rigs and 22 drilling rigs operating in Nisku, Alberta and Casper, Wyoming. The sale will realise annual operating synergies of US$20 mn and there is expectation to monetise some US$20 mn of “excess CWC real estate” after the transaction closes later this year.

- Perenco completed its Santuario Noreste drilling campaign in Tabasco state, Mexico. The campaign entailed drilling three new producer wells and three water injectors in the Santuario-El Golpe mature field. The first producer well, which came onstream in April 2023, is producing 2.3 kbpd whilst the second is producing at an average of 1.5 kbpd. Production in the third well is currently being ramped up from approximately 1.3 kbpd. Perenco has reported an aim to further boost output by 2024.

- Industry sources advised that Sonangol is close to spudding the Tobias-13 exploration well on the Kon 11 block, in Angola’s Kwanza basin. The well, which targets approximately 66 mmbbls of light oil at 750 metres, will be the first onshore well drilled in this basin since 1996. It is not clear which rig Sonangol will employ for this operation, but Westwood data indicates that four drilling rigs, ranging between 525 HP and 1,000 HP, are currently in Angola.

- SDX Energy has spud the Ksiri-21 (KSR-21) gas well in the Gharb Basin onshore Morocco. The company intends to drill the well to approximately 1,950 m targeting the Hoot formation. This well is being drilled in a low-risk step-out location and will be immediately put into production, supplying gas to existing customers. SDX Energy’s Managing Director, Daniel Gould, also advanced that the company is accessing the feasibility of drilling additional wells, back-to-back, in hopes of minimizing capex per well, streamlining operational efficiency, and proving sufficient reserves of ‘gas-behind-pipe’ to meet existing and future demand.

- Strike Energy has reported that Ensign’s, 1,500 HP, rig 970 is drilling the South Erregulla-2 (SE-2) appraisal well and has reached a depth of 3,600 m. Total depth of approximately 4,450 m is expected to take 50 days to reach from the 20 August spud date. Strike Energy also received approval for the drilling application submitted for the South Erregulla-3 (SE-3) well in EP-503 and will proceed with drilling the SE-3 and SE-4 wells utilising Ensign’s 970 rig, for which it holds a rig-sharing agreement with Mineral Resources’ until at least October-November 2023.

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

Updated – 12th August, 2023

- Saudi Aramco recorded a US$30.1 billion profit in 2Q 2023 amounting to a total US$62 billion profit during 1H 2023. The company attributes this to its low-cost upstream production and integrated downstream operations. Aramco also confirmed that projects for its planned increases of both oil and gas production were progressing as planned. These planned output ramp ups will require a substantial increase in rig demand, with year-on-year growth expected through to 2027. Utilisation of the onshore rig fleet is expected to be at, or close to, 100% through much of the 2020’s with a consistent addition of new land rigs added to the country’s fleet to support activity.

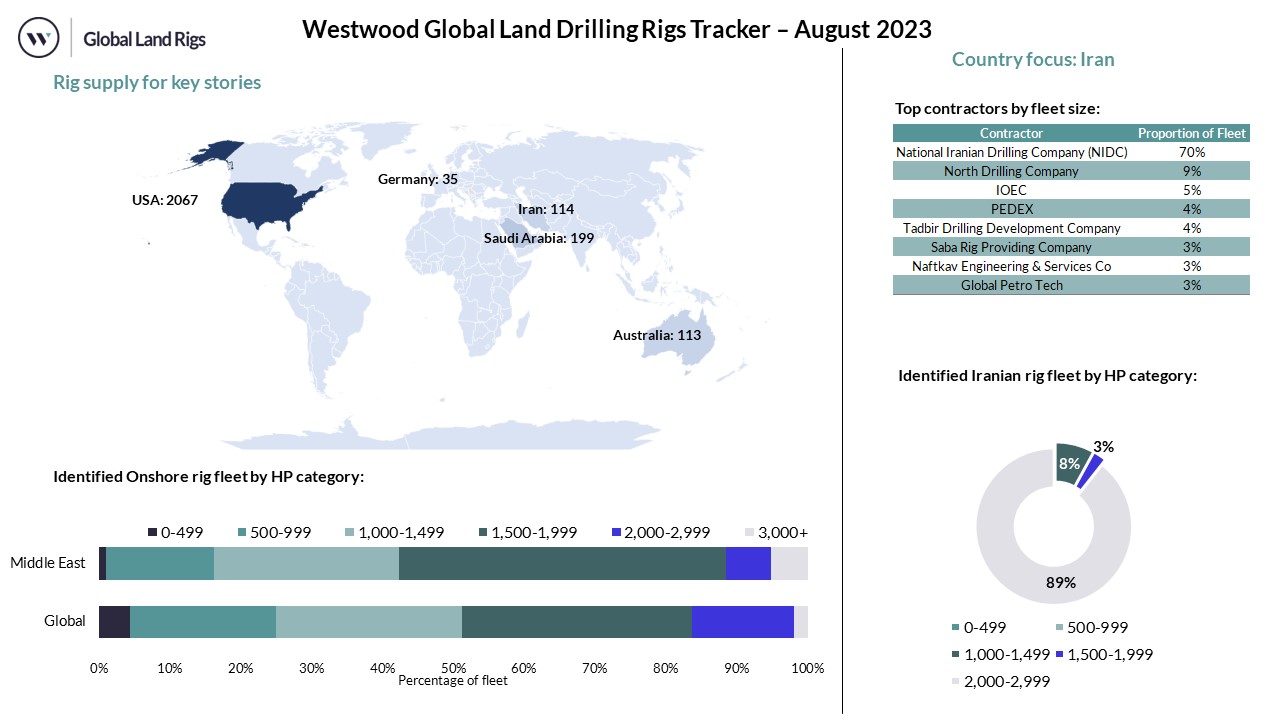

- Industry sources have reported that the Iranian National Drilling Company (NIDC) drilled and completed 36 oil and gas wells from 21 March 2023 to 22 July 2023, an increase of eight wells compared to the same period in 2022. It was clarified that one of these was a development well, and the remainder were workover wells. Thirty of these wells were drilled in the National Iranian South Oil Company (NISOC) operational zone, one in a field supervised by the Iranian Offshore Oil Company (IOOC), two in fields operated by the Petroleum Engineering and Development Company (PEDEC) and three were developed by private contractors.

- Drilling is underway in Rhein Petroleum’s deviated mechanical sidetracked Schwarzbach-2 ( SCHB-2) well. This well is being drilled utilising RED Drilling & Services, 1,250 HP, E202 rig. Once total depth of 2,255 metres has been reached, it will progress with testing the reservoir targets and conducting well completions prior to putting the well on production.

- Precision Drilling highlights the company’s expectations for increased drilling across its areas of operation in the USA and Canada. In the USA, Precision Drilling reported that it signed various rig contract reactivations, which will be valid for this year and into 2024. For its Canadian operations, Precision registered an increase in drilling license approvals from the British Columbian government and the Blueberry River First Nation which should prompt increased drilling activity, especially for their Large pad drilling programmes over the next couple of years.

- Falcon Oil & Gas spud the Shenandoah South 1H (SS1H) shale gas well utilising Helmerich & Payne’s super-spec Flex rig number 3. This is the first of two horizontal wells set to be drilled this year by the company in the Betaloo sub-basin. Drilling is expected to take 45 days, and the well will include a 1,000-metre horizontal section targeting the Amunge Member B-Shale at 3,200 metres.

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

Updated – 12th July, 2023

- One month on from its $5.4 billion merger with NexTier Oilfield Solutions, Patterson-UTI announced the acquisition of Ulterra Drilling Technologies in a deal worth $370 million. Ulterra is a designer, manufacturer and provider of Polycrystalline Diamond Compact (PDC) drill bits in the US and also has customers in the Middle East and Asia. The deal is expected to close in 3Q 2023 and will be funded by cash in hand and a revolving line of credit.

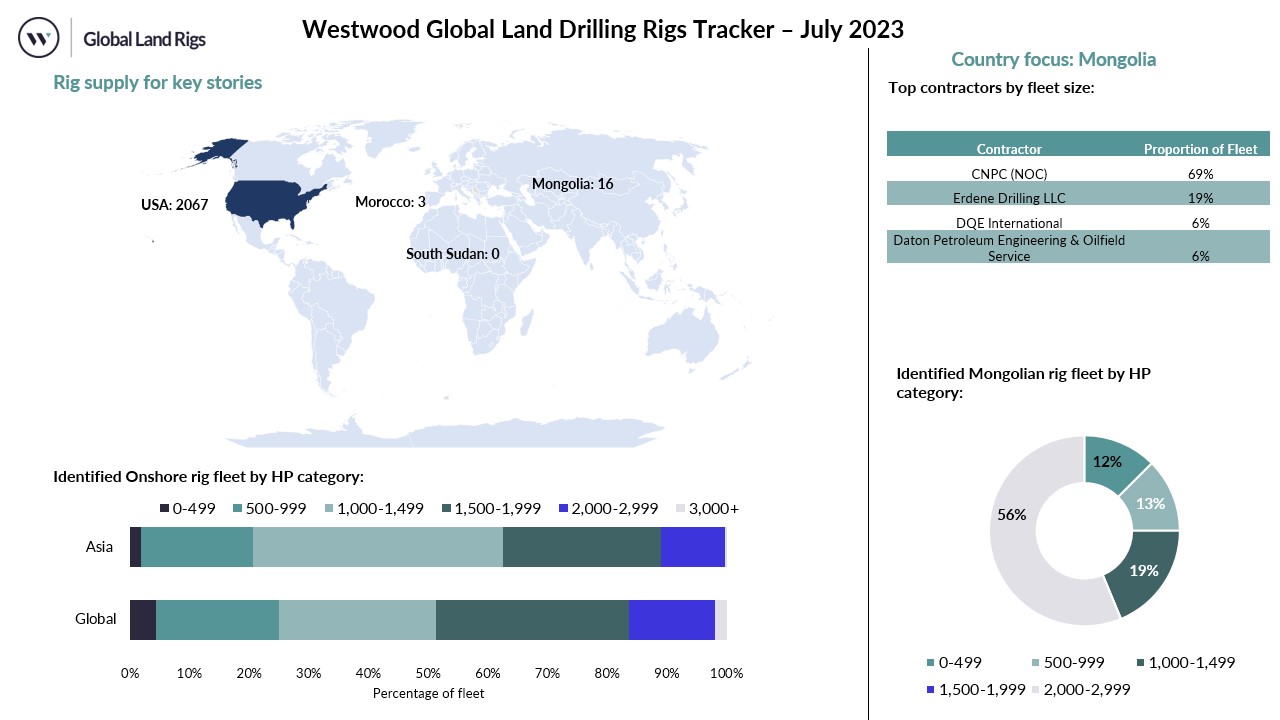

- Following the spud of the Velociraptor-1 exploration well on 13 June 2023, Petro Matad announced that it completed wireline logging after the well reached its total depth of 1,500m. Well results were unsatisfactory as all reservoirs were water bearing thus it will be plugged and abandoned and Major Drilling’s rig will be released. Well results will be used to interpret further operations in Block V and the company is shifting its focus back to near term oil production in the Heron development in Block XX.

- Nile Drilling and Services (NDS), a subsidiary of South Sudanese Nile Petroleum, has announced the purchase of two workover rigs from Tianjin Dong Fang Xian Ke. This is the second time NDS has purchased rigs from the company having also purchased two rigs in 2019. The workover rigs will be sent to the Paloch oilfield where over 100 wellheads were reportedly damaged due to floods in 2021.

- In its Investor Meet Presentation, dated 5 July, Sound Energy reported that it has received a conditional offer from Calvalley for the financing of its Tendrara project in Morocco. The project, which is already producing 100mcm a year (1.6 kboed) via a micro-LNG development, is due to see a major uplift in phase two with an additional 300mcm a year (4.8 kboed). The proposed terms include Sound Energy divesting 40% WI across two licences and obtaining Calvalley funding. This is 40% of Phase 1 costs including back costs of c.$8 million and funding of up to $48 million of SE and Calvalley’s Phase 2 equity funding requirement. It will also be required to carry out 100% of activities at the TE-4 exploration well and advance with additional Phase 1 and Phase 2 capex (if needed). The deal is currently in an exclusivity period during which time Calvalley will undertake confirmatory due diligence and the parties will seek to agree binding transaction agreements.

Michela Francisco

Analyst, Onshore Energy Services

mfrancisco@westwoodenergy.com

Updated – 17th June, 2023

- Arrow Exploration has began completion at the Carrizales Norte-1 well (CN‑1) which was drilled by Petroworks PW-160, 1,500 HP rig at the end of April. The company is putting the C7A and C7 zones on production after they showed favourable reservoir conditions with oil flowing at 1,100 bopd during well testing in the Ubaque pay zone. The company expects the CN-1 well to produce at at least 1,000 bopd, gross. Once the well has been put in production Petroworks rig will be mobilised to spud the Carrizales Norte-2 (CN-2) well in a 10–12-day operation.

- Matahio Energy has designed a multi-year appraisal and development programme for its six onshore oil and gas assets in the Taranaki basin. This programme is targeting an additional 3.8 mmboe and consists of appraisal of newer fields and infill and step-out drilling in its 100% owned Puka license. Matahio holds 100% participating interest in six licenses and 70% in the two more assets and with this deal the company will operate the Cheal and Sidewinder fields which have a net output of 1,400 boe/d. There are currently 9 rigs in New Zealand however, the company is yet to announce the rig it’s considering for this appraisal and development programme.

- TotalEnergies has expressed interest in kicking off the delayed drilling campaign at the OML 58 onshore block. The company will start the campaign in 2024 with drilling expected to last between two to three years. TotalEnergies is targeting three wells at Ibewa and three workover wells in Obagi. There are currently 30 land drilling rigs in Nigeria which could be potentially employed for this drilling campaign.

- Petroleum Development of Oman (PDO) awarded Galfar Engineering and Contracting (Galfar) with a $726 million contract for the provision of off-plot facilities for the Qarn Alam EOR oil field. The company had previously been entrusted with a field development contract for the Marmul and Harweel oil fields.

- China Petroleum Engineering and Construction (CPECC) won a 39-month production upscale EPC contract for ADNOC Onshore’s Bab, Northeast Bab and Southeast fields. With this contract, ADNOC Onshore aims to increase oil and gas processing capacity from these fields by 20%. The contract also covers adding water and gas injection facilities and the company was granted 15 months to conclude 95% of engineering work.

Todd Jensen

Analyst, Onshore Energy Services

tjensen@westwoodenergy.com

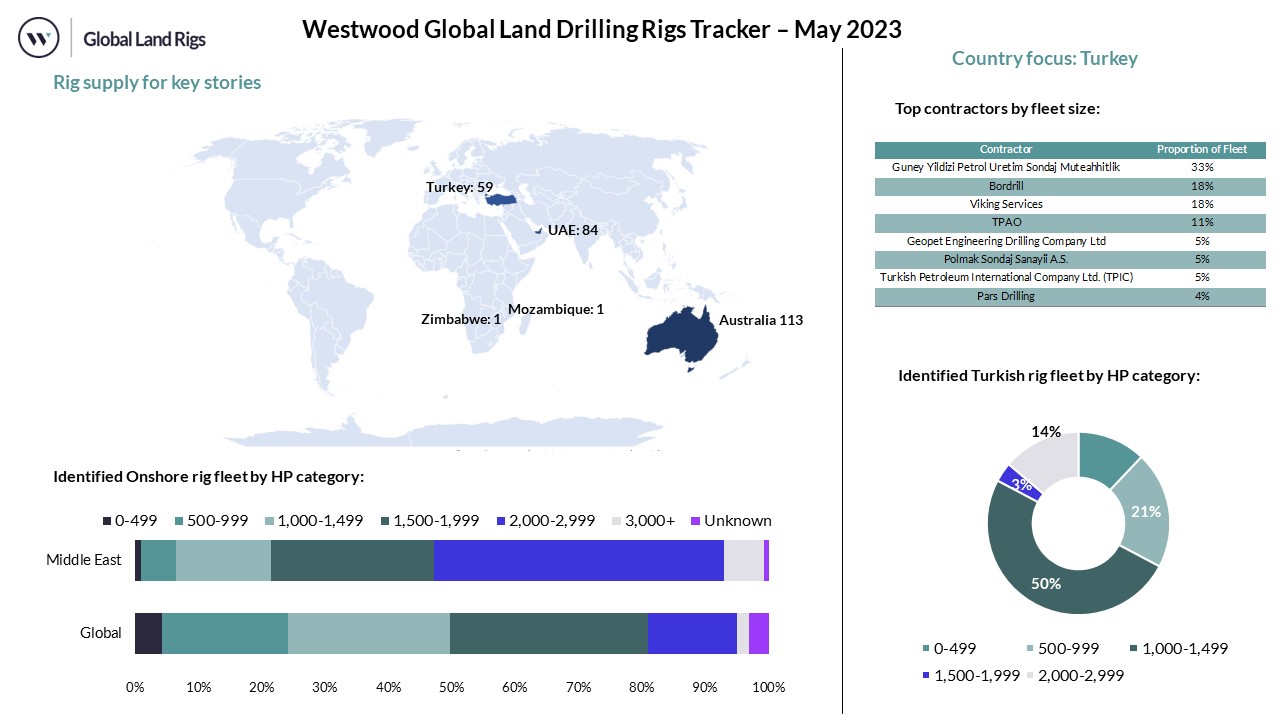

Updated – 17th May, 2023

- Tamboran Resources has contracted Helmerich & Payne’s 469 rig, a 1,500 HP, Flex 3 rig for drilling in the low carbon dioxide unconventional gas plays of the Beetaloo basin. The company aims to start shale gas production in 2025 following the government’s decision to reopen exploration of the Northern Territory’s onshore Beetaloo basin. The company is considering contracting four more H&P rigs for further operations in Australia.

- ADNOC spudded the first well in its first CO₂ to rock drilling campaign. This project will be fully operational in 2H 2023 and entails injecting a mixture of CO₂ and seawater into carbonate saline aquifer deep underground rock formations. This is a partnership with Masdar, Fujairah Natural Resources Corporation and 44.01, an Omani environmental company, and is aligned with the companies $15bn commitment to reducing its carbon footprint across its operations.

- Invictus Energy confirmed the presence of light oil, gas-condensate and helium at the Mukuyu-1 well from mud gas compositional analysis. These results are consistent with wireline log interpretations confirming multiple oil and gas pay zones in the Cabora Bassa basin. Thus far, gas condensates ratios are estimated to fall between 30 to 135 barrels per million cubic feet. The Mukuyu-1 well was drilled utilising Exalo’s 202, 1,200 HP rig.

- Turkish Petroleum (TPAO) made a billion-barrel onshore oil discovery in the Aybuke Yalcın-1 probe. This discovery has a production potential of 100,000 bopd and was made in the 162 metre proven oil play southeast of the Sehit, at a depth of 2,609-2,771 metres. TPAO’s chairman highlighted that this year the company is planning on drilling additional exploration wells in the Sirnak region.

- Sasol announced it has discovered gas at its Bonito-1 exploration well in Mozambique. The well, drilled in Area PT5-C, was drilled to a total depth of 1,934 metres by Marriott Drilling’s Rig 46, a 1,080 HP Drillmec unit. Despite the initial success it is yet to be confirmed whether the well contains commercial amounts of hydrocarbons.

Todd Jensen

Analyst, Onshore Energy Services

tjensen@westwoodenergy.com

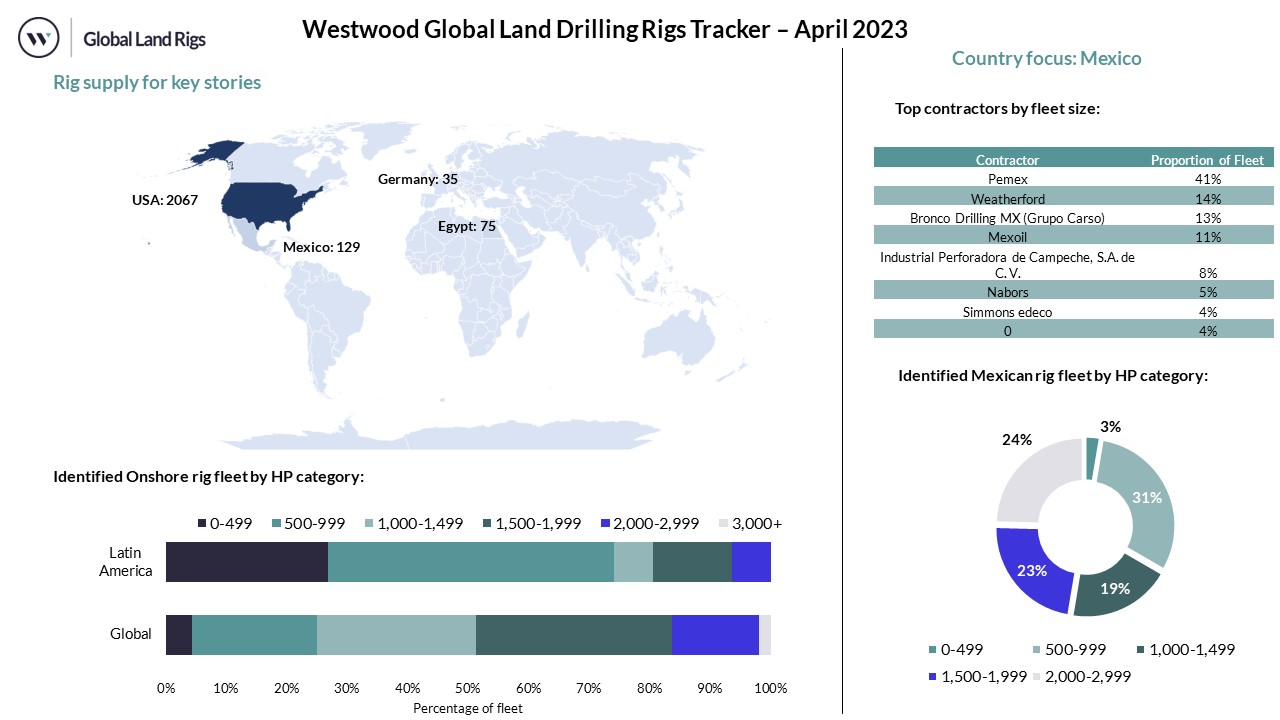

Updated – 17th April, 2023

- Omega Oil and Gas has suspended the Canyon-2 well for completion and flow testing after it was drilled to 3,807m, wireline logged and cased. The mud logs and wireline logs both confirmed the presence of hydrocarbons in sands and coals within the Kianga and upper Back Creek Group Formations. SLB’s 185, 1,200 HP rig was released form the Canyon-2 well location and is now being mobilised to spud the Canyon-1 exploration well in mid-May 2023.

- Parker Wellbore has signed contracts for use of the 256 and 165 rigs in Mexico, the operator contracting the rigs is yet to be confirmed, however, the rigs have been contracted previously by Mexoil. Both units are 3,000 HP with OIME drawworks and NOV top drives.

- United Oil and Gas (UOG) commenced drilling the ASD-3 well utilising Sino Tharwa’s 2,000 HP, ST-1 rig. Primary targets are the Abu Roash-E and Abu Roash-C reservoirs whilst the Lower Bahariya reservoir acts as a secondary target. The company intends to conclude drilling and complete within 55 days at a total depth of 3,649m.

- Rhein Petroleum GmbH contracted a fully-crewed RED Drilling & Services GmbH rig for drilling of the Schwarzbach-2 (SCHB-2) development well. The company has set a mid-June 2023 spud date with the rig due to be mobilised in early-2023. Drilling is expected to take 25 days with a total depth target of 2,255m at a true vertical depth of 1,709m. Following this the well will be tested for 12 days.

Todd Jensen

Analyst, Onshore Energy Services

tjensen@westwoodenergy.com

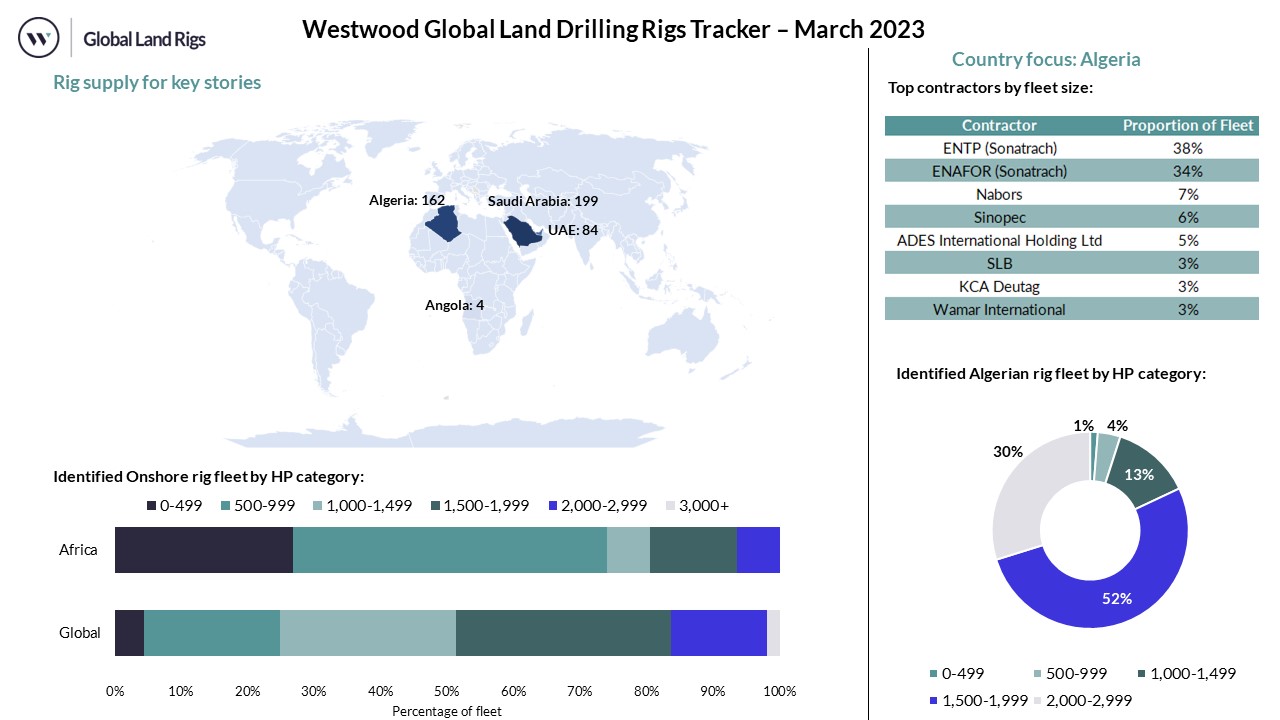

Updated – 17th March, 2023

- The Angolan Secretary of State for the Ministry of Mineral Resources, Oil & Gas has made public that the country has plans to launch a bidding round for twelve onshore blocks in the Congo and Kwanza basins. The blocks on offer are the Con: 2, 3, 7 & 8 and the Kon: 1, 2, 7, 10, 13, 14, 15 & 19 with bidding expected to commence in September.

- Saudi Aramco awarded a long term well testing contract to National Energy Services Reunited Corp (NESR). This will allow the company to apply NESR’s advanced well testing technology on various applications and expand its well testing services. This follows a nine-year wireline services platform contract awarded to NESR on 10 January 2023.

- ADNOC Drilling signed a contract worth $252 million with China Petroleum Technology & Development Corporation for the provision of 10 new build 1,500 HP fast desert moving hybrid power land rigs. Utilising high-capacity battery and engine automation in parallel with traditional diesel generators the new rigs will have 10-15% lower emissions and will support the company’s decarbonisation strategy of a 25% reduction in greenhouse gas emissions by 2030. The first rigs are due to be delivered in Q4 2023. Additionally, the company will lease four land rigs for onshore drilling projects, meaning 14 rigs in total will be added to the ADNOC Drilling onshore fleet, currently standing at 73 rigs including workover units.

- ADNOC Drilling and Masdar have signed a 5-year MoU for geothermal drilling where the companies will evaluate ADNOC Drilling’s potential to provide geothermal drilling services. ADNOC Drilling will also provide advisory and technical support services to Masdar as it takes on geothermal energy projects on a global scale. Through this deal Masdar hopes to benefit from ADNOC Drilling’s drilling and completion technologies to generate geothermal energy to thousands of households and office buildings.

- Eni has finalised the acquisition of BP’s 33.15% and 45.89% working interest in In Amenas and In Salah gas concessions in Algeria, respectively. This development comes after the Algerian national and antitrust authorities approved the buyout of these concessions which are jointly operated with Equinor and Sonatrach. This will boost ENI’s equity production to ~130 kboe/d in 2023 given that these concessions produced ~11 billion cubic metres of gas and 12 mmbbl of condensate and LPG in 2021.

Todd Jensen

Analyst, Onshore Energy Services

tjensen@westwoodenergy.com

Updated – 17th February, 2023

- KCA Deutag finalised the acquisition of the Kuwaiti division of Saipem Onshore Drilling, as part of the $550 million deal which will also see Saipem obtain a 10% stake in KCA Deutag. Saipem Onshore Drilling’s Kuwaiti fleet consisted of the 3,000 HP, 5913 and 5946 rigs. KCA is expected to finalise its acquisition of Saipem Onshore Drilling’s Latin American business as well as its fleets in Romania and Kazakhstan on 31 March 2023.

- Webuild has confirmed that they will continue with Clough’s work in the Waitsia 2 onshore gas project, Australia. Concerns were eminent regarding the timely delivery of the Mitsui E&P operated gas project after Clough was acquired by Webuild, following going into administration in December 2022. Webuild will construct a new purpose-built production facility with a daily production capacity of 250 terajoules which Clough had been contracted to build.

- TMK Energy secured one of Major Drilling Group’s rigs for drilling operations in the Pilot Well Program (PWP). This program entails drilling 3 production wells, and the provision of installation pumps, with drilling scheduled to commence in April for eight weeks. TMK was prompted to go ahead with the PWP after results from the Snow Leopard-02 (SL-02) exploration well indicated a strong possibility of an early gas breakthrough and commercially viable production rates. This follows Petro Matad’s announcement on 14 February that it is ready to drill the Velociraptor-1 well in Block V, with a drilling contract already signed with Major Drilling with an initial spud date expected in Q2 2023.

- ADNOC Drilling is planning a two year, $2.5 billion spending spree on drilling rigs to keep in line with the UAEs capacity enhancement programme. The announcement follows the release of ADNOCs annual financial results for 2022, with an additional $1 billion in capex for 2023 and 2024 on top of the original guidance. ADNOC Drilling now expects to increase its fleet to 142 units by the end of 2024, up from a current fleet of 115 units of which 74 are onshore drilling rigs. This drive to increase its rig fleet shows ADNOCs ambition to reach its 5 mmbbl/d production capacity target by 2027.

Todd Jensen

Analyst, Onshore Energy Services

tjensen@westwoodenergy.com

Updated – 17th January, 2023

- ADNOC launched its new gas unit, ADNOC Gas, effective from 01 January 2023. This new division will focus on all processing, operations and marketing and is a joint venture between existing ADNOC Gas Processing and ADNOC LNG businesses. This is a move that will grow its gas production and processing capacity.

- Saudi Aramco has sought expressions of interest for the second phase of its Jafurah Phase 2 development. Aramco stated that at least five EPC packages will be included, following a raft of contract awards in 2021 as part of Phase 1. One package will include a gas treatment, a second will involve utilities and off-site facilities, a third will see work on Jafurah’s gas compression facilities and two pipeline packages will also be on offer, combined requiring more than 830km of pipeline.

- Sinopec has set a new vertical drilling record of 8,866m at its Yuanshen-1 exploration well in the Sichuan Basin by utilising Sinopec’s ultra-deep carbonate drilling technology, which permits drilling in deep hydrocarbon reservoirs. To further explore the deep oil and gas basins, Sinopec unveiled ‘Project Deep Earth’ Natural Gas Base in Sichuan and Chongqing’ in which it will conduct deep E&P activities in collaboration with several subsidiaries.

- KCA Deutag reported three contract extensions in Oman; the 1,500 HP T-849 and T-858 rigs and the 2,000 HP T-899 rig. The T-899 rig will also be electrified, allowing it to be connected to the grid with the aim to reduce annual emissions by 2,550 tonnes. The company also secured a contract for its 2,000 HP T-63 rig to drill two wells in the Kurdistan region in Iraq, while its 1,500 HP T-208 rig won a contract in Europe for 2023.

- Sonatrach has launched a tender for the supply of 18 drilling rigs in Algeria. The tender includes four 2,000 HP and 14 1,500 HP units. Signatures for the contracts are expected to be signed in 3Q 2023.

Todd Jensen

Analyst, Onshore Energy Services

tjensen@westwoodenergy.com