The U.S. land rigs have been increasing along with the WTI price since mid-2016. In 2018, the US active land rig count was up 17% from the previous year. Energent’s Rig Insights page suggests that currently there are 1,013 rigs operating as of last week of February. On a basin-by-basin level, the drilling activity in the Williston increased by 36% Y-o-Y, while the Eagle Ford and MidCon increased by 26% and 20%, respectively.

Multi-well pad drilling is more mature in DJ-Niobrara and Bakken but gained momentum in the Permian over the last several years. As the price plummeted to WTI $35 in Q1 ’16, operators and oilfield service players were faced with challenges to bring down costs while increasing production.

Rise of the Drilling Factory

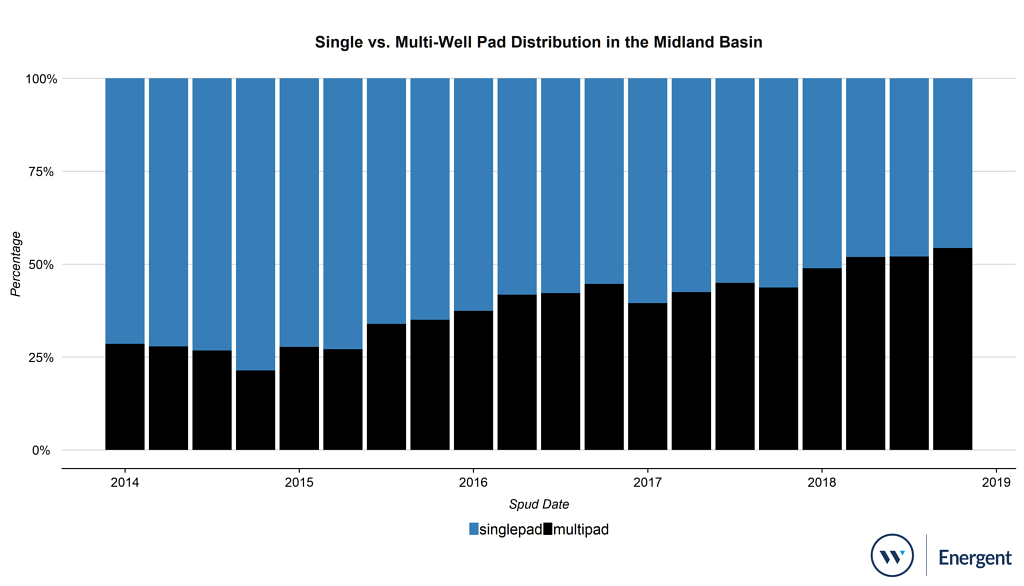

In recent years, more and more operators started adopting multi-well pads due to the benefits of reducing environmental footprint on a pad-level, optimizing operational efficiency and improving production. In the Midland Basin, the multi-well pad construction level exceeded 50% of well pads in Q2 ’18.

Figure 1: Evolution of multi-well pad in the Midland basin Source: Energent Group

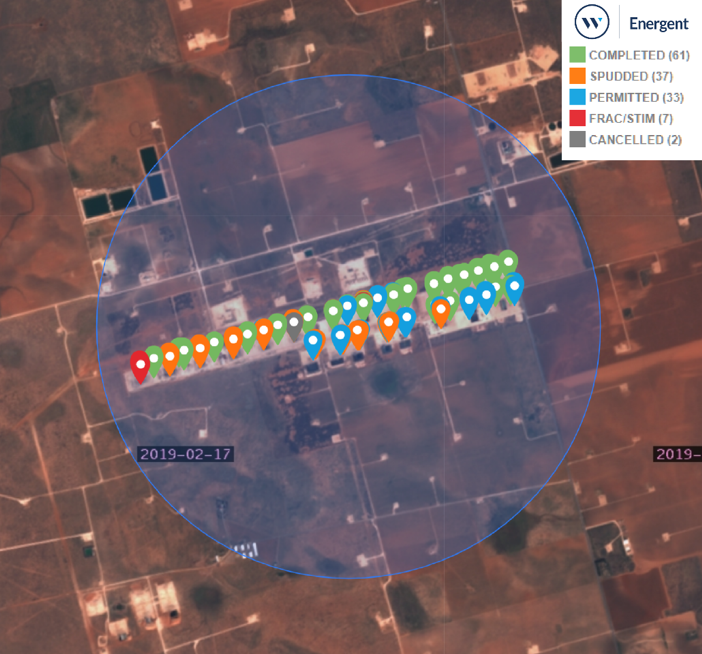

Individual operators have not only increased the number of wells per pad, but also started implementing factory-style drilling characterized by constructing multiple pads side-by-side. For instance, Concho Resources’ (CXO) Dominator pad in the Northern Delaware basin consists of 20+ wells targeting five distinct landing zones within a single section. Concho operated seven rigs simultaneously to achieve economies of scale with factory drilling.

Figure 2: The Dominator pad by Concho Resources in the Delaware basin

Source: Energent

Similarly, QEP Resources (QEP) constructed a drilling factory of 100+ wells, stretching over 2 miles, in Martin county, Texas. QEP refers to this development style as ‘tank-style’ development.

Figure 3: Cube development by QEP Resources in the Midland basin

Pad Complex and Cube Development in Permian

QEP Resources and Concho are recent examples of operators moving from single pads to multiple pads in a “Pad Complex” or sometimes referred to as “cube development”. The concept originated with Encana’s Davidson Pad Complex in the Permian. Numerous other operators including Oxy, Felix Energy, and others are adopting the Pad Complex based on our SatScout observations.

Frac hits are arguably the key challenge for 2019 as the industry strives to optimize production from shale assets. Operators will continue testing different approaches like sequencing development, spacing of wells or patterns, and horizontal isolation to mitigate potential frac hits. However, no one has cracked the code yet.