Quarterly Summary

Onshore drilling activity remained strong in the second quarter of 2023 with global rig demand on an upward trend, driven by high levels of activity in well-established regions such as the GCC (Gulf Cooperation Council). At the same time, several countries with limited historic activity have also seen drilling begin or progress – highlighting a renewed interest in underexplored areas. Merger and acquisition (M&A) activity has been prevalent this quarter, with the US, once again, the centre of many onshore M&A deals. This quarter did however also see KCA Deutag manage to complete the Latin American section of its acquisition of Saipem Onshore, following completed handover of the Middle East fleet in October 2022.

Brent crude prices have remained steady during 2Q 2023, settling in the US$70 per barrel region, creating a sense of stability that the industry has been craving. OPEC+ countries have signalled their intent to maintain this stability and support prices at a time when concerns over a global economic slowdown threaten to send them lower. The group announced the continuation of production cuts throughout 2024, along with revising the baseline that the quotas are reduced by for the majority of members to reflect current capacity. Saudi Arabia also announced an additional 1 mmbbld reduction for July, which they subsequently announced would be extended through August. Russia appears to be following suit, with Deputy Prime Minister Alexander Novak reporting that Russia will reduce exports by 500 kbbld in August.

Deals continue to flow

One of the biggest mergers of the first half of 2023 saw Patterson-UTI and NexTier combine, forming a US$5.4 billion oilfield services company. NexTier shareholders will receive 0.752 shares of Patterson-UTI common stock for each NexTier common stock share owned. The merger combines Patterson-UTI’s land drilling business, which comprises of 192 land drilling rigs, and NexTier’s well completion operations.

| Seller | Buyer | Country | Value (US$mn) | Asset | Effective Date |

| Chesapeake Energy | INEOS | USA (Eagle Ford) | 1,400 | 172,000 acres | October 2022 |

| Petronas | Chadian NOC | Chad | - | Doba basin assets | December 2022 |

| Mesquite Energy | Crescent Energy | USA (Austin Chalk, Upper Eagle Ford) | 600 | 75,000 net acres | March 2023 |

| Petrobras Norte Capixaba | Seacrest Petróleo | Brazil | 462.5 | Norte Capixaba Cluster | April 2023 |

| EnCap Investments | Ovintiv | USA (Midland Basin) | 4,275 | 65,000 acres | June 2023 |

| Patterson-UTI | NexTier | USA | - | Merger | 3Q 2023 |

| Challenger Energy | Predator Oil & Gas | Trinidad & Tobago | 9 | Cory Moruga permit | 3Q 2023 |

| TotalEnergies | ConocoPhillips | Canada | 3,000 | 50% in Surmont oil sands | 3Q 2023 |

| *Novo Oil & Gas | Earthstone Energy | USA | 1,500 | Novo Oil & Gas* | May 2023 |

| *Earthstone Energy | Northern Oil & Gas | USA | 500 | 33.3% interest in Delaware basin assets* | May 2023 |

| Stateside Energy | Zenith Energy | USA (Oklahoma) | 2 | 3,200 acres | - |

| SDX Energy | - | Egypt | - | South Disouq, West Gharib | - |

*Deals carried out simultaneously

Deals Carried Out & Initiated in 2Q 2023

Source: Westwood Global Land Rigs DailyLogix/Press Releases

The continued trend of big deals in US shale plays continued in 2Q 2023. British company INEOS Energy entered the US market for the first time with its purchase of 172,000 acres of Chesapeake Energy’s Eagle Ford shale assets. In mid-June 2023 Earthstone Energy acquired Novo Oil and Gas Holdings in a deal worth US$1.5 billion. This deal was carried out simultaneously with Northern Oil and Gas acquiring a 33.3% working interest in Novo’s assets from Earthstone, for a total of US$0.5 billion. The acquisition will be effective from 1 May 2023, and is expected to complete in 3Q 2023.

In Canada, supermajor ConocoPhillips purchased TotalEnergies’ 50% stake in the Surmont oil sands; this comes as TotalEnergies continues to move towards a less carbon intensive portfolio.

In Latin America, Seacrest Petróleo announced that it had acquired Petrobras Norte Capixaba onshore assets for US$427 million in addition to the US$36 million purchase contract signing handout. The company is also required to pay Petrobas up to US$66 million, contingent on future Brent prices. The deal see’s Seacrest Petróleo establish itself as the third largest onshore oil and gas producer in Brazil with 2P reserves of 140 mmboe.

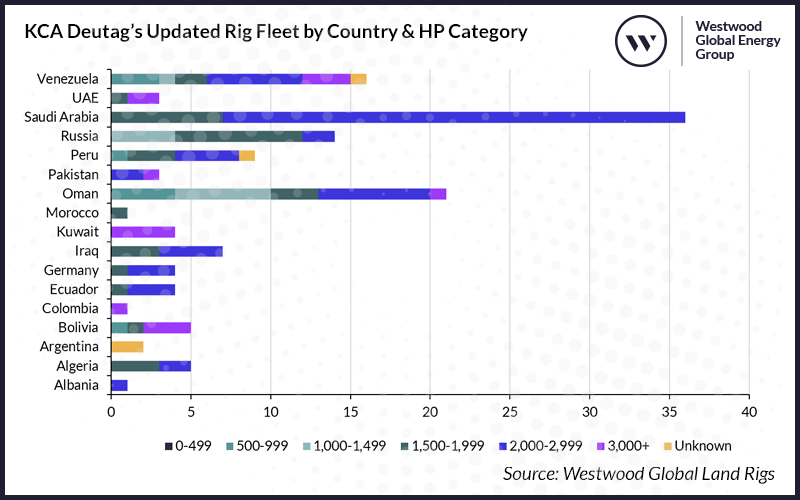

KCA Deutag completed the acquisition of Saipem Onshore’s Latin American drilling rigs, containing 17 units currently inactive in Venezuela. The initial announcement was made on 1 June 2022 with Saipem closing the sale in late October 2022. The agreement included the entirety of Saipem’s onshore drilling operations covering the Middle East, Africa and the Americas for an overall cash consideration of US$550million, in addition to a 10 percent share participation in KCA Deutag.

KCA Deutag’s Updated Rig Fleet by Country & HP Category

Source: Westwood Global Land Rigs

Positive signs for drilling developments

A significant number of drilling campaigns have taken steps forward with several companies securing funding and some big players showing renewed interest in onshore projects across the globe.

On 1 June ConocoPhillips announced that funding for the development of the Nuna Project in the Kuparuk River Unit (KRU), Alaska, had been approved. On pad construction and the installation of a pipeline are scheduled to begin this year and be completed next year, with the drilling campaign to follow. This timeline should allow for first oil in early 2025. This project is expected to augment the existing KRU development with an additional 29 development wells, increasing oil production by ~20,000 bopd.

Invictus Energy raised US$12.7 million from an oversubscribed share purchase plan capital raising activity, allowing them to proceed with the next phase of drilling of the Mukuyu-2 appraisal well in the Cabora Bassa basin, Zimbabwe. Exalo’s 202, 1,200 HP rig has been contracted to drill the Mukuyu-2 appraisal well. Invictus also awarded Polaris Geo a 2D data seismic survey contract for phase two of its Cabora Bassa basin exploration and appraisal (E&A) programme.

Also in Africa, Expro Group was awarded a five-year Well Intervention and Integrity Contract for TotalEnergies Tilenga project. The contract is rumoured to be valued at over US$30 million and Expro will be supporting the project through the provision of carbon reducing operational solutions. TotalEnergies also expressed interest in kicking off the delayed drilling campaign at the OML 58 onshore block, Nigeria. The company will start the campaign in 2024 with drilling expected to last between two to three years. TotalEnergies is targeting three wells at Ibewa and three workover wells in Obagi.

Sub Saharan Africa Top 12 Countries by Rig Fleet Size

Source: Westwood Global Land Rigs

The Ghanaian National Petroleum Corporation (GNPC) has unveiled plans to start its pioneering onshore exploration programme in the Voltain Basin in 2024. The company has held a licence for this asset since 2015 and in 2017 it began working on building capacity for exploration. Drilling is due to take place in 2024 and dependent on the drilling results, GNPC hopes to boost exploration in Northern Ghana. GNPC will be tendering for a rig to carry out this drilling in late 2023/2024.

Matahio Energy, who completed the acquisition of six oil and gas licences onshore New Zealand in June, has announced a multi-year appraisal and development programme for these assets. This programme is targeting an additional 3.8 mmboe and consists of appraisal of newer fields and infill and step-out drilling in its 100% owned Puka license.

The Iraqi Oil Minister announced that it has reached a preliminary agreement to develop the Akkas onshore gas field with Saudi Aramco. Final terms are yet to be announced but this agreement aims to boost Iraqi production to 400 mmscfd as this field is believed to hold 5.6 tcf of gas reserves. The Akkas field had previously been awarded to Korea Gas Corporation in 2010 but the company withdrew from the development in 2017 due to military instability.

On 13 June 2023, Petro Matad spud the Velociraptor-1 exploration well in Block V, Mongolia. This is the first well the company is drilling in the Raptor Trend of prospects and it is targeting an inversion anticline prospect holding ~200 mmbbl of mean prospective recoverable crude resources at a TD of 1,500 metres in a 30-day operation.

Investment continues across the board

Several contract awards were announced in 2Q 2023, and the GCC – dominant through the last few quarters – continued to see significant activity. In Oman, both Galfar Engineering and Contracting and NESR were awarded contracts. Galfar was awarded a US$726 million contract for the provision of off-plot facilities for the Qarn Alam EOR oil field by Petroleum Development of Oman (PDO). Gulf Energy, a subsidiary of NESR, signed multiple well intervention contract extensions for clients in Oman valued at US$100 million. The contract extensions vary in length with five years the longest obtained.

Elsewhere in the GCC, China Petroleum Engineering and Construction (CPECC) won a 39-month production upscale EPC contract for ADNOC Onshore’s Bab, Northeast Bab and Southeast fields. ADNOC Onshore aims to increase oil and gas processing capacity from these fields by 20%. The contract covers adding water and gas injection facilities and the company was granted 15 months to conclude 95% of engineering work. This contract is aligned with ADNOC’s ambition to boost daily production to 5 mmbbls per day and its commitment to invest US$489million to upgrade the Bab field, its largest onshore asset, to sustain its long-term production capacity.

In Kuwait, Sparrows Group and Kuwait Petroleum Corporation (KPC) signed a maintenance and provision of certificates of conformance contract for the NOC’s onshore rig fleet. Sparrows will provide servicing for critical drilling equipment such as iron roughnecks, catwalks, mud pumps and top drives. This follows reports from March 2022 that KOC had tendered for the supply of 24 drilling rigs of 1,500 and 2,000 HP and 20 small drilling rigs of 750 HP. In October, Kuwait Drilling Company also signed a deal with Chinese rig builder Honghua Group to supply an undisclosed number of 3,000 HP land rigs, in a deal worth US$60 million.

In the UAE, ADNOC announced its biggest contract award of 2023 to date, awarding Petrofac an engineering, procurement and construction (EPC) contract worth US$700 million. The contract covers work on ADNOCs Habshan Complex and comprises of three gas compressor trains, associated utilities and power systems.

In Latin America, Parker Wellbore signed contracts for use of the 256 and 165 rigs in Mexico. The operator contracting the rigs is yet to be confirmed however, the rigs have been contracted previously by Mexoil.

Gran Tierra Energy and Ecopetrol renegotiated the duration and terms for the Suroriente Block contract, agreeing a 20-year extension. The new contract added a novel term allowing for long-term investment in work programmes and infrastructure to boost oil recovery efficiency in existing fields in the block as well as the incorporation of appraisal drilling to potentially prolong the life of the fields. The Suroriente block will continue to be operated by Gran Tierra Energy and the company has committed to a three-year US$123 million capital investment programme for operations in the block.

Tamboran Resources contracted Helmerich & Payne’s 469 rig, a 1,500 HP Flex 3 unit, for drilling in the low carbon dioxide unconventional gas plays of the Beetaloo basin. The company aims to start shale gas production in 2025 following the government’s decision to reopen exploration of the Northern Territory’s onshore Beetaloo basin. The Flex 3 rig has the capability to drill horizontal sections >3,000m and is targeting the Mid Velkerri B shale formation. Tamboran’s chief executive, Joel Riddle, stated that the company is considering contracting four more H&P rigs for further operations in Australia.

Ben Wilby

Senior Analyst, Onshore Energy Services

[email protected]

Michela Francisco

Analyst, Onshore Energy Services

[email protected]

The Global Land Rigs Newsletter highlights key takeaways for the quarter. Full access to daily news updates on the global onshore drilling industry is available to subscribers of Global Land Rigs.