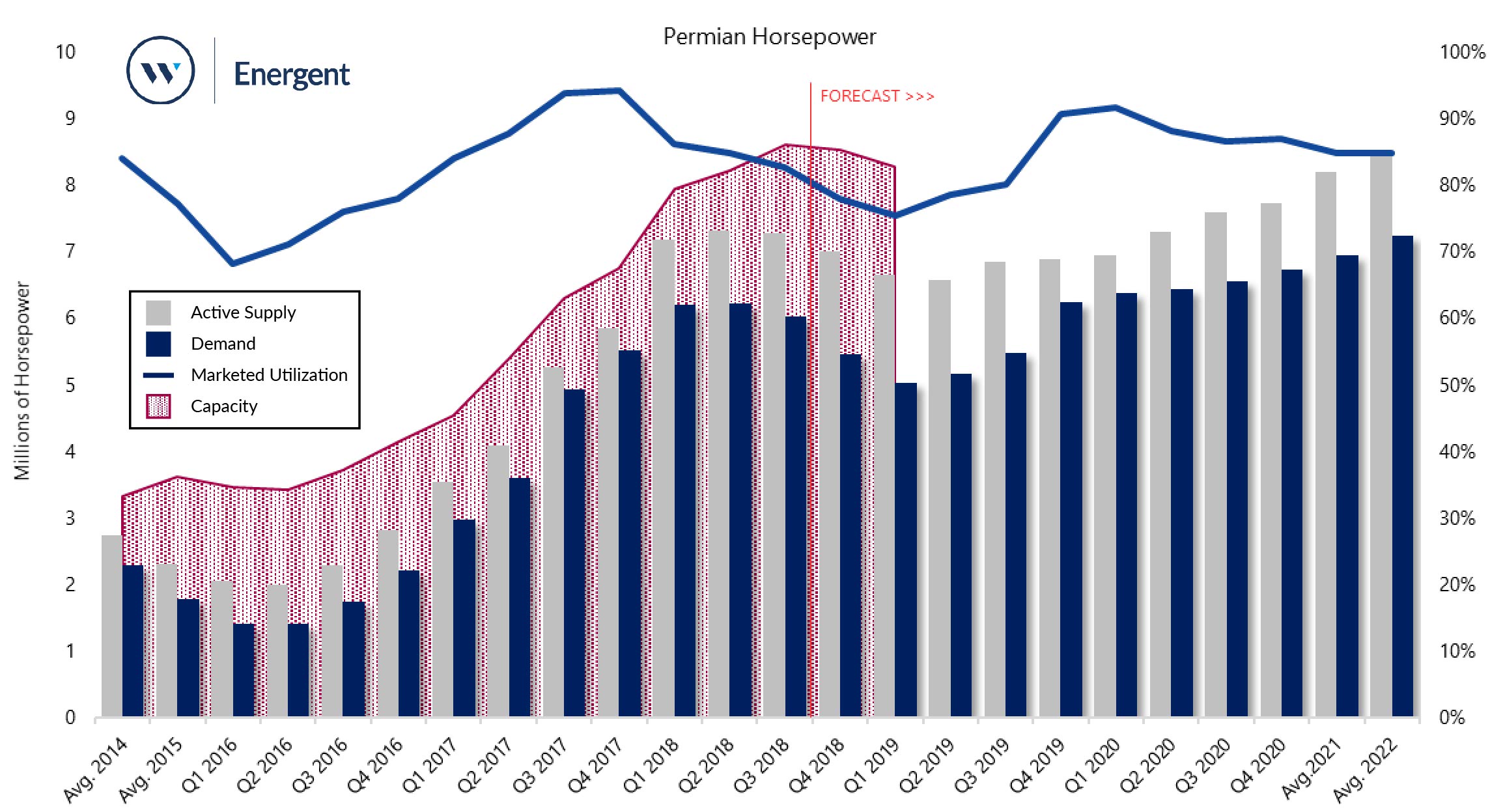

Permian HHP demand is forecasted to trough in 1H’19, declining roughly 19% from the 2Q 2018 peak to 5 million HHP before takeaway capacity comes online in 2H 2019 and operators begin completing deferred activity. Active Permian crews are likely to decrease an additional 7% from Q4’18 levels, to match an 8% decline in HHP demand over the same period.

Westwood estimates a 15% sequential increase in HHP demand from 3Q 2019 to 4Q 2019, with a 1% increase in active, or marketed, supply. Pressure pumpers are not yet scrambling to expand their fleets in this temporarily oversupplied HHP market. However, pressure pumpers will need to begin hiring, mobilizing crews, and preparing for 2H’19 completion activity.

With pressure pumpers presently moving HHP capacity to other nearby basins (i.e. Eagle Ford and MidCon), Westwood forecasts a tight frac market late in 2019 and into 2020, given the costs of adding stacked—and relocating active—frac equipment.

Source: Energent Group

Source: Energent Group

Total US capacity ticked just above 23.6 million HHP in the third quarter, representing the smallest sequential increase since the beginning of 2017, when oil prices were locked in low-$50/bbl. Even more telling, active HHP decreased 3% to 19.7 million in the US. This is the first time active HHP declined since the industry trough in 2Q 2016. Likewise, the trend towards more intensive frac jobs means more wear on the equipment, so when pumpers add to their fleet much of that HHP will be used to replace already existing equipment.

The Permian basin of West Texas and Southeastern New Mexico makes up more than 40% of total HHP supply in the Lower 48, meaning Permian activity can have a ripple effect into the rest of the industry. In both the MidCon and Eagle Ford, marketed utilization rates are flat or rising heading into 2019, while ticking down in the Permian, as operators relocate capital to these basins. One private OFS provider active in the Permian estimated additional price drops around 5% in 1H 2019, adding onto the 3-5% drop witnessed in 2H 2018.