Premier has recommended that its investors accept a reverse takeover offer from Chrysaor creating an E&P company with 245,000 boe/d of production. Premier will retain its stock market listing, but its existing equity investors will only own c.5% of the merged company while its bondholders will get between 61-75 cents cash in the US$ owed to them.

The deal consolidates Chrysaor’s position as the number one UK producer. Premier’s North Sea assets are a good fit and the combined portfolio will provide synergies, with Chrysaor now having the ability to reduce its UK tax liabilities from Premier’s tax losses – though at a cost to the UK treasury. Premier’s international assets, particularly Zama and Sea Lion, could provide growth options to diversify the portfolio and offset the underlying decline in production from the mature UK fields.

This note gives a preliminary assessment of the deal from each company’s perspective and the outlook for the merged company and the wider North Sea M&A market.

The Deal

Premier is to merge with Chrysaor, the UK’s largest oil and gas producer, in a reverse takeover which will maintain Premier’s stock market listing. Premier will issue new shares to Chrysaor’s private equity owners which will repay Premier’s US$2.7bn of gross debt facilities (1). Premier’s current letters of credit worth US$0.4bn will also be refinanced as part of the deal. Premier’s recent deal to acquire BP’s equity in the Andrew Area and Shearwater fields (2) has been terminated, as has its previous refinancing plan based on the BP deal.

This latest deal was opportunistic – Premier announced last month that it was in discussions with third parties, including Chrysaor, to see if it could agree a better deal than the refinancing plan it announced in August. Premier needed to conclude a deal due ahead of its debt maturity in May 2021 (3). Chrysaor was able to move quickly given its private equity ownership and has agreed a deal, subject to the approval of Premier’s creditors and shareholders. Deal completion is expected during Q1 2021.

The deal with Chrysaor will see Premier’s existing creditors receive a cash payment of US$1.23bn, equivalent to 61 cents in the US$ owed to them, together with new shares in the combined company. A partial cash alternative to the new shares is being offered, up to a capped limit of US$175m. If creditors take the cash equivalent up to the limit available, it would be equivalent to 75 cents in the US$. The creditors will have to choose between the upside that equity in the new combined entity could potentially provide them with, or an additional 14 cents in the US$ in cash paid on completion.

Assuming that all the partial cash alternative is taken, Premier’s stakeholders would own 16.08% of the new entity, with 10.63% of that held by existing creditors and 5.45% held by Premier’s existing equity holders. Chrysaor would own 83.92%, of which 39.02% would be held by Harbour Energy, Chrysaor’s main private equity financier. If none of the partial cash alternative is taken up the new entity will be owned 23.0% by Premier (with existing shareholders having 5.0%) and 77.0% by Chrysaor (with Harbour 38.5%).

Based on Premier’s immediate pre-merger announcement share price, its market cap. was US$184m. With its shareholders set to own 5.45% of the new entity (assuming that the creditors take the maximum cash payment available), the newco needs to have a market cap. of at least US$3.38bn for the deal to be at a premium to the pre-deal valuation. The newco will have net debt of US$3.2bn on deal completion, which would give an enterprise value of $6.58bn.

The newco will have 2P reserves of 717 mmboe (at end-2019) and H1 2020 combined production would have been 254,000 boe/d. If an EV of US$6.58bn is achieved, it is equivalent to EV/2P US$9.2/boe and US$25,900 per flowing boe/d. The following table compares the newco’s metrics against Cairn Energy and Enquest, with UK production, and Aker BP and Lundin, Norwegian players.

| Company | Enterprise Value US$m |

2P Reserves mmboe |

Production boe/d |

EV/2P US$ boe |

EV/Production US$’000 per boe/d |

| Premier Oil (pre deal) | 2,146 | 175 | 67,500 | 12.3 | 31.8 |

| Chrysaor / Premier newco | n/a | 717 | 254,000 | n/a | n/a |

| Cairn Energy* | 710 | 43 | 21,000 | 16.5 | 33.8 |

| Enquest | 1,408 | 213 | 66,055 | 6.6 | 21.3 |

| Aker BP | 9,264 | 906 | 212,500 | 10.2 | 43.6 |

| Lundin | 9,415 | 693 | 157,000 | 13.6 | 60.0 |

* Assumes Cairn’s Senegal sale completes

It looks highly probable that the Chrysaor / Premier newco would achieve a higher enterprise value for Premier’s shareholders than pre-deal, based on the benchmarks.

The alternatives to the Chrysaor deal, such as the refinancing associated with the BP asset acquisition, had it gone ahead, would also have been significantly dilutive to shareholders too. Premier’s share price closed 2% up on the day of the merger announcement reflecting a perceived value-neutral deal for equity holders.

A key upside for Chrysaor from the deal will be to utilise Premier’s US$4.1bn of accumulated UK tax losses. At end-H1 2020 Chrysaor had deferred tax liabilities of US$1.5bn on its balance sheet. Although Chrysaor received a tax credit of US$96m in H1 2020, it has paid an average US$223m/year in tax over the past two years. Offsetting the tax liabilities from the producing assets with Premier’s tax losses could create significant value for the newco and its investors – but at the expense of significantly reduced tax revenues from the North Sea for the UK. The government’s UKCS tax revenues in 2019-20 were US$1.6bn (4) with the Brent oil price averaging US$52.3/bbl.

Further savings will be made through eliminating G&A costs from the Chrysaor / Premier merged newco. Chrysaor’s G&A costs are currently US$58.4m/year based on its H1 2020 accounts, with Premier’s G&A costs US$8.4m/year. Savings are also likely on net financing costs (5). Chrysaor’s net finance costs were US$307.0m in FY 2019 with US$2.2bn of net debt. Premier’s FY 2019 net finance cost was US$352.5m with net debt of US$2.2bn. The newco is expected to have net debt of US$3.2bn on deal completion.

The Asset Portfolio

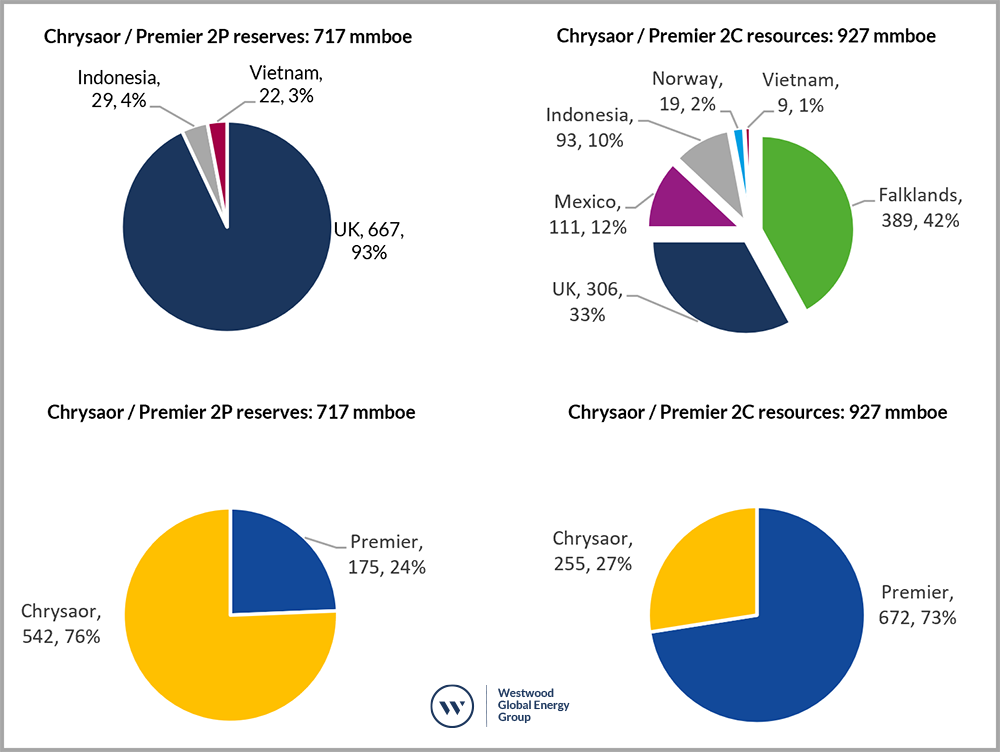

The following charts show the combined Chrysaor / Premier newco’s 2P reserves and 2C resources as at end-2019 and the contribution to the total from each company (6).

Source: Chrysaor / Premier merger documentation, 6th October 2020

The newco will have 93% of its 2P reserves in the UK, with 76% of this contributed by Chrysaor reflecting its position as a major UKCS player. Premier’s 24% contribution includes its small international 2P reserves. 63% of the 2P reserves are operated by the newco.

Premier has a much bigger 2C resources position largely due to its equity in Sea Lion in the Falkland Islands and Zama in Mexico, and contributes 73% of the newco total compared to Chrysaor’s 27%. Premier has been in discussions to farm-down its equity in Sea Lion and had put Zama up for sale. Harbour has stated that it wants to create a diversified E&P portfolio and may look to retain some or all Premier’s international assets. In 2018 Harbour made an unsuccessful bid for Santos, so its international aspirations are credible.

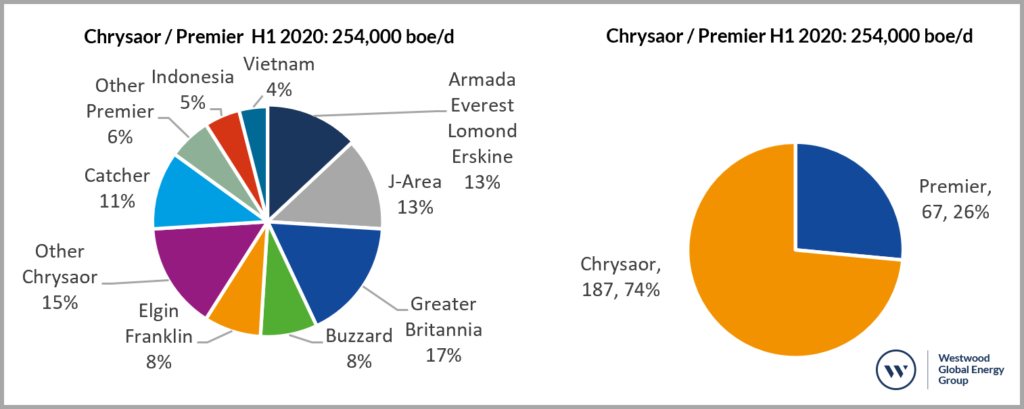

The following charts show 254,000 boe/d H1 2020 production of the combined Chrysaor / Premier newco, broken down by key assets / hubs and the contribution from Chrysaor and Premier (7).

Source: Chrysaor / Premier merger documentation, 6th October 2020

Chrysaor operates three main production hubs in the North Sea, the Armada, Everest, Lomond, Erskine hub; the J-Area; and the Greater Britannia area. These accounted for 58% of Chrysaor’s production in H1 2020 and 43% of the combined newco total. Premier’s key producing asset is its operated Catcher Area which accounted for 42% of its production in H1 2020 and 11% of the combined total. Other Premier assets include Solan (100% equity), Chrysaor’s first development in the UKCS which ironically Premier helped Chrysaor to fund (8) before the private equity investment in Chrysaor.

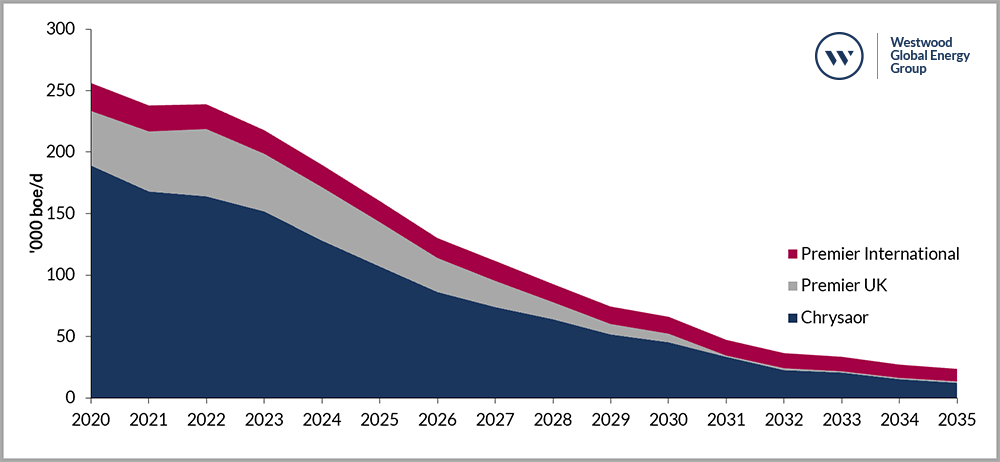

The following chart shows the production profile (9) for Chrysaor, Premier UK and Premier’s international assets. Assets under development and near-term developments are included, but assets yet to receive FID, such as Premier’s Zama and Sea Lion discoveries, are excluded.

Source: Westwood Atlas and analysis

Chrysaor’s key UK assets are mature and its production profile is in decline, with output set to fall from nearly 190,000 boe/d in 2020 to 107,000 boe/d in 2025 and 45,000 boe/d in 2030. In the short term the addition of Premier will help offset the decline with its UK production increasing from 44,000 boe/d to 55,000 boe/d over the next two years, largely driven by the start-up of the Tolmount field. From 2023 onwards Premier’s UK and international production declines. This would be transformed if a fast-track development of Zama goes ahead (operator Talos is looking at a 2023 start-up date though this may be optimistic) – assuming that Harbour decides to keep the asset rather than sell it as Premier had intended to.

Harbour stated in the merger announcement that it intends to continue to reinvest in the North Sea, though it is not clear if this relates to further deals or for capex in new projects. Chrysaor is investing to extend the life of the production hubs it previously acquired to ‘maximise economic recovery’ (and delay abandonment), key aims for the UK Government. Without further investment the Chrysaor / Premier newco production would fall by nearly 75% over the next ten years. The company will be a cash cow, with Premier’s UK tax losses offsetting Chrysaor’s UK tax liabilities. With UK tax being offset, the economics of new North Sea developments will also be enhanced which may be an incentive for the newco to invest further capex in the UKCS.

It remains to be seen whether the newco’s free cash will be used to fund UK and/or international developments and/or corporate purposes such as paying down the newco’s US$3.2bn net debt and funding dividend payments to Harbour and the other equity owners of the Chrysaor / Premeier newco. HitecVision, the Norwegian private equity company, has received more than US$2bn in dividends from its 30.4% stake in Vår Energi in Norway since 2016, which may be a precedent for the Chrysaor / Premier newco.

Implications for the North Sea M&A Market

The Chrysaor reverse takeover offer for Premier is an opportunistic deal, reflecting Premier’s increasingly urgent needs to refinance its debt and Chrysaor’s ability to react rapidly. The good fit of the assets and potential upside from reducing tax liabilities added to the deal momentum.

There are other companies burdened by debt such as and Enquest and Delek/Ithaca which may be receptive to a corporate deal. Private equity investors still have enthusiasm for investing in the North Sea. HitecVision, the Norwegian private equity group, announced this month that it had a fund of up to US$1.1bn available to invest in its Norwegian upstream E&P company, Sval Energi, and its UK E&P company, NEO (which recently completed a US$635m purchase of a package of UK assets from Total). HitecVision also has an equity stake in Vår Energi in Norway.

This latest deal does not necessarily herald an upsurge in M&A activity, as in the current market there are few cash buyers unless the assets provide a compelling strategic fit and/or they are being sold at cheap prices by distressed sellers.

The reaction of the market to the Chrysaor / Premier merged company will be watched with interest, particularly to see if it achieves the market cap. of at least US$3.4bn at which point Premier’s existing shareholders will have broken–even from the deal. Harbour is restricted from selling its shares in the Chrysaor / Premier newco for 12 months from the date of completion but could then reduce its stake. If the Chrysaor / Premier newco is a market success, other private equity players, such as those invested in Neptune Energy, could look to exit through a listing (which last month stated that it was considering an IPO in 2021).

Private equity investment has been vital in forming and sustaining a new generation of E&P companies that have become increasingly important players in the North Sea. Whether equity investors and bondholders will again be attracted to the sector remains to be seen given their recent experiences with companies such as Premier and Hurricane not to mention concerns around the Energy Transition.

Keith Myers, President, Research

[email protected]

Yvonne Telford, Senior Analyst

[email protected]

1 The US$2.7bn includes debt and currency and interest rate hedges. Premier’s gross debt at H1 2020 was US$2.1bn with net debt of US$2.0bn

2 Westwood Wildcat Corporate Report, June 2020

3 Westwood Wildcat Corporate Report, August 2020

4 UK Oil and Gas Authority

5 Finance expenses less finance income

6 Chrysaor / Premier merger announcement

7 Chrysaor / Premier merger announcement

8 Chrysaor gained a 100% interest in the Solan licence in 2008. Premier acquired a 60% interest in Solan in 2011 for a US$10m up-front fee, a further US$10m on FID and a development carry. Premier acquired Chrysaor’s remaining 40% in Solan in 2015 for no consideration but an NPI and royalty to be paid once Premier’s US$530m development carry plus interest had been repaid.

9 Westwood Atlas for individual UK asset production profiles. Premier’s international production decline based on historical figures.