As part of the increasing focus on climate change, several regions and countries have announced targets and pledges to reach net-zero emissions by mid-century and limit warming to 1.5°C. According to the Climate Action Tracker, countries responsible for around 63% of emissions are now considering or have adopted net zero targets.

These pledges point to a major boost for renewable power investment. The IEA’s Sustainable Development Scenario – which assumes the planet will achieve net-zero later than mid-century – forecasts average annual investment in renewables to almost double from $310bn/pa over the last five years to $615bn/pa over the next 20 years.

Companies across the energy sector are responding to the investment opportunity with increasing ambition. Recently the attention is on the companies Bloomberg has labelled as ‘clean energy Supermajors’ – Iberdrola, Enel, NextEra Energy and Ørsted. Now, however, the Energy Transition strategies of (European) oil and gas Majors, who are also targeting investment in renewable power generation (primarily wind and solar), could be seen as direct competition to the clean energy supermajors. But are these two groups really in direct competition – how do they compare in ambition and approach to renewable power generation, and what possible implications does this have?

The European Oil & Gas Majors

As the Energy Transition gains pace, European oil and gas majors (BP, Shell, Total, Equinor, Repsol and ENI) are adapting their businesses to address both the growing energy demand and reducing their carbon footprint over the next decade and beyond. All have set scope 1-3 net-zero emission targets for their businesses. Whilst oil and gas is still expected to dominate their businesses in 2030 /35, there is a growing ambition to increase their renewables footprint (primarily wind and solar) and focus on natural gas. In addition, these companies are also involved in (blue and green) Hydrogen and CCUS.

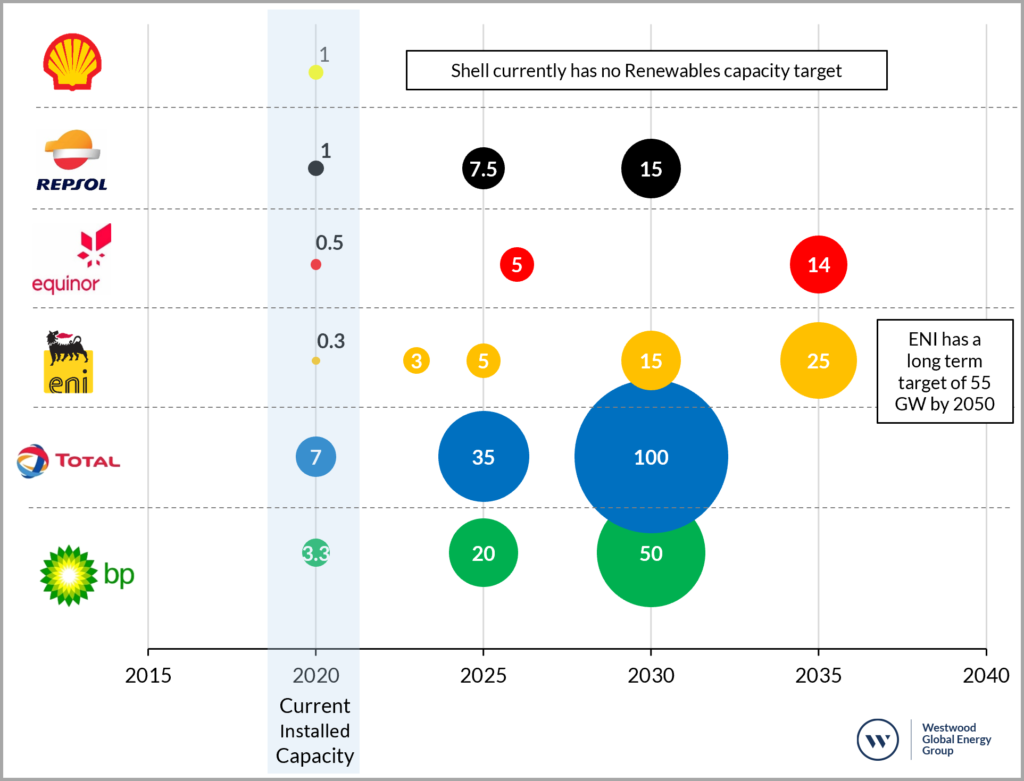

From modest beginnings, the companies have outlined their renewable capacity targets leading into 2030 and 2035. These companies currently account for c. 13 GW of installed renewable capacity (as per disclosures as until February 2021) led by Total at 7 GW[1](c. 55%). Solar and Onshore Wind account for c.85% of the installed capacity.

European oil and gas majors have indicated they will be evaluating renewable projects with a strict financial hurdle rate. They also believe they can improve base level renewable project returns through a combination of their operational expertise, financing structures, integrated operations, and portfolio rationalisation (i.e. farmdowns), as appropriate.

BP

In 2020, BP outlined its goal to transition into an Integrated Energy Company (IEC), with an overview of its “Low Carbon Energy” business. The ambition is to develop (to FID) 20 GW and 50 GW of renewable capacity by 2025 and 2030 respectively, from an installed base of c. 3.3 GW at the end of 2020, which we assume to be primarily focused on wind and solar projects. The company has indicated that these targets are underpinned by a pipeline of 11 GW net capacity (c. 80% solar and 20% offshore wind) and over 20 GW of active projects in its renewable hopper. While BP has been active in onshore wind (USA) and solar (via Lightsource) for a while; the recent strategic partnership with Equinor is key to its foray into offshore wind projects – Empire Wind One and Two, Beacon One and Two (USA).

BP believes that it can improve unlevered projects returns from c. 5 – 6% to c. 8-10%, with further upside potential from farm down optionality. Worth noting is that Lightsource project returns are at the higher end of the indicated range. The focus will be on high margin (EBITDA / MWH) renewable projects, as opposed to volume – which implies that the business will be continually reviewing and rationalising its renewable generation portfolio.

Shell

Renewables and Energy Solutions is part of the Growth Pillar (The Future of Energy), as per Shell’s recent 2021 Strategy Day Presentation. Some of the key considerations within this pillar are project level IRR of c. 15-25%, capital recycling and payback of 4 – 8 years. Shell believes the minimum cash Capex required to deliver its strategy is $19 -$22 bn per annum, with Renewables and Energy Solutions accounting for $2 – $3 bn. In line with net debt reduction (below $65 bn), the company aims to increase cash capex to $23 – $27bn per annum, with c. 50% of incremental capex expected to be allocated to the Growth Pillar.

A key milestone for Shell by 2030 is to deliver the equivalent of more than 50 million households with renewable electricity. The company has indicated that its current share of renewable generating capacity includes c. 1 GW (operational) and c. 3.9 GW (under development), via a mix of solar, offshore and onshore wind projects. Key offshore wind projects in development include CrossWind and Blauwwind (Netherlands), Atlantic Shores and Mayflower (offshore USA). Contrary to its peers, Shell has so far not articulated its renewable generation (wind and solar) targets by 2025/2030/2035.

Total

During a strategy presentation in 2020, Total indicated its ambition to become a world leader in renewables, in line with the company’s strategy to transition into an increasingly broader energy company by 2030. Over the 2016 – 2020 period, Total invested $8bn in renewables & power, whilst increasing its gross renewable capacity to c.7 GW[1]. Looking forward the company has set itself a target of 35 GW gross renewable capacity by 2025 with equity returns > 10%. A significant proportion of the capacity additions are already in construction or in development. From a strong foundation in solar and onshore wind, Total entered the offshore wind market through the Seagreen project in partnership with SSE. Beyond 2025, Total has recently announced ambition is to increase capacity to c. 100 GW gross renewable capacity in 2030 (if successful).

Total is involved across the entire PV solar value chain – all the way from cell manufacturing to developing and operating solar power plants, power storage and sales. The company is pursuing with Blue Energy and Macquarie c. 2.4 GW (cumulative) of floating offshore wind capacity in the UK and South Korea. The floor for capital investments in renewables and electricity has been set at c. $2bn/year and is expected to account for > 15% of Group Capex over the 2021 – 2025 period. The proportion is likely to be increased to over 20% of Group Capex over the 2026 – 2030 period, to meet capacity addition targets.

ENI

As at end of Q3’20, ENI’s installed renewable capacity was 0.27 GW (80% – solar PV and 17% – onshore wind). Capacity under construction was 0.17 GW – focused on the Badamsha 2 wind project and Shaulder PV project in Kazakhstan amongst others. As per the company’s articulated plan: (i) short to medium term installed renewable capacity targets are 3 GW in 2023 and 5 GW in 2025, (ii) long term targets are 15 GW in 2030, 25 GW in 2035 and > 55 GW by 2050. One of the key highlights in 2020, was ENI entering the offshore wind sector with the acquisition of a 20% stake in Dogger Bank.

Like its European peers, ENI is now active across solar, onshore and offshore wind markets. However, it is perhaps unique in setting both short (2023) and long term renewable capacity targets. The company has indicated that its Capex for the green businesses (i.e. bio-refineries, renewables, and retail customers) over the 2020 – 2023 period, will increase by c. €800mm while upstream oil and gas Capex will reduce by €6 bn. This will result in Green Capex amounting to c. 26% of Group Capex by 2023.

Equinor

Profitable growth in renewables is one of the key levers that Equinor will use to achieve its ambition of net-zero emissions by 2050. The company’s goal is to increase its net installed offshore wind capacity to c. 4 – 6 GW by 2026. That is c. 10x the installed capacity of 0.5 GW in 2019. There is a desire to increase the installed base to 12 – 16 GW by 2035, contingent on the availability of attractive renewable investment opportunities. Equinor has indicated its desire to commercialise floating wind solutions by 2030. Equinor is also investing in solar projects, via its partnership with Scatec Solar.

Repsol

Repsol was the first oil and gas company to set a target to become a net zero emissions company by 2050, with “low-emissions businesses” as one of the five key pillars to reduce its carbon footprint. Renewable Electricity generation is the third component of this pillar alongside bio-fuels and chemicals. The company’s current renewable installed capacity is c. 1 GW, focused on hydro and wind which includes the Delta 1 onshore wind farm (0.3 GW) and a 5 MW share in WindFloat Atlantic, the world’s first semisubmersible floating wind farm. Within its project pipeline the company has an additional c.1 GW of onshore wind and 0.6 GW of solar capacity, either under construction and/or advanced development. WindFloat Atlantic was Repsol’s first investment into the clean energy market outside its home market of Spain and was followed by its entry into Chile’s renewables market through a 50/50 JV with Ibereolica, adding c.0.8 GW of net capacity to Repsol’s portfolio by 2025. Repsol has set out its renewable generation targets of 7.5 GW by 2025 and 15 GW by 2030.

Figure 1: European Oil & Gas Majors Current Renewables Installed Capacity (GW) and Future Targets[2]

Source: IEA, Company announcements, investor and conference presentations

All targets are assumed to be ‘net’ unless otherwise stated by the company. For Total, the current capacity and targets shown are gross as per the company’s disclosures.

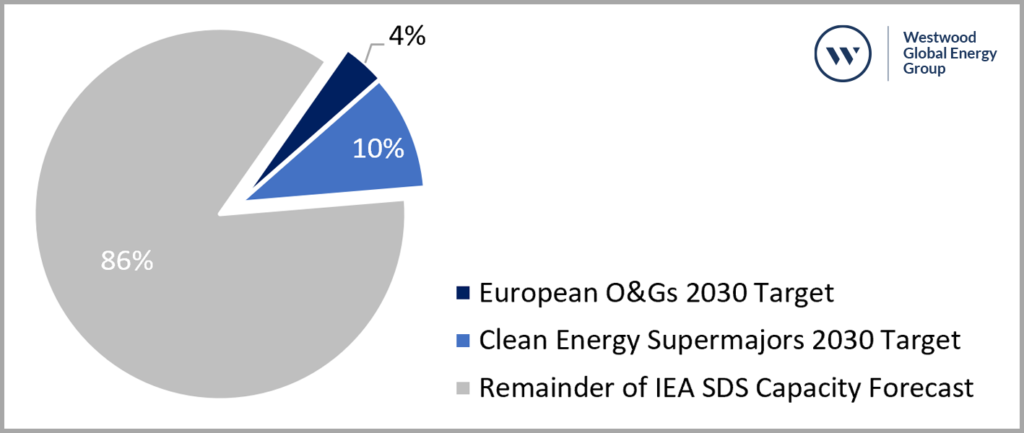

The renewable capacity targets of European Oil & Gas majors are only a small fraction (c.4%) of the overall renewable capacity (solar PV and wind) targets as per the IEA’s 2030 Sustainable Development scenario. However, it is worth bearing in mind that these companies are at the early stages of their transition into broader Energy companies. These targets could be revised and / or upgraded, as they gain more experience and improve their understanding of the underlying markets and participants.

The focus at the moment is on wind and solar – two markets with exceptionally high growth trajectories, partly due to considerable cost deflation over the last decade. Execution risk, however, remains a key consideration. In the coming years stakeholders will expect detailed disclosures on renewable capital investment projects and their operational and financial performance.

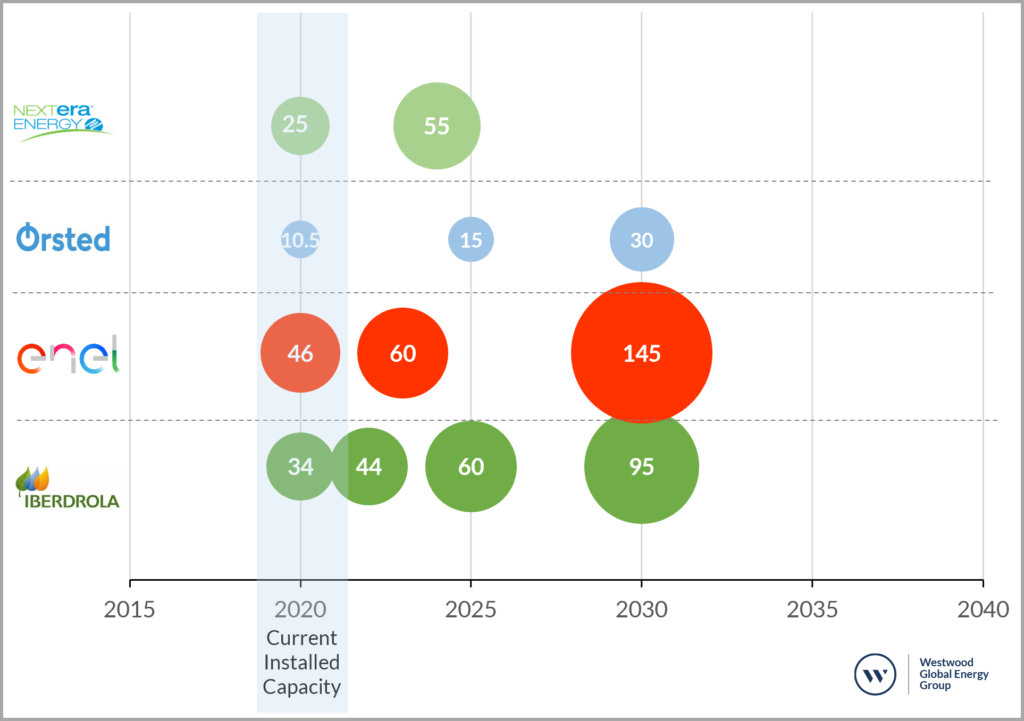

The Clean Energy Supermajors

The oil and gas companies may have been grabbing the recent Energy Transition headlines, but the ‘clean energy supermajors’ like Enel, Iberdrola, Ørsted and NextEra have already gone through their own transition and have c. 118 GW of installed renewable capacity.

These companies have their beginnings in fossil fuels (mostly coal and natural gas), and have pivoted to renewables as their business models were disrupted by various market and regulatory forces. Ørsted has shed fossil fuels completely and is focused solely on renewable energy generation, whilst natural gas fuelled power generation still plays an important role some of the ‘clean energy supermajors’. Iberdrola only recently decommissioned its last two coal power plants in 2020, and Enel still has around 9 GW of coal capacity.

A key difference is that the renewable supermajors typically made the transition earlier than oil & gas companies. They have built portfolios that took advantage of early regulatory support (such as subsidies) and built (often global) positions and project pipelines, from which they have a strong platform to grow. These businesses are also the incumbents in the electricity market, with positions across the value chain, which the oil and gas majors are now looking to grow into.

Enel

Italy’s Enel positions itself as a global leader in the energy transition, having built a business across renewable generation, power networks, and customer solutions. Current renewables capacity of 46 GW is just over half of its generation portfolio, of which 60% is hydro, and the remainder split between onshore wind, solar, and others such as geothermal. It has the largest clean energy portfolio in the world (except for China Energy Investment).

Enel described itself as a “renewables supermajor” during its 2020 investor day, and in targeting net-zero emissions by 2050 it will shed its remaining (9 GW) coal generation business by 2027 and transform its power generation capacity to 80% renewables (from c. 55% today). 80-90% of its capex over the next few years will be aligned to the EU taxonomy[3] guidance. Almost half of all capex is aimed at renewables, with Enel targeting 60 GW of renewables by 2023 and 145 GW by 2030 – focusing largely on expanding solar and onshore wind, and spending €70bn over the next decade. Of the 145 GW target, 120 GW will be fully owned by Enel, while the remaining 25 GW will be managed by Enel but includes a portion of investment from third parties. The total scale of targeted investment is the biggest of the peer group.

A key growth enabler is the already healthy pipeline of projects and global reach that Enel has. A further value driver for Enel is the concept of ‘hybridization’ of up to 40% of its renewables capacity, integrating batteries and hydrogen (c. 90 kton per year) with renewables to manage intermittency, and creating the potential for higher margins.

Iberdrola

Like Enel, Spain’s Iberdrola has a business strategy that is underpinned by building strength across renewable generation, networks and customers, together with geographical diversification. Its current renewables portfolio of c. 34 GW is dominated by Hydro at c. 40%, followed by onshore wind, and smaller positions in other renewable technologies. A key difference between Enel and Iberdrola is that it has a 1 GW foothold position in offshore wind – held mostly through its ScottishPower subsidiary in the UK.

Iberdrola divested its coal business (whilst retaining 15.5 GW of CCGTs) and is targeting net-zero emissions by 2050 and 75% of future capex will be aligned to the EU taxonomy guidance. Renewables will be core to this – targeting 60 GW in 2025 and 95 GW by 2030. and similar to Enel, renewables will be increasingly coupled with batteries and green hydrogen with the aim to scale to 85kton per year by 2030, similar to Enel’s ambitions).

Near term growth will be most significant in Solar (1 GW to 15 GW by 2025), while after 2025 all technologies are targeted for growth, and for offshore wind to play a key role. For Offshore Wind the next 5 years should see projects developed in the UK, Europe (e.g. Baltic Eagle in Germany) and also the USA (e.g. Vineyard I). The longer term Offshore Wind pipeline, which includes new geographies such as Japan, already sits at 17.6 GW.

NextEra Energy

Recently unseating Exxon Mobil as the USA’s most valuable energy company, NextEra Energy has added more clean energy capacity to the US grid than any other business – reaching around 25 GW at the end of last year. Thisonshore wind and solar portfolio was built over the last two decades as wholesale markets were deregulated.

Over this period NextEra has also maintained a regulated utility business in which natural gas continues to play an important part (c. 75% of generation), and it still owns c.1.1 GW of coal assets. It is also one of the only major power producers that has not set itself a net-zero emissions target, instead focusing on reducing its carbon intensity by 67% by 2025, from a 2005 baseline.

In January 2021 NextEra Energy set itself a target of building up to an additional 30 GW of renewables capacity by the end of 2024, significantly expanding its clean energy portfolio. The expansion plan is larger than any of its European peers. An estimated 13.5 GW pipeline together with a strong balance sheet and active capital recycling programme is expected to support the aggressive growth. NextEra is likely to continue focusing on onshore wind and solar in North America, having previously labelled Offshore Wind as “terrible energy policy”. NextEra is also looking to diversify offerings linked to its renewables by spending $1bn on battery storage in 2021 and investing in green hydrogen.

Ørsted

The transformation of the ‘Danish Oil and Natural Gas’ (DONG) company into Ørsted (labelled as the ‘World’s most sustainable company’ in global corporate rankings is an oft cited example of how a business can re-orientate from fossil fuels business to clean energy. The company’s upstream oil and gas business was sold to Ineos in 2017, with other hydrocarbon infrastructure being sold off incrementally. The last remnant is the phasing out of coal from its Danish power stations (due for 2023). All future financing needs are assessed under its green financing framework and are focused on expanding ‘green’ investment.

Ørsted’s focus is Offshore Wind – a business which it started in 1991 – and is the driver of growth for the company. Its early mover advantage has given it an opportunity to build a strong business foundation of c. 11 GW of capacity. It is now seen as the world’s largest ‘pure play’ renewables business (unlike Enel etc, with large network businesses and fossil fuel generation assets).

Ørsted is now targeting 15 GW of renewables capacity by 2025 and 30 GW for 2030. The primary focus will remain in its area of core strength – Offshore Wind. Capacity is now mainly focused in the maturing European market (the UK accounts for over 50% capacity), so Ørsted will look for new geographies where it can gain a competitive edge in, including the US and Asia. As Offshore Wind is capital-intensive, it will farm down assets to enable growth that is set to include diversification into onshore wind and solar PV, while also coupling its renewables with green hydrogen.

Figure 2: Clean Energy Super Majors Current Renewables Installed Capacity (GW) and Future Targets

Source: IEA, Company announcements, investor and conference presentations.

All targets are assumed to be ‘net’ unless otherwise stated by the company. For Enel, 25 GW of the 145 GW target will be developed under a stewardship model, where Enel w ill part own but manage the generation asset

Submit your email to download a combined infographic.

The Renewables Supermajors are all doubling down on renewables in the coming decade – often balancing this with a network and customer business. As the market evolves, they are investigating ways of differentiating and extracting further value – primarily through batteries and green hydrogen.

Solar and onshore wind will be the focus technologies underpinning the growth of the Renewables Supermajors. Only Ørsted and Iberdrola are currently expanding offshore wind investment – partly down to the size of the market being smaller, but also because of the more capital-intensive nature of the sector.

Collectively the six European oil & gas majors have an ambition to grow their renewable capacity to c.189 GW by 2030, compared to c.505 GW by the Clean Energy Supermajors. This amounts to less than (15%) of the target renewable capacity (solar PV and wind) as per the IEA’s Sustainable Development scenario. Whilst the Clean Energy supermajors have a higher target, the growth for oil & gas is higher, at almost 15 the times current capacity, as they start from a lower base.

Figure 3: Proportion of IEA SDS Forecast (2030) accounted for by the European Oil & Gas majors’ and Clean Energy Supermajors’ 2030 Targets

Source: IEA, Company announcements, investor and conference presentations. SDS: Sustainable Development Scenario

Similar but different

Both the European Oil & Gas Majors and Clean Energy Supermajors have significant growth aspirations in renewable power – taking advantage of a fast-expanding market to diversify and transition their energy portfolios. The targeted growth by the Oil and Gas Majors is particularly spectacular, given they are starting from a lower base.

The combined scale of ambition of these companies, together with their focus on onshore Wind and Solar will see them overlap and compete against one another in high growth markets such as Spain, India and the US.

One of the areas of differentiation for Oil and Gas companies is likely to be in the more capital-intensive offshore wind sector; where the skill and knowledge transfer from oil to renewables is clearest, as exemplified by the transition of DONG to Ørsted. There will also be some geographies, with a historic link to hydrocarbon exploration, where the Oil and Gas Majors can leverage local relationships for competitive advantage in renewables.

As technologies, markets and companies evolve, the boundaries are becoming more blurred and collaboration will be an increasingly important part of the modus operandi. Collaboration is already happening between Oil and Gas Majors (such as Equinor’s US offshore wind strategic partnership with BP) and between the sectors, especially in areas such as green hydrogen. Examples here include BP partnering with Ørsted to leverage its Offshore wind portfolio to produce hydrogen for the Lingen Refinery.

The share price performance of the Clean Energy Supermajors has been the antithesis of the European Oil and Gas Majors over the last year. It is not clear is how the growing renewables portfolio of oil and gas companies will be perceived and valued by the investment community going forward. In the next decade oil companies are still expected be underpinned by sizable fossil fuel businesses. Can the renewables portion of their portfolio become of material scale and deliver stable, low risk returns that investors will accept? Or do investors still expect higher risk, higher returns? The answer to these questions will have a great bearing on the Energy Transition and the Oil and Gas Majors role in it.

Kathryn Symes, Manager Consulting

[email protected]

Arindam Das, Head of Consulting

[email protected]

David Linden, Head of Energy Transition

[email protected]

[1] Gross capacity. Excludes the recent acquisition of a 20% interest in Adani Green Energy Limited

[2] The numbers with reference to Total are gross capacities as per the company’s disclosures.

[3] The EU Taxonomy is a classification system for investors and companies that helps to define corporate activities and requirements that must be met to be considered ‘green’ or sustainable