Frontier tests decline with less focus on long term renewal

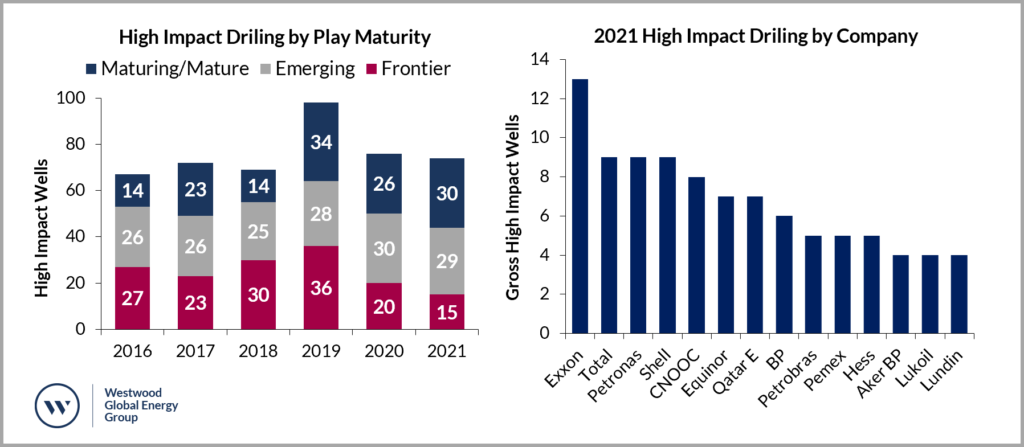

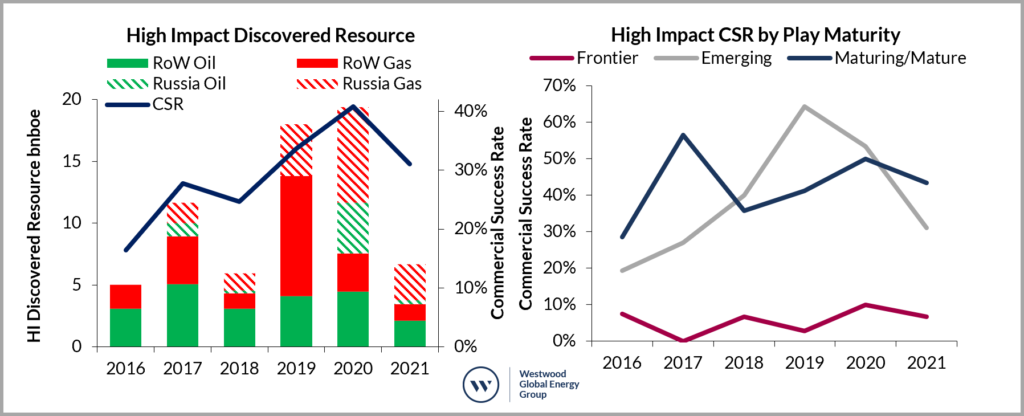

High impact drilling activity in 2021 was at a similar level to 2016-2018, with 74 wells completing (Figure 2). Discovered resource was disappointing, down from 19bnboe in 2020 to 6.6bnboe in 2021, split 36% oil and 64% gas. The commercial success rate declined from an unusually high 41% in 2020 to 31% in 2021, but still higher than the 23% average in 2016-2018.

Figure 1: Map showing potentially commercial high impact discoveries estimated >100mmboe in 2021

Source: Westwood’s Wildcat

As in 2020, discovered resource in 2021 was dominated by a small number of large discoveries in Russia, which together accounted for 3.2bnboe (48%) of the total.

Outside Russia, discoveries in 2021 were at the lowest level (3.4bnboe) since at least 2008. The largest discovery of the year was at the Zinichev discovery (VKB-1) in the Yenisey-Khatanga Basin onshore Russia, estimated at 2.3bnboe (13tcf). VKB was the only discovery in 2021 estimated to be >500mmboe, compared to 2020 when eight discoveries >500mmboe were made. The largest discovery outside of Russia is considered to be Eni’s Baleine discovery offshore Cote d’Ivoire.

Frontier exploration drilling fell to the lowest level ever recorded by Westwood (since 2008) with only 15 frontier wells completing and only one making a potentially modest sized commercial discovery. Emerging play exploration was dominated by the Upper Cretaceous play offshore Suriname-Guyana where four discoveries added an additional estimated ~1bnbnoe. High impact drilling in more mature, established plays delivered 13 potentially commercial discoveries and a 43% commercial success rate, however, only seven of these appear to be >100mmboe post-drill.

72 companies participated in the 74 high impact wells drilled in 2021, with 38 companies participating in only a single well. The most active high impact explorers were Exxon (13 wells), Total, Petronas & Shell (nine wells each). Rosneft and BP were the only companies to deliver >1bnboe net, however, due to their exposure to some large discoveries in Russia. Repsol and Eni fell out of the list of most active explorers participating in only three high impact wells each. Both companies have stringent net zero targets.

Figure 2: High impact exploration drilling by play maturity 2016-2021 and high impact exploration drilling by company

Source: Westwood Analysis

Figure 3: High impact exploration drilling discovered resource and commercial success rates 2016-2021

Source: Westwood Analysis

2021 showed there was no obvious loss of appetite for high impact exploration at the drill-bit, but the decline in frontier exploration drilling shows that the industry is less concerned with long term renewal and is instead focused on quicker returns.

The outlook for 2022 drilling plans suggests this pattern will continue in 2022 with 70-80 high impact wells expected to complete in the year, a similar level to 2020/21.

Hot spots for drilling in 2022 will be mostly in South America, particularly in the Suriname-Guyana Basin and offshore Brazil. The Gulf of Mexico will be a hotspot, both offshore US and Mexico, and key wells are also expected in the Flemish Pass offshore Eastern Canada. After a quiet few years Africa is expected to see key frontier tests in the Orange, Rio Muni, Mozambique and Lamu basins. Northwest Europe should see ~10 high-impact wells drilled which is a similar number to 2020, but well down on the 27 high impact tests drilled in 2019. The Middle East may see the largest prospect drilled in the Iranian Caspian Sea.

The combined unrisked predrill resource potential (from wells either drilling, or considered firm or probable wells) in 2022 is estimated to be ~30bnboe which Westwood estimates as ~8bnboe on a risked basis.

So, despite the energy transition, the E&P sector has so far maintained the high impact well count. Whether this will continue beyond 2022 is the question. The 2022 exploration programme is dominated by commitment wells on licences acquired prior to 2020. Things may change in 2023 and beyond, as current portfolios are drilled out and if acreage is not renewed in response to energy transition pressures

Westwood published its flagship ‘Key Wells to Watch’ report in December 2021 and will publish its ‘Hits and Misses of 2021’ in January 2022. The reports review the largest discoveries of 2021, as well as the key failures. The wells to watch are reviewed in detail, with commentary and analysis on the play, prospectivity, risks and implications of success or failure.

Jamie Collard, Senior Analyst, Global Exploration and Appraisal

[email protected]

Westwood will be hosting a webinar on 9th February 2022 covering the ‘Hits and Misses of 2021’ and another webinar in March covering the Key Wells to Watch. If you are an existing Wildcat client, please contact Ili Afifuddin [email protected] to request an invitation.