2022 was a turbulent year for the oil and gas industry that was dominated by the invasion of Russia on Ukraine. This had an immediate effect on the global economy and markets, with commodity prices soaring to record highs and energy security becoming the focus for most countries across Europe. The UK Government succumbed to mounting pressure with the introduction of the Energy Profits Levy (EPL) in May to recover more tax from the ‘extraordinary profits’ being generated by the oil and gas sector. This was increased further in November causing significant uncertainty for E&P investment in the UK. In terms of energy security, Norway is in a more enviable position being self-sufficient for its energy supply and is a net exporter of oil and gas. Europe looked to Norway to fill the volume gaps created by its boycotts and sanctions on Russian hydrocarbons.

The impact of the war on oil and gas markets is likely to continue for some time, and governments across Europe are looking to find the right balance between security, affordability and sustainability. In 2023, E&P activity and investment is expected to remain relatively steady in the UK and is set to increase in Norway. However, there is a greater focus in both countries on low-risk, quick wins rather than longer term E&P investment, while investment in ‘net zero’ projects offshore continues to accelerate.

Exploration and appraisal

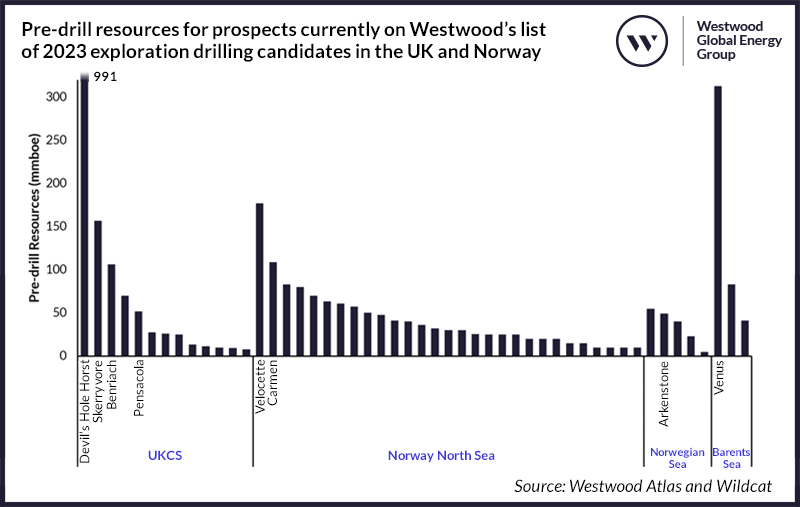

Although E&A drilling in the UK was mooted to recover in 2022, activity proceeded more slowly than expected with just five exploration and three appraisal wells completing during the year. The results were even more disappointing with just one commercial discovery and discovered commercial volumes the lowest since 2014 when no discoveries were made. The outlook for 2023 has got off to a positive start with initial results reporting discoveries at Orlov and Pensacola. Including wells that are currently active, Westwood holds 13 prospects targeting c. 1.5 billion boe of pre-drill resources that could potentially operate in 2023 (Figure 1) as well as five appraisal wells. Despite an increased focus on infrastructure-led exploration (ILX) in recent years and a general lack of success in high impact (HI) and frontier wells, companies continue to pursue HI opportunities in the UKCS, where positive results can be both company makers and provide the catalyst for further activity and investment in a play. In addition to the recent Pensacola high impact well, other exploration wells to watch in 2023 include North Sea Natural Resources’ Devil’s Hole Horst and Parkmead’s Skerryvore prospects in the CNS, and TotalEnergies’ Benriach prospect in the WoS.

In Norway, exploration activity remained relatively buoyant in 2022, however, performance was disappointing compared to the last couple of years. Although nine commercial discoveries were made from the 28 wells completed, only 214 mmboe was discovered and all discoveries were less than 40 mmboe. High levels of exploration and appraisal drilling are expected to be maintained in 2023, however, there is a clear focus on near field exploration. There are 38 prospects, targeting c. 2 billion boe of unrisked resources currently on Westwood’s list of drilling candidates in 2023 (Figure 1), as well as seven appraisal wells targeting volumes of c. 1 billion boe. All but four of the exploration wells are targeting ILX prospects that could add volumes to the surrounding hubs and there are only five high impact wells. Companies continue to pull out of the Barents Sea and shy away from frontier drilling, due to a lack of recent commercial success. Vår Energi and Aker BP are the only companies to operate wells in the Barents Sea this year, and Equinor and Vår Energi are the only companies to operate frontier wells.

Figure 1: Pre-drill resources for prospects currently on Westwood’s list of 2023 exploration drilling candidates in the UK and Norway. Note: Only high impact wells (HI) are labelled, which are wells targeting a prospect or discovery with resources >100 mmboe or where a well is targeting a frontier basin where a commercial discovery has yet to be made. The remaining wells are largely infrastructure led wells (ILX). Source: Westwood Atlas and Wildcat

Production and field developments

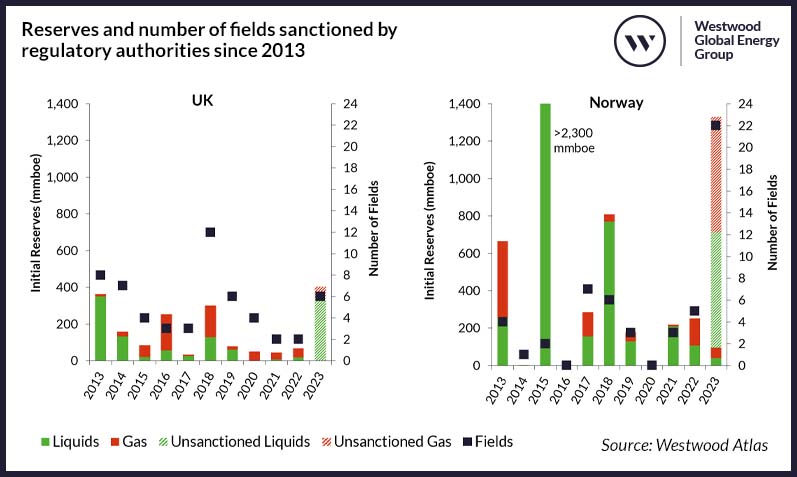

A slight uplift in UKCS production is expected in 2023, with Westwood estimating production at 1.5 million boepd. Production should be bolstered with the start-up of the Neptune operated Seagull field, an HPHT tie-back to ETAP, and Shell’s Penguins Redevelopment. Infill campaigns, including Clair Ridge, Cygnus and Golden Eagle, are also expected to provide uplifts to hub production. Some existing capital investment assumptions though could be subject to change, with operators revising budgets in response to the EPL, which could have a knock-on impact on production. Although development activity is expected to pick up in the near term, to take advantage of sustained high commodity prices, most companies’ activities are likely to focus on low-risk, quick wins rather than longer term investments, which will remain exposed to fiscal and political instability concerns. In addition, a focus on emissions is making oil and gas investment more complex with companies finding capital access more challenging, having to strike the right balance between achieving desired returns and meeting increasingly stringent environmental standards. There are, however, six field developments expected to be sanctioned by authorities in 2023, the largest being the Equinor operated Rosebank development which bucks the low-risk investment trend (Figure 2).

In Norway, Westwood is also forecasting a slight increase in production in 2023 to 4.25 million boepd. Norway is expected to continue to support Europe with increased gas exports from specific hubs, but Johan Sverdrup Phase 2 will drive the bulk of the production increase in 2023 having been brought onstream in mid-December. Norway has not historically had a consistent pipeline of greenfield developments. However, the current strength of Norway’s development hopper demonstrates how effective the temporary tax breaks, introduced in 2020, have been in ensuring resources are being progressed to reserves. There is a healthy level of reserves replacement over the coming years with a good pipeline of field start-ups through to the latter stages of the decade. The result is forecast to sustain production levels at c. 4 million boepd to 2026. 2023 is expected to be a record-breaking year for field development sanctions with PDOs having been submitted for the development of 22 fields which are currently under review and await approval by the Ministry. Combined these fields have associated reserves of 1.23 billion boe (Figure 2).

Figure 2: Reserves and number of fields sanctioned by regulatory authorities since 2013. Source: Westwood Atlas

M&A activity

There was a drop in both the number and the aggregate value of M&A deals announced in the UK in 2022 compared to 2021. Volatile commodity prices, along with political and fiscal instability thwarted some deal making. The largest deal of the year was Ithaca Energy’s acquisition of Siccar Point Energy for an initial consideration of US$1.1 billion, over half of the total disclosed consideration value in the UK. Westwood expects there to be further consolidation of portfolios in 2023, but the pool of prospective buyers is decreasing as companies recalibrate their North Sea strategies and take a more cautious approach to UKCS investment.

Aker BP’s acquisition of Lundin Energy completed in June 2022, creating the largest independent company on the NCS. The deal was initially announced in December 2021. Sval Energi continued its inorganic growth with acquisitions of Equinor’s Ekofisk interests and 19% in Martin Linge for US$1 billion, and of Suncor Norge for US$320 million – the two largest Norway deals announced in 2022. The outlook for M&A in 2023 is expected to remain tight. Norway has a relatively low number of companies in operation on the shelf, with fewer opportunities coming onto the market compared to other countries in the region, such as the UK. The recent consolidation of companies through mergers or takeovers, however, could lead to some portfolio rationalisation. Companies’ emissions reduction strategies could also lead to rationalisation of high emissions intensity assets. In Norway, there is a willing pool of buyers looking to snap up opportunities. However, with commodity prices remaining volatile, the challenge will be the alignment of buyer and seller value expectations.

Energy Transition

Historically, oil and gas have underpinned the energy supply mix and will continue to do so over the coming years while the transition to new energy ramps up. The UK’s North Sea Transition Deal, published in March 2021, set ambitious targets to reduce emissions from oil and gas production by 50%, bring 50 GW of offshore wind and 10 GW of hydrogen online and capture 20-30 mtCO₂ per year by 2030. While progress is being made, the invasion of Ukraine has shocked the world and, with it, energy markets. The impact is being felt most in Europe due to its exposure to Russian gas. For political leaders, energy security has perhaps become more of a concern in the short-term than the transition to net zero emissions. In the UK, Prime Minister Rishi Sunak has promised to speed up the country’s transition to renewable energy but is also in support of further domestic exploration and production to curtail imports and reduce Russian dependence.

Norway has been in an enviable position of being self-sufficient for its energy supply and as a net exporter of oil and gas. Significant investment has been made in Norway, and the country continues to lead the way with one of the lowest offshore oil and gas emissions intensities in the world, due to the large number of offshore facilities powered by renewable energy.

E&P companies in both the UK and Norway are continuing to set more ambitious carbon reduction targets and increase their involvement in energy transition projects. Investment in offshore wind, carbon capture and storage (CCS) and hydrogen projects are all increasing with oil and gas companies among the key stakeholders supporting the progression of projects from concept to FID.

Emma Cruickshank, Head of NW Europe

[email protected]