In 2019, Texas will reach over 130 million tons of production per year (MMTPY) of frac sand nameplate capacity, of which 85% will come from Permian and Eagle Ford facilities, as new construction projects wind down and ramp to full utilization. Energent is closely monitoring regional operations in central and south Texas as mines shut down in the first half of 2019.

Pioneer Natural Resources (NYSE: PXD) and Covia Holdings Corporation (NYSE: CVIA) reported future closures scheduled in the first half of 2019 through company press releases. Pioneer is divesting their Brady assets as the company shifts to West Texas supply. Additionally, Covia announced the idling of their Voca facilities in November of 2018. These facilities have a combined frac sand capacity near 10 MMTPY. Other notable sand operators in central Texas are U.S. Silica, Permian Frac Sand, Erna Frac Sand, and Superior Silica Sands (NYSE: EMES).

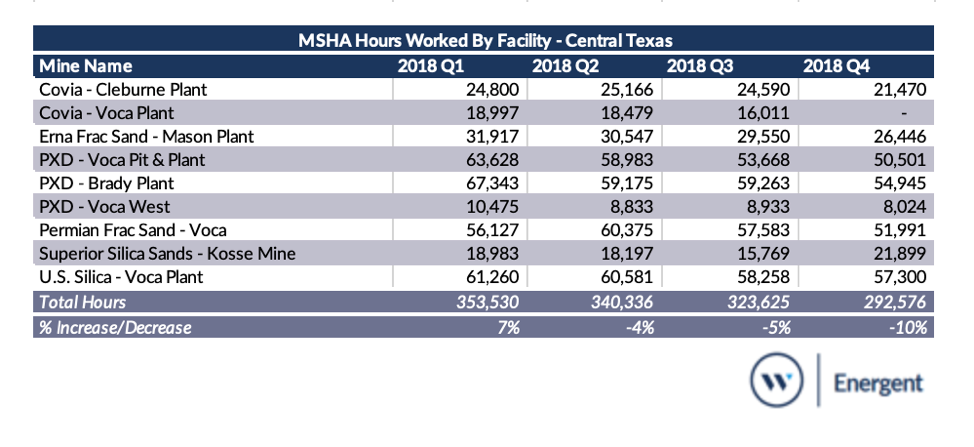

Total hours worked in central Texas facilities have declined since 2Q 2018 compared to an increase in total hours worked at facilities in the Eagle Ford, Haynesville, and Mid-Continent based on data from the Department of Labor, Mine Safety and Health Administration (MSHA) website. Although MSHA data does not guarantee mine closures, the information indicates the level of labor hours quarter over quarter.

Source: Energent Group

As for the 80 mines and facilities we currently track across the United States, overall man hours worked declined 6% and 17%, respectively, in the last two quarters of 2018. As reported in February, Hi-Crush idled their Augusta Facility, which contributes 2.8MMTPY of Northern White sand (NWS), while the company reinstated its’ Whitehall facility.

Ramping Up in Eagle Ford and Mid-Continent

As central Texas operations soften, activity increases in both the Eagle Ford and Mid-Continent basins as existing mines expand and new construction develops. Currently, 7 greenfield developments are scheduled to complete construction this year bringing online over 14MMTPY. Given these developments, we expect labor hours to climb and doors to remain open.

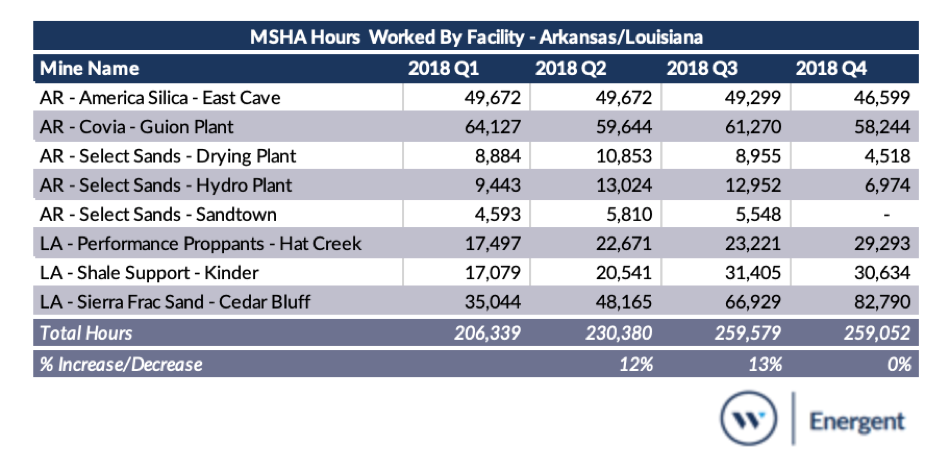

Output stays flat in Louisiana and Arkansas

Combined labor hours remain flat exiting 2018 for Louisiana and Arkansas. However, expect new mines from Performance Proppants and Gen 6 to increase the overall hours worked in the region. Haynesville operators continue to show lower well costs using in-basin mine so expect Sierra Frac Sand, Shale Support, and Covia to benefit from the increased focus on regional mines.

Source: Energent Group

2019 will certainly be an interesting year as most major frac sand construction projects finish up and drilling and completion activity pick up. For the time being, we will keep track of whether or not regional operations, and not just in Texas, keep their doors open or if we have seen them sell their last ton.