Permian In-basin Sand Becomes a Reality in 2018

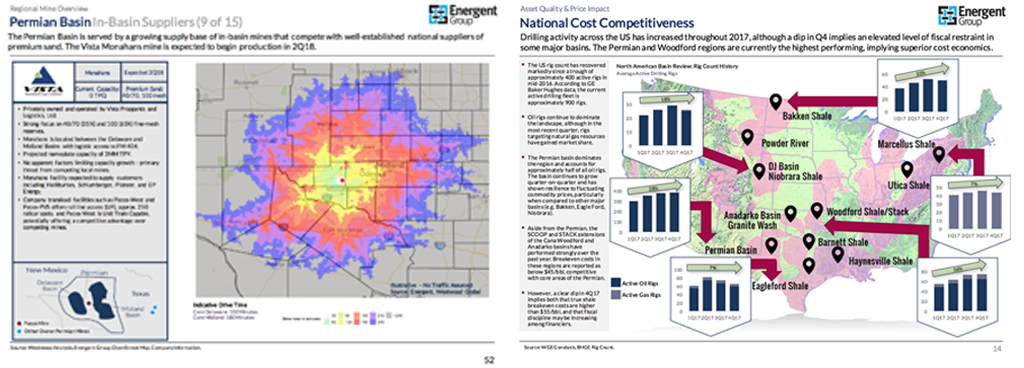

Assuming a 50% adoption rate of locally mined sand, incumbent suppliers will see a material decline in non-contracted volumes by Q3 2018. Beginning in the second half of the year, in-basin sand will make major inroads into the current supply chain. As operators reduce the delivered to wellsite frac sand cost, several mines will have a cost advantage due to mine location. Each mine is profiled with drive time analysis, current capacity, and production time frame similar to Vista Proppant’s profile page below.

Sample Pages From The In-Basin Sand Report

With 28% growth in Permian rigs, service companies and operators are reducing costs with new sand supply coming online in West Texas. Permian and SCOOP/STACK are leading the rig count growth (see sample page below).

Sand Supply, Frac Sand Demand and Last Mile Logistics

New Sand Mines

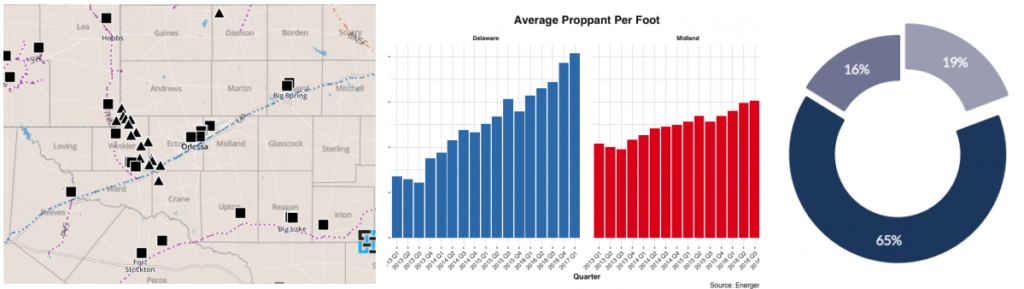

New sand mines are changing frac sand pricing and logistics dynamics. The mines are concentrated in and around Winkler county in the heart of the Permian Basin.

With 28% growth in Permian rigs, service companies and operators are reducing costs with new sand supply coming online in West Texas. Permian and SCOOP/STACK are leading the rig count growth. Will the in-basin frac sand trend continue to other plays?

The report highlights supply scenarios and key facts gathered from proprietary sources.

Frac Sand Demand Scenarios

Frac sand demand scenarios for 100 mesh and 40/70 sand that is prevalent in the Winkler mines. E&Ps in Delaware and Midland Basin will require more sand in 2018 compared to previous years. Delaware and Midland Basin analysis in the report show pricing and forecasted volumes by mesh size.

Location, Location, Location

Mine location, construction, and time to first sand are paramount in the new mine landscape in West Texas. As new mines come online, frac sand companies will monitor the distance from the mine to the well site. Drive time analysis in the report allows readers to view service areas for each mine.

Last Mile Solutions

Box and silo solutions are enabling greater efficiencies while reducing the number of pneumatic trucks on the road. Truck traffic and concentration will become a focus as more mines come online in 2018 and 2019. Logistics constraints for E&Ps evaluating the supply chain will need to understand turn around times and efficiencies for different frac sand solutions.

Request a sample to understand how in-basin frac sand is changing the market for operators, pressure pumpers, logistics, and frac sand companies.

Terms & Conditions

Please read our full Terms & Conditions for purchase in PDF format. By purchasing any of our reports the buyer agrees to adhere to these Terms & Conditions.

Additional services: tailored to meet your company’s needs, include dedicated real-time analysis, on-site support and presentations. Please contact us to discuss further [email protected] or call +44 203 4799 505 for more details.