Many oilfield service and supply companies, including Halliburton (NYSE: HAL), Hi-Crush (NYSE: HCLP), U.S. Silica (NYSE: SLCA), and Fairmount Santrol (NYSE:FMSA) have cited a shortage of frac sand for the U.S. shale plays, specifically 40/70 in the Permian Basin.

Advancements in the horizontal drilling and completion techniques of leading shale E&P’s are driving frac sand demand to new high points. The significance of multi-well pad drilling in the Permian increased each of last several years, even during the downturn. In 2016, 42% of the wells completed in the Permian were drilled on multi-well pads compared to only 22% of wells in 2015. Most notably, Encana Corporation (NYSE: ECA) initiated a 64-well pad program in 2016 that continues to headline pad drilling discussions in the Permian Basin.

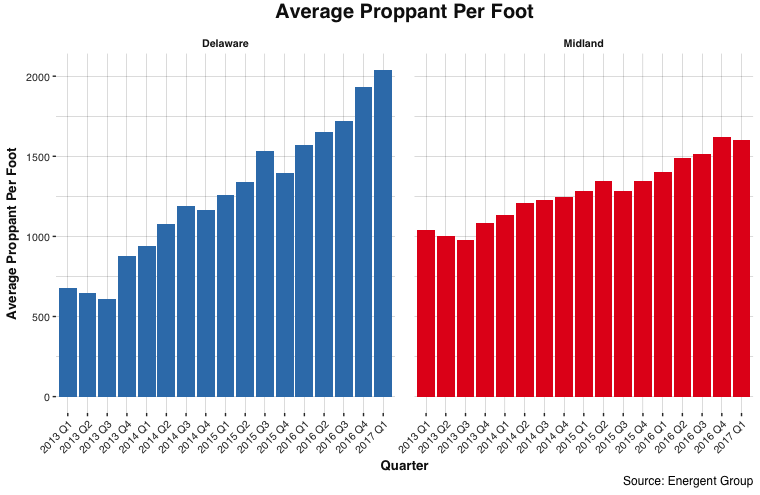

High-intensity completions (“mega fracs”) use increased amounts of frac sand, fluid, and chemicals to stimulate the near wellbore rock. Based on Q1’2017 data from Energent Group, the majority of new Delaware Basin completions use on average 1,990 pounds of frac sand per lateral foot and 1,920 gallons of fluid per lateral foot.

Another key driver is longer laterals per well in the shale plays. The two-mile lateral will be much more common in 2017 as E&Ps acquire contiguous acreage positions. For the last two years, an average Bakken well was greater than 10,000 lateral feet. Other major shale plays are fast approaching with the Midland Basin nearing 7,500 and Haynesville at 6,000 lateral feet.

Another key driver is longer laterals per well in the shale plays. The two-mile lateral will be much more common in 2017 as E&Ps acquire contiguous acreage positions. For the last two years, an average Bakken well was greater than 10,000 lateral feet. Other major shale plays are fast approaching with the Midland Basin nearing 7,500 and Haynesville at 6,000 lateral feet.

E&Ps continue to monitor the frac sand supply chain for shortages, choke points, and opportunities to maintain prices at current levels. Last-mile logistics are critical for both northern white frac sand and regional brown suppliers. Demand for regional sand and northern white frac sand is expected to increase in 2017 and 2018. The regional sand suppliers are expanding capacity of mines with close proximity to Permian, Eagle Ford, Barnett, and Haynesville shale plays. Meanwhile, the premium northern white sand suppliers are optimizing last mile logistics, establishing longer term contracts, and adding production capacity.