During 3Q 2022 the onshore oil and gas (O&G) industry continued to enjoy strong levels of activity, with an array of M&A deals, project developments and new discoveries announced. While the drive to diversify energy supply to improve energy security following Russia’s invasion of Ukraine and subsequent sanctions on Russia’s O&G activities, remains a prevalent driver of activity, oil prices have retreated from their 2Q peaks. Brent averaged $103/per barrel in the quarter, compared to $113 in 2Q, with September having the lowest monthly average since January.

As a means of supporting oil prices, OPEC+ has committed to continuing to limit the group’s output beyond the initial September 2022 end point. The group announced that October’s output target would return to August 2022 levels, ~100 kbbl/d lower than September, before taking a more aggressive approach for November and announcing a 2 mmbbl/d cut from the August level. As a result of this decision, the OPEC+ allowable production will decrease from 43.856 mmbbl/d to 41.856 mmbbl/d.

* All numbers are in mmbbl/d

| Country | August 2022 Required Production | Voluntary Adjustment | Production (November 2022) |

| Algeria | 1,055 | -48 | 1,007 |

| Angola | 1525 | -70 | 1,455 |

| Congo | 325 | -15 | 310 |

| Equatorial Guinea | 127 | -6 | 121 |

| Gabon | 186 | -9 | 177 |

| Iraq | 4,651 | -220 | 4,431 |

| Kuwait | 2,811 | -135 | 2,676 |

| Nigeria | 1,826 | -84 | 1,742 |

| Saudi Arabia | 11,004 | -526 | 10,478 |

| UAE | 3,179 | -160 | 3,019 |

| OPEC 10 | 26,689 | -1,273 | 25,416 |

| Azerbaijan | 717 | -33 | 684 |

| Bahrain | 205 | -9 | 196 |

| Brunei | 102 | -5 | 97 |

| Kazakhstan | 1,706 | -78 | 1,628 |

| Malaysia | 594 | -27 | 567 |

| Mexico | 1,753 | 0 | 1,753 |

| Oman | 881 | -40 | 841 |

| Russia | 11,004 | -526 | 10,478 |

| Sudan | 75 | -3 | 72 |

| South Sudan | 130 | -7 | 123 |

| Non-OPEC | 17,167 | -727 | 16,440 |

| OPEC+ | 43,856 | -2,000 | 41,856 |

OPEC Output Cut Agreement Production Levels

This is expected to have a limited impact on overall production from the group, which has been closer to 40 mmbbl/d as many countries struggle to ramp up production but will stifle production from key producers such as Saudi Arabia. While long-term output restrictions could potentially impact the growth forecasts of several major producers within the group, this has not stopped some (such as Saudi Arabia and the UAE) from heavily investing in new developments this quarter.

Investment in the onshore industry was robust throughout the quarter as well, with the monetisation of assets in GCC countries continuing with Arabian Drilling announcing an initial IPO. M&A activity was also strong, driven once more by activity in the US shale plays:

3Q 2022 M&A Activity

| Buyer | Seller | Country | Cost ($mn) | Notes |

| Ring Energy | Stronghold Energy | USA | 465 | 37,000 acres, Crane County (TX) |

| Freehold Royalties | Private Sellers | USA | 119.5 | 147,000 acres, Midland basin |

| Devon Energy | Validus Energy | USA | 1,800 | Validus Energy (42,000 net acres, Eagle Ford) |

| IKAV | Shell Offshore Inc. | USA | 2,000 | Shell Onshore Ventures (51.8% interest in Aera Energy LLC) |

| EQT | Quantum Energy Partners | USA | 5,200 | 90,000 acres, 153 kms gathering systems, 1 bcfe/d capacity gas trunkline, 3.5 bcfe/d lean gas trunkline |

| Zephyr Energy | Unknown | USA | 0.75 | 21 miles of gas gathering lines, Powerline Road gas processing plant, 5,480 acres. |

| Santos | Hunter Gas Pipeline | Australia | - | Approved underground gas pipeline route from Wallumbilla in Queensland to Newcastle in New South Wales |

| Santos | Comet Ridge | Australia | 5.14 | 12.86% option interest in the Mahalo Gas Project |

| ShaMaran Petroleum Corp | TotalEnergies | Iraq | 155 | Non-operated 18% interest in the Sarsang oil field in Kurdistan |

| VAALCO Energy | TransGlobe Energy | Egypt | 307 | VAALCO Energy set to acquire TransGlobe Energy’s outstanding common shares |

| Eni | BP | Algeria | - | Stakes in the two major gas fields, In Salah (33.15%) and In Amenas (45.89%) |

| 3R Fazenda Belém S.A. | Petrobras | Brazil | 13.4 | Stakes in the Fazenda Belém and Icapuí fields |

| Tamboran PTY Limited | Origin Energy | Australia | 40 | 77.5% interest in Blocks EP 76, 98 and 117 |

| EIG Global Energy Partners | Repsol | Spain | 4,800 | 25% stake in Repsol’s exploration and production business |

Middle East

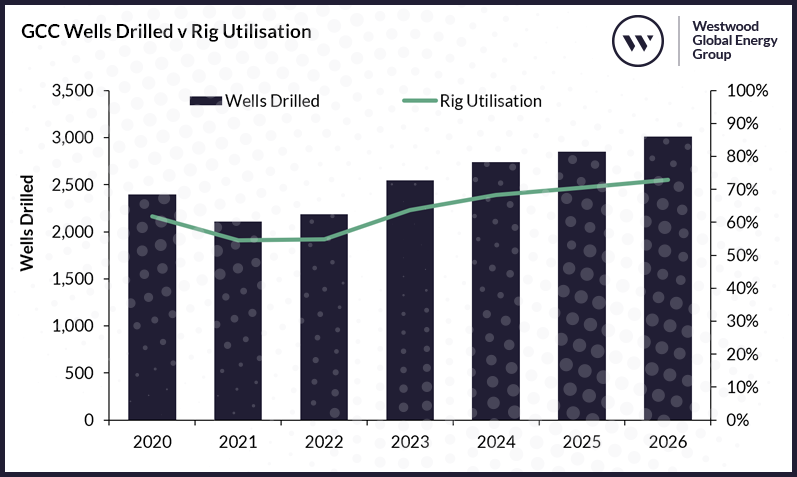

GCC Wells Drilled v Rig Utilisation

Source: Global Land Rigs, Westwood Analysis

Iraq

Iraq’s federal supreme court ruled that the legal foundations of the Kurdistan region’s O&G sector were unconstitutional, leading three key international service companies; Schlumberger, Halliburton and Baker Hughes, to cease activities in the area. Iraq’s oil ministry has said the companies are in the process of closing their existing tenders and contracts in the region with the ministry reportedly informing contractors in early June 2022 that they had three months to terminate existing contracts and projects in Kurdistan or face being blacklisted.

Russian company Eriell awarded an engineering, procurement, and construction (EPC) contract to Zhongman Petroleum and Natural Gas Group Corporation (ZPEC). The EPC covers the cementing of 16 wells at the Garraf oilfield. Operator Petronas is aiming to increase production from the field to 230,000 bpd up from 86,000 bpd in 1Q 2022. ZPEC also provides drilling and well completion services at BP’s Rumaila oilfield.

Oman

Tethys Oil appraised its Al Jumd discovery in Block 56, Oman, drilling the Al Jumd-3 and 4 appraisal wells. Tethys utilised the 2,000 HP, Schlumberger owned, 279 drilling rig. Both wells targeted the Al Khalata sandstone formation at a depth of 1,300m with horizontal sections of at least 400m.

In August, Maha Energy awarded Gulf Drilling LLC a drilling contract for a minimum of six wells on Block 70, Oman. Maha will use the 1,000 HP Gulf Drilling 109 unit, with mobilisation expected in October 2022. Maha is drilling four horizontal pilot production test wells and two appraisal wells on the Mafraq oilfield to obtain reservoir information to assist in developing a full Field Development Plan. Maha also entered a farm-out agreement with Mafraq Energy for 35% of Block 70, leaving Maha with 65% operated interest.

Shell signed an exploration and production sharing agreement with the Oman Ministry of Energy & Minerals that will see Shell take operatorship of an exploration tract covering Block 11, onshore Oman. 1,400 square km of 3D seismic is to be acquired in late 2022, with multiple exploration wells planned for 2023. Shell will hold a 67.5% operated stake, while TotalEnergies and OQ will partner them with 22.5% and 10% respectively.

In September, KCA Deutag was awarded contracts in Oman and Saudi Arabia with a combined value of $112 million. In Oman a one-year contract with a new client, with one optional year, as well as contract extensions on multiple rigs provides an additional $70.5 million in value. Multiple one-year extensions were also awarded in Saudi Arabia with a value of $35 million.

Saudi Arabia

Saudi Aramco has confirmed a phased development plan for the $100 billion, 200 tcf, Jafurah unconventional onshore gas project which is expected to produce up to 2 bcf/d of gas by 2030. During its 2022 earnings call, Aramco announced it expects production to start by 2025. The facility for the gas plant will come in two phases, the first in 2025 and the second in 2027. The unconventional gas project aims to increase gas production to free up ~1 mmbbl/d of oil from domestic use.

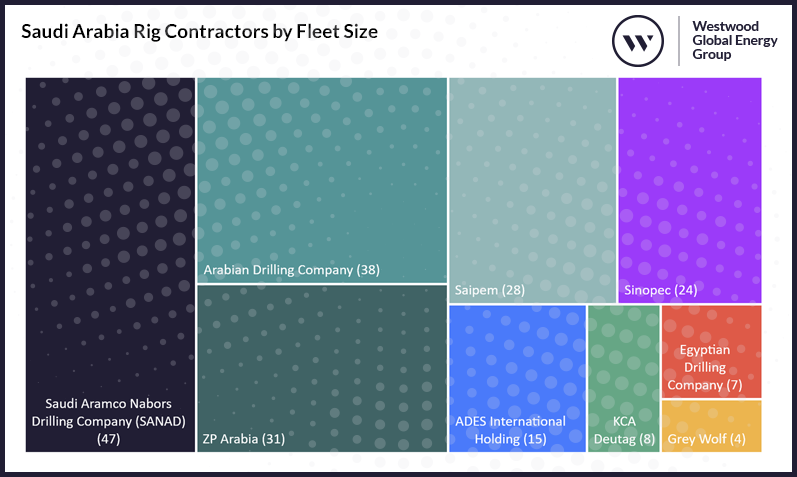

In the second half of September, Arabian Drilling announced it will proceed with an initial public offering (IPO) of 30% of its shares, with plans to list on the Saudi Exchange’s main market. The IPO will include 19.89% of existing share capital as well as 9 million new shares to account for the remaining 10.11%. Arabian Drilling operates 45 drilling rigs, including 38 onshore drilling units in Saudi Arabia.

Saudi Arabia Rig Contractors by Fleet Size

Source: Global Land Rigs, Westwood Analysis

United Arab Emirates

ADNOC continued to award big contracts with framework agreements worth $1.83 billion agreed with five companies (Al Ghaith Oilfield Supplies and Services Company, Al Mansoori, Schlumberger, Halliburton, and Weatherford) for Directional Drilling and Logging While Drilling services. ADNOC also awarded a key contract for work on the full field development of its onshore Bab Far North project. The contract covers front-end engineering and design and was awarded to Dubai-based Kent. The work scope involves 22 new oil producer wells and 32 water and gas injectors, across multiple pads. The contract is also likely to include a carbon dioxide recovery plant and injection facilities. The target for ADNOC is to reach and maintain a plateau of 30,000 bpd for an eight-year period from the Bab Far North field.

At the end of 3Q, Petrofac was awarded a two-year Field Maintenance Services contract extension with ADNOC Group’s, Al Dhafra Petroleum. The agreement will see Petrofac continue to support operations at the Haliba oil field, onshore Abu Dhabi. The Haliba oilfield is one of ADNOC’s key developments and is expected to play an integral part in ADNOC reaching its 2030 oil production capacity target of 5 mmbbl/d. It will also be the first oil field to have fully outsourced facilities maintenance allowing ADNOC to optimise the company’s internal resources.

North Africa

Algeria

Lots of activity has occurred in Algeria over 3 2022, driven by Italian National Oil Corporation (NOC) Eni. BP announced the sale of its Algerian assets to Eni, including stakes in the two major gas fields, In Salah and In Amenas. BP held 33.15% in In Salah and 45.89% in In Amenas. The value of the deal was not made public. For Eni, the move is just the latest in a clear push to grow its presence within Algeria as it looks to shore up gas supplies to Italy. This acquisition will increase Eni’s Algerian production to >120 kboe/d. Eni, along with Sonatrach, Oxy and TotalEnergies signed a new Production Sharing Contract (PSC) for blocks 404 and 208 in the Berkine basin, allowing the partners to boost investment, increasing the fields’ hydrocarbon reserves, and extending its production life for 25 years.

Eni and Sonatrach, also announced a discovery in the Sif Fatima II concession. The Rhourde Oulad Djemaa Ouest-1 (RODW-1) exploration well, the third in Eni’s current drilling campaign, discovered oil and associated gas in the Tagi reservoir formation. During testing the well produced 1,300 bbl/d of oil and about 2 mmscfd of associated gas. The RODW-1 discovery comes after the significant discovery of HDLE-1 in Zemlet el Arbi, announced in March 2022. The development of these discoveries will be fast-tracked due to their proximity to existing facilities.

Service contracts were also awarded by Sonatrach during 3 with a consortium led by Petrofac and including Genie Civil et Batiment for an EPC contract. The contract, valued at $300 million, will cover the Tinrhert EPC2 Development Project in Algeria, including a new Central Processing Facility with inlet separation and decarbonisation units, tie ins to the existing Alrar Separation and Boosting Facilities, along with commissioning, start-up, and performance testing.

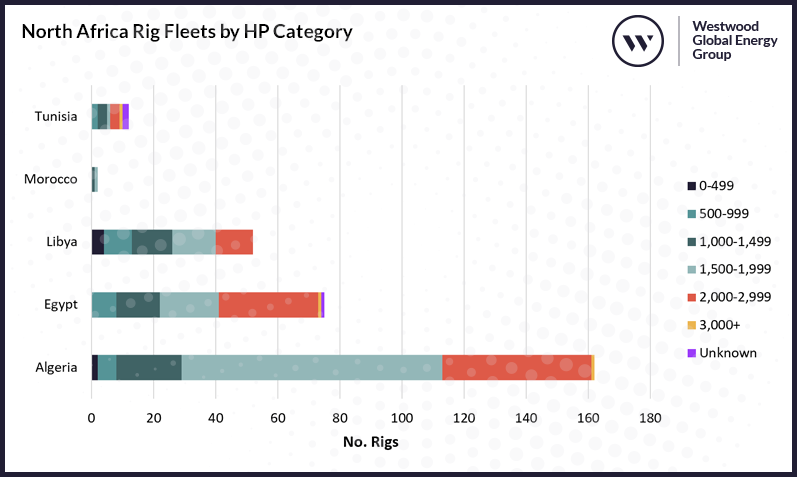

North Africa Rig Fleets by HP Category

Source: Global Land Rigs, Westwood Analysis

Libya

In Libya, Akakus Oil began a pre-qualification process to provide new flowlines and a water injection pipeline at the El Sharara O&G field. This comes as the NOC encourages domestic and international operators to boost O&G output from Libya.

Morocco

In August, Sound Energy launched a farm-out process for the Tendrara Production Concession and the surrounding Greater Tendrara and Anoual exploration permits. On 23 June 2022 Sound Energy mandated Attijariwafa bank, a Moroccan multinational bank, to arrange a long-term project senior debt facility of up to $250 million for the partial financing of the $330 million Phase 2 development costs of the Tendrara Production Concession. To cover the remaining $60 million net to Sound Energy (75% interest), the company has launched a formal farm-out process and has appointed Gneiss Energy Limited, a leading energy corporate finance advisory firm, to manage the farm-out process. Sound Energy has outlined three drilling targets, SBK-1 Appraisal, TE-4 Horst Appraisal and M5 Exploration.

On 11 August 2022 SDX Energy spud the SAK-1 exploration well in the Lalla Mimouna Sud concession. SAK-1, the first of a fully funded, two-well campaign, will target the Guebbas formation reservoir at ~1,108 metres and is being drilled by the Star Valley Drilling 101 rig, a 1,000 HP unit with a maximum drilling depth of 10,000 ft and a hookload capacity of 300,000 lbs.

Sub-Saharan Africa

Democratic Republic of Congo

On 1 August 2022 the Democratic Republic of Congo launched a 30-block licensing round; 11 blocks in the Lake Tanganyika rift basin, nine in the interior Cuvette Central basin, three in the coastal basin, four blocks in the Albertine graben play and three blocks in the Lake Kivu area. Bidders have until 10 October 2022 to submit expressions of interest for the Lake Kivu blocks and until 31 January 2023 for the other blocks. Once companies are pre-qualified, they then have until 30 April 2023 to submit bids. Awards will be announced on 30 June 2023. The round has been met with some opposition with several blocks overlapping protected areas including carbon-rich peatlands in the Cuvette basin.

Namibia

ReconAfrica received good news in August when Namibia’s high court overruled a legal case brought against the company by local environmental groups. The groups claimed environmental requirements had not been met and wanted the exploration activities to be suspended. The ruling allows ReconAfrica and its partner Namcor to continue drilling the 8-2 exploration well and fulfil its drilling campaign.

Uganda

TotalEnergies Tilenga project continued to progress with Chinese rig contractor ZPEB reporting that it has received the first newbuild rig. The ZPEB Rig 1501 underwent endurance testing and will be shipped to Uganda from the Honghua Factory, in Guanghan, China. The fully automated Rig 1501 is a 1,500 HP with walking capability. TotalEnergies reported that it can move between wells without the need to disconnect equipment. The Ugandan National Oil Company has stated that this is one of two rigs that is ready for activity in the country, with another unit earmarked for the CNOOC-operated Kingfisher field.

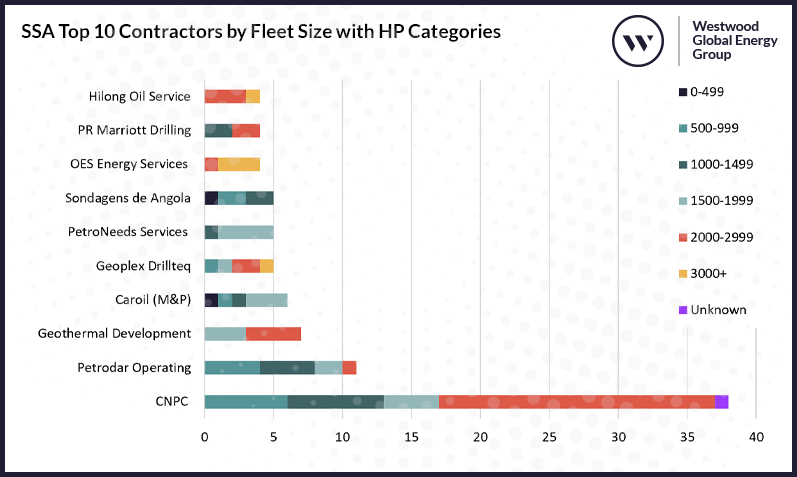

SSA Top 10 Contractors by Fleet Size with HP Categories

Source: Global Land Rigs, Westwood Analysis

Zimbabwe

On 24 September 2022 Invictus Energy spud the much-anticipated Mukuyu-1 exploration well in the SG 4571 permit. Invictus had previously announced a significant upgrade in prospective resources at the Mukuyu-1 prospect with prospective resources upgraded to 20 tcf of gas and 845 mmbbl of condensate, up from 8.2 tcf of gas and 247 mmbbl of condensate. The prospect is believed to include multiple stacked hydrocarbon zones.

The well is the first of a two-well campaign and will target stacked Triassic and younger sandstones. The second well will be called Baobab-1 located in the EPO 1849 permit, targeting stacked Cretaceous and younger sandstones. The drilling will utilise the 1,200 HP, Exalo Drilling-owned 202 drilling rig.

Latin America

Brazil

In mid-September PetroReconcavo and 3R Petroleum signed a memorandum of understanding to collaborate efforts in the Potiguar and Reconcavo basins. The deal will see the two companies share facilities and resources to improve efficiencies in blocks that are in the mature phase. PetroReconcavo are reportedly planning to contract new rigs in the area to reach a total of 44 wells by the end of 2022. This comes after 3R Fazenda Belém S.A. purchased Petrobras’ stakes in the Fazenda Belém and Icapuí fields.

Colombia

In Colombia Gran Tierra Energy successfully drilled 16 wells in the Acordionero field during 1H 2022, consisting of 10 oil producing wells and six water injection wells. The company also made good progress with its planned polymer flood pilot project in this field; polymer injection is planned for the newly drilled AC-95i injection well during 3Q 2022. Gran Tierra also drilled five infill development wells at the Costayaco field which are all now onstream. It also has plans to drill the Gaitas, Rose-1 and Churuco exploration wells in Colombia along with the Bocachico-1 and Charapa-B exploration wells in Ecuador.

Cuba

Melbana Energy’s Zapato-1 exploration well in Cuba was side-tracked following the drill string becoming stuck at a depth of 1,698 metres. As of 1 September, the well has been drilled and cased to a depth of 2,298 metres. Drilling was due to continue following leak testing, however no further announcements have been made. The well is being drilled by the Sherritt International Rig-1.

Trinidad & Tobago

Trinidad and Tobago, which is aiming to increase gas production and LNG exports, also launched a bid round offering 11 blocks; Aripero, Buenos Ayres, Charuma, Cipero, Cory D, Cory F, Guayaguayare, Southwest Peninsula Onshore, St. Mary’s and Tulsa, Central to Southern onshore acreage of Trinidad and Southwest Peninsula Offshore, located off the southern coast of Trinidad. The round, which opened on 8 July 2022, will close at 12 noon on 9 January 2023. All bids must be submitted by this deadline and are subject to a $30,000 bid fee. Successful bids will be announced three months after the close of the bid round.

North America & Canada

Alaska

A significant amount of activity occurred in Alaska over 3Q. ConocoPhillips received a potential lifeline for its Willow project; a new supplemental environmental impact statement from the US Bureau of Land Management (BLM) features options by which the project can proceed. The project, which lies within Alaska’s National Petroleum Reserve, was put in doubt after a federal judge in Alaska voided ConocoPhillips’ permits. The revised environmental impact statement does not represent a final decision but does address issues bought up by the federal court last year. ConocoPhillips believes the Willow discovery holds between 400 and 700 mmboe and could produce up to 100,000 bopd.

Pantheon Resources concluded drilling operations and stimulation and flow testing at the Alkaid-2 well. The well reached a total measured depth of 14,300 ft, including a lateral length of 5,300 ft. The sections targeted by the well were the Shelf Margin Deltaic, Alkaid Anomaly and Alkaid Deep. Pantheon will now demobilise the Nabors 105 drilling rig and bring in a smaller completion rig to undertake flow testing. After the completion, long term production testing will take place.

Santos and Repsol have taken the final investment decision on the $2.6 billion Pikka phase one oil project on the Alaska North Slope. Phase one will seek to develop proven plus probable undeveloped oil reserves of 397 mmbbls and is expected to produce 80,000 bopd on a gross basis, with first oil expected in 2026. The development plan will utilise existing pipeline capacity, including the Kuparuk pipeline and the Trans-Alaska pipeline system, as well as a single small footprint drilling pad. Phase one will see 45 wells drilled from a single drill pad, using the latest technology to reduce the environmental footprint.

Geothermal

Eavor has commenced a demonstration project (Eavor-Deep) aiming to drill the deepest and hottest directional geothermal well in history. The project was designed to demonstrate new processes and technologies developed by the company that they believe alleviate the issues that arise when drilling geothermal wells at great depths. H&P, a shareholder in Eavor, has been a key collaborator on the project and will provide the rig and associated drilling rig technologies for the project. John Redfern, President & CEO at Eavor, said: “If everything goes according to plan, we will establish a clear line-of-sight to sub US$60 per megawatt-hour costs. This is an important milestone which unlocks an enormous portfolio of Eavor-Loop™ project locations in key US, European and Asia Pacific markets.”

Asia

China

China has continued to push towards increasing its energy security. Sinopec made a major shale oil discovery in the Subei basin, eastern China. The Hua-2-ce discovery well was drilled at the existing Jiangsu oilfield and flowed 30 tonnes (220.5 barrels) of shale oil and 1,500 cubic metres of gas per day. The discovery is believed to hold as much as 8 billion barrels of shale oil. Further exploration and appraisal work is required to confirm the volumes in place. The company has plans to increase its shale oil production capacity to 1 million tonnes per annum by 2025.

PetroChina has announced intentions to start production from the Tieshanpo sour gas block in the Sichuan basin, targeting first gas in November 2022, with full production expected in 1H 2023 at a rate of 1.32 bcm per annum. The company plans included drilling five horizontal wells, of which two, 002-H3 and 002-H4, have already been completed. The development is expected to cost $730 million and include five well pads for production wells, a gas plant, export pipelines and pipelines for water re-injection.

Indonesia

The 2022 Indonesian licensing round was launched on 19 July consisting of six blocks, two onshore and four offshore. The blocks are split into two sections, the onshore Bengara I, onshore Arakundo and offshore Maratua II blocks are on offer via the usual tender process. Whereas the offshore Bawean, Northwest Aceh (Meulaboh) and Southwest Aceh (Singkil) blocks are available via direct offer. Bids for onshore blocks are due by 17 November 2022. Indonesia is targeting new investment in exploration with the government aiming boost liquids production to 1 mmbbl/d and gas output to 12 bcf/d by 2030, however, the country is already falling short of its 2022 targets of 703,000 bpd of liquids and 5.8 bcf/d of gas, recovering figures of 614,500 bpd and 5.326 bcf/d in 1H 2022.

Australasia

Australia

Australia 3Q 2022 Wells Drilled (*Upcoming Wells)

| Well | Operator | Contractor | Rig |

| Gynatrix-1 | Mitsui EP | Ventia | 106 |

| Cooroo-NW7 | Santos | Ensign | 967 |

| Kangaroo-3 | Beach Energy | Schlumberger | 84 |

| Palm Valley-12 | Central Petroleum | Ensign | 963 |

| Sapphire-5V | Blue Energy | Silver City Drilling | 23 |

| Knapmans-1 | Beach Energy | Schlumberger | 184 |

| Narcoonowie-11 | Santos | Ensign | 967 |

| Rocky-1 | Beach Energy | Schlumberger | 184 |

| Sapphire-6V | Blue Energy | Silver City Drilling | 23 |

| Sapphire-5L1 | Blue Energy | Silver City Drilling | 23 |

| Sapphire-5L2 | Blue Energy | Silver City Drilling | 23 |

| Sapphire-5L3 | Blue Energy | Silver City Drilling | 23 |

| Sapphire-5L4 | Blue Energy | Silver City Drilling | 23 |

| West Erregulla-3 | Strike Energy | Ensign | 970 |

| Swan Lake-17 | Santos | Schlumberger | 188 |

| Maverick-1H | Tamboran Resources | Ensign | 970 |

| Nungeroo West-1 | Santos | Ensign | 970 |

| Yarrow-3 | Santos | Ensign | 974 |

| Marsilea-2 | Santos | Schlumberger | 188 |

| Odonata-3 | Santos | Ensign | 967 |

| Rougemont-3 | State Gas | Silver City Drilling | 20 |

| Jena-29 | Santos | Ensign | 967 |

| Ragno-2 | Santos | Ensign | 967 |

| Ragno-3 | Santos | Ensign | 967 |

| Ragno-4* | Santos | Ensign | 967 |

| Trigg-1* | Beach Energy | Ventia | 106 |

| Synaphea-1* | Mitsui EP | Ventia | 106 |

| Elegans-1* | Mitsui EP | Ventia | 106 |

| Carpentaria-4V* | Empire Energy | tbc | tbc |

| Lockyer-2 | Energy Resources | tbc | tbc |

| Lockyer-3 | Energy Resources | tbc | tbc |

| North Erregulla Deep-1 | Energy Resources | tbc | tbc |

Malaysian company RP Trust has signed a non-binding Letter of Intent (LoI) with Icon Energy to record RP Trust’s interest in a farm-in and associated potential commercial areas for development of Block ATP 855. Icon Energy took over 100% of Block ATP 855 several years ago when Beach Energy withdrew. ATP 855 contains the Halifax-1, Hervey-1, Keppel-1, Redland-1, Etty-1, and Geoffrey-1 shale gas discoveries. According to Icon the discoveries contain 1.57 tcf of gas on a best estimate contingent basis.

Mitsui EP is testing its Waitsia-8 well which was drilled as part of the Waitsia Project. The well was drilled by the 1,500 HP, Ventia 106 rig which will be moved on to drill the Waitsia-7 well next. Waitsia-7 is being drilled out of sequence due to extra time being required for well site preparation. Mitsui EP recently approved two additional exploration wells in the Perth basin, Synaphea-1 in the L-1 permit, and Elegans-1 in the L-2 permit.

Papua New Guinea

High Arctic Energy Services, Papua New Guinea’s dominant onshore drilling contractor, has signed a three-year drilling services agreement. The deal will see the operator utilise High Arctic Energy Services 103 drilling rig. The 103 rig is a 1,500 HP unit with a hookload capacity of 750,000 lbs. Though High Arctic did not name the company, they stated that it was for their principal customer, who merged with one of the largest energy exploration and production companies operating in Asia Pacific in late 2021. As a result, the contract is likely for Oil Search who merged with Santos at that time. The rig is currently being prepared with drilling expected to start in 4Q 2022. This contract is seen as a sign that exploration and development activity in Papua New Guinea is starting to rebound. It is believed the drilling will be linked to the PNG LNG project.

Eastern Europe & FSU

Azerbaijan

As a result of Russia’s invasion of Ukraine, Azerbaijan has emerged as a potential replacement for Russian gas supply to Europe. As the European Union (EU) hunts for alternatives to Russian gas it has announced plans to double gas imports from Azerbaijan. This will see the EU import at least 20 bcm per year by 2027. European Commission president Ursula von der Leyen and Azeri President Ilham Aliyev signed a memorandum of understanding (MoU) on 19 July 2022, committing to expansion of the Southern Gas Corridor. The EU plans to increase imports from 8 bcm/y to 12 bcm/y by the end of 2023. The MoU also includes plans for future cooperation in the new energies space, in which Azerbaijan has great potential in offshore wind and green hydrogen.

The 3 bcm per annum, Interconnector Greece-Bulgaria (IGB) pipeline has been successfully linked to Bulgaria’s national transmission network, operated by state-run Bulgartransgaz. This comes as Bulgaria looks to secure an alternative gas supply having been wholly dependent on Russian gas. Bulgaria had been cut off by Gazprom after refusing to pay for gas in rubles. Earlier this year, the IGB was connected to the Trans-Adriatic Gas Pipeline (TAP) that carries gas from Azerbaijan to Southern Europe. The gas interconnector between Greece and Bulgaria is in the final stages and commercial operations are expected in 4Q 2022.

Georgia

Block Energy has commenced Project II of its three-project plan to redevelop the Patardzeuli Middle Eocene reservoir in Patardzeuli oil field, Georgia. The company has deepened the JSR-01 Deep well in Block XI with work carried out between 5 September and 27 September. The original JSR-01 well was drilled by the previous operator in 2013. Block Energy are targeting the undrained section of the Patardzeuli Middle Eocene reservoir which is over 600m thick and has produced over 100 mmbbls oil. The well was deepened by the JSC Norio Oil Company owned, 1,000 HP, ZJ-40 rig and is currently being prepared for testing.

Romania

Serinus Energy drilled the Canar-1 exploration well to a depth of 1,570 metres. The well targeted three hydrocarbon zones, however, initial results concluded the zones did not contain sufficient gas resources to justify proceeding. Canar-1 has now been suspended and will be used in future as a water disposal well. The rig has since been moved and is now drilling the Moftinu Nord-1 well, which spud on 19 September. Moftinu Nord-1 will be drilled to a depth of 1,000 metres, targeting four prospective hydrocarbon zones.

Ukraine

Enwell Energy has provided updates on its operations in Ukraine, including the Mekhediviska-Golotvshinska (MEX-GOL), Svyrydivske (SV) and Vasyschevskoye (VAS) gas and condensate fields, as well as the Svystunivsko-Chervonolutskyi (SC) exploration licence. Despite Russia’s invasion of Ukraine, Enwell has been able to continue production and some field operations at both MEX-GOL and SV and is drilling the SC-4 well at the SC license. However, operations at the VAS field, near Kharkiv, remain suspended due to the military risks. Production continues at the MEX-GOL and SV fields with a current production rate of ~2,600 boepd. Other operations have also resumed, including workover on the SV-2 well, perforation and testing in the SV-29 development well and upgrades to the gas processing facilities at the MEX-GOL and SV fields. All other works have been deferred or suspended.

Western Europe

Germany

In Germany, Neptune Energy spudded a new production well at its operated Rӧmerberg oil field in the Rhine Valley, south-western Germany. The well is the ninth on the field and is expected to come onstream in 4Q 2022. The new production well is being drilled by a rig operated by Drilltec, with a final measured planned depth of 2,180 metres. The field is currently producing 2,000 boepd. An application to increase production from the field, currently limited to 500 tons of crude oil per day, is in the final stages of review. Once approved, Neptune can progress plans to drill additional production wells to develop the reservoir further.

KCA Deutag also had success in Europe as well as the Middle East, being awarded $6 million worth of new contracts in Germany and the Netherlands.

United Kingdom

In late September, the UK government lifted a moratorium on shale gas exploration (fracking) in England in a move to bolster its energy security following Russia’s invasion of Ukraine. The moratorium has been in place since 2018. Meanwhile moratoriums on fracking in Scotland or Wales will continue. Only three test wells have been hydraulically fractured in the UK to date. The government said there was a need for more sites to be drilled to gather further data and improve the evidence base. Previous fracking projects in England have failed to progress due to strong local opposition from local councils and the wider public.

UK-based geothermal developer CeraPhi Energy’s signed an agreement with Halliburton that will see the OFS provider supply drilling and well intervention services to CeraPhi’s existing projects. The work will centre around repurposing old O&G wells into geothermal wells. The company’s first project is expected to start in 4Q 2022.

Uzbekistan

Azerbaijan’s state oil producer Socar is looking to move forward with a potential exploration project in Uzbekistan. Socar’s former partner, BP, left Uzbekistan’s upstream sector back in 2020, however, Socar is now looking to continue the work started on the Samsko-Kosbulaksky and Baytereksky blocks. It is understood that prior to BP leaving the partnership it helped compile an exploration plan for the two blocks, including seismic shoots and exploration wells. According to Westwood’s identified rig fleet, Uzbekistan hosts a fleet of 107 land drilling rigs, dominated by national contractor Uzgeoburneftegaz.

Todd Jensen

Research Analyst, Onshore Energy Services

[email protected]