The release of the IEA’s Roadmap to Net Zero by 2050 report on 20 May is a potential bombshell for the industry as it concludes that ‘Beyond projects already committed as of 2021, there are no new oil and gas fields approved for development in our pathway.’ The industry now faces some stark choices on the path to take.

To this point, forecasters always had a shortfall between future supply from existing fields and future demand for oil and gas, thereby justifying continued investment in new sources of production and exploration. The IEA’s Net Zero pathway is the first to argue that this is not the case, and it will increase the pressure on oil companies to justify their business models.

How the industry and governments respond to the challenges laid out in the report will determine the investment outlook for years to come. What are the key elements of the IEA’s pathway and how does it differ from previous forecasts, and what are the choices facing the oil and gas sector?

This is the first time the IEA, the most widely cited independent forecaster on energy matters, has released an Energy Transition scenario that constrains global warming to 1.5 degrees Celsius (c). Previously it had modelled a <2 degrees warming scenario, which it called the ‘Sustainable Development Scenario’ (SDS). However, since the Intergovernmental Panel on Climate Change (IPCC) special report on the Paris Agreements’ ‘stretch’ goal of pursuing “efforts towards 1.5C” was published in 2018 (three years after the original Paris Agreement), the target has moved from achieving 2 to 1.5 degrees to further limit the impacts of global warming. A 1.5 degrees scenario requires a faster reduction in emissions, and therefore a faster and broader energy transition.

The IEA Net Zero Pathway in context

The IEA’s net zero scenario (NZE 2050) provides a roadmap (with 400 milestones) that achieves net-zero CO2 emissions for the energy sector and industrial processes by 2050 with a 50% probability of limiting global temperatures on average 1.5 degrees above pre-industrial levels. The IEA says its approach aims to balance assumptions regarding technology innovation, behavioural changes and international co-operation to achieve an ‘orderly transition’ – this includes ensuring security of supply and achieving universal energy access by 2030.

The IEA believes that its approach follows stricter criteria when compared to other scenarios. For example, several of the IPCC’s scenarios initially overshoot (both in CO2 and / or temperature) and reach 1.5 degrees later than 2050, often by deploying carbon removal or other technologies.

The IEA has made choices about which technologies, policies etc will be needed and at what time to achieve net-zero. Therefore, it stresses that its scenario should “not be mistaken as the path to net-zero emissions by 2050… rather it is a path”. Shell, BP and International Renewable Energy Association (IRENA) amongst others have published their own net zero 2050 and 1.5 degree scenarios (but typically without a detailed roadmap).

There are some striking elements in the IEA NZE compared to these other models:

- Energy demand is >20% lower than in 2019: The IEA NZE 2050 total final energy consumption (TFEC) of 344 exajoules (EJ) by 2050 is lower than in many IPCC scenarios, as well as other available net-zero scenarios. For example, BP’s Net Zero scenario is at 625 EJ, and Shell’s Sky 1.5 is 549 EJ. It is closer to IRENA’s 1.5 scenario, where TFEC in 2050 is 348 EJ. The IEA includes strong energy efficiency gains to achieve its TFEC, meaning that the 344 EJs is 21% lower than TFEC in 2019 at 435 EJ despite a world economy that is twice the size.

- Renewable energy penetration is high: The IEA has historically underestimated the growth of renewables, but in NZE 2050 renewables would provide 70% of the energy supply mix, similar to IRENA’s own scenario. IPPC 1.5 scenarios typically reach on average 60% penetration levels, as does BP’s net-zero scenario.

- CCUS is deployed conservatively: The 7.6 GtCO2 that would be captured by CCUS in 2050 is the lowest of almost all the IPCC scenarios, but is more than both BP’s Net-Zero and Shell’s Sky 1.5 Scenario.

- Hydrogen plays a bigger role: At 33 EJ of the TFEC, hydrogen plays a bigger role than in most IPCC scenarios, but is bigger still in others e.g. BP’s net-zero includes 58 EJ by 2050.

- Fossil fuel production in 2050 is low: The total fossil fuel supply of 120 EJ in 2050 (which includes oil, natural gas and coal) is much lower than most IPCC 1.5 pathways, but similar to IRENA’s scenario, and only a little lower than BP’s 135 EJ.

Relative role of oil and gas in the IEA scenario

The role that oil and natural gas plays in the IEA NZE 2050 is determined by the combination of the assumed pace of CO2 reduction, the lowering of total energy demand, the significant build of renewables and the use of carbon removal technologies.

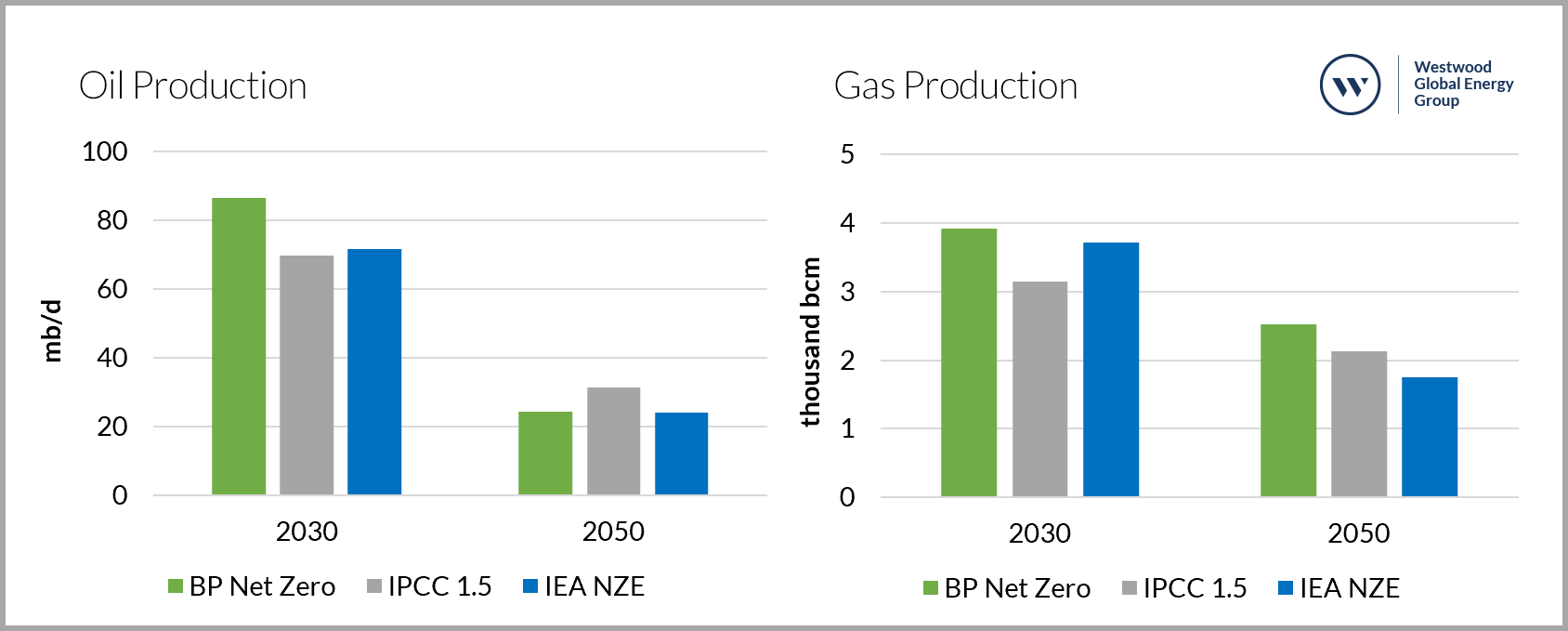

The result is that in the IEA’s scenario there is simply much less requirement for oil and gas in the energy mix than under other scenarios – even if its relative contribution in terms of energy supplied is similar in percentage terms, as illustrated by Figure 1.1 below.

| Scenario | Energy Demand (EJ) | Oil and Gas Supply (EJ) | Oil / Gas Split (%) | Energy Supply Contribution (%) |

| IEA NZE 2050 | 344 | 102 | 41 / 59 | 20 |

| BP Net Zero | 625 | 123 | 34 / 66 | 19.8 |

| IPCC 1.5* | 404 | 146 | 48 / 52 | 26 |

Figure 1.1 Comparison of energy supply in 2050 under different net zero 2050 scenarios

Note: 2019: Energy Demand = 435 EJ, Oil and Gas Supply = 329 EJ

Conversion factor: mmboe / EJ 163.4

*median of below and low overshoot IPCC scenarios.

The gap between the expected demand for energy and the supply that can be offered by renewables has reduced to the level that it can be filled by existing oil and gas production.

Figure 1.2 Oil and Natural Gas production outlooks under different net zero 2050 scenarios

Response to the report

The IEA NZE 2050 scenario has so far garnered a mixed response from governments and the industry. The overall conclusions have been broadly welcomed by Governments, NGOs and the green energy industry, including the clean energy supermajor Enel.

Open criticism of the report has been muted as yet, but concerns have been raised pointing out that there is more than one pathway to achieving a net-zero economy, or that the pathway is unrealistic or that it doesn’t properly reflect the growth needs of developing nations. OPEC also noted that the report could be a source of instability in oil markets.

Implications for Upstream Strategy

Whether the industry welcomes the outcome of the report or not, the IEA scenario will play an important and influential role in future discussions around a path to net-zero. It was specifically requested as input into the negotiations of the UN COP26 summit in Glasgow in November this year – and so will be at the forefront of Government and stakeholder thinking in the process. The discussions at COP26 will almost certainly see greater commitment and practical actions to increase the chance of reaching that target.

The IEA’s scenarios have also historically been used as inputs to corporate strategy development. The IEA model assumes that investment in existing fields will always trump greenfield projects and that production from existing fields and already sanctioned projects can meet future oil and gas demand in its net zero scenario. The upstream industry needs to form a view on how much future demand can be met from investing in existing fields, and how new project sanctions could compete for investment.

In formulating upstream strategy, a key question is – which energy transition pathway to align the business to? More specifically, what does it mean to be Paris (or potentially in future, Glasgow) aligned? Companies need to fully understand the potential range of uncertainties, risks and opportunities that they face, and plan for these accordingly.

Governments, regulators and operators really have three options in how to respond:

- Align to 1.5 and the IEA scenario – managed decline; focus is on existing fields and infrastructure led exploration.

- Align to 1.5 but follow a different pathway that allows for continued investment in new oil and gas production – requires an alternative credible pathway to net zero. For example, some of the IPCC 1.5 degree scenarios.

- Do not align to 1.5 or Paris Agreement – Continue to invest as BAU and accept future legal / regulatory risks.

Global exploration will not end today as individual companies will make different choices, but E&Ps need to prepare themselves for a world where exploration capital is constrained. Infrastructure-led exploration will still be needed as part of the required investment in existing fields, while riskier exploration would be dependent on following pathways other than the IEA NZE 2050.

In the meantime, explorers will be ever more focussed on low breakeven costs, short cycle times to production and zero upstream emissions to justify expenditure.

Governments, regulators and companies alike face a choice in which energy transition pathway to follow as the IEA scenario is not the only pathway to net zero in 2050.

The time to choose is now.

For more information on how we are helping our clients through the Energy Transition, do get in touch.

David Linden, Head of Energy Transition

[email protected]

Keith Myers, President of Research

[email protected]