Confidence had returned to global exploration with improved performance and the emergence of several new multi-billion barrel plays. The confidence carried over into 2020 but has evaporated in the face of the Covid-19 crisis and the collapse in oil prices. Short term plans are in a state of flux and exploration strategy is being reset again.

As well as dealing with the immediate crisis, societal pressure is building for a rapid transition to a low carbon future. It is in this context that Westwood has published its annual review of global exploration activity and performance over the last five years and the outlook for 2020 and beyond.

What are the key themes that have emerged from the analysis?

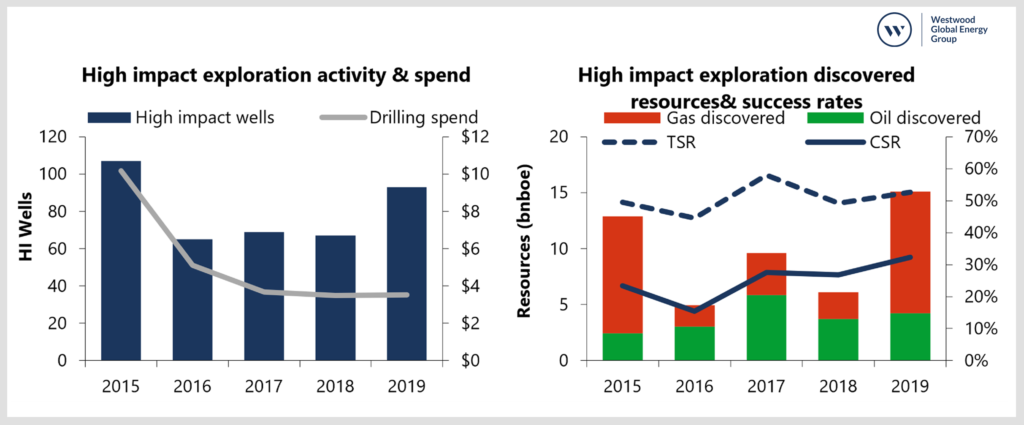

Figure 1: High impact exploration activity, drilling spend, discovered resources and success rates 2015-2019

Source: Westwood State of Exploration 2020 Report

There was more drilling and better performance in 2019. The number of high impact wells in 2019 was up 39% on 2018, in excess of 15bnboe was discovered and commercial success rates increased to 32%, the highest in at least 10 years, driven by exceptional results in emerging plays. There were 28 potentially commercial discoveries larger than 100mmboe, close to double the number in 2018 and the highest since 2014. The four largest discoveries were gas or gas condensate in Iran, Russia, Mauritania, and Cyprus and most volume from high impact discoveries was gas for the first time since 2016. There were eight oil discoveries greater than 200 million barrels, three of which were in Guyana.

Success has been highly concentrated geologically. In the last five years 342 different geological plays were drilled globally but the top 10 plays delivered 64% of the total discovered resource. Six of the top 10 plays were gas and four were oil. Less than 10% of plays found more than 250mmboe in the period. The top three plays all emerged through frontier drilling success in the last five years in Mauritania/Senegal, Guyana, and Egypt.

A fast follower strategy has generally not worked for emerging plays. 11 of the top 16 discoveries in 2019 were made in plays at the emerging stage. Accessing plays at the early stage of the exploration creaming curve has never been more important and to do so explorers need to be in at the start. 90% of the discovered resources in plays opened since 2010 has been captured by companies that already held acreage in the new plays as they were opened. Companies following a fast-follower strategy were only able to access 10% of the discovered resource. The challenge is that frontier drilling commercial success rates were only 7% in the last five-years. Explorers must therefore continue to innovate and tolerate frontier play risk to sustain the emerging play prospect inventory.

Stratigraphic traps are increasingly important. Stratigraphic traps, i.e. traps without a structural component, have often been considered higher risk than structural traps. This is not the case anymore. The proportion of wells targeting stratigraphic trap prospects has doubled over the last five years and commercial success rates have been significantly higher, at 41%, than other traps. Discovered resources in stratigraphic traps, at 20 billion boe, were also higher than all other trap types combined. Excelling at stratigraphic trap exploration is now key to top quartile performance.

The discovered resource opportunity grows. 51% of the high impact resource discovered since 2008 remains undeveloped and 34 bnboe of potentially commercial resource discovered between 2008-2016 has shown no sign of progression since 2016. This offers a significant opportunity and competition for exploration if the barriers to commercialisation can be removed.

The competitive landscape is evolving. More NOCs have expanded internationally, away from their home countries and an increasing proportion of high impact wells have participation from the supermajors or the NOCs. In 2019, NOCs and the Supermajors participated in 80% of the high impact wells drilled. At the same time, the energy transition and capital constraints are beginning to drive more companies away from frontier wildcats into short cycle and infrastructure-led exploration.

Exploration strategy is harder than ever. Explorers must consider full cycle time frames and above ground challenges more carefully than ever. The median time from a frontier discovery to first production has been 8.5 years in the last decade. Uganda’s oil is a case in point. A frontier discovery in 2006 – 14 years and counting since discovery and 23 years since licence award in 1997 it has still not made it even to FID. Tanzania’s deep water gas is another example, discovered in 2010 and yet to be sanctioned. Kosmos, the poster child for a successful specialist frontier explorer, has transitioned to a full cycle E&P company and has announced it will not be accessing any new frontier long cycle acreage in the light of the energy transition.

E&Ps justified US light tight oil on the basis that it was short cycle and flexible. The problem is it is also high cost. Infrastructure led near field drilling is the obvious choice with an average 3 years from discovery to first production, but there will be limits to the number drillable prospects in tie-back distance and high impact discoveries in mature basins are rare. Deep water frontier oil can also be low cost and does not have to mean long cycle – Jubilee and Liza were 3.5 and 4.5 years respectively from discovery to first oil.

The ESG movement means strategy will change. Discoveries that produce barrels with low emissions intensity should have a premium value in future. Access to capital for E&Ps is more difficult especially for those that are not self-funding. Small companies have played important roles in exploration as pathfinders and innovators. Who will play this role in future is unclear?

Those that can invest in exploration counter cyclically can take advantage. Now is the time to renew portfolios. Competition is lower and Governments are increasingly desperate to sustain exploration (at least the ones that have not banned it…). Distressed companies with assets to sell are out there. Equity valuations are so low that a corporate acquisition may be the lowest cost option for portfolio renewal.

This is a difficult time for exploration without question, but there is still a business case for it. Explorers have raised their game and need to continue to do so with a focus on finding low cost, low emissions oil and gas. Those that do can continue to prosper in the transition to come.

Keith Myers, President, Research

[email protected]

Graeme Bagley, Head of Global Exploration and Appraisal

[email protected]

For more information or purchase options for the State of Exploration 2020, please contact Ili Afifuddin on [email protected]

Click here to register to join Westwood’s webinar Video on Demand on “High Impact Appraisal Hits and Misses” or view the series schedule here.