Direct air capture: a vital negative emissions technology or a distraction?

Imagine a business where you could pull unlimited money out of thin air while at the same time saving the planet. That, in a nutshell, is the promise of direct air capture (DAC) in a world with high carbon pricing—although the reality is a bit more complicated.

DAC extracts carbon dioxide from the atmosphere by passing air through a solid sorbent or liquid alkaline solvent. The sorbent or solvent is then heated to release its CO2 for storage or reuse. The problem is that the concentration of carbon dioxide in the air is very dilute, meaning the amount of heat required to extract CO2 from a DAC plant is considerable: from 80ºC to 120ºC for solid sorbents and up to 900ºC for liquid solvents. This requires a lot of energy—up to around 2.6 terawatt-hours to remove a million tonnes of CO2 a year, according to one estimate, and two to four times more energy than direct capture from a power plant—which makes DAC expensive.

Based on research from 2018, historic cost estimates for DAC can range from USD$50 to $1,000 per tonne of CO2. Further analysis indicates the cost is likely to fall between roughly $95 and $230 in the next decade, depending on design options and economic assumptions. If carbon costs were above this range, then DAC really would make money out of thin air. As it stands, though, the average price for carbon worldwide is just $3 per tonne, according to the International Monetary Fund. Only in some sectors in Sweden, Switzerland or Lichtenstein would the carbon price be sufficiently high to support DAC today. So, the technology looks like a non-starter for now. But that hasn’t put developers, governments and the research community off. Expectations of future rises in carbon pricing have led to a spree of recent DAC-related headlines.

In Scotland, for example, Storegga Geotechnologies and Carbon Engineering have announced a DAC project that could capture a million tonnes of CO2 a year by 2027. Meanwhile, the US Department of Energy said in June it would put $12 million into six DAC research and development projects. Elsewhere, Scotland’s Net Zero Technology Centre is working with partners including Heriot Watt University’s Research Centre for Carbon Solutions on technology to bring the cost of DAC down to £100 ($139) per tonne of CO2.

And a Washington, DC-based start-up called Co2Rail is planning to use the regenerative breaking energy from trains to power what it says will be “gigaton-scale CO2 removal by 2030.”

Capturing interest from oil and gas

Oil and gas players are active participants in the nascent DAC sector. Chevron and Equinor are co-investors in DAC technology developer Clean Carbon Solutions, for example. And ExxonMobil is linked to Global Thermostat, which is aiming to remove up to 40 giga-tonnes of CO2 a year. TotalEnergies, meanwhile, is investing in DAC in partnership with France’s IFP Energies Nouvelles public research body.

In Italy, Eni is teaming up with solar-syngas developer Synhelion on a DAC project due for 2025. And Shell, TotalEnergies and Equinor in March joined forces for a DAC initiative in Norway. Finally, Occidental’s Oxy Low Carbon Ventures arm last year announced plans to licence technology from Carbon Engineering for a million-tonne-a-year-capacity plant in Texas.

However, the fact that the Texas plant’s CO2 will be used to pump out oil, a relatively common practice in parts of the lower 48, is viewed more controversially by climate watchers than the permanent storage of carbon or its use in producing low-carbon fuels. This is not a trivial issue. In the effort to meet climate goals, priority is increasingly being given to the reduction of atmospheric greenhouse gases as well as their avoidance.

As the International Energy Agency (IEA) points out, “Carbon removal is expected to play a key role in the transition to a net-zero energy system in which the amount of CO2 released into the atmosphere is equivalent to the amount being removed.”

DAC is increasingly seen as a credible contender for carbon removal, even though you can get the same effect much more cheaply through nature-based solutions such as planting trees—which can get rid of CO2 at a cost of just $10 per tonne. But trees need a lot of space, take decades to reach maturity, and can be subject to wildfires, whereas DAC could in theory be scaled up rapidly, across a small land area, if the conditions are right.

It is also cheaper to build traditional carbon capture and storage plants, but these typically remove CO2 emissions at or close to source, for example from exhaust flues. DAC can work anywhere where there is air and, more importantly, be located next to or on top of potential carbon storage sites. But today, because of the cost issues outlined above, DAC is a niche sector, with the IEA counting just 15 plants in operation.

For a brief overview of the history, technology and strategies of direct air capture, view the explainer page here.

DAC to the future

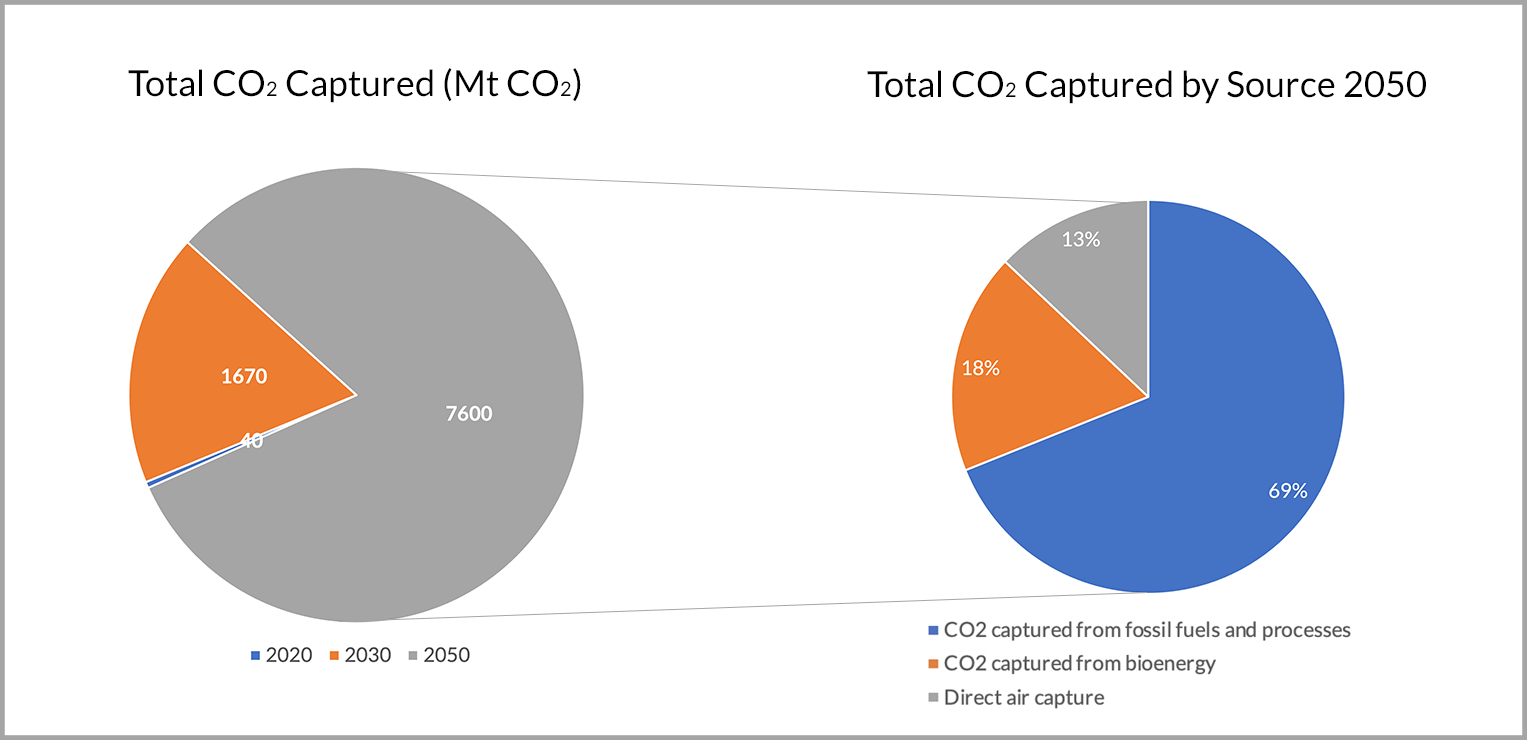

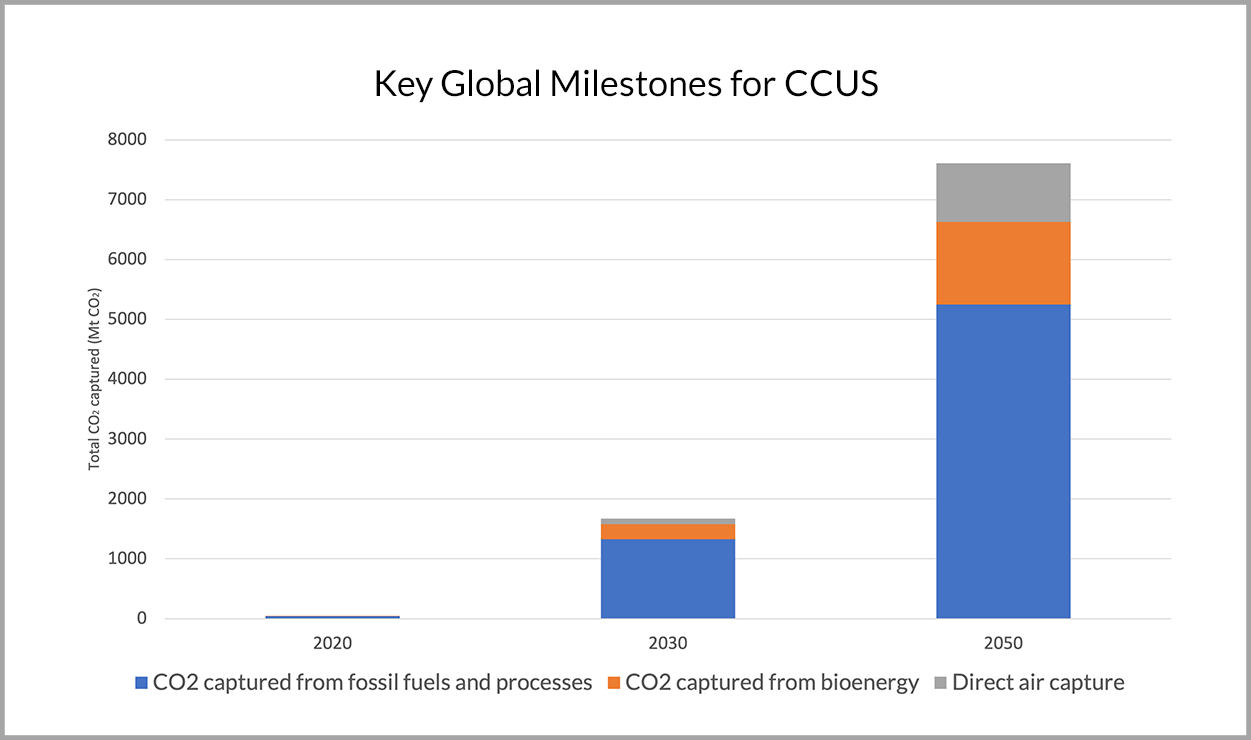

However, the IEA sees this negligible capacity surpassing 90 million tonnes of CO2 a year by 2030 and hitting 985 million tonnes by 2050 under its Net Zero by 2050 roadmap. At that level, the technology would still only represent around 13% of total captured CO2.

Source: IEA Net Zero 2050 scenario, Global CO2 capture by source in the NZE

Source: IEA Net Zero 2050 scenario, Key global milestones for CCUS

Such a scale-up could of course reduce the cost of DAC somewhat, but the power-hungry nature of the process will be a problem for as long as the energy costs of capturing CO2 remain above the price of carbon. One way to cut the cost of DAC is to use the cheapest possible sources of renewable or low-carbon energy. That will not achieve much, though.

With today’s technology, even the most cost-effective sources of energy for DAC, such as geothermal, result in a minimum cost of $250 per tonne of CO2, based on an analysis published in June by Mihrimah Ozkan of the University of California Riverside. Geothermal isn’t a mainstream energy source yet and so will struggle to contribute much to DAC’s near-term expansion, which makes it even harder to see how direct air capture technology could become competitive any time soon.

And even assuming cost concerns can be overcome, there are question marks over whether DAC could scale up fast and far enough to offer a meaningful contribution to the fight against climate change. Ozkan, for example, has calculated that to meet global climate goals with DAC alone we would already need to have 13,000 plants in operation, each with a capacity of a million tonnes of CO2 each a year. That would cost $1.7 trillion.

All these factors, together with competition from nature-based solutions, would seem to indicate that DAC is destined to become an energy transition negative emissions technology also-ran. However, there is one emerging trend that could offer a lifeline to the technology. In January, DAC firm Climeworks revealed its technology was being used as part of IT behemoth Microsoft’s efforts to become carbon negative by 2030. And Climeworks is also partnering with fintech company Stripe on a venture called Stripe Climate.

This allows businesses using Stripe to put a fraction of their revenues towards carbon removal efforts. For rich tech companies such as these, the ability to pull carbon out of the air is worth more than the cost of DAC today. In the future, other hard-to-abate sectors, such as aviation, may have no other choice but to use DAC if alternatives to current fuels are slow to develop. These may well be markets worth keeping an eye on.

Episode 8 of the Energy Transition Now podcast, featuring Dominic Emery of bp, now available.

The digest: this month’s key headlines

- The City isn’t buying the hydrogen hype. HydrogenOne Capital Growth, the first hydrogen-only investment fund to seek a listing on the London Stock Exchange, failed to secure even half of its initial public offering target.

- It seems everyone wants a piece of Scotland’s Acorn carbon capture and storage project, with Carbon Clean, ExxonMobil, Shell and Ineos and Petroineos all announcing their involvement. From little acorns….

- Offshore wind’s great future hope—floating technology—faces “significant technical challenges,” according to a Carbon Trust Floating Wind Joint Industry Project report.

- This year’s BP Statistical Review of World Energy is out, charting what the oil company says was “one of the most tumultuous years for global energy in modern history.”

- The carbon border tax that is key to the European Union’s Fit for 55 net-zero roadmap is in breach of global trade rules, according to China.