Energy Transition Insights

For years, the oil and gas sector has looked to the seabed for fossil fuel riches. Now it’s looking for something else, to tell from the results of February’s UK seabed leasing auction for offshore wind rights. Of the 8 GW of capacity that was on offer, 56% went to joint ventures featuring European supermajors, according to a Westwood analysis this month. As we note in our analysis, this is further evidence of a paradigm shift in the offshore energy sector, and one that is having a profound impact on oil and gas company strategies. Offshore wind is becoming an important clean energy focus area for the industry.

It’s not the only one, though, and in this edition of Westwood Energy Transition Insights we turn to another form of renewable energy that is garnering increasing attention within the sector.

If you can spare a minute, let me know what you think of this newsletter. We’re keen to make sure it meets your need for information and insight as the oil and gas industry moves to a more sustainable footing.

David Linden

Head of Energy Transition

Geothermal: could the UK be the key to wider markets?

Geothermal is hot. There is growing enthusiasm for the technology across a wide spectrum of organisations, particularly in the US. A Breakthrough Institute analysis of US Department of Energy (DoE) investments between 2004 and 2019 shows the federal government has spent around $1 billion on geothermal—more than the $700 million invested in hydro and only $300 million less than that allocated to wind.

The US is already the world leader in geothermal energy, with almost 3.7 GW of the 15.4 GW installed worldwide as of the end July 2019, according to TGE Research from 2020. It is also home to a host of promising start-ups, such as Fervo Energy, GreenFire Energy and Sage Geosystems (see our explainer). These have captured the attention of investors as diverse as Google and Bill Gates’s Breakthrough Energy Ventures, plus oil and gas companies such as Mitsui, Shell, BP and Chevron.

The catalyst for the recent flurry of investment in the US was an influential study by the DoE in 2018, which recommended increasing geothermal electricity generation 26-fold by 2050. This was followed by a series of government research grants. The first established the Frontier Observatory for Research in Geothermal Energy in Utah, with a focus on development and testing techniques for creating, sustaining and monitoring enhanced geothermal systems (EGS) reservoirs.

Later, in May 2020, the DoE launched a $4.56 million American-Made Geothermal Manufacturing Prize to spur innovation and address manufacturing challenges fundamental to operating in harsh geothermal environments. The US DoE initiatives have been vital in fuelling the growth of start-ups in the sector, and ultimately capturing the attention of private investment.

In September 2020, the Breakthrough Institute stated that “It’s time to take geothermal energy seriously,” based on the development of EGSs that could harness anything up to 4 terawatts of power, depending on economics, demand, material constraints and social factors.

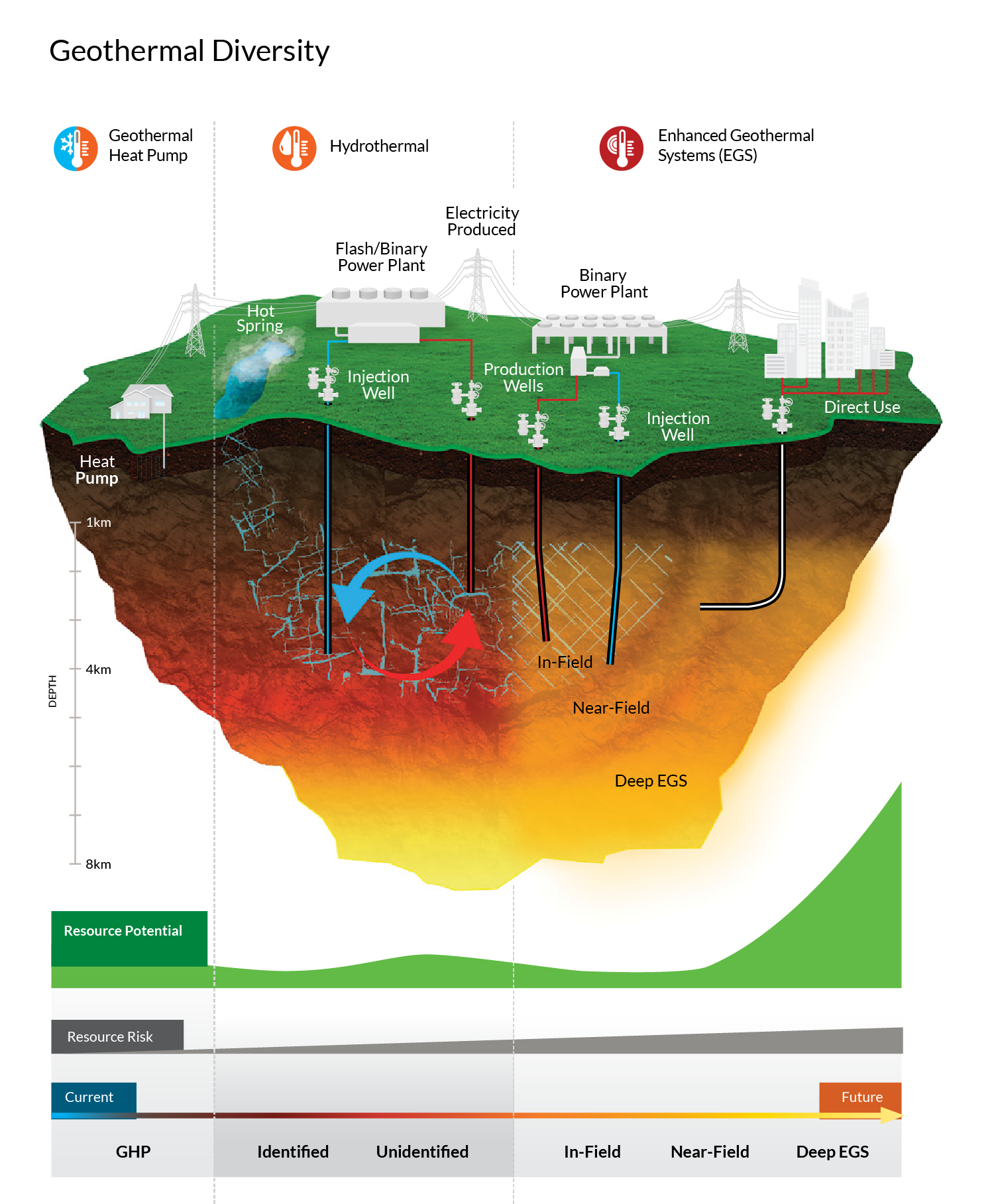

The diversity of geothermal resources and applications, delineated within three resource categories: geothermal heat pump, hydrothermal, and enhanced geothermal systems

Source: US Department of Energy “GeoVision: Harnessing the Heat Beneath Our Feet” report.

For a brief overview of the history, technology and strategies of geothermal energy, view the explainer page here.

UK geothermal momentum builds

But for the technology to achieve truly global reach, it could be that the UK is the market to watch—even if that might be hard to believe from current figures. In comparison to the US, the UK is significantly behind the curve, but momentum is growing. The United Downs Deep Geothermal Power Plant (UDDGP) is the first geothermal power plant in the UK, funded by the European Regional Development Fund, Cornwall Council and Thrive Renewables. After a decade of research, planning, funding and drilling, a binary power plant was commissioned this year. The Eden project in Cornwall is hot on the heels of UDDGP and aims to become the UK’s second geothermal power plant. In recent weeks, IGas Energy has received planning approval from Stoke-on-Trent City Council for a deep geothermal project in the Etruria Valley. There are growing pleas for more of these projects to be delivered across the UK.

A UK report by Arup, backed by organisations as diverse as Greenpeace, the renewable energy trade association REA and United Kingdom Onshore Oil and Gas, called for Whitehall to support the development of 360 geothermal plants by 2050. Recognising the role that the DoE has played in boosting geothermal activity and investment in the US, the Arup study calls for government support in a geothermal development incentive and modifications to the UK’s Contracts for Difference scheme.

This support could be key for the industry—and not just in the UK. Although it is very simple in its most basic form, the technical hurdles associated with developing geothermal technologies that can provide power anywhere, forever, are still considerable. The UK is a good example. In contrast to the US, there is no high-temperature region associated with a plate boundary in the UK, nor are there onshore areas with thousands of boreholes from hydrocarbon exploration to de-risk subsurface environments.

Thus, the UK must design techniques to overcome subsurface uncertainties and offer efficient heat transfer via conduction in lower-temperature environments. Away from high-temperature regions, you may have to drill down several kilometres to encounter temperatures hot enough for power generation, which requires at least 100ºC.

Episode 3 of the Energy Transition Now podcast, featuring Julien Perez of the OGCI, now available.

The key to global markets?

To capture the potential of direct heat for electricity generation, advances in heat pump technology, smart wells and superconductive fluids must be made. If developers can overcome these challenges, then that could open up massive new markets since the UK is much more representative of the rest of the world than the US, in terms of its geothermal resource.

Hence UK solutions, when found, could provide a truly global footprint for geothermal beyond ‘hot regions’ or those that have benefited from decades of hydrocarbon exploration. And the UK already appears to be on the cusp of a geothermal revolution. The UDDGP project has been well received by the public, offering encouragement for future endeavours.

Additionally, a number of UK-based pre-pilot companies, including CausewayGT and CeraPhi, have recently emerged, focused on advanced geothermal solutions with direct heat and, possibly, electricity generation. Oil and gas companies looking to diversify into geothermal would be wise to keep an eye on these companies, along with other developments in the UK. Check in with our commercial advisory service to find out if geothermal could be part of your energy transition plans.

The digest: this month’s key headlines

- An International Energy Agency call to cease investment in fossil fuels has met with mixed reactions from world leaders. Don’t miss our own analysis of the Agency’s roadmap.

- The oil and gas sector has faced a day of reckoning in May as Chevron, ExxonMobil and Shell were all forced to embrace tougher action on climate change within 24 hours.

- Many fossil-fuel producing nations will face challenges in embracing the move to low-carbon energy, a Financial Times analysis has found.

- Germany has brought its target date for climate neutrality forward by five years, to 2045.