A paradigm shift is occurring in the offshore energy sector with the recent surge in momentum to achieve net-zero emissions by 2050 having a profound impact on oil & gas company strategies.

European supermajors are at the forefront of this energy transition with the results of February’s UK seabed leasing auction a clear signal of intent. Of the 8GW up for grabs, JVs including European supermajors were awarded 56%.

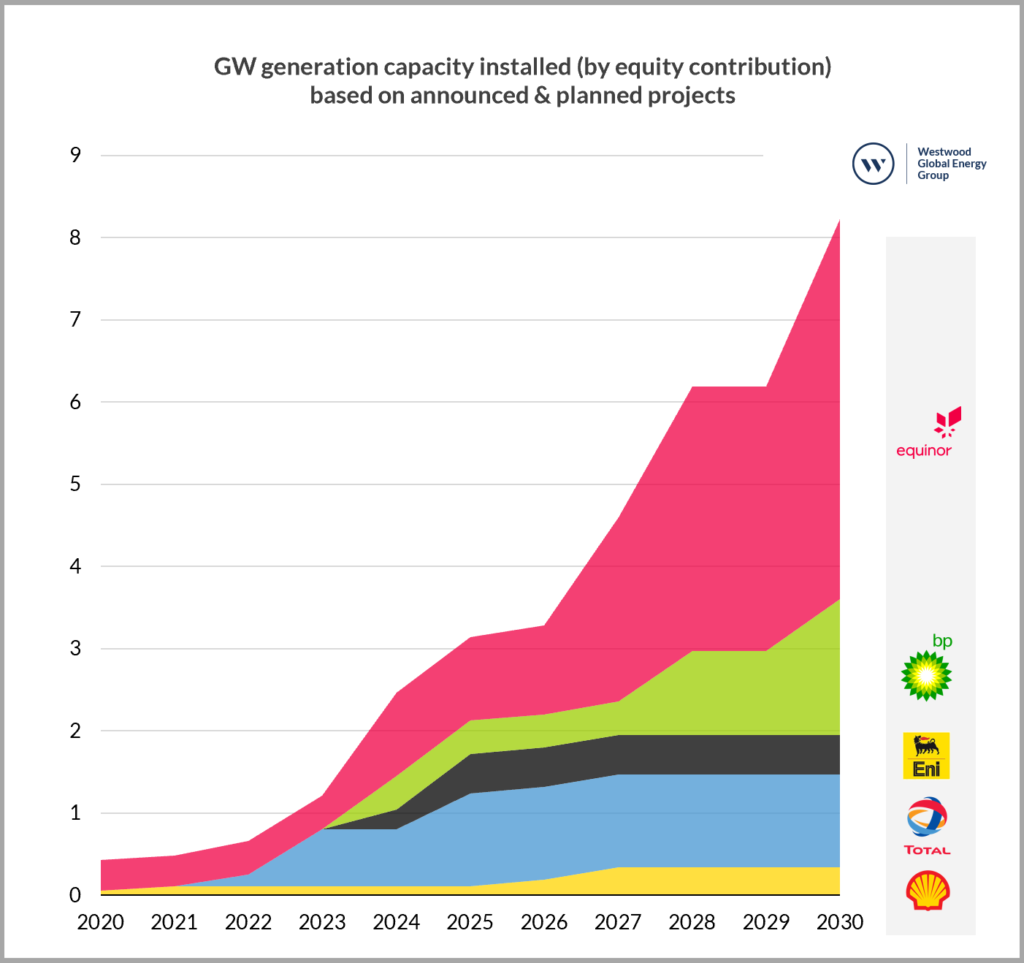

Figure 1: GW generation capacity installed (by equity contribution) based on announced & planned projects

Source: WindLogix

BP, in partnership with German utility EnBW, were a big winner, receiving the rights to 3GW of this new capacity. This was preceded by BP’s first foray into the offshore wind sector, the 50% acquisition of the Empire Wind and Beacon Wind prospects in the USA from Equinor back in September 2020. Combined, the Empire 1, 2 and Beacon Wind 1 could add up to 1.7GW of further generation capacity for BP.

Equinor has arguably led the pack. They entered 2021 with almost 400MW of generation capacity at Sheringham Shoal, Dudgeon & Hywind Scotland off the UK and Arkona offshore Germany. In addition to the US projects being developed with BP, Equinor is also investing heavily in Poland and South Korea with 2.4GW of generation capacity being planned. The Norwegian E&P is also pioneering commercial scale floating wind with the 2019 sanction of the 88MW Hywind Tampen development which will link to the Snorre & Gulfaks oil platforms in the North Sea.

Total has also been busy with the acquisition of a 23% interest from WPD in the 640MW Yunlin development off Taiwan back in April. This move builds on the French E&Ps 51% interest in the up to 1.5GW Seagreen complex off the UK.

Currently, European supermajors are expected to increase their offshore wind generation capacity from around 400MW in 2020 to 8,200MW by 2030. Although this only accounts for 3% of our expected total installed capacity it should be noted that this figure represents only current equity participation with significant potential for upside given the rapid momentum observed over the past 12 months. In particular, all eyes will be on the results of the upcoming ScotWind leasing round with a further 10GW potentially up for grabs and BP & EnBW hoping to enjoy similar levels of success.

Michelle Gomez, Research Manager, WindLogix

[email protected]