On March 24, 2017, Weatherford and Schlumberger announced a proposed joint venture to deliver completions products and services for the development of unconventional plays in the United States and Canada. Going by the name OneStim, the venture will boast one of the largest hydraulic fracturing fleets in the industry, possibly rivaling that of Halliburton.

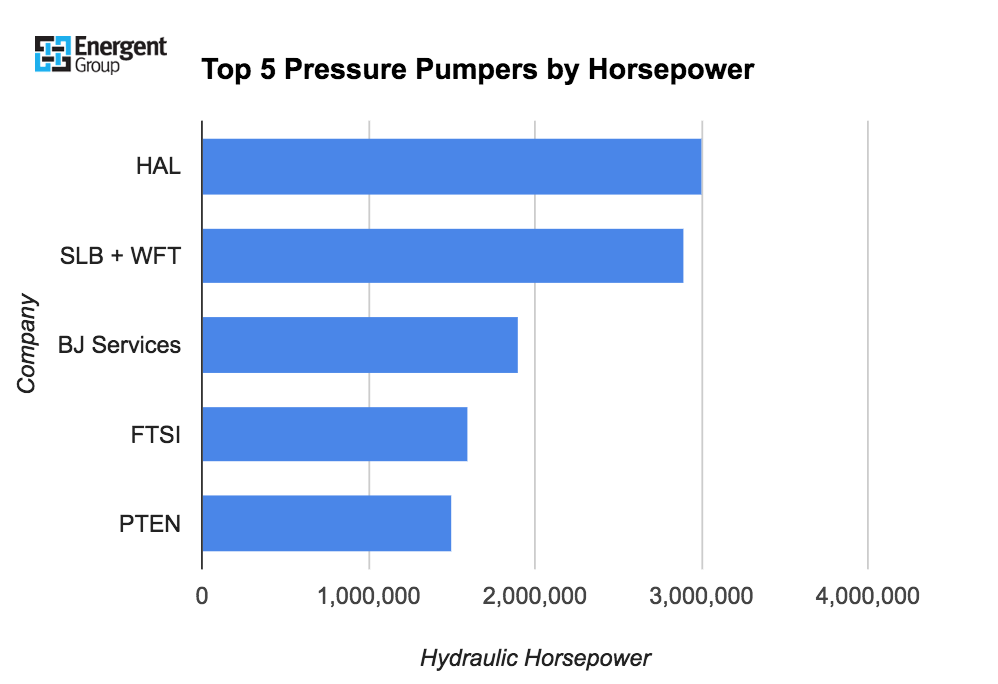

Schlumberger’s hydraulic fracturing fleet currently has 2 million horsepower and Weatherford’s is estimated at 800,000-1 million HHP. The combined horsepower as OneStim exceeds BJ Services’ 1.9 million HHP fleet and approaches that of industry leader Halliburton, whose fleet currently totals 3 million HHP.

Source: Energent Group

Schlumberger and Weatherford will share 70/30 ownership, respectively, in the OneStim venture. Both companies will commit all their North American land hydraulic fracturing pressure pumping assets, multistage completions, and pumpdown perforating businesses. Schlumberger will contribute its surface and downhole technologies, operational processes, and geo-engineered workflows, while Weatherford will supply its multistage completions portfolio, regional manufacturing capacity, and supply chain.

Weatherford had been hit especially hard by the recent industry downturn, announcing in February that it had shut down the last of its frac fleets at the end of 2016. Earlier this year, the company had announced another proposed joint venture, this one with Nabors Industries, for delivering land drilling solutions to the oil and gas land market in the lower 48 states.

Some market analysts are speculating that the Weatherford-Schlumberger JV came about due to increased completion activity, particularly in shale plays, resulting from higher oil prices and improved drilling efficiency.

Halliburton is currently reactivating fleets after having parked a large portion of its equipment over the last two years. The company recently announced that due to the recent surge in drilling activity, it is re-activating twice as much of its fleet this year as originally forecast.

Consolidating a fragmented market – challengers expand HHP footprint

The pressure pumping market is changing dramatically. ProPetro (NYSE: PUMP) is adding 2 more units which are scheduled for delivery in April and June 2017, bringing total to 510,000 HHP. ProPetro is pure play pressure pumper focused on the Permian.

Patterson-UTI (NYSE: PTEN) acquired 77 Energy’s Performance Technologies fleet bringing their total HHP to 1.5 million. Patterson-UTI’s Permian and Marcellus fleets are now combined with the strength of Performance Technologies Mid-Con and Eagle Ford assets.

Meanwhile, Keane (NYSE: FRAC) acquired Rockpile adding 245,000 HHP, 8 wireline trucks, 12 workover rigs, and 10 cement units. For Keane, the Rockpile addition adds geographic coverage in the Bakken and DJ-Niobrara.

Expect the pure play pressure pumping trend to continue. Other regional pressure pumpers include Mammoth Energy Services, Pro Frac, Evolution Well Services, and US Well Services among others.

The OneStim deal is expected to close in the second half of 2017, pending regulatory approval.