New Westwood report reviews the UK’s 1st Carbon Storage Licensing Round results and associated projects and finds that the UK will exceed its CCS targets if all projects maintain proposed timelines. However, further delays, project cancellations or under-delivery risk targets being missed.

UK Carbon Storage Licence Round increases project pipeline

The UK’s 1st Carbon Storage Licence Round opened on 14 June 2022 and by the application deadline of 13 September 2022, a total of 26 bids were received from 19 companies for the 13 areas available. Preliminary results were announced on 18 May 2023 and on 15 September 2023, the North Sea Transition Authority (NSTA) announced the 14 companies that have accepted the 21 awarded licences. Eight of the 21 licences were awarded to single licensees (Spirit Energy, Neptune Energy, Eni and EnQuest), while the remaining 13 licences were awarded to partnerships. By company, Shell was awarded the most licences with five, closely followed by ExxonMobil, Harbour Energy and EnQuest, each with four.

The results of the Round saw both an expansion of existing carbon storage projects as well as adding several new projects. Additional acreage has been awarded to the Acorn, NEP and Viking Track-1 and Track-2 projects, while six of the awarded licences are associated with five storage projects outside of the cluster sequencing process but targeting ambitious timelines:

- Eni was awarded a licence for the Hewett field. The company has long had plans to utilise the Hewett field for carbon storage. The project was originally targeting first injection in 2027, although Westwood now forecasts this to commence in 2029 at the earliest.

- A Perenco and Carbon Catalyst partnership was awarded three licences, which form part the Poseidon and Orion projects, targeting first injection in 2029 and 2031 respectively. Carbon Catalyst has since farmed down equity in its licences to Wintershall Dea and Summit Energy Evolution (SEEL).

- Spirit Energy was awarded a single licence in the East Irish Sea, which contains the Morecambe North and Morecambe South fields. Spirit has announced the gas fields, which are currently forecast to cease production in 2030, could initially store over 5 MTPA, scaling up to 25 MTPA.

- Wintershall Dea and Synergia Energy were jointly awarded a licence in the Southern North Sea (SNS). The licence forms part of the Medway Hub project, targeting first injection in 2032. The project will transport CO2 utilising CO2 carriers, which will offload liquid CO2 onto a Floating Injection, Storage and Offloading (FISO) vessel for subsequent injection into the storage reservoir.

- EnQuest was awarded four licences in the Northern North Sea (NNS). The company has plans to develop a carbon storage project at its Sullom Voe Terminal (SVT) in Shetland. Initial studies indicate a capability within existing infrastructure to support a project of up to 10 MTPA, although there is no indication yet of project timelines.

Elsewhere there were further licences offered, which if they mature into storage projects, will further bolster the project pipeline. Neptune was awarded three licences in the SNS, one of which is in partnership with ExxonMobil, while Shell and ExxonMobil were also awarded three licences in the SNS.

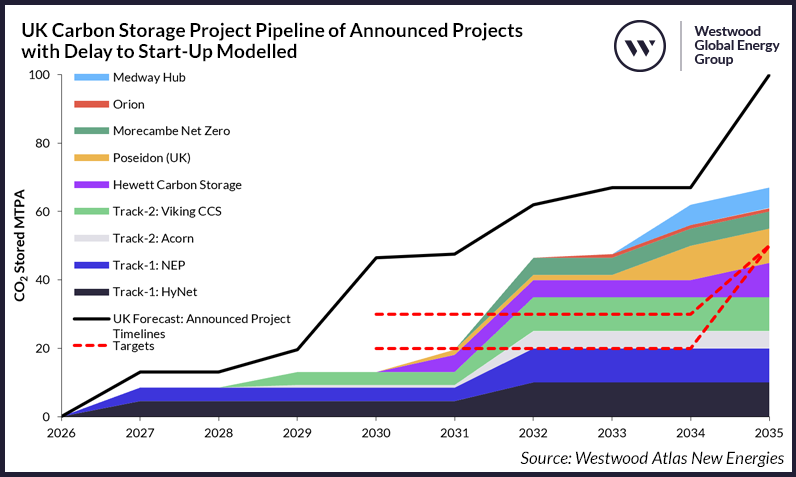

The UK’s target is to capture and store 20-30 million tonnes per annum (MTPA) of CO2 by 2030, increasing to 50 MTPA by 2035. The country’s project pipeline is dominated by the projects of the Track-1 and Track-2 Clusters. The Track-1 Transport and Storage (T&S) projects, HyNet and Northern Endurance Partnership, are now expected to achieve first injection in 2027, despite initially targeting a 2025 start-up. The Track-2 T&S projects, Acorn and Viking CCS, are understood to have both been progressing on Track-1 timelines, despite being Track-2 clusters, and as such could also be online in 2027, although government funding will likely dictate the project timelines.

Westwood forecasts that if all projects can achieve their proposed timelines and secure a source of CO2 to inject, then the UK will have no issues in achieving its 2030 and 2035 targets. Based on reported project schedules and injection rates, the UK could have up to seven carbon storage sites online by 2030, with over 45 MTPA of storage capacity, while the target of 50 MTPA storage capacity by 2035 is more than achievable. Factor in additional projects in the NNS with EnQuest and in the SNS with Neptune, Shell and ExxonMobil, and the project pipeline could exceed 100 MTPA by 2035.

Risks to project schedules

Project targets and reality can often differ. Not every project will progress to a Storage Permit application, some projects will be delayed, while others will under-deliver. Some of the key risks and challenges the industry will face are highlighted below.

Funding timelines: Given the need for financial support for early carbon capture and carbon storage projects, few projects are expected to take FID until funding has been awarded. The UK Government risks becoming a bottleneck in project schedules as it progresses with the Track-1 and Track-2 clusters.

Financial support mechanism: The financial support mechanisms available for projects outside of the Track-1 and Track-2 clusters are currently unknown. Projects are unlikely to continue to invest without clarity on available support.

Storage site appraisal: A storage site may be deemed unsuitable during the appraisal phase and a project may not progress to a Storage Permit application. Many of the projects aiming for early injection are targeting storage complexes in depleted fields. Repurposing hydrocarbon fields is however, not without its challenges, in particular issues associated with legacy wells.

Work programme delays: Across the 21 licences awarded in the Round, there are four firm wells and nine contingent wells, as well as four firm and five contingent 3D seismic data acquisition commitments. The commitments are likely to increase demand for rigs and seismic vessels over the next few years. The increased competition for rigs and seismic vessels will undoubtedly result in some delays and increase companies’ financial burden to execute the work programmes.

Access to CO2: The rate of progress made by carbon capture projects could also impact the construction of associated T&S infrastructure, with operators unwilling to construct T&S systems that have the potential to remain idle for an extended period while awaiting a supply of CO2. Competition for CO2 among T&S systems could also limit project progress. Some projects are likely to be considering importing CO2 from abroad and while bilateral agreements between countries can help circumvent the London Protocol, which prohibits the transfer of CO2 between countries for permanent storage, there is still uncertainty of how the UK Emissions Trading Scheme (ETS) and EU ETS will interact. For instance, whether a UK storage operator will be able to take on liabilities for allowances awarded to an EU ETS emitter.

Co-location challenges: Co-location with offshore production licences, existing carbon storage licences, offshore windfarms, and decommissioning licence holders is expected to have an impact on future operations. It is not yet clear how the CS licences will impact the existing E&P operators still producing or with decommissioning activities within the awarded acreage. The need to share the seabed with the offshore wind industry is also a key consideration, so early engagement and collaboration between licences and leaseholders will be required to ensure it does not lead to delays.

Infrastructure re-use: Companies are looking to re-use existing infrastructure, in particular offshore pipelines. However, the required operating conditions and fluid properties of high-pressure CO2 and the condition of existing pipelines could limit opportunities for potential re-use. Project schedules and economic viability could be hampered if those looking to re-use infrastructure are instead required to install new.

Project delays risk missing carbon storage targets

The risks and challenges identified above could result in delays or cancellations to carbon capture or carbon storage projects. Industry trends suggest the timelines announced by project developers on initial announcement are ambitious and assume no complications during project maturity.

Westwood has modelled the impact of project delays on the current carbon storage project pipeline in the UK to understand how CO2 storage capacity targets can be impacted (Figure 1). A nominal delay of two years for all projects and phases was selected, with the exception of the initial phase of the Track-1 projects. In this scenario, the 2030 target would not be met, highlighting the importance of the Government’s support to ensure the prompt commissioning of projects to reach its own targets.

Figure 1: UK Carbon Storage Project Pipeline of Announced Projects with Delay to Start-Up Modelled. Source: Westwood Atlas New Energies

*Track-1 project – No delay to phase 1, subsequent phases delayed by two years

**All other announced projects delayed by two years

Project delays are not the only risk to the storage targets. Some projects will under-deliver while others may even be cancelled. It is also worth noting the target is to “capture and store”, not to install the infrastructure to store. Any complications with the capture facilities, such as capture rates being less than anticipated, will also hamper the likelihood of targets being met.

Despite the challenges the industry will face, this has been an exciting year for CCS in the UK. The Energy Act 2023 has received Royal Assent, the government has pledged to invest £20 billion over 20 years to scale-up CCS projects across the UK, while the eight carbon capture projects that will progress to the next phase of the Track-1 cluster sequencing process were selected, as were the Track-2 Clusters. The industry has demonstrated its commitment to the sector by the results of the 1st Licensing Round and progress is already being made on the work programmes. The licence commitments demonstrate licensees are willing to invest significantly to securing a licence. The industry is still at an early stage with many challenges to overcome, but the number of licence awards is encouraging and marks a major milestone for the sector. The Round is expected to be the first of many, as the country continues to expand its storage capacity to meet the UK’s net zero needs.

Stuart Leitch, New Energies Research Manager

[email protected]

Catherine Horseman-Wilson, Senior Analyst – NW Europe

[email protected]

Westwood’s 35-page analytical report on the UK’s 1st Carbon Storage Licensing Round includes:

- A detailed review of each carbon storage licence awarded in the UK’s 1st Carbon Storage Licensing Round, including requirements, commitments and intended storage targets

- How each licence relates to the Transport and Storage (T&S) projects in development

- Company analysis and who may have bid in the Round but been unsuccessful

- An overview of the UK CCS industry and how the business models and support mechanism are being proposed

The report is available to all Atlas and Atlas New Energies subscribers. Non-subscribers can complete the form below or contact [email protected] for information on report pricing and access.