- With Brent prices breaching $100 per barrel, the recovery seen in 2021 is set to continue at a stronger rate.

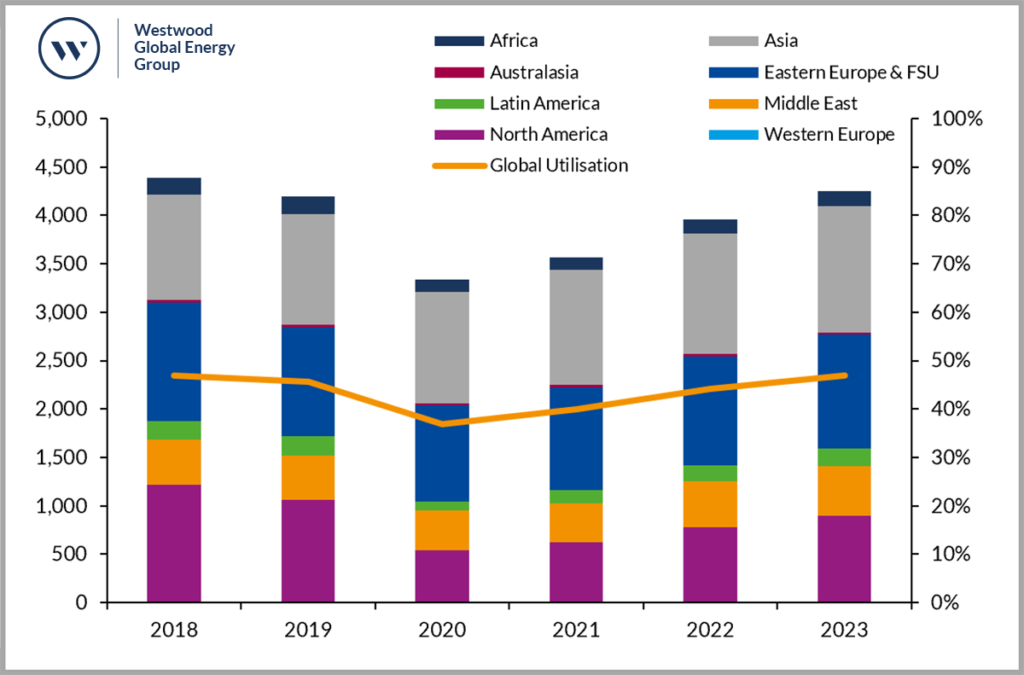

- Globally, 46,700 onshore wells are expected to be drilled in 2022, utilising 3,960 active rigs per day to drill them, 20% higher than 2020 levels.

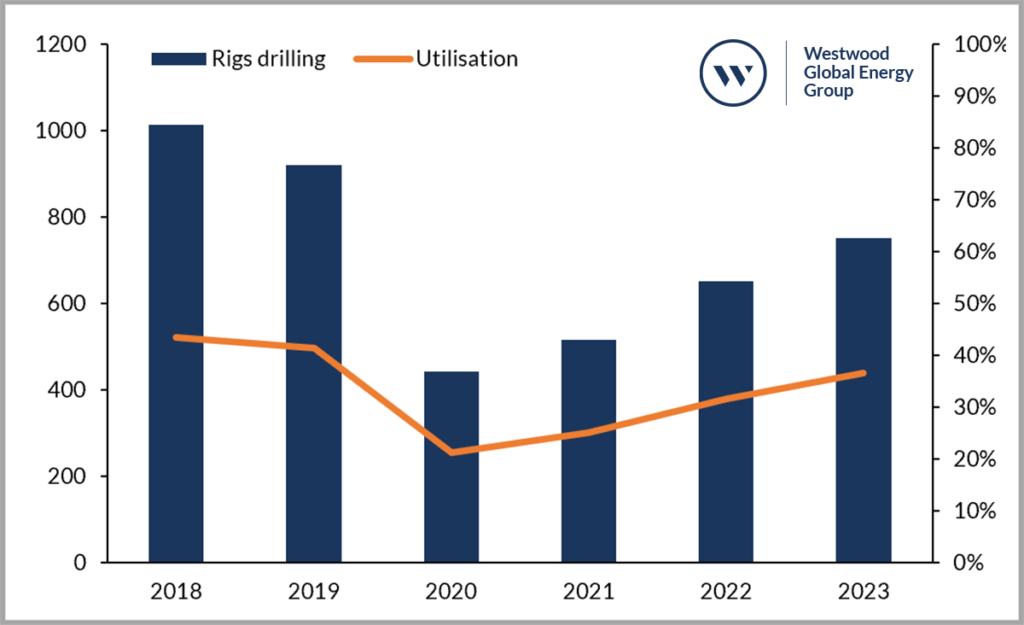

- Increased pricing supports US recovery from nadir of 2020 (440 active rigs) but capital discipline from independent operators is set to keep activity below 2018 levels (650 active rigs 2022, compared to 1,010 in 2018).

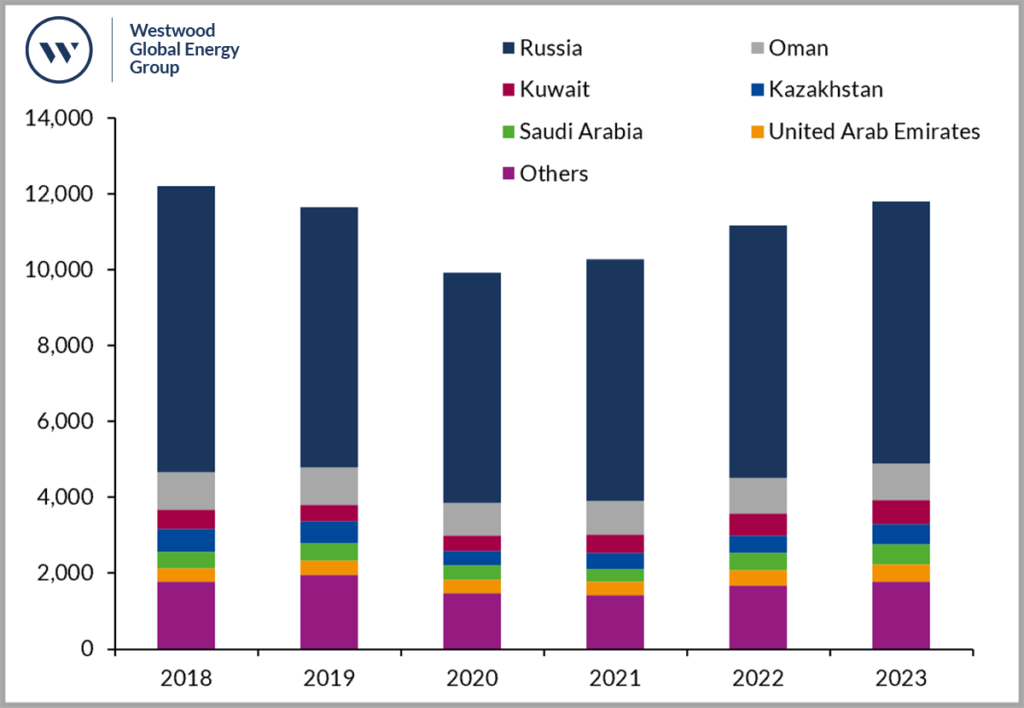

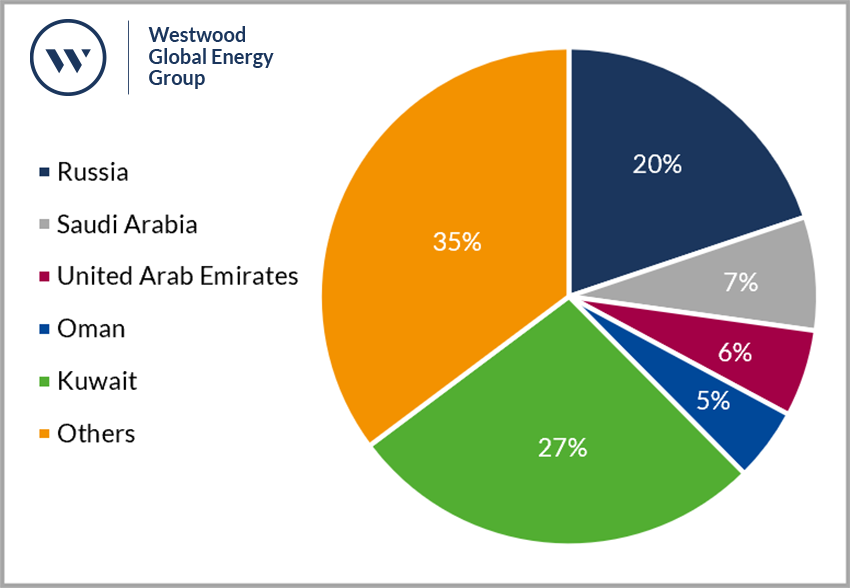

- OPEC+ group, especially Russia and key Middle Eastern members, expected to be a vital driver of rig demand with 23,000 wells to be drilled in 2022-2023.

- Outside of the US and OPEC+, countries with strong NOC involvement in the onshore industry such as Argentina, China and India are expected to see major increases in activity.

Figure. 1: Average Land Rigs drilling by region 2018 – 2023

(LHS: No. Rigs Drilling, RHS: Rig Utilisation)

Source: Westwood Global Land Rigs Platform

At the beginning of January 2022 Brent prices were at $78 a barrel, well above the nadir of 2020 when they reached a low of $9 a barrel. What has been seen since has been well outside of most forecasts, with Brent prices breaching $100 a barrel on the 24th of February 2022 on the back of continued discipline from some OPEC members and an inability to increase production from others, as well as significant uncertainty caused by events in Ukraine. In this Insight, Westwood Global Energy Group (Westwood) looks at how higher commodity pricing could impact the onshore oil and gas industry in 2022 and 2023.

Overall, a growth in activity levels that was already expected in 2022 compared to 2021 is to be somewhat boosted by higher commodity prices with close to 4,000 rigs drilling on average in 2022 compared to an average of 3,450 in 2020 and 2021 overall. Despite this improvement, and the buoyant prices, Westwood does not expect to see a sharp return in global activity but one that is more measured. Areas dominated by NOC’s, such as the Middle East and China are seeing activity return to pre-2020 levels quicker than those dominated by independents. Many operators appear reluctant to substantially increase activities beyond original plans based on a much lower oil price expectations, nowhere is this clearer than in the US.

United States to see steady return in drilling and rig activity

US Independents, which account for more than 50% of shale production, are wary of ramping up activity to levels seen in the past which caused OFS prices to increase to unsustainable levels, instead in recent years they have focused on returning capital to shareholders. Publicly listed players such as Pioneer Natural Resources and Devon Energy have pledged to limit 2022 production increases to no more than 5%, compared to the 20% plus annual growth targets set pre-COVID. A high oil price, coupled with the increased focus on the most productive shale plays mean that they can achieve higher returns without the need to ramp up drilling activity to previous levels where 38,000 wells were drilled a year (average 2000-2014).

Instead, Westwood expects 13,000 wells to be drilled in 2022 and 15,000 in 2023. As a result, the number of rigs drilling in the United States is expected to average 650 in 2022 and 751 in 2023, with the 2023 figure being 70% higher than the nadir of the latest downturn in 2020 but still substantially below the figures seen in 2018 and 2019. Some smaller companies have already increased their 2022 rig guidance versus their 2021 average, such as Matador increasing from 4 to 6 rigs; while many of the larger E&Ps intend to have similar rig counts in 2022 versus 2021, such as Pioneer who intends to run 23 rigs in 2022, the same as it did in 2021.

Figure 2: Average Land Rigs drilling in US and utilisation 2018 – 2023

(LHS: Rigs Drilling, RHS: Rig Utilisation)

Source: Westwood Global Land Rigs Platform

Sustained high commodity prices will be a true test of discipline for E&Ps who have linked any increase in their drilling and completion (D&C) activity to changes in market fundamentals. Targets such as a return to pre-COVID demand levels and diminished OPEC+ spare production capacity have been key targets for companies such as EOG and Devon Energy. Even if these criteria are met, several factors could limit E&Ps’ ability to effectively increase their production.

According to data from Westwood, frac fleet hydraulic horsepower (HHP) utilization has approached very high levels in the US at 82% in 2021 Q4, including nearly 90% in the Permian. The high HHP utilization is being exacerbated by backlogs in Tier 4 dynamic gas blending (DGB) engines, which are sought after by E&Ps for their reduced emissions and fuel savings (due to their ability to displace 80% of diesel with natural gas compared to their non-DGB diesel counterparts).

To meet a sudden increase in HHP demand, pressure pumpers would need to spend millions of dollars per fleet on their legacy diesel Tier 2 fleets. That is a cost which may be unjustifiable given that many pressure pumpers would prefer long-term contracts to re-activate fleets. Without such commitments, pressure pumpers will instead seek to hold steady their number of deployed crews in 2022.

In the Appalachia basin region, takeaway capacity may limit E&Ps’ ability to increase their D&C activity. Since 2020, nearly 2.8Bcf/day of potential takeaway capacity has been removed through the cancellation of the Atlantic Coast and PennEast pipelines. Delays in the Mountain Valley Pipeline construction have kept 2Bcf/day of takeaway capacity from being utilized.

During EQT’s 2021 Q4 earnings conference call, CEO Toby Rice estimated that nearly 8Bcf/day of takeaway capacity remains unrealized due to either cancellations or delays in the Appalachia basin region. That unrealized takeaway capacity is equivalent to 7.6% of the EIA’s projected 2022 marketed natural gas production in the US.

As a result of these factors Westwood expects the steady growth picture for the US to remain the most likely scenario, regardless of the current boom in oil prices.

Mixed picture outside the US

Outside of the US, one of the key areas to look at is OPEC+ countries where a general trend emerges among many of the key players. For most, the decline in onshore drilling activity caused by the pandemic was more muted compared to elsewhere (15% drop in 2020 wells drilled on 2019, compared to a 51% drop in the US) and as a result, the growth is not expected to be as pronounced as the US but, unlike the US, overall activity is expected to return to 2018 levels by 2023 and grow strongly from there.

Figure 3: Number of wells drilled by OPEC+ members 2018 – 2023

(LHS: Wells Drilled)

Source: Westwood Global Land Rigs Platform

The OPEC+ group has refused calls to accelerate planned production increases, with some countries even struggling to reach their increased allowances over the last few months. The group is sticking to a gradual output increase through to September 2022 where, should oil prices remain buoyant, they will come to an end. Russia, the second largest producer of OPEC+ is likely to ramp up drilling activity quickly and has plans for development of major gas and condensate plays, including those in the Yamal Peninsula announced earlier this month.

However, one key feature of the oil and gas industries in many of the countries that make up the OPEC+ block is the long-term contracts and development plans that characterise them. Even before the current boom in oil prices, major OFS companies such as Haliburton and Schlumberger were planning to increase their focus on the MENA region. This was a result of the clear plans for capacity output increases there and the potential for long term contracts, rather than short-cycle work in the US lower 48. Due to the long term nature of these plans, while we expect to see substantial increases in drilling, this is in line with already announced development plans and long-term goals, with the current oil prices acting as further justification for these plans, rather than the key drivers of them. The long-term nature of these plans also means that while activity is expected to increase across 2022 and 2023 it will likely be at a steady rate whilst existing infrastructure is upgraded and new infrastructure is constructed, before seeing a stronger ramp up in drilling activity later in the 2020’s. As a result, 2023 activity levels are not expected to exceed that of 2018.

Key OPEC countries such as Iraq, Saudi Arabia, and the United Arab Emirates all have production capacity expansion plans in place for crude oil, as well as substantial increases in their gas outputs. Abu Dhabi National Oil Company (ADNOC) has been investing heavily over the past year in a bid to increase crude oil production capacity to 5 mmbpd by 2030 and invest in natural gas production to allow for LNG exports such as the 9.6 mmtpa facility in Fujairah. These investments have seen ADNOC award over $10 billion worth of contracts to rig contractors and OFS companies. The awards will support ADNOC’s requirement to drill thousands of new wells to expand its production capacity and continue progress towards its 2030 goal. Similarly, Iraq has ambitious plans to raise production capacity to 8 mmbpd by 2027 which will spur increased drilling activity even if they do fall short of the target. While Saudi Arabia’s long term 13 mmbpd target, as well as its development of unconventional gas at sites such as Jafurah should spur activity there. Overall, Westwood expects OPEC+ members to drill a total of 11,800 wells in 2023, up 19% on the nadir of 2020 but still 3% lower than 2018.

Figure 4: Land rig demand by OPEC+ members 2022 – 2023

Source: Westwood Global Land Rigs Platform

Outside of the OPEC+ group there are several countries that will see the improved oil price as justification and incentive to keep pushing ambitious drilling programmes. This includes China and India where high oil prices, coupled with a heavy reliance on crude oil imports, gives plans to increase domestic production extra incentive helping to spur activity there.

Another country likely to benefit heavily from the improved pricing is Argentina. In January, the country experienced its highest oil production in over a decade with rates averaging 570,000 bpd, aided by record output from its shale fields. Shale oil production accounted for nearly 40% of production in January totalling 224,000 bpd, a 61% jump from the previous year. This is largely due to the large Vaca Muerta shale deposit in the Neuquen province. The Vaca Muerta shale play will be key for plans to export 100,000 bopd via the Argentina-Chile pipeline, due to come onstream in 2022. The pipeline has been refurbished after 16 years of disuse following steep production decline in Argentina in 2006.

Overall, Westwood expects to see a total of 47,000 wells drilled onshore in 2022 with the number of rigs drilling reaching close to 4,000 at a slightly more accelerated rate than was expected before the recent surge in oil prices. However, a return to the levels of global activity seen when oil prices were over $100 in the past is unlikely unless this is a long-term return to such levels. Otherwise, the rate of drilling activity is expected to be close to that seen since 2016 for the foreseeable future as operators maintain capital discipline. NOCs, somewhat removed from the pressures of shareholder returns, are likely to be major beneficiaries of the higher oil prices which will help to support ambitious development plans in countries such as Argentina, Saudi Arabia and United Arab Emirates.

Ben Wilby, Senior Analyst

[email protected]

Todd Jensen, Analyst

[email protected]

Luke Smith, Analyst

[email protected]