After a turbulent 2020 for the oil and gas industry, 2021 is expected to see a modest rise in investment in the UK and Norway offshore sectors, assuming a US$50 per barrel average oil price. Exploration activity could recover to 2019 levels and investment in new developments is set to increase. The M&A market is not expected to be buoyant, but there are plenty of assets for sale and deals to be done. The Energy Transition is high on the agenda as E&P companies and governments begin to implement net zero carbon projects.

Production and Field Developments

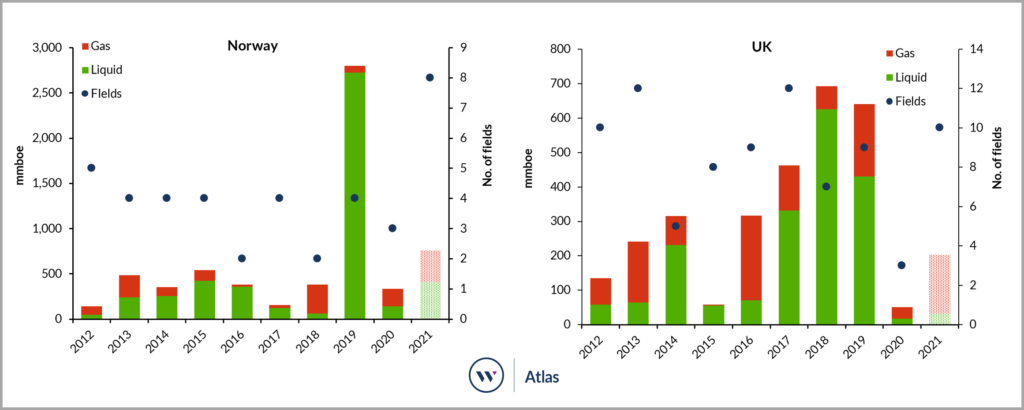

UKCS production is expected to decline slightly in 2021 to 1.64 million boepd. This is due to operators deferring maintenance work such as the Forties Pipeline System, but there were also only three small fields brought onstream in 2020. 2021 should see more development activity with 10 fields expected to be brought onstream with reserves of c. 200 mmboe (Figure 1) and 15 fields progressing towards project sanction with reserves of c. 375 mmboe. If all of these developments progress as planned, then production could increase to 1.71 million boepd in 2022.

UKCS oil and gas capital expenditure on field development in 2021 is estimated at US$4.0 billion, up from US$3.8 billion in 2020. The increase is largely due to the deferral of work from 2020 to 2021, such as the completion of the Tolmount and Finlaggan projects, and a ramp-up of development activity. Producing assets are expected to account for 57% of capex, fields under development for 27% and the remaining 15% is associated with fields that are expected to be sanctioned in 2021. Thirty-three UKCS companies are expected to spend US$1.5 billion on decommissioning 29 hubs in 2021. Shell, ExxonMobil, Repsol Sinopec, Premier Oil and TAQA are expected to account for c. 50% of this total.

In Norway, Westwood expects production of 4.18 million boepd in 2021, which is forecast to increase further in 2022 as field start-ups ramp-up to full production. Eight greenfield projects are planned to be brought onstream in 2021 with combined reserves of c. 760 mmboe (Figure 1). If all of these go ahead as scheduled, then 2021 would see the highest number of field start-ups ever recorded on the NCS in a single year. Five field developments could be sanctioned in 2021, with combined resources of c. 295 mmboe.

Westwood forecasts capital expenditure on field development activity in Norway to increase marginally from US$14.3 billion in 2020 to c. US$14.8 billion in 2021. Around 75% of capex will be spent in the North Sea, 15% in the Norwegian Sea and 10% in the Barents Sea. Approximately 80% of 2021 capex commitments is on producing assets and 20% on fields under development and new project sanctions. This does not include upside from the large pool of potentially commercial discoveries, some of which could be brought forward under the temporary tax incentives introduced by the Government in 2020.

Figure 1: Reserves and number of UK and Norway fields brought onstream by year, including 2021 expected start-ups.

Source: Westwood Atlas

Exploration

Exploration was hit hard in 2020, especially in the UK where activity was down by 70% on pre-crash expectations. Norway fared better, but activity was still lower as companies cut costs and deferred wells. Exploration in both the UK and Norway performed well. In total, 26 exploration wells are expected to complete in Norway and five in the UK, resulting in 10 commercial discoveries in Norway and two in the UK, delivering c. 500 mmboe of discovered resource.

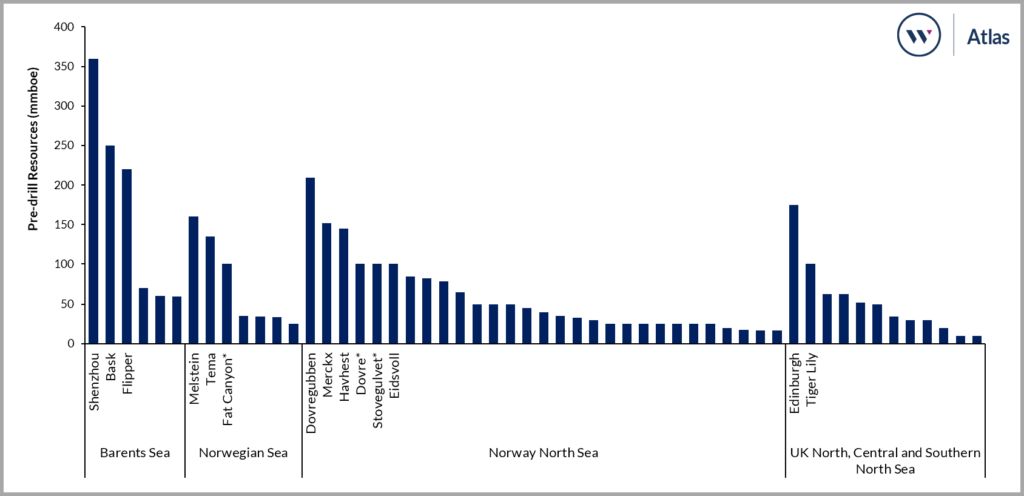

Preliminary forecasts based on company plans suggest a recovery in activity in 2021 for both the UK and Norway. More than 50 exploration wells could be drilled in 2021 across the two countries, targeting unrisked pre-drill resources of close to 4 billion boe. 2021 is also expected to see a return to high impact drilling with 15 prospects targeting resources greater than 100 mmboe, including 13 in Norway and two in the UK (Figure 2).

In the UK, 17 companies are expected to participate in exploration drilling in 2021, targeting total unrisked resources of c. 640 mmboe. Shell is the only company targeting net resources in excess of 100 mmboe, as a result of its participation in five exploration wells.

In Norway, 42 prospects have been identified that could be drilled in 2021 with a total unrisked resource of c. 3.2 billion boe. Equinor should be the most active explorer in 2021, participating in around 15 exploration wells and targeting c. 485 mmboe of net pre-drill resources. Lundin Energy is targeting the most net pre-drill resources with c. 570 mmboe, whilst Neptune, Aker BP, Sval Energi and Petoro are all targeting over 200 mmboe.

Figure 2: Pre-drill resources for prospects currently on Westwood’s list of 2021 drilling candidates for the UK and Norway (only high impact wells are labelled).

Source: Westwood Atlas

*Resources are a Westwood estimate based on prospect analogues in the absence of published resources

M&A Activity

The events of 2020 have resulted in several sales being renegotiated, cancelled or postponed. The M&A market is not expected to be especially buoyant in either the UK or Norway in 2021 but there are deals to be done with a huge range of assets known to be for sale.

ExxonMobil’s divestment of its non-operated interests in its Northern North Sea and Central North Sea assets will be a key deal to watch in the UK. The package of 24 fields holds 127 mmboe in remaining reserves (at 1 January 2020) and 2020 forecast production of c. 38,600 boepd. The closing date for bids was 28 October 2020.

In recent years there has been an upsurge of private equity investment in both the UK and Norway and many of the PE backed companies are looking for an exit route, be it through an IPO or new ownership. Chrysaor has listed itself via a reverse takeover of Premier Oil which will complete in 2021 when the company will be renamed Harbour Energy. Wintershall DEA and Neptune Energy are positioning themselves for IPOs, Spirit Energy owners Centrica and Bayerngas have initiated sales processes for their respective shares in the company and PE backed ventures such as Zennor Petroleum and Siccar Point are being marketed. Finding buyers will be more challenging as investors increasingly shy away from oil and gas as part of the increasing focus on the Energy Transition.

Energy Transition

Energy Transition and Net Zero ambitions will remain firmly on the agenda in 2021 for governments, regulators and industry. In the UK, the long-awaited Energy White Paper was published in December which sets out how the energy sector can decarbonise in order to achieve the 2050 net zero carbon target. For the oil and gas industry, this includes a review of the offshore licensing regime and aims to transform the sector through tighter emissions regulations, carbon capture, utilisation and storage (CCUS) projects, support for diversification into renewables and hydrogen production.

2021 will see oil and gas companies continue to implement projects to reduce emissions, such as the Utsira High project, which will power 10 fields in Norway.

Several offshore wind projects will reach key milestones in 2021. The EDPR led Moray East and RWE Triton Knoll wind farms are expected to deliver first power to shore in early 2021, delivering an extra 950 MW and 857 MW capacity respectively. The third phase of the Equinor and SSE 1,200 MW Dogger Bank C and the 1,400 MW RWE Sofia wind farm developments are both expected to receive final investment decisions in 2021. In Norway, the Hywind Tampen floating wind project, which is set to provide 88 MW of electricity for the Snorre and Gullfaks hubs, is progressing ahead of start up in 2022.

Green hydrogen projects at Humber H2H Saltend and Liverpool Bay HyNet are moving towards sanction in 2022 – 2023, and in Norway the first hydrogen fuelled ferry route is set to begin service as part of the Pilot-E Hellesylt Hydrogen Hub project.

The Longship CCS project, which the Norwegian Government launched in September and secured funding in December, is expected to receive approval for its Northern Lights pilot CO2 injection project. In the UK, the Acorn CCS project hopes to reach a final investment decision in late 2021, and the BP-led Northern Endurance Partnership, which aims to capture CO2 emissions from the proposed Net Zero Teesside and Zero Carbon Humber Schemes, is expected to enter its FEED phase.

In summary, 2021 looks to be a year of modest recovery in upstream capital investment whilst investment in ‘net zero’ projects offshore continues to accelerate.

Emma Cruickshank, Head of NW Europe

[email protected]