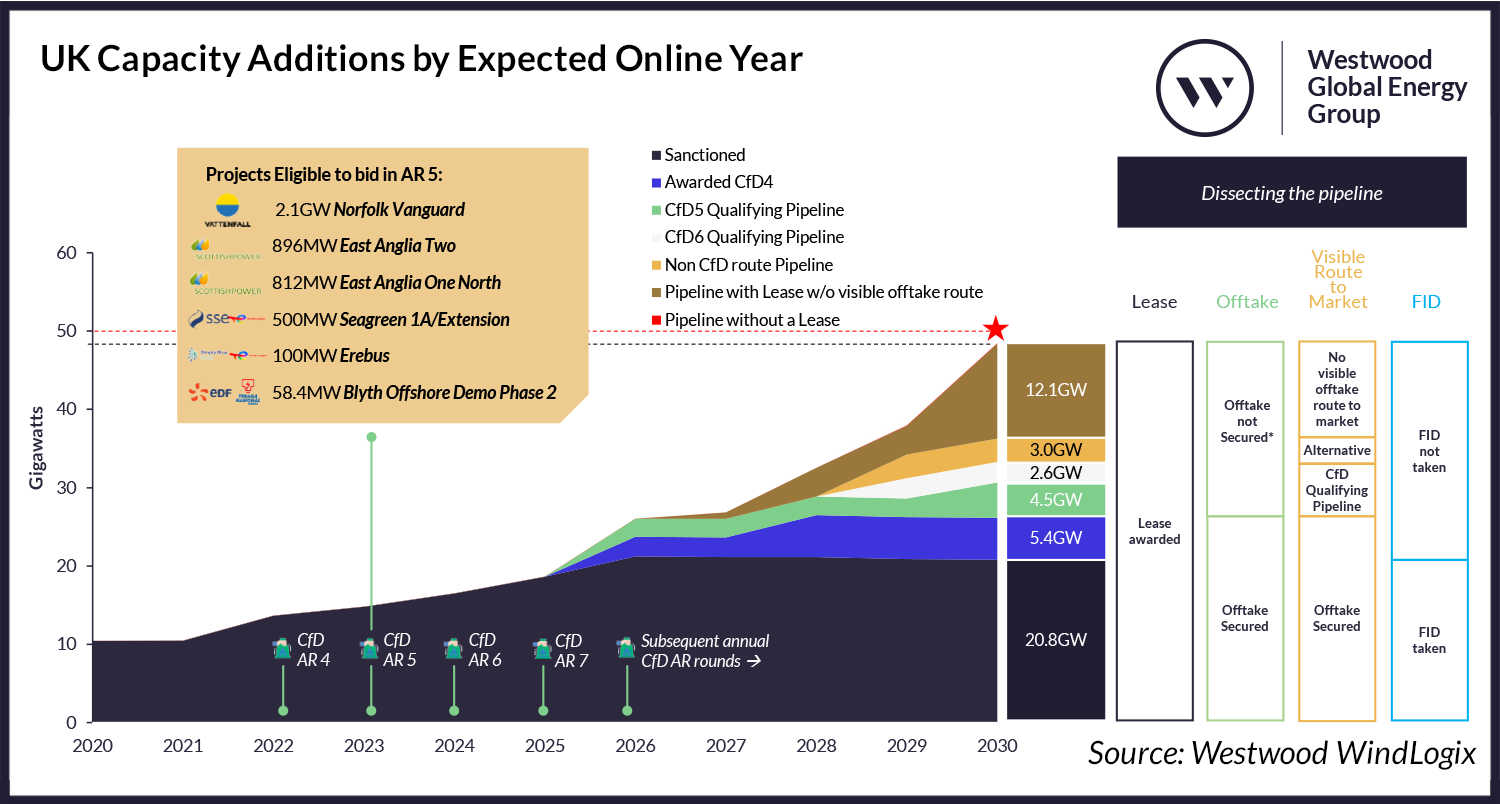

Westwood’s current outlook for the UK’s 2030 installed base for the offshore wind sector stands at 48.4GW. This suggests that the UK will only fall slightly short of its ambitious 50GW 2030 target. But before we pop the champagne at what ought to feel like a celebration, a review of the pipeline leading up to 2030 reveals potential risks that could result in a shift in our outlook.

UK Capacity Additions by Expected Online Year

Source: Westwood WindLogix

Securing a Contract for Difference (CfD) in prior allocation rounds does not necessarily equate to a project FID. In 2022, just under 8GW of capacity secured a CfD in Allocation Round (AR) 4, and most industry observers were anticipating business as usual, with a natural progression towards an FID being taken. But this changed when the market was hit by news that effectively saw the UK’s 2030 pipeline drop by 1.7GW overnight. On 20 July 2023, Vattenfall announced that it would be suspending its 1.7GW Norfolk Boreas development indefinitely, quoting “challenging market conditions” and that “financial frameworks had not adapted to current market conditions”. The stalling of Norfolk Boreas means that of the original near 8GW, only 6.2GW of projects which received a CfD in AR 4 remain. A total of 5.3GW of this has yet to take FID, and on the surface are on track to do so. Albeit Orsted warned in March 2023 that its 2.8GW Hornsea Project Three wind farm was “at risk” due to increasing interest rates and supply chain costs. However, Orsted recently stated in its 2023 2Q Earnings Call that “we continue to progress our Hornsea 3 project towards FID before year end”.

Whilst 4.5GW worth of projects are eligible to compete in the ongoing CfD AR 5, their participation and allocation is not certain. In AR 5, for the first time, fixed bottom offshore wind projects are set to compete against other established technologies such as solar and onshore wind. The 100MW Erebus development and 58.4MW Blyth Offshore Demonstration Phase 2 may compete in the emerging technologies pot While historically the CfD rounds have seen a reduction in strike price, and the government is expecting a further 4% reduction in the strike price for fixed offshore wind as well a reduction of 5% for floating wind, the industry is faced with rising costs of up to 40%. The general market consensus is that the CfD strike price does not reflect the current market environment and additional support should be provided. Without such support, projects may simply not move ahead or need to find other routes to market, running the risk of shifting overall project timelines to the right; or worse.

Planning delays are not uncommon to the UK offshore wind jurisdiction and therefore present an element of unpredictability. Delving further into our data, the only project that is currently eligible to compete in CfD AR 6 is the 2.6GW Hornsea Project Four. Originally intending to compete in AR 5, this project has been a victim of the UK’s cumbersome planning process, given a delay in the consent decision. Other projects such as the 812MW East Anglia One North and 896MW East Anglia Two wind farms have faced the same plight and are now having to compete in AR 5 (instead of AR 4). Projects are eligible to compete once they have received their planning consents.

The next few CfD rounds will be extremely critical in deciding the UK’s fate and the achievability of its 2030 offshore wind target. Westwood estimates that 25% of our 2030 forecast capacity (12.1GW) do not currently have a visible offtake route to market defined at this point, and will likely contend for subsequent CfD rounds, particularly 6 and 7, which are expected in 2024 and 2025 respectively. Should they fail to secure offtake over the next two years, the compressed construction timeline may put them at risk of coming online post 2030, based on an average of five years for a project to become operational after receiving a CfD.

Perhaps offering a beacon of hope in the UK market is the (rising) concept of alternative routes to market that can and are increasingly considered by developers. BP recently stated that it may “opt out” of obtaining a CfD for its 3GW worth of projects (Morgan and Mona) by exploring the option of using the power generated by the two wind farms for its electric vehicle charging stations and its UK green hydrogen projects. These are perhaps the first commercial projects in the UK which may exclude themselves from a process that has traditionally been necessary in progressing towards an FID.

With AR 5 results imminent, this round will be crucial in setting the landscape for the future of the UK’s offshore wind sector. If all eligible projects are able to obtain offtakes at a sustainable price that will allow them to move towards an FID, then this will be a step in the right direction for the country to meet is 2030 target.

Bahzad Ayoub, Senior Analyst – Offshore Wind

[email protected]