Introduction

Onshore rig demand continued to be high in numerous regions across the globe in the fourth quarter of 2022, with utilisation reaching over 70% in some countries in the Gulf Cooperation Council (GCC). Global utilisation meanwhile averaged 45%, an increase on the 39% utilisation recorded during the height of the pandemic but below the 50% average seen in 2018 and 2019, indicating that the market is still in the early years of a multi-year recovery. Rig demand in 4Q 2022 was driven by elevated commodity prices (oil prices averaged over $85/bbl in 4Q), the continuation of higher global energy demand, ongoing sanctions on Russia, and a strict adherence to output agreements from OPEC+ members.

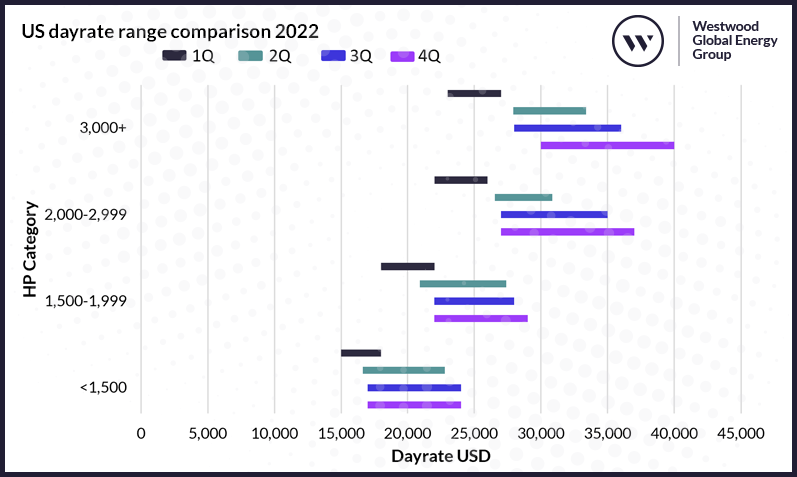

US dayrate range comparison 2022

Source: Global Land Rigs, Westwood Analysis

The improvement in activity levels reaped benefits for rig contractors in high demand regions, especially those in the US where drilling contracts are usually short term, leading dayrates to rise rapidly throughout the year. Tier 1 rigs in particular are in extremely high demand, leading to front-end dayrates reaching up to $40,000 per day and causing several contractors to upgrade existing rigs to meet this demand. Nabors for example expects its entire 111 strong high-spec rig fleet to be deployed by the end of 2023. However, Nabors still has 40+ M550 units stacked and reportedly has no plans to upgrade any to high-spec rigs with upgrades costing $13-15 million per rig. If we look at other regions such as the GCC or Latin America we see much less fluctuation in dayrates; this is due to the longer rig contracts typical in the regions, which tend to run for at least five years.

GCC continues push with major contracts awarded

Despite continued OPEC+ production cuts stymying production output, GCC continues to lead the way in contract awards for development projects. Saudi Arabia, the United Arab Emirates (UAE), Kuwait, and Oman have all tendered or awarded significant contracts during 4Q 2022. Saudi Arabia and the UAE are both investing heavily to reach production capacity targets of 13 mmbbl/d (by 2027) and 5 mmbbl/d (by 2030) respectively. However, during November 2022, ADNOC announced plans to bring forward this target to 2027 in order to meet rising global energy demand.

Strong regional demand is drawing interest from both domestic and international rig contractors. In November, ADNOC Drilling announced plans to expand into the GCC, beyond their current operating base of the UAE. Abdulrahman Al Seiari, CEO of ADNOC Drilling said, ‘The aim of any potential mergers and acquisition activity or stake purchases would be to expand into the Gulf region first.’ Mr Al Seiari also stated that ADNOC Drilling will be focusing efforts onshore for 2023 and is in the early stages of discussions about the manufacturing of oil and gas equipment.

During 4Q 2022, ADNOC awarded $4 billion worth of contracts for drilling-related services and equipment including framework agreements to ADNOC Drilling, SLB, and Halliburton. The agreements cover onshore and offshore fields and run for five years with an optional two-year extension. Petrofac will also be resuming operations in Abu Dhabi after being awarded an EPC contract to design and install facilities, optimising ADNOC’s operations and reducing emissions at the Habshan Complex. Taking these contracts into account ADNOC Drilling has secured $8.85 billion worth of contracts in 2022. ADNOC’s ambitions were also highlighted when it signed an agreement with Petronas for the first unconventional oil block in Abu Dhabi. Petronas will hold 100% operated interest in the 2,000 sqkm permit in Al Dhafra. The permit has a six-year exploration and appraisal agreement, which will be followed by a 30-year production concession term, in which ADNOC will have the option to hold a 50% stake.

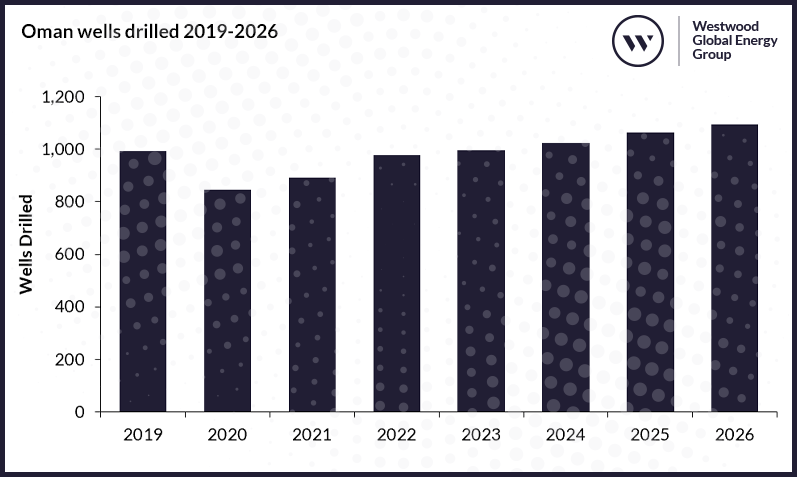

Weatherford continued its strong relationship with Petroleum Development Oman (PDO) with the award of a five-year integrated drilling services contract worth more than $500 million. Weatherford will deliver over 700 wells in the Marmul and Grater Saqar fields. Petrofac also had success in Oman, being awarded three engineering and procurement service (EPS) contracts by Shell for its Block 10 operations. One contract covers the Mabrouk Phase-2 Project with the other two lined up to complete Phase 1B of the Block 10 development. The Mabrouk Phase-2 Project contract scope covers well pads, remote manifold stations, connecting pipelines and a field operation base.

Oman wells drilled 2019-2026

Source: Global Land Rigs, Westwood Analysis

Kuwait is also targeting production capacity increases up from a current value of 3.15 mmbbl/d to 4.75 mmbbl/d by 2040. While Westwood believes this ambitious target is likely to be missed, it highlights a desire from the government to increase their investment into the country’s oil and gas industry, leading to increased rig demand, especially for high-spec units. For example, in this quarter Kuwait Drilling Company agreed a deal with rig manufacturer Honghua Group, to supply an undisclosed number of land rigs in a deal worth $60 million. The rigs, which will be 3,000 HP, incorporating direct top drives, five-cylinder slush pumps and iron roughnecks, will be utilised to drill ultra-deep wells to depths up to 9,000 metres.

M&A activity remains strong with US leading the way

The US has dominated M&A activity over the past year with an array of big deals being completed and this trend continued in 4Q. Below Westwood outlines some of the key deals carried out.

Diamondback Energy announced back-to-back acquisitions in October and November acquiring Firebird Energy and Lario Permian in deals worth $1.6 billion and $1.5 billion respectively. The deals added a combined 100,000 gross acres to Diamondback’s portfolio. The Lario Permian deal is expected to be completed on 31 January 2023 and will see Diamondback reduce the rig count on the acreage from two rigs to just one or less.

Marathon Oil also made a splash in the M&A market completing the acquisition of Ensign Natural Resources for $3 billion on 29 December 2022. The deal added 130,000 net acres to Marathon Oil’s portfolio in the Eagle Ford basin. Marathon plans to maintain production of 67,000 boepd with the drilling of 35-40 wells utilising just one rig.

TotalEnergies agreed to sell its Kazakh affiliate Total E&P Dunga, to Oriental Sunrise, a locally owned company owned by Bauyrzhan Bisembayev and Zhan Makatov, two of Kazakhstan’s top oil magnates. The deal, worth $330 million, will see Oriental Sunrise acquire a 60% operating interest in the Dunga onshore heavy oil development in the Mangistau region. The transaction requires approval from the authorities of Kazakhstan and the waiver of the partners’ pre-emption rights. Other shareholders in the oilfield are Oman Oil and Partex Oil & Gas who both hold 20% interest.

This strong M&A activity looks to continue into 2023 with Eni reportedly showing interest in acquiring Neptune Energy in a potential deal worth up to $6 billion. No official offer has been made to date. Neptune produces 130,000 boepd, 75% of which is understood to be natural gas, from fields across several European and North African countries as well as Indonesia, where it has operations with Eni.

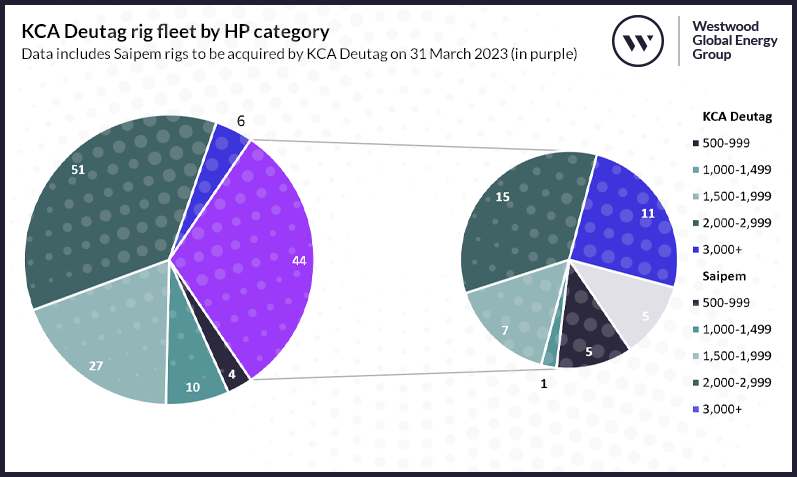

In the drilling rig market, KCA Deutag will be looking forward to completing the second stage of its acquisition of Saipem’s onshore rig fleet, having completed the acquisition of the Middle East based rigs (excluding Kuwait) on 31 October 2022. The remaining rigs located in the Americas, Kuwait, Kazakhstan, and Romania are due to be transferred on 31 March 2023. Phase 1 saw 33 rigs added to KCA Deutag’s fleet, with a further 42 rigs coming in the second phase. This will take KCA Deutag’s onshore fleet up to 142 units.

KCA Deutag rig fleet by HP category

Data includes Saipem rigs to be acquired by KCA Deutag on 31 March 2023 (in purple)

Source: Global Land Rigs, Westwood Analysis

Mainland China continues push for energy security

As with many countries across the globe, Mainland China (MC) is investing heavily in securing its energy future and independence. Sinopec and PetroChina continue to lead the way in unconventional gas exploration activity, as well as planning the development of some key discoveries over the coming years. The Ministry of Natural Resources believes MC holds 21.8 tcm of recoverable shale gas resources and is looking to increase proven in-place shale gas reserves to 6.5 tcm by 2025.

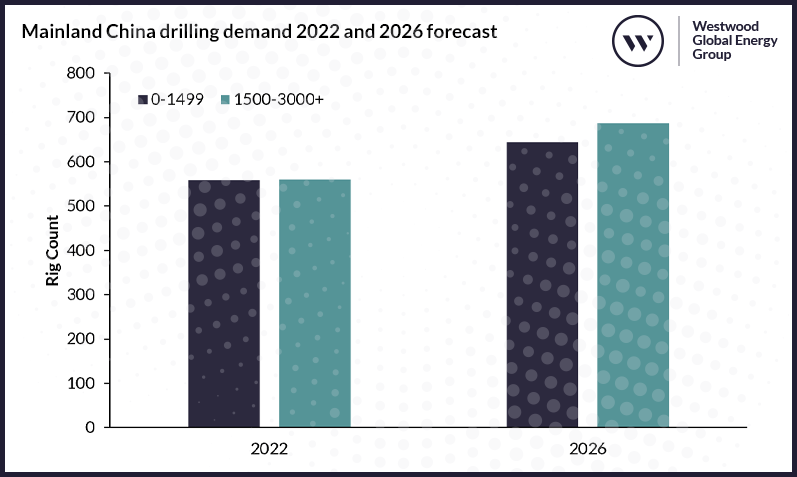

Sinopec was an exemplar of this plan, building on its success in 3Q 2022 by making significant discoveries in the Sichuan Basin. In October they announced a shale gas discovery at the Jinshi-103 well, drilled to a depth of 3,920 metres, with flowrates of 258,600 cubic metres of gas per day and reserves of 387.8 bcm. This was followed by a 145.9 bcm shale gas discovery in late November at the Qijiang shale gas field. Due to the nature of drilling in deep complex geology, high horsepower (>1,500 HP), high-spec rigs are expected to increase in demand in MC over the coming years with Westwood forecasting 23% more high HP rigs drilling in 2026 compared to 2022.

Mainland China drilling demand 2022 and 2026 forecast

Source: Global Land Rigs, Westwood Analysis

A prime example of the type of drilling required in MC came in late December 2022 when Sinopec had a breakthrough in its “Project Deep Earth,” when the 8,866 metre TVD, Yuanshen-1 well reached the deepest oil and gas formation in burial depth in the Sichuan Basin and further shows the great potential of deep ancient carbonate rocks in the region.

Early in 4Q 2022, PetroChina put out a tender for 164 shale fracking trucks as part of its plans to increase shale exploration in MC’s southwest and northeast regions. The trucks are required for between two and six years with several companies already expressing interest, including Jereh Group, PetroChina’s Baoji Oilfield Machinery, Nanjing Develop and Sinopec Oilfield Equipment.

Authorities in MC have also been making moves to attract foreign investment and increase exploration activity with several blocks being offered throughout 4Q 2022. In October, local energy authorities in the Xinjiang Uygur autonomous region invited foreign and Chinese companies with offices in MC to bid on onshore oil and gas blocks in the Tarim and Jungar basins. This came as part of government efforts to attract foreign and private investment to boost MC’s depleting hydrocarbon reserves. The round resulted in five companies being awarded acreage. Xinjiang Energy and Shaanxi Yanchang Petroleum were each awarded three permits, while Inner Mongolia Guwanchuang Industry, Xinjiang Yuanzhou Oil & Gas, and Ningxia Property Development were awarded one each.

This offering was followed in November with authorities in Xinjiang Uygur, inviting bids for a further five onshore exploration blocks in the region. To be eligible to bid on the blocks companies must be registered in MC with capital of more than 300 million yuan (US$42 million).

What to expect in 2023

As we enter 2023 there is a general positive outlook for the land rig market, albeit with some caveats. The start of the year has seen oil and gas prices dropping in the face of warmer weather and global economic concerns, as well as reduced demand in MC following growth in Covid-19 cases. Brent crude has averaged c. $78.5 per barrel in 2023, well below the average of $100 a barrel seen in 2022. At these prices, activity should remain healthy but further falls in pricing present serious downside risk to demand. Despite this uncertainty, activity in key regions, such as the Middle East (especially from GCC members) and North America, is expected to lead to higher levels of activity, supported by strong operator cash flows. Many operators reported record profits in 2022 and enter 2023 with significant free cash flows (industry sources estimate this at over $1 trillion). While this free cash flow is expected to lead operators to increase investment into hydrocarbon projects, a significant proportion will be focused on increased investment in the energy transition, as well as increasing shareholder dividends. At the same time, rapid inflation has hit the supply of many key materials – increasing the amount of investment required per well drilled, putting further pressure on activity levels. Due to these factors, Westwood forecasts utilisation rates increasing to nearly 50% over the course of the year, around 5% greater than 2022.

Activity is not the only thing expected to grow. Supply should also see a major increase in 2023, something that has been minimal in recent years. National oil companies in the GCC region are planning to increase their rig fleets in 2023 with Saudi Aramco, Kuwait Oil Company and ADNOC all acquiring or constructing high-spec drilling rigs to meet greater demand. Saudi Aramco’s partnership with Nabors, which goes under the name of Saudi Aramco Nabors Drilling Company (SANAD), is delivering 50 new rigs over a 10-year period starting in 2022, of which five have been delivered to date. In Kuwait, there is the aforementioned $60 million award to Honghua from Kuwait Drilling as well as a tender from the Kuwait Oil Company for 44 new rigs (24 drilling and 20 workover), in 2Q 2022.

Higher activity levels are also expected to support both new rig contracts and extensions to existing ones. On 21 December 2022, KCA Deutag secured three rig contract extensions in Oman. The rigs involved are the 1,500 HP, T-849 and T-858 rigs and the 2,000 HP T-899 unit. KCA also managed to secure a contract for its 2,000 HP, T-63 rig to drill two wells in the Kurdistan region in Iraq and its 1,500 HP, T-208 rig, has been contracted in Europe for work in 2023.

Todd Jensen

Research Analyst, Onshore Energy Services

[email protected]

Ben Wilby

Senior Analyst, Onshore Energy Services

[email protected]

The Global Land Rigs Newsletter highlights key takeaways for the quarter. Full access to daily news updates on the global onshore drilling industry is available to subscribers of Global Land Rigs.