June 2025

Strong public funding signals and emerging infrastructure developments show clear progress toward scaling the European hydrogen market. At the same time, persistent market challenges and regulatory delays are prompting stakeholders to reassess timelines and strategies towards hydrogen. In this month’s Hydrogen Compass Newsletter, we explore the dynamic mix of recalibration and momentum across corporate, policy and funding landscapes.

In addition, we are delighted to introduce the first episode of our Hydrogen Compass Podcast. Designed to complement our newsletter, each episode dives deeper into topical issues, providing expert insight and timely analysis from Westwood’s Hydrogen team. Published periodically, the podcast delivers in-depth discussions when they matter most. Episode one explores the potential impacts from delayed implementation of the EU’s Renewable Energy Directive III (RED III) into national law.

Strategic shifts in industry participation

In May, several major players in Europe’s hydrogen sector signalled a strategic scale-back on pursuing renewable hydrogen projects, citing high costs and continued market uncertainty.

Statkraft

Statkraft announced it will cease developing new renewable hydrogen projects globally, attributing the decision to rising market and geopolitical uncertainty, though it offered few specific reasons. The Norwegian utility is Europe’s largest renewables producer and will continue advancing its most mature hydrogen projects in the UK – where government backing remains strong – and will seek external investors to bring them into the construction phase.

This shift includes the cancellation of a NOK 120 million (USD 12 million) contract with Nel for a 40MW electrolsyer at the Hydrogen Hub Mo project in Mo I Rana, Northern Norway. Originally launched in partnership with steelmaker CELSA to create a renewable hydrogen-powered steel value chain, the project has faced repeated delays. Statkraft cited the inability to secure a commercially viable model under current conditions. The company now plans to focus on select markets and has similarly slowed progress in hydrogen due to high costs and political uncertainty.

Despite scaling back elsewhere, Statkraft is still exploring opportunities in the UK. It has proposed a renewable hydrogen facility at the former Hunterston coal terminal in Scotland, in partnership with Peel Ports Group. The plan includes exporting hydrogen-derived ammonia via existing port infrastructure.

Honeywell/Johnson Matthey

In parallel, Honeywell agreed to acquire Johnson Matthey’s Catalyst Technologies business for £1.8 billion, gaining access to critical low-carbon hydrogen and CCS technologies. This includes Johnson Matthey’s Low Carbon Hydrogen (LCH) process, used in flagship UK projects such as Equinor’s H2H Saltend and EET’s Stanlow refinery. The acquisition strengthens Honeywell’s sustainable fuels portfolio, while Johnson Matthey retains its Hydrogen Technologies division, focused on renewable hydrogen through PEM electrolyser membranes and fuel cells.

This transaction follows pressure from Standard Investments, Johnson Matthey’s largest shareholder, which in December 2024 urged the company to pause further hydrogen investment pending a clearer route to profitability – suggesting even a partial or full divestiture.

BP

Meanwhile, BP withdrew from the 250MW H2-Fifty renewable hydrogen project in Rotterdam, jointly developed with HyCC, as part of a broader move to prioritise fewer, high-impact hydrogen and CCS projects. The decision aligns with BP’s strategic pivot toward core oil and gas operations, reducing its low-carbon energy commitments.

Following BP’s exit, HyCC launched a new project – H2Next – of similar scale. Announced at the World Hydrogen Summit in Rotterdam in May, H2Next aims to produce 25,000 tonnes of renewable hydrogen annually for regional industrial use and broader distribution through the Dutch hydrogen network. Located at the Maasvlakte hydrogen, the project targets a final investment decision by 2028 and startup by 2030.

Europe’s hydrogen market is entering a more realistic, if not more cautious, commercially-driven phase. High capital costs, slow policy progress, and investor pressure are prompting companies to refocus on scalable, lower-risk opportunities or exit entirely. While some strategic pivots, such as Honeywell’s acquisition, signal continued belief in low-carbon hydrogen’s future, the retreat by firms like Statkraft and BP underscore the challenge in developing business cases for renewable hydrogen at scale in the current environment.

Funding momentum

Despite commercial headwinds, significant public funding continues to flow into the European hydrogen market.

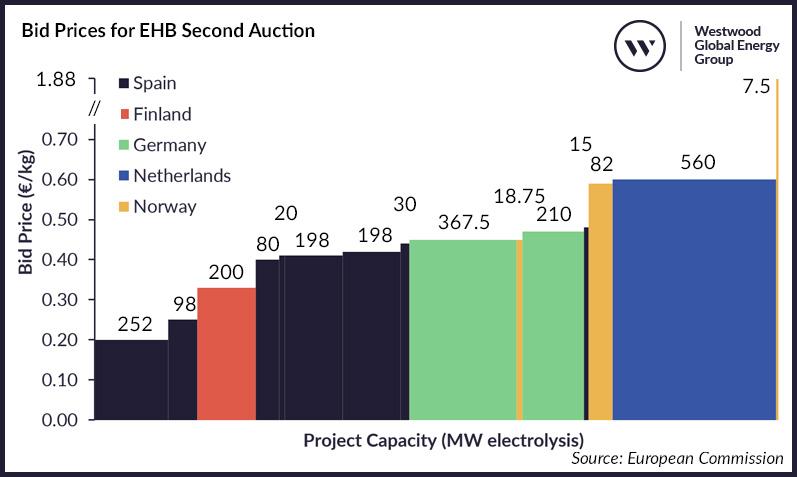

The EU awarded €992 million to 15 renewable hydrogen projects in May under the second auction of the European Hydrogen Bank (EHB), supported by the Innovation Fund. Spread across five countries in the European Economic Area, these projects are expected to produce around 2.2 million tonnes of renewable hydrogen over the next decade (~2.3GWe), avoiding over 15 million tonnes of CO2 emissions. Final grant agreements are expected by September/October 2025.

The auction was designed to narrow the cost gap between renewable hydrogen production and current market prices. Most selected projects will receive fixed premiums between €0.20 and €0.60/kg, while three maritime-focussed projects in Norway will benefit from higher premiums of €0.45 to €1.88/kg, supported by a dedicated maritime budget of €96.7 million. These maritime bids mark the first time the auction has included sector-specific funding, aimed at hydrogen used in bunkering activities.

Bid Prices for EHB Second Auction Source: European Commission

In the UK, 11 hydrogen projects across Scotland were awarded £3.4 million in public funding to support feasibility studies, pre-FEED work, and early-stage infrastructure development. The aim is to strengthen Scotland’s hydrogen production, storage and transport ecosystem. Notable funded projects include:

| Project | Developer | Funding Amount |

| Creca Hydrogen Facility | Green Cat Hydrogen Ltd. | £490,088 |

| Starthallan Hydrogen | Green Cat Hydrogen Ltd. | £320,549 |

| Cromarty Hydrogen Phase 2 | Storegga Hydrogen | £528,555 |

| Shetland Hydrogen Project 2 Pre-Feed | Statkraft Hydrogen UK | £270,500 |

| Binn Ecopark Hydrogen | Green Cat Hydrogen Ltd. | £258,478 |

These funding announcements reinforce commitment from the public sector to advance renewable hydrogen. The second EHB auction signals a more targeted approach, prioritising sector-specific applications like maritime fuels. While the private sector has slowed in some notable cases, governments are working to de-risk investment by injecting capital into hydrogen market development.

Policy timeline drifts – RED III implementation is delayed

In May, France launched a public consultation on its national implementation of the EU Renewable Energy Directive III (RED III), proposing a binding target for renewable hydrogen and its derivatives to comprise 1.5% of transport fuels by 2030. The target would ramp up from 0.1% in 2026 to 2% by 2035, exceeding the EU’s minimum requirement of 1% by 2030.

The proposal includes a sub-target for synthetic fuels in maritime and aviation. It also recognises low-carbon hydrogen produced using nuclear power, leveraging France’s predominantly zero-carbon electricity mix. Importantly, the proposal includes penalties of €80 per gigajoule for fuel suppliers that fail to meet the obligations.

While France’s proposal demonstrates ambition, it does not include critical industry-use targets to meet the EU’s 42% mandate.

Although RED III was passed 18 months ago, no EU member state has fully transposed it into national law, missing the 21 May deadline. This delay leaves the hydrogen sector without the legal clarity needed to drive demand and investment. While countries like the Netherlands, Denmark, and France have made proposals, many fall short of EU targets and remain politically uncertain.

Key European Project Watch

| Project | Update |

| Boden Steel Plant | Stegra’s Boden steel project in northern Sweden is set to receive 740MW of electrolysers in the coming weeks from Thyssenkrupp Nucera, consisting of 37 alkaline modules (20MW each) currently being assembled in Spain. The renewable hydrogen will be used to produce low-emission steel, with long-term supply agreements already secured with major automotive players like Mercedes-Benz and Porsche. |

| Uniper Humber Hub | Uniper has selected ITM Power to supply 120MW of electrolysers for its Humber Hub project at the Killingholme site in the UK. The renewable hydrogen plant will use six of ITM’s 20MW Poseidon modules to supply hydrogen to Phillips 66’s Humber refinery, replacing part of the refinery’s fuel gas. The project has been shortlisted for funding under the UK government’s second Hydrogen Allocation Round (HAR2), which requires funded projects to be operational between 21 March 2026 and 31 March 2029. |

| Aldbrough Hydrogen Pathfinder | The Aldbrough Hydrogen Pathfinder project in Yorkshire, developed by SSE Thermal and Equinor, has received local planning approval. It will use a 35MW PEM electrolyser powered by renewable electricity to produce renewable hydrogen, which will be stored in an underground salt cavern. The hydrogen will then be used in a 100% hydrogen-fired open-cycle gas turbine to deliver flexible power during periods of low renewable generation. The project is also one of 27 shortlisted under the UK government’s second Hydrogen Allocation Round (HAR2) and is currently undergoing due diligence. |

| Kassø E-methanol Project | The Kassø e-methanol project, developed by European Energy and co-owned with Misui & Co., has been officially inaugurated in Aabenraa, Denmark. The facility uses 52.5MW of Siemens Energy PEM electrolysers powered by the adjacent 304MW Kassø Solar Park to produce 42,000 tonnes of e-methanol annually. By combining renewable hydrogen with biogenic CO₂ from the nearby Tønder Biogas facility, the plant delivers e-methanol with up to 97% lower carbon emissions than fossil methanol. Offtakers include A.P. Moller - Maersk (to fuel its methanol-powered vessel Laura Maersk), the LEGO Group (for sustainable plastic production) and Novo Nordisk (to decarbonise chemical processes). |

| Arcadia eFuels Vordingborg | Arcadia eFuels have obtained an Environmental Permit from the Danish Environmental Protection Agency for the eFuels project in Vordingborg, Denmark. Arcadia eFuels are planning to produce eSAF from renewable hydrogen produced by a 360MW electrolyser which will be provided by Plug Power. |

NEW PODCAST - LISTEN NOW

In the first episode, Jun Sasamura and Arthur James explore the potential impacts of the delayed implementation of the EU’s Renewable Energy Directive III (RED III) into national law, and what it means for hydrogen deployment across the region.

Jun Sasamura, Manager – Hydrogen

[email protected]

Arthur James, Analyst – Hydrogen

[email protected]