C&J Energy Services and Keane Group announced a $1.8 billion all-stock merger on Monday morning. If completed, the deal will create the third largest US pressure pumper in terms of total hydraulic horsepower (HHP) capacity.

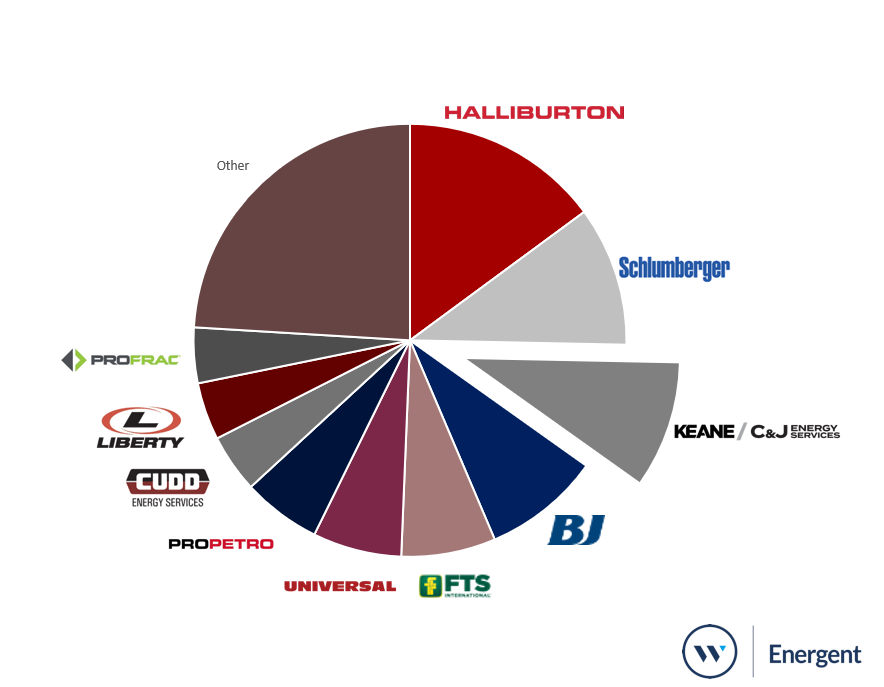

Based on Energent’s Lower 48 Horsepower and frac crew data, the combination of the two Houston-based pressure pumpers would result in roughly 2.3 million HHP capacity, ranking the newly combined entity behind Halliburton and Schlumberger in total capacity. BJ Services would drop to fourth at 2.1 million HHP.

Figure 1: Lower 48 Horsepower Market Share by Frac Company

Source: Horsepower Outlook

By active HHP, or horsepower available to put into service, C&J and Keane would have a combined 1.7 million HHP, which translates to roughly 37 crews (Keane currently operates 21 active crews and C&J operates 16).

This step towards market consolidation means 5 frac companies now account for 50% of the total HHP supply and 10 companies handle 75% of the total HHP.

Market share gains in Haynesville, Bakken, and Permian

Of the two frac companies, Keane is currently the market share leader in terms of capacity and active crews. The combined pressure pumper, however, will benefit from C&J’s wide stretch of operations, as C&J is currently active in each of the seven major US basins.

Specifically, the merger allows Keane entry into the growing Haynesville Shale play of East Texas and Louisiana, where C&J currently possesses 15% of the active HHP market share. Additionally, the combined company would tie BJ as the second largest market presence in the Bakken shale play in North Dakota, where both Keane and C&J currently operate.

As for the Permian, Keane will surpass Profrac as the fourth largest pressure pumper in terms of active HHP, ranking behind ProPetro, Schlumberger, and Halliburton.

From a market perspective, the merger doesn’t create significant overlap of the individual pumper’s current customer base. Reviewing both pumper’s top clients in terms of frac jobs in the last year, both Keane and C&J work with Exxon and Marathon, but overall, the deal would create a large set of opportunities for the new entity. The merger would not interfere with either of the pumper’s top three customers.

A positive sign for oilfield services investors?

When the deal closes in 2019, the merger would represent the second major transaction in the pressure pumping market, following the closing of ProPetro’s recent acquisition of Pioneer Natural Resource’s pressure pumping assets during Q1’19—a deal which boosted ProPetro to the market share leader in the Permian with more than 1.2 million active HHP.

The current oversupplied horsepower market is not sustainable for the public or private frac companies. Investor sentiment towards oilfield services broadly continues to be negative. However, as pressure pumpers seek mergers that deliver cost savings and improve margins, investor reactions will turn positive.

Pressure pumpers may use the investor attention to consolidate the public mid-sized pressure pumpers. For example, Superior Energy Services (Pumpco), Basic Energy Services, US Well Services, and Mammoth Energy Services have lower horsepower utilization rates than their larger peers. These pressure pumpers may explore mergers more aggressively due to the need for scale and efficiency to win business, especially in the Permian.

With the merger to expected to close in Q4’19, Keane’s Chief Executive Drummond will remain CEO of the new entity, with C&J’s CEO Gawick remaining on the combined board of directors.