Significant cost reductions have improved E&P cashflows and should drive increased offshore tendering activity in 2020. Pricing is expected to remain competitive, however, and contractors will need to remain focussed on profitability and avoid being locked into low-margin purgatory.

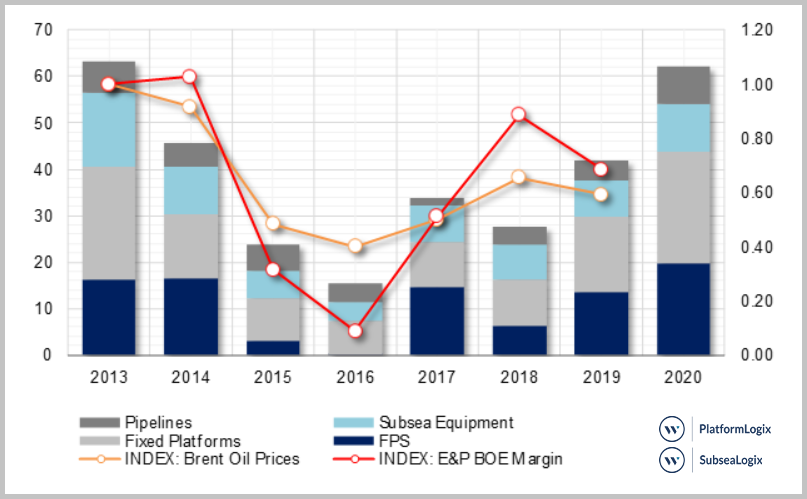

Oil markets are off to a rocky start in 2020, with heightened tensions in the Middle East, unprecedented Australian bushfires and the rise of the COVID-19 virus in China. For the offshore oil & gas sector, however, 2020 should be the second year of growth for an industry still reeling from the most severe downturn in its history. Westwood Global Energy Group expects $63 billion (bn) of contract awards for new offshore O&G production infrastructure (subsea production systems, SURF, pipelines, fixed platforms and floating production systems) in 2020 – a 49% increase over 2019 and the highest in seven years.

Floating production systems (FPS) spend is projected to reach $20bn in 2020 after hitting $13.5bn last year. Latin America will dominate activity with major awards such as Mero 3 (2Q), Itapu (4Q) and Sergipe (4Q) underpinning $7bn of spend. Africa will also feature with Woodside’s focus FPSO already awarded to MODEC in January and BP’s PAJ & Shell’s much anticipated Bonga SW projects currently expected to be awarded late in the year. Other major awards anticipated are Western Gas’ Equus (Australia) and LLOG’s Shenandoah (USA).

Subsea tree contract awards underwhelmed in 2019 with only 212 tree orders – significantly lower than the 263 registered in 2018. Much of this can be attributed to delay in award of certain key contracts such as Payara (45 trees), Mamba (16 trees) and Sangomar (23 trees). With these major projects now expected this year, (Sangomar was awarded to the Subsea Integration Alliance of Subsea 7 & Schlumberger in early January), 2020 looks like a bumper year with 321 of projected tree awards and $10bn of subsea equipment order value for contractors.

Offshore EPC Spending 2013-20 by Contract Award

Source: SubseaLogix & PlatformLogix

Increasing orders are a welcome reprieve for a beleaguered offshore EPC supply chain still reeling from the worst downturn in its history. In addition to fewer project sanctions, E&P customers have also driven down costs – drilling, field development and ongoing production costs are all significantly lower relative to 2013/14 highs. The recovery remains fragile, however. With most E&Ps budgets based on $60-$65/bbl, there is very little room for pricing growth, meaning contractors must continue to look within themselves to improve margins and profitability of their operations. This “new normal” is already leading to delays in the rapidly recovering FPS sector, where orderbook growth for market leaders such as MODEC & SBM is forcing E&Ps to widen their search for EPCs that can deliver projects on time and on budget. If oil prices do continue to stick to their current $55-$65/bbl groove, contractors will more than ever need to clearly understand future tender activity and contracting dynamics. This will enable them to prioritize internal resources and stay right sized and relevant. Overall, 2020 is expected to see a jump in offshore E&P infrastructure tenders, as E&Ps rush to lock in low costs.

It looks like supply chain will have to hold its breath a while longer for relief from higher prices.

Mark Adeosun, Senior Analyst Offshore

Westwood’s suite of offshore market intelligence tools and commercial advisory services, including the recently launched SubseaLogix and PlatformLogix solutions, are aimed supporting client growth in the offshore energy services marketplace by identifying the size and timing of future opportunities as well as pricing/contracting trends.