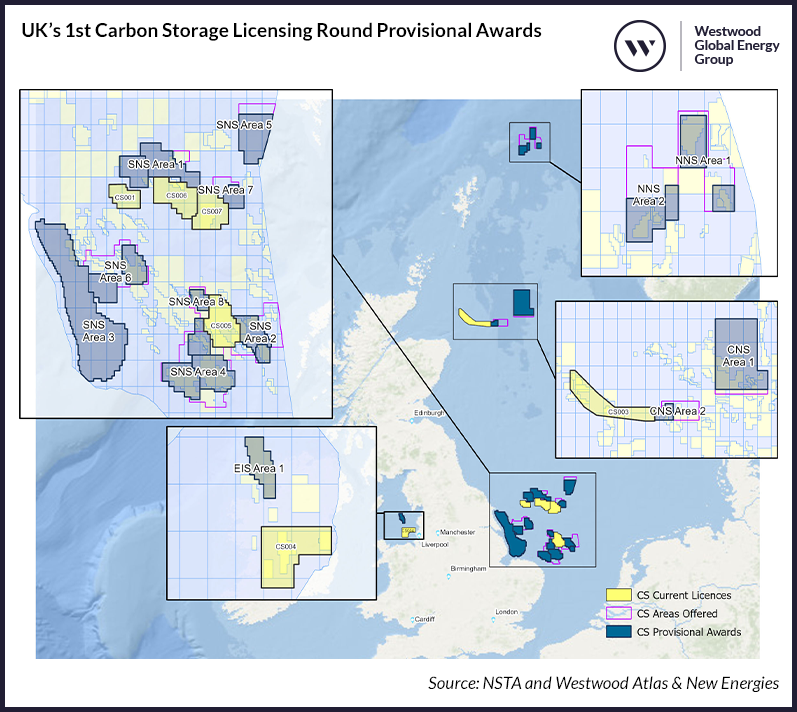

On 18 May 2023, the North Sea Transition Authority (NSTA) announced the preliminary results of the UK’s 1st Carbon Storage Licensing Round with the offer of awards for 20 carbon storage licences to 12 companies (Figure 1).

Westwood has reviewed each of the licences offered to identify the potential storage targets in depleted hydrocarbon reservoirs and saline aquifers. In addition, an assessment of successful applicants and potential bidders have been provided, based on company announcements, ownership of existing carbon storage licences as well as proximity of hydrocarbon licences and infrastructure. A summary of the Round is provided below, and the full analysis of potential storage targets and bidders is available on request.

Figure 1: UK’s 1st Carbon Storage Licensing Round Provisional Awards

Source: NSTA, Westwood Atlas and New Energies

The Round opened on 14 June 2022 and by the application deadline of 13 September 2022, a total of 26 bids were received from 19 companies for the 13 areas available. Offers have been made in all 13 areas, with some areas split into multiple licences. The total acreage offered was c. 12,230 km2 from a total of c. 15,702 km2 that was offered in the Round. The SNS area had eight areas available to bidders and was the most hotly contested region with 13 provisional licence awards made by the NSTA. The Work Programme for each potential licence has not been released but at the EGC1 conference in Aberdeen on 18 May 2023, the NSTA stated that five firm wells or tests, nine contingent wells or tests, plus four firm and five contingent new seismic acquisition work programmes have been committed to, if all offered licences are accepted.

While the NSTA requested that companies do not announce their awards, Spirit Energy has confirmed it has been offered EIS Area 1, which supports the company’s ambition to establish its Morecambe Net Zero Cluster. EnQuest has confirmed it has been offered four licences in NNS Area 1 and NNS Area 2. Neptune Energy is understood to have been awarded three licences and Perenco, with partner Carbon Catalyst, confirmed it has been offered licences in the SNS. Synergia Energy announced that one of the two applications it made was under consideration by the NSTA. Westwood assumes this to have been successful and is negotiating terms with the NSTA. It is also understood that BP, Equinor and Eni have been successful as well as one or more of the participants in the Acorn CCS project, Storegga, Shell, Harbour Energy and NSMP. Acceptance of the awards is expected in the coming weeks and if any company declines an offer, due to the proposed work programme or area offered being smaller than applied for, the NSTA will offer the licence to another company that had applied for the same area.

The new sites offer significant storage opportunity, storing up to 10% of the UK’s annual emissions. The UK has provisionally awarded 20 carbon storage licences, a threefold increase in active licences in the country. Alongside legally binding net zero targets, and in the wake of significant financial investment being allocated to support CCS, it marks a major step in the development of the industry.

Interest in the Round was high and there will be companies that are disappointed with the results. Westwood’s analysis has identified many companies that are likely to have applied for acreage based on ownership of existing oil and gas infrastructure and CS licences, however, they may not all have been successful. It is not yet clear how the CS licences will impact the existing E&P operators still producing within the awarded acreage.

Within the full report, data and spatial analysis is derived from Westwood’s integrated Atlas and Atlas New Energies products, leveraging our knowledge and experience of the UKCS, to answer questions such as:

- What are the potential storage targets?

- Who are the potential bidders and successful applicants?

- Why was acreage that was made available in the Round not offered within the awarded licences?

- How might co-location with oil and gas licences, existing carbon storage licences, offshore windfarms, and decommissioning licence holders have impacted the awards?

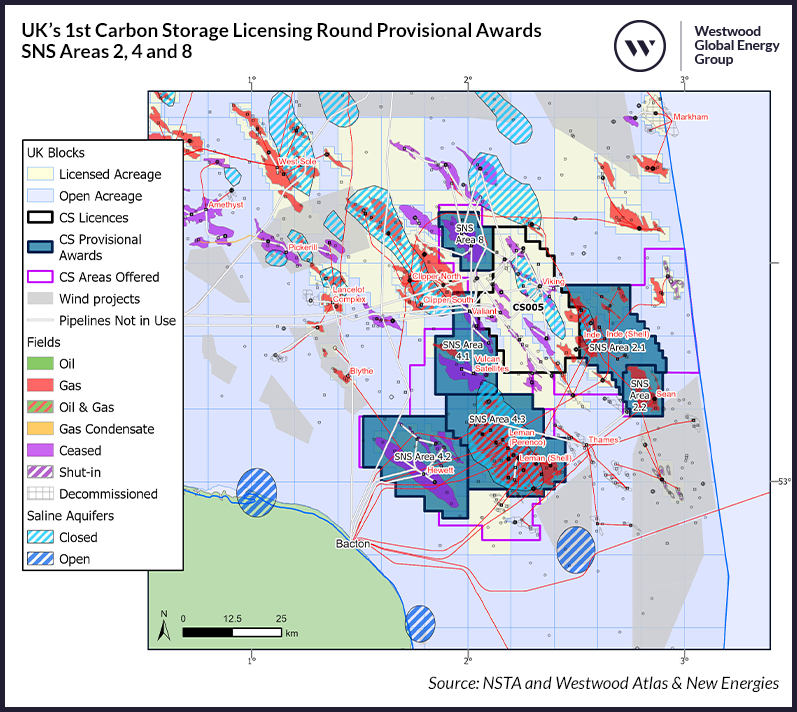

As an example, Figure 2 shows the licence offers and the potential storage targets in SNS Areas 2, 4 and 8.

Figure 2: UK’s 1st Carbon Storage Licensing Round provisional awards

SNS Areas 2, 4 and 8

Source: NSTA, Westwood Atlas and New Energies

Emma Cruickshank, Head of Northwest Europe Research

[email protected]

Stuart Leitch, New Energies Research Manager

[email protected]

Catherine Horseman-Wilson, Senior Analyst – Northwest Europe

[email protected]

Alyson Harding, Technical Manager – Northwest Europe

[email protected]

To register your interest to receive the full analytical report, please complete the form below or contact [email protected].

Northwest Europe Carbon Storage Report

To keep informed of upcoming developments in CCS as well as oil and gas, hydrogen and offshore wind activities in NW Europe, request a demonstration of Atlas and Atlas New Energies to show the capabilities of the products, including:

- Track Carbon Storage Licences and Licence Rounds including ownership, timelines and work programmes

- Access detailed technical and commercial analysis covering the full oil and gas exploration and production lifecycle

- Understand the evolution of NW Europe’s energy market including the importance of oil and gas in the energy transition along with CCS, hydrogen and offshore wind

- Analyse the interdependencies and co-location constraints between CS licences and offshore wind and how they interact with the oil and gas industry

For further information, please contact [email protected].