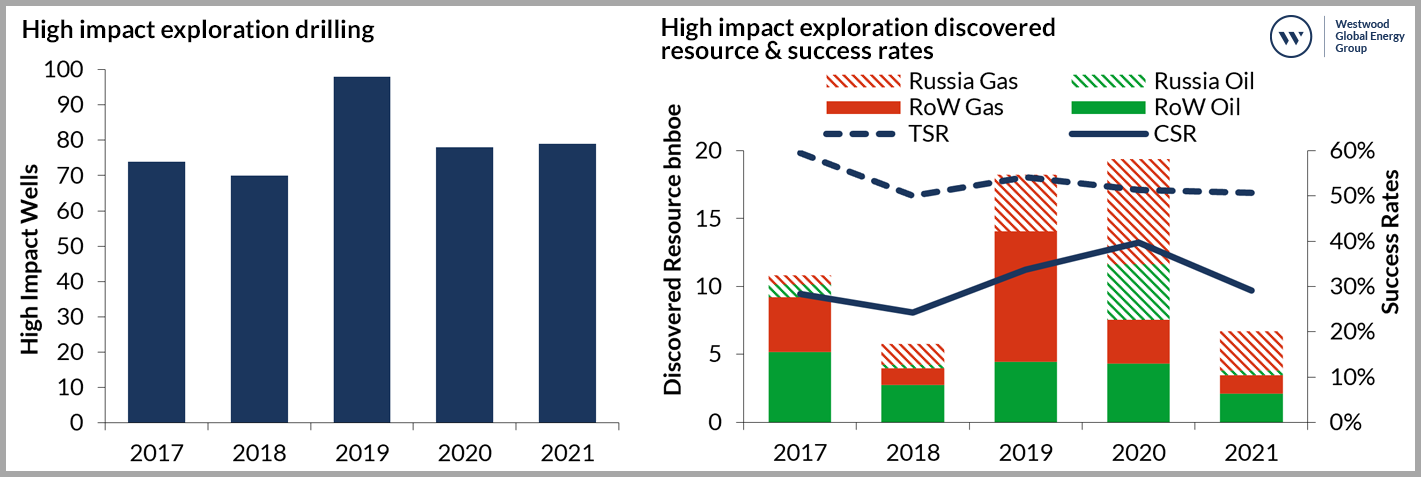

Oil and gas exploration in 2021 was remarkably resilient despite the COVID-19 pandemic and accelerating energy transition. The high impact well count was maintained year on year, but performance dropped significantly both in terms of discovered resources and success rates.

High impact exploration drilling, discovered resource & success rates 2017-21

Source: Wildcat, Westwood Analysis

What are the key trends that emerged in 2021 and what are the implications for the future State of Exploration?

Exploration drilling levels were maintained in 2021 but with poorer performance. 79 high impact wells completed in 2021 compared to 78 in 2020. Discovered resource, however, dropped 65% in 2021 to 6.7 bnboe. Excluding Russia, discovered resource fell 54% to 3.5 bnboe. The commercial success rate fell 11 percentage points from 40% in 2020 to 29% in 2021. With the exception of 2019 when 98 wells were drilled, the number of high impact wells completed annually since 2016 has been maintained between 67 and 79 despite significant variations in the oil price.

Exploration is increasingly dominated by Supermajors and NOCs. Together they accounted for 68% of high impact well equity in 2021 compared to 47% in 2018. There is an opportunity for smaller companies to participate in high impact exploration activities, but funding for developments in the success case may be challenge.

Frontier drilling still has a role to play and is likely to see a short-lived bounce back from a 14-year low ebb in 2021. Only 16 frontier wells were drilled in 2021 with just one minor success whilst three frontier successes have been made already in 2022, including the opening of a potentially major new oil province in the Orange basin. Whilst significant frontier discoveries can be made, success rates have been less than 10% for many years and the follow on volumes have been small, with one or two exceptions. There is still an appetite for exploration for new plays, particularly those that can be commercialised quickly, but the pool of active frontier drillers has shrunk from 52 in 2019 to 24 in 2021.

Companies with a focus on infrastructure led exploration delivered more consistent performance, with higher commercial success rates, averaging 47% but much smaller average discovery sizes of 28 mmboe. Exploration successes that can be brought on stream quickly remain attractive as companies seek payback before demand for hydrocarbons declines.

Underpinning all future exploration activity is a requirement for low emissions intensity developments. Prospects will be chosen for drilling based not just on volumes and chance of success but increasingly on time to break even and the success case impact on company net zero targets.

Graeme Bagley, Head of Global E&A

[email protected]

For more information on how to access The State of Exploration 2022 report please complete the form below;