E&Ps, oilfield service, and supply companies made significant cuts during 2020 in order to survive to see another cycle. As the industry adapted, oil prices have seen a favorable increase, reaching $60 WTI in Q1 2021. The Westwood base case average oil price scenario is $52 WTI in 2021 and $55 WTI in 2022. With this base case, Westwood forecasts the number of US shale wells drilled in 2021 to decline by around 1% while completion activity increases by nearly 20%.

The sharp decline in commodity prices coupled with investor pressure on companies to self-finance made 2020 a dismal year for oilfield activity. The US land rig count entered 2020 at 764 rigs, bottomed at 226 rigs in August, and exited the year 330 rigs. The fall out in oilfield spending allowed the US Shale E&P peer group to create positive free cashflow in aggregate through Q3 2020 at $38 WTI.

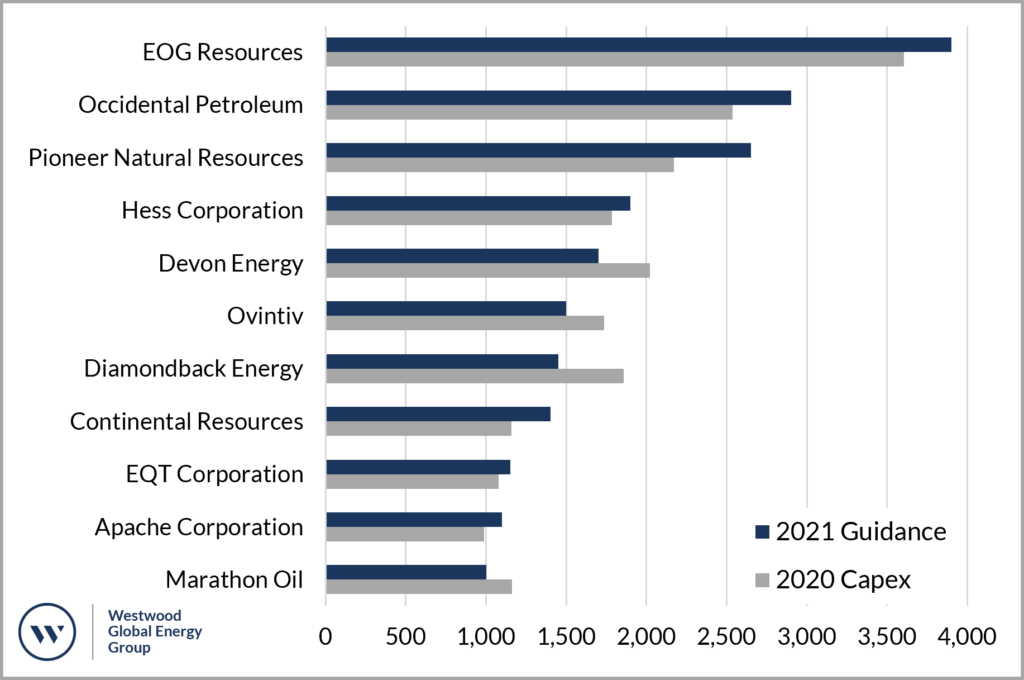

Early guidance from US shale E&Ps indicates a slight increase in capital expenditure for 2021. For 27 of the public US shale E&Ps (non-Majors), planned capex guidance is near $29 billion compared to $26 billion in 2020, a 9% increase. EOG Resources, Occidental, and Pioneer Natural Resources account for 33% of the total capex guidance for 2021.

Figure 1: E&P capex guidance (in USD millions) for select US shale companies (> $1 billion capex guidance for 2021)

Source: Energent

For 2020 capex in Figure 1, Parsley capex is included with Pioneer and WPX capex is captured in Devon Energy.

Wells Drilled to Fall 1%, Wells Completed to Increase by 15%

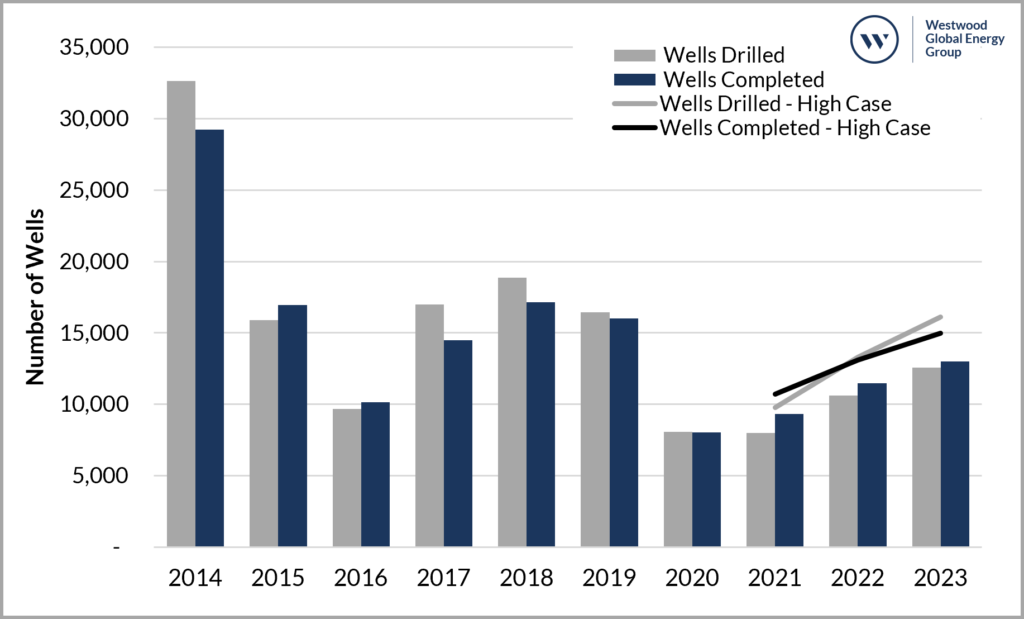

Wells drilled in 2020 were 7,400, a decline of 55% compared to 2019 and lower drilling activity than 2016. Wells completed finished the year around 7,500, a 50% decline from 2019.

Westwood expects the wells drilled to decrease 1% with a flat rig count in our base case scenario for 2021. Wells completed, however, is expected to increase by about 15%, from 8,000 in 2020 to 9,300 in 2021. In a high case scenario, wells drilled and wells completed exceed 10,000 wells in 2022.

Figure 2: US Lower 48 Wells Drilled & Completed Outlook (Base and High Case scenarios)

Source: US D&C Outlook, Energent

What Does This Mean for Lower 48 Crude Production?

According to EIA’s Short-Term Energy Outlook (STEO), crude oil production in the Lower 48 states will increase from 8.7 million b/d in February 2021 to 9.1 million b/d in December 2021, as operators respond to rising oil prices. Upward price pressures are likely to emerge in 2022. EIA’s 2021 and 2022 STEO forecast is $49 WTI which roughly aligns with Westwood’s $52 WTI in 2021 and $55 WTI in 2022.

If the EIA’s production increase is to materialize, it will require operators to drawdown the horizontal drilled uncompleted (DUC) inventory. As of early March 2021, the Permian Basin accounts for nearly 45% of the nearly 7,600 DUC wells based on Energent data. EOG Resources, ExxonMobil, Pioneer, Concho Resources, and Diamondback hold the most DUCs in the Permian, accounting for nearly 40% of basin’s DUC count.

Accelerated Frac Recovery in the Permian

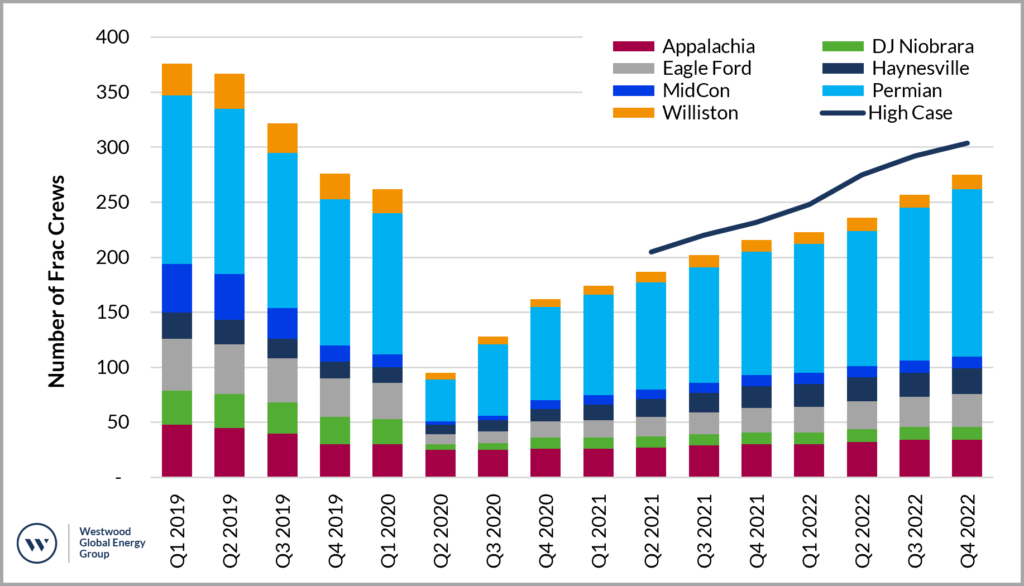

With stronger completion demand in 2021, frac crews across all basins must steadily increase in order to meet E&P demand.

Figure 3. Lower 48 Frac Crew Historical and Forecast

Source: US D&C Outlook, Energent

Haynesville and Appalachia gas plays are expected to increase frac crews by 80% (+9) and 15% (+5) from Q4 2020 to Q4 2021, respectively. The oil plays (excluding Permian) will see a moderate recovery over the same period ending 2021 with single digit increases in frac crews for the Bakken (+4), DJ-Niobrara (+1), Eagle Ford (+7), and MidCon (+2).

Westwood expects a more pronounced increase in frac crews in the Permian basin where frac crews leapt by 71% from Q2 to Q3 2020 and finished the year at 81 crews on average for Q4 2020 according to SatScout, satellite monitoring data. Westwood anticipates almost 30 crews reactivated or added in the Permian during 2021, under the Base Case scenario.

During the second half 2020, the industry retired nearly 2 million hydraulic horsepower (HHP) capacity. This was largely due to the bankruptcy of BJ Services and several other frac companies retiring older equipment. Unfortunately, horsepower supply still far exceeds demand in every basin.

Westwood tracks horsepower supply and demand based on real-time satellite imagery, historical frac data, and industry consultations. Total horsepower demand is currently near 9 million HHP yet horsepower supply remains near 15 million HHP. In 2022, horsepower demand will likely reach 14 million HHP by the end of the year. Pricing continues to be challenging due to E&P cost cutting initiatives and oversupply of equipment and services.

Rebuilding a Decimated Frac Sand Supply Chain

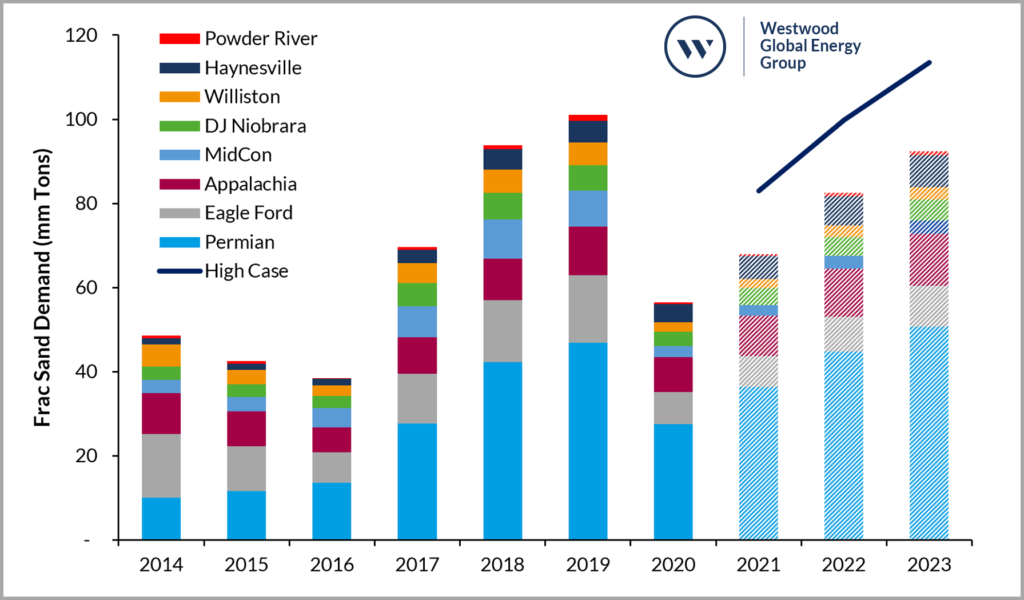

Frac sand consumption continues to differ across basins An average well in the DJ-Niobrara basin used about 5,200 tons in 2020 compared to 4,600 tons in 2019. The Powder River averaged 4,400 tons per well, a 31% decline in 2020, compared to 6,400 tons in 2019. In the Appalachia, proppant per well increased by 6% (500 tons) in 2019 and by another 4% (400 tons) in 2020. The Delaware basin uses about 9,500 tons per well in 2020 compared to 8,600 tons per well in 2019, a 10% increase in 2020.

In 2020, proppant consumption in the Lower 48 declined by almost 50% from 2019, halting a wave of frac sand increases starting in 2017 (+81%, +35%, and +8%). In 2019, frac sand consumption surpassed the 100 million tons mark, a record year for the frac sand supply chain, led primarily by the 75 million tons used in the Permian, Eagle Ford, and Appalachia.

Figure 4: Frac Sand Demand for Lower 48 (Base and High Cases)

Source: US D&C Outlook, Energent

Mine utilization fell dramatically as well in 2020. Total man-hours worked, according to the Mine Safety and Health Administration (MSHA), declined by 43% in 2020 compared to a +6% in 2019 and a +67% in 2018. A number of mines were deactivated or abandoned altogether due to the decline in demand. Beginning in Q1 2020, of the 160 frac sand mines tracked by Energent, about 90 were active, about 50 temporary idled or non-producing, and 20 mines abandoned. At the end of Q4 2020, the frac sand supply chain was decimated to about 60 active mines, about 55 temporary idled or non-producing, and 45 abandoned.

By the end of 2021 (under the Base Case scenario), Westwood expects total proppant consumption to increase by 20%, reaching approximately 65 million tons. With further increases in completion activity in 2022 and 2023, frac sand consumption is likely to increase to about 80 million and 90 million tons, respectively.

Stronger oil prices should lead to an improvement in E&P sentiment but US oilfield spending will continue to face headwinds in 2021, driven by considerable uncertainties on oil demand recovery versus global supply and access to capital markets. A Permian led recovery will help restore a critical frac supply chain needed to sustain Lower 48 oil production.

Todd Bush, Head of Onshore Energy Services

[email protected]