Report Summary

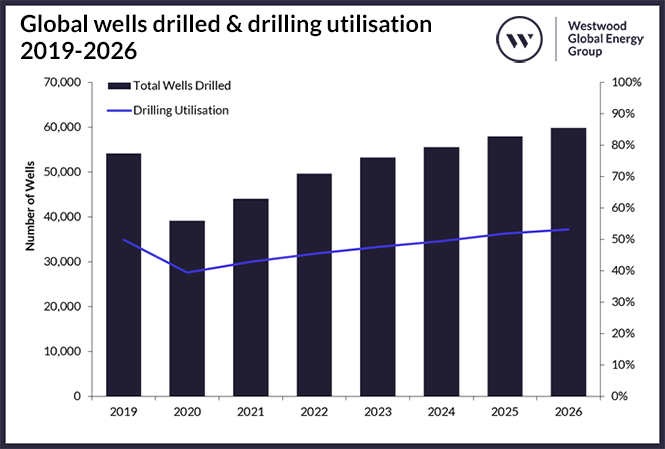

Westwood projects the number of wells drilled over the forecast period (2022-2026) to strongly increase year-on-year, reaching upwards of 60,000 in 2026, compared to c. 49,600 in 2022. Global drilling levels are expected to top 2019 drilling levels in 2024, which was not previously considered in Westwood’s outlook last year. The increase in wells drilled is forecast to lead to a year-on-year growth in the number of rigs operational. Westwood estimates that 4,070 rigs on average will be operational in 2022, growing to c. 5,050 by the end of the forecast, representing an increase of 24%.

This is the eleventh edition of the World Land Drilling Rig Market Forecast report. It has been drafted as the upstream oil and gas industry is facing commodity prices at the highest levels since 2014 following Russia’s invasion of Ukraine and OPEC members sticking to quota cuts despite a surge in hydrocarbon demand. At the same time, the industry is still dealing with the effects of the commodity price crash following the Covid-19 outbreak in 2020, which have hampered pricing for most services, including land rig dayrates. Despite Westwood expecting to see a stronger increase in activity than previously forecast, operators are expected to remain wary of threats such as rapid changes in commodity pricing and the pricing of drilling materials such as drill pipe and frac sands.

The report presents Westwood’s in-depth outlook for the global land drilling rig market over the 2022-2026 period, with a focus on addressing the following key questions:

- What is the market outlook, in terms of the volume of rigs operational and rig utilisation, across different regions and countries? Specifically, which jurisdictions are likely to drive demand for rigs in the coming years?

- What are the key factors worth highlighting within specific countries or regions – basins, plays, E&P companies, national production targets (if appropriate)?

- What does the competitive landscape look like within specific markets – key rig contractors and the size and horsepower distribution of their fleet?

- What are the potential upsides to Westwood’s forecast – regions, countries, and drivers?

Global onshore wells drilled & drilling utilisation, 2019-2026

Source: Global Land Rigs, Westwood analysis

Executive Summary

1. Introduction

1.1 Macro Market Indicators

1.1.1 Oil Prices

1.1.2 Land Rig Company Revenues

1.1.3 Energy Transition & Net Zero Ambitions

1.1.4 E&P Operator Emissions Reduction Targets

2. Global Analysis

2.1 Global Outlook

2.2 Regional Rig Fleets

2.3 Land Drilling Rig Dayrates

3. Asia Pacific Analysis

3.1 Asia Pacific Rig Supply & Demand

3.2 Asia Pacific Identified Rigs

3.3 Australia

3.4 China

3.5 India

3.5 Indonesia

3.6 Pakistan

3.7 Thailand

4. Eastern Europe & FSU Analysis

4.1 Eastern Europe Rig Supply & Demand

4.2 Eastern Europe & FSU Identified Rigs

4.3 Azerbaijan

4.4 Kazakhstan

4.5 Russia

5. Latin America Analysis

5.1 Latin America Supply & Demand

5.2 Latin America Identified Rigs

5.3 Argentina

5.4 Brazil

5.5 Colombia

5.6 Ecuador

5.7 Mexico

5.8 Peru

6. MENA Analysis

6.1 MENA Rig Supply & Demand

6.2 MENA Identified Rigs

6.3 Algeria

6.4 Egypt

6.5 Iraq

6.6 Kuwait

6.7 Oman

6.8 Saudi Arabia

6.9 United Arab Emirates

7. North America Analysis

7.1 North America Rig Supply & Demand

7.2 North America Identified Rigs

7.3 Canada

7.4 USA

8. Sub-Saharan Analysis

8.1 Sub-Saharan Rig Supply & Demand

8.2 Sub-Saharan Identified Rigs

8.3 Chad

8.4 Gabon

8.5 Nigeria

9. Western Europe Analysis

9.1 Western Europe Rig Supply & Demand

9.2 Western Europe Identified Rigs

10. Conclusions

Appendices

Appendix 1: Methodology

A1.1 Drilling & Production Methodology

A1.2 Onshore Rig Demand Methodology

A1.3 Rig Data, Analysis & Assumptions

A1.4 Dayrate Methodology

Appendix 2: Glossary

For further information on the “World Land Drilling Rig Market Forecast 2022-2026” report, please use the form below or contact [email protected]