The UK’s path to reaching net-zero by 2050 will result in a structural shift in the energy system, requiring significant investment in new technologies and business models. The waters surrounding the UK – the UKCS – will see a decline in oil & gas production, with other offshore technologies, including hydrogen production, CCUS and offshore wind power set for significant expansion. According to the Committee for Climate Change (CCC) offshore wind alone is expected to grow over 900% in capacity by 2050 to enable the UK to achieve net-zero.

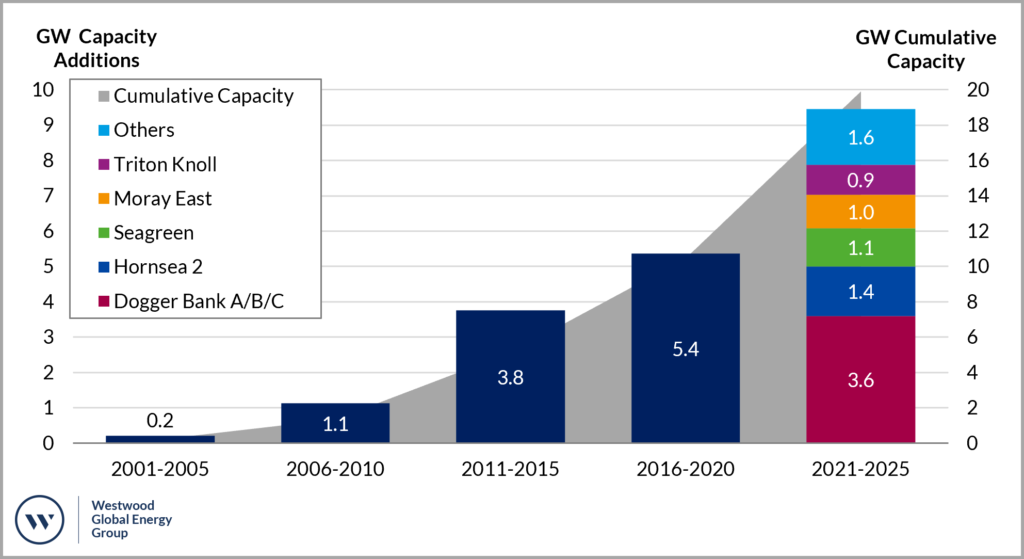

Figure 1: UK Offshore Wind Capacity Outlook to 2025

Source: Westwood Energy

With a significant oil and gas legacy, the UK’s transition will only be successful through collaboration between existing and new technologies. The oil & gas and wind sectors to this point have operated in relative isolation from one another despite 10GW of offshore wind capacity installed in the UK, and synergies have not been effectively explored. This is starting to change through joint initiatives such as the ‘Energy Transition Alliance’ set up between the Oil & Gas Technology Centre and Offshore Renewable Energy (ORE) Catapult in July this year. The main commercial drivers for exploiting synergies across these two sectors are to:

- Reducing the levelized cost of electricity (LCOE) of offshore wind (especially floating wind), and support its continued growth

- Ensuring the oil and gas sector’s skills, capabilities and infrastructure are leveraged to support the wind sector’s growth, as well as maintain the oil and gas sector’s own commercial viability

What are the potential opportunities for collaboration and synergy between the offshore oil & gas and wind sectors?

Transfer of knowledge and capability

The IEA’s 2019 Offshore Wind Outlook highlighted an opportunity for the oil & gas sector of up to US$350bn in European offshore wind over the next 20 years. This is based on the calculation that “about 40% of the full lifetime costs of a standard offshore wind project” has “significant synergies with the offshore oil and gas sector”. Therefore, there will be only certain aspects of an offshore wind project where the oil and gas sector can add value. For example, the supply of turbines is a well-established and competitive industry, with little synergy with the oil & gas sector.

The oil and gas sector’s experience in offshore infrastructure will be of most benefit in offshore wind whether it be in foundations / structures, project management, vessel operations, working with moving cables, seabed survey / investigation, or Balance of Plant (BoP) Operations and Maintenance (O&M). The oilfield support / services sector also has transferable assets and skills, such as in the provision of tugs, mooring systems, heavy lifting vessels and cabling. It is likely the most synergies will be realised in floating wind, as this will require a set of capabilities that many offshore wind players do not have.

To access the market effectively, it will be important for the oil & gas sector to understand the differences in how the offshore wind market functions – including different tender processes, contracting terms, supplier relationships, the focus on innovation together with cost reduction etc.

Joint commercialisation

There is potential for collaboration of the two sectors through oil and gas platform electrification and the repurposing existing infrastructure.

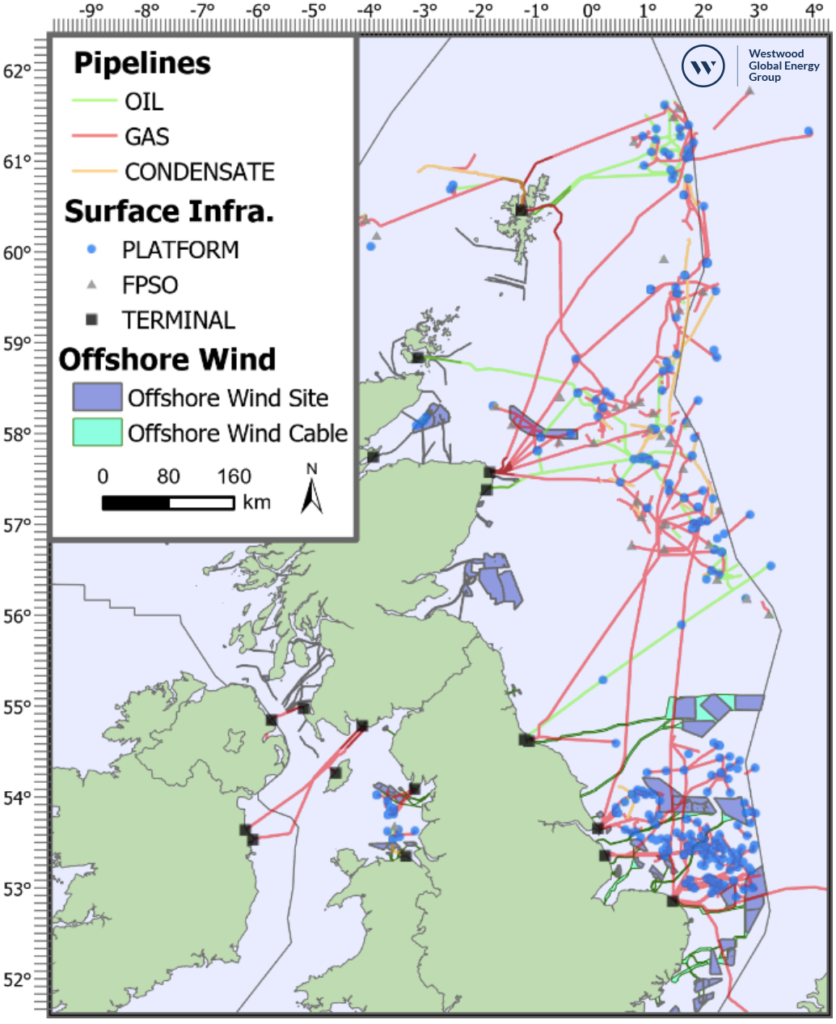

Figure 2: UKCS Infrastructure

Source: Westwood Energy, OGA

Platform electrification can create demand for the renewable electricity generated by a (fixed or floating) offshore wind farm that is in close proximity and displace gas and / or diesel power generation. This can reduce emissions from the platform and make available fuel that once would have been burnt on the platform, extending the field’s life. On average ~5% of production is used offshore to power platforms. This combination alone may justify the investment cost, but there are several technical challenges that need to be overcome. Offshore wind generated electricity is variable – therefore requiring backup, potentially in the form of batteries, hydrogen fuel cells or connection to the main grid. Equinor’s 88MW Hywind Tampen floating wind project will only provide 35% of the annual power demand of the 5 platforms, illustrating some of the constraints of 100% variable power supply. A balance needs to be struck between the benefit of platform electrification and the cost of achieving this. Platforms that are nearer to land could make power-from-shore a more viable alternative to offshore wind, while others may be too old to justify the necessary investment for the remaining life of the asset.

Existing oil & gas infrastructure can also be repurposed, primarily to support the development of the green hydrogen economy from offshore wind. Hydrogen can be produced at sea by electrolysis – either on a repurposed oil & gas platform, on an energy hub island (e.g. North Sea Wind Power Hub), or directly from an electrolyser housed in an offshore wind turbine. It can then be delivered back to shore through repurposed natural gas pipelines. The PosHYdon pilot project off the coast of the Netherlands is an example of this concept, bringing several partners together to realise the opportunity. Similar projects are being considered across the North Sea. The business case is based on reduced capital investment and O&M costs through the use of existing infrastructure, the lower cost of transportation of hydrogen vs. electrons, and the value of using hydrogen as ‘storage’ for variable offshore wind (and using this energy when commercially favourable). The cost savings through using existing oil and gas infrastructure will vary depending on the state of the infrastructure available, whether it can be repurposed, the distance from shore of the facility, and the remaining asset life.

Projects need to be considered in the context of the market dynamics and subsidy regime in the UK. Joint developments with the oil and gas sector could be a benefit or hinderance as a route to market for renewable projects depending on the offshore wind capture price outlook (the average price achieved in the wholesale market when the wind blows), or the level of revenues already supported by a subsidy (such as the current Contact for Difference (CfD) regime) or Power Purchase Agreement (PPA).

The emerging opportunity

The opportunity that the synergy between oil and gas and offshore wind presents is becoming clearer, with impacts across the value chain:

- E&Ps are well positioned to deploy their capital and project management skills, and importantly, have a need to diversify their portfolio and to address the emissions intensity of their existing oil and gas production.

- EPC contractors and the supply chain can support in the design, manufacture, and installation of wind farms, as well as in platform electrification and the repurposing of oil and gas infrastructure (primarily for green hydrogen).

But while there are synergies, the oil and gas community need to recognise the differences between the two sectors to understand where the opportunity really lies. Joint commercialisation concepts such as platform electrification by offshore wind are at an early stage of development, and there are technical and commercial hurdles still to overcome.

David Linden, Head of Energy Transition

[email protected]