Westwood’s Drilling & Well Services Spotlight

Each month, Westwood’s onshore team provides a summary outlook for specific service line categories in the wells, services and equipment sector.

Updated – 1st May, 2021

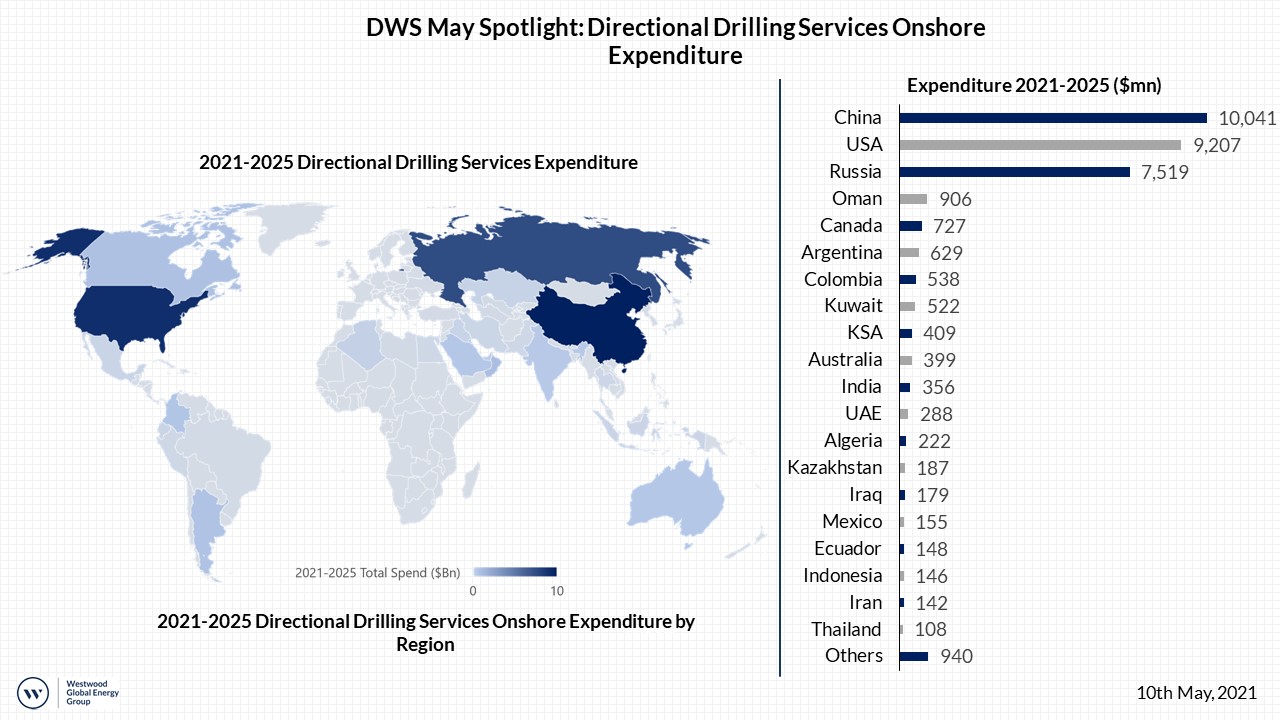

THIS MONTH WESTWOOD PROVIDES AN OUTLOOK FOR DIRECTIONAL DRILLING SERVICES, WHERE EXPENDITURE IS EXPECTED TO TOTAL $34bnBN OVER 2021-2025 WITH GROWTH IN CHINESE DEVIATED and horizontal drilling to drive spend.

- Directional drilling services are one of 21 service lines covered in Westwood’s World Drilling & Well Services report, the latest edition of which has just been released. For more information, or to purchase the report, please click here.

- The directional drilling market is driven by an increasing prevalence of deviated wells, particularly high-angle and horizontal wells. For more complex petroleum systems or unconventional plays, directional drilling can be used to target pay zone sweet spots and increase productivity. China’s production growth is heavily reliant on non-vertical drilling techniques at its key oil-producing Songliao, Bohai Bay, Ordos, Jungar and Tarim basins and gas at projects in the Ordos, Sichuan and Tarim basins.

- Global directional drilling expenditure is expected to total $34bn over the forecast. China will lead expenditure, driven by a government push to increase production capacity, especially at unconventional plays. The US and Russia are expected to account for 50% of total forecast expenditure. Year-on-year growth is expected over the forecast, as the number of wells drilled recovers from the nadir of 2020. Further upside comes as operators continuing to develop more complex and challenging reserves, requiring directional drilling as conventional plays mature.

Jack Baxter

Analyst, Onshore

[email protected]

Updated – 1st April, 2021

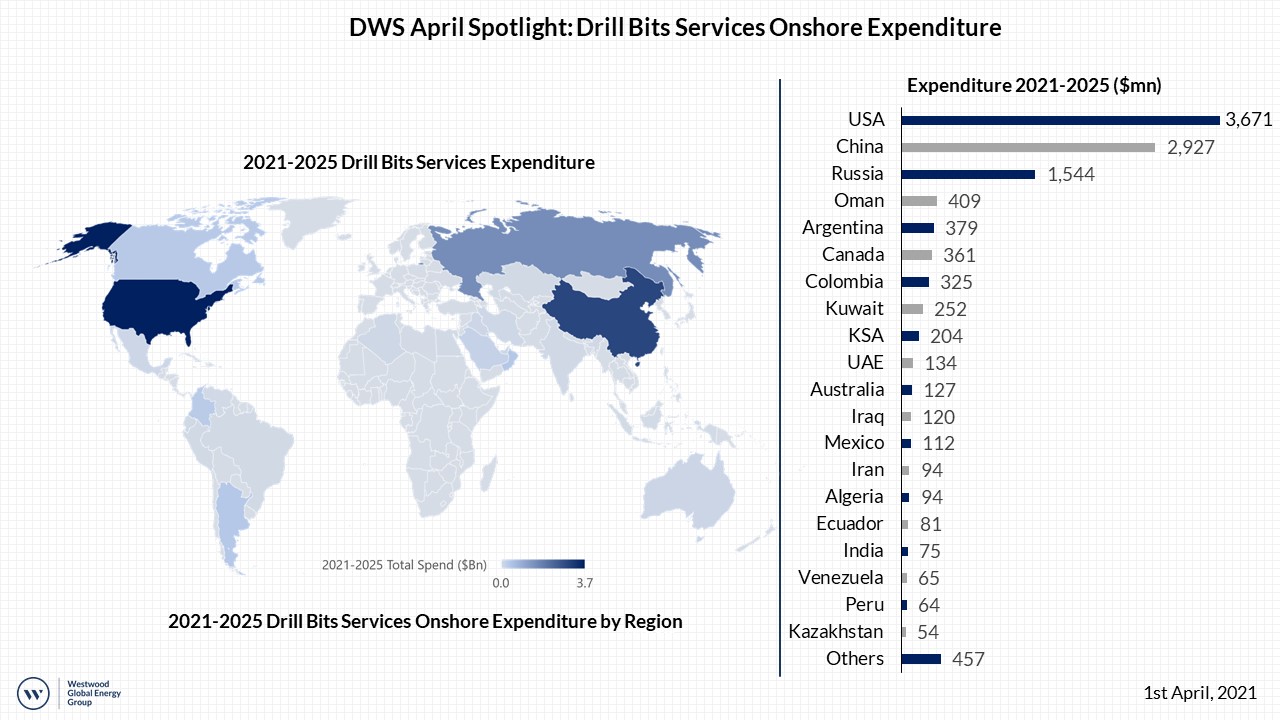

DRILL BITS SERVICES EXPECTED TO TOTAL $12BN OVER 2021-2025 WITH ACTIVITY IN CHINA, Russia and UNITED STATES forecast to drive spend

- Drill bits services are one of 21 service lines covered in Westwood’s World Drilling & Well Services report, the latest edition of which has just been released. For more information, or to purchase the report, please click here.

- Drill bits spend includes the material costs of oilfield drill bits. Choice of drill bit depends on project-specific characteristics, such as polycrystalline diamond compact (PDC) bits that are known for higher durability but higher costs. Roller cone bits have a short run life but are relatively cheap and able to be manufactured in larger sizes.

- Global drill bits expenditure is expected to total $12bn over the forecast. The USA will lead expenditure, driven by the high number of wells to be drilled, accounting for 32% of total spend. China, Russia, Oman and Argentina are expected to account for 46% of total forecast expenditure. Wells drilled, average well depths and the complexity of workscope drive the drill bits market. Year-on-year growth is expected over the forecast, as the number of wells drilled recovers from the nadir of 2020. Further upside comes as operators continuing to develop more complex and challenging reserves as conventional plays mature.

Jack Baxter

Analyst, Onshore

[email protected]

Updated – 1st March, 2021

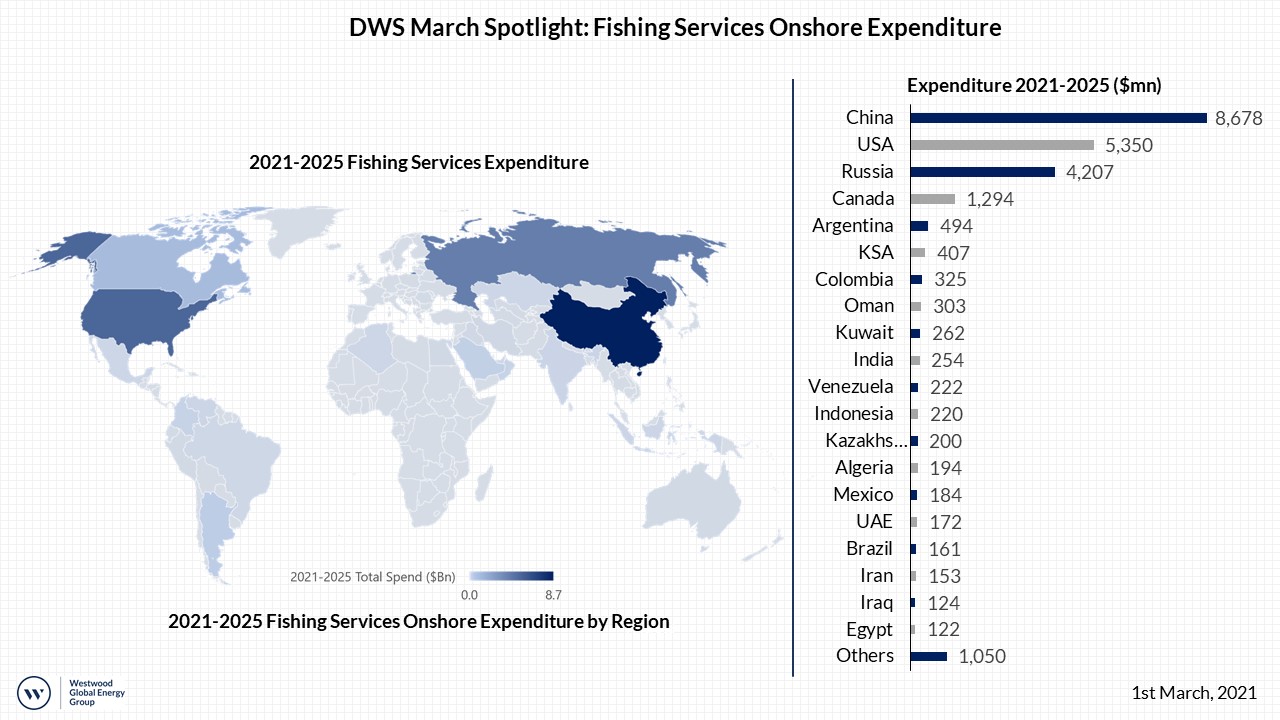

THIS MONTH WESTWOOD PROVIDES AN OUTLOOK FOR FISHING SERVICES, WHERE EXPENDITURE IS EXPECTED TO REACH $24BN OVER 2021-2025 WITH ACTIVITY IN CHINA, RUSSIA AND THE US FORECAST TO DRIVE SPEND.

-

Fishing services are one of 21 service lines covered in Westwood’s World Drilling & Well Services report, the latest edition of which has just been released. Click here to get a sample report or more information.

-

Fishing involves the recovery of unwanted objects or downhole tools from the wellbore, operations are required during the majority of well drilling and workover operations. The number of days required to drill a well, as well as the complexity of operations (HPHT drilling, horizontal/deviated wells) drive demand within the market, which Westwood expects to total $24bn over 2021-2025.

-

The USA, China and Russia account for 74% of onshore wells drilled globally, with a large proportion of these wells expected to be either horizontal or deviated. As a result, fishing services expenditure will be dominated by these three countries. Notably, both Russia and China will see forecast fishing spend increase compared with the hindcast as they pursue increasing horizontal drilling going forward. However, the USA is expected to see forecast spend fall 13% compared to the hindcast as uncertain oil prices subdue drilling and completion activity.

Jack Baxter

Analyst, Onshore

[email protected]

Updated – 1st February, 2021

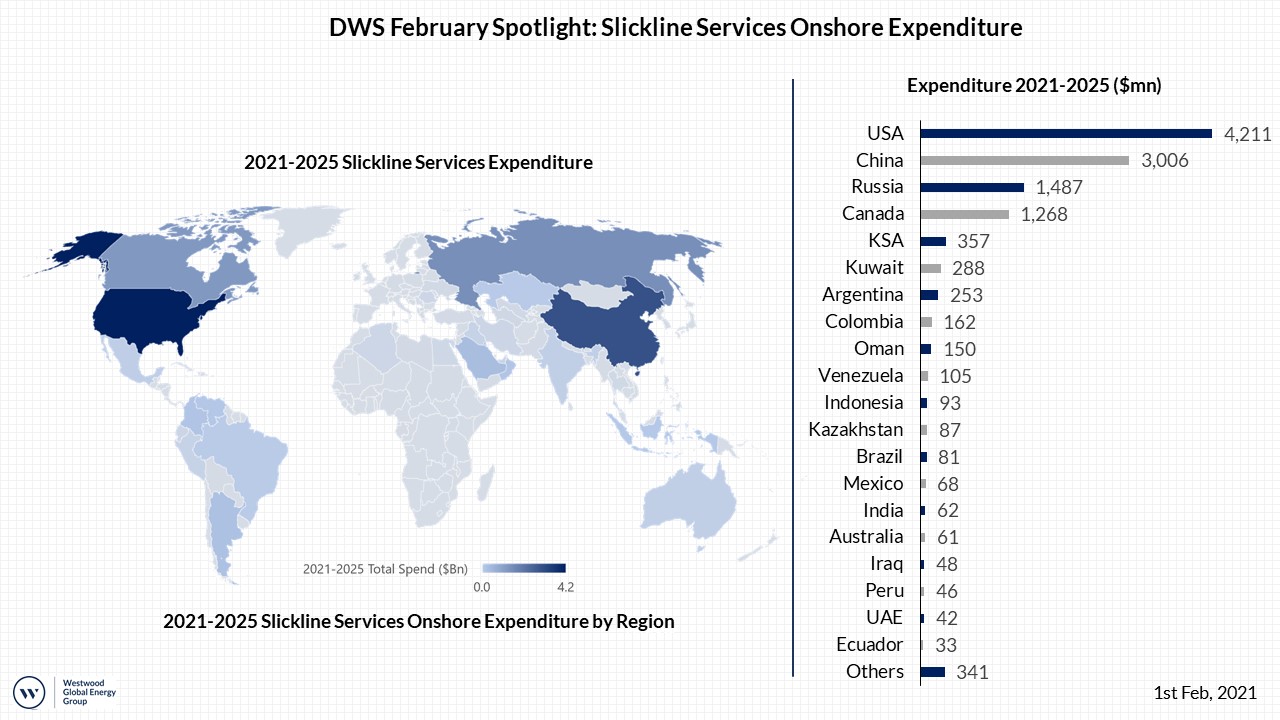

This month Westwood provides a summary outlook for the Slickline Services sector, where expenditure is expected to reach $12bn over 2021-2025, driven by activity in China and the USA.

- Despite being an older oilfield technology, slickline remains a commonly used well intervention tool. Westwood expects global onshore slickline services spend to total $12bn over 2021-2025, similar to the previous five-year period. However, growth in Chinese activity will drive Asia’s forecast expenditure to grow 18% compared to the hindcast, while North America will experience a 10% decline in spend between the hindcast and forecast.

- Combined, North America and Asia will account for 71% of onshore slickline services spend, driven by the high levels of drilling, completion and workover activity in the USA and China. Eastern Europe & FSU is expected to account for 14% of the total, driven predominantly by Russia, while countries such as Argentina, Colombia and Ecuador will support demand in Latin America.

- Argentinian NOC YPF has announced plans to increase investment by 73% in 2021, the majority focused on rebuilding oil & gas production following a 10% decrease in production in 2020. However, this remains contingent upon the success of a bond restructuring bid that is currently underway, with bondholders given until the 8th of February to accept the offer.

Jack Baxter

Analyst, Onshore

[email protected]

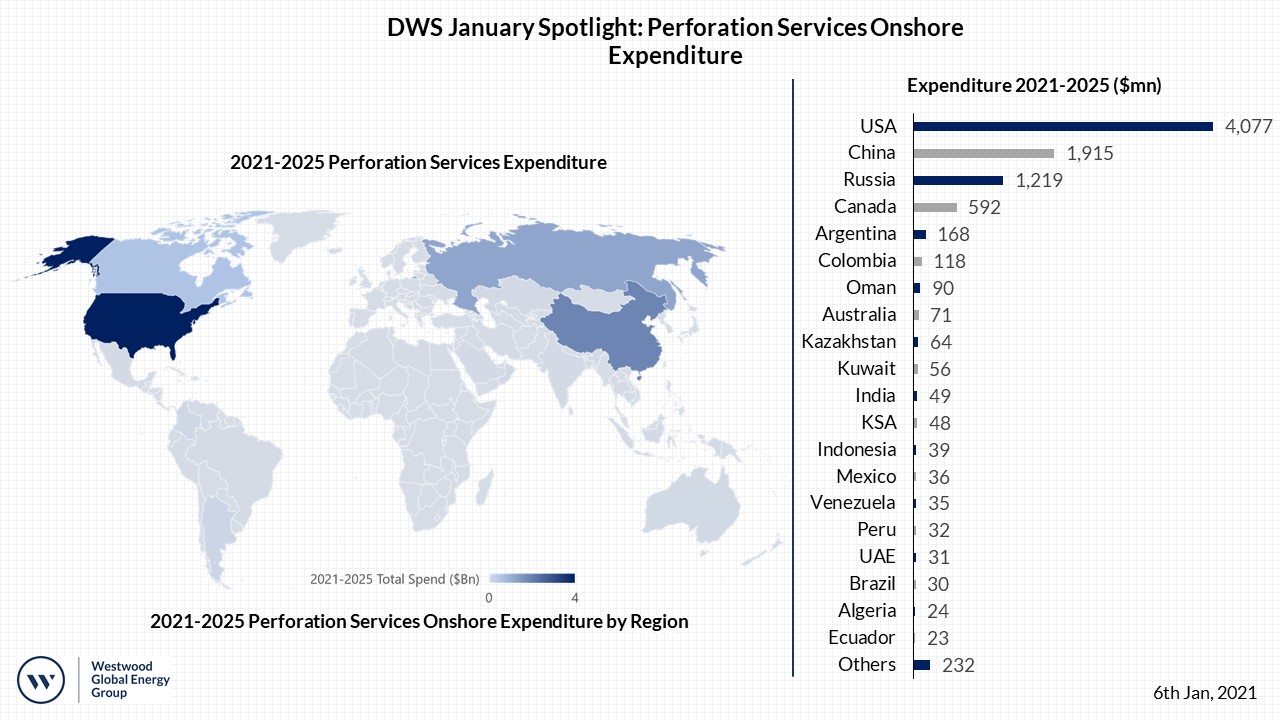

Updated – 6th January, 2021

- From this edition of the DWS spotlight, the forecast period will cover 2021-2025 rather than 2020-2024.

-

Completion and workover activity drives global onshore perforation spend, which is expected to total $9bn between 2021-2025. Those countries with a significant number of drilled but uncompleted wells (DUCs), as well as countries with a large wellstock, will account for the largest proportion of expenditure. Unlike the majority of other DWS service lines, Westwood anticipates forecast perforation spend increasing on the previous 5-year period, due to the relative resilience of workover operations compared to new drilling activity through a downturn.

-

So far in 2021, there has been a notable increase in oil prices, helped by OPEC’s recent decision to extend and, in some cases, deepen production cuts. While uncertainty remains prevalent, perforation expenditure is expected to see year on year increases from the nadir of 2020, with total spend in 2025 expected to be 56% higher, as completion activity improves in line with an expected improvement in oil price

Jack Baxter

Analyst, Onshore

[email protected]

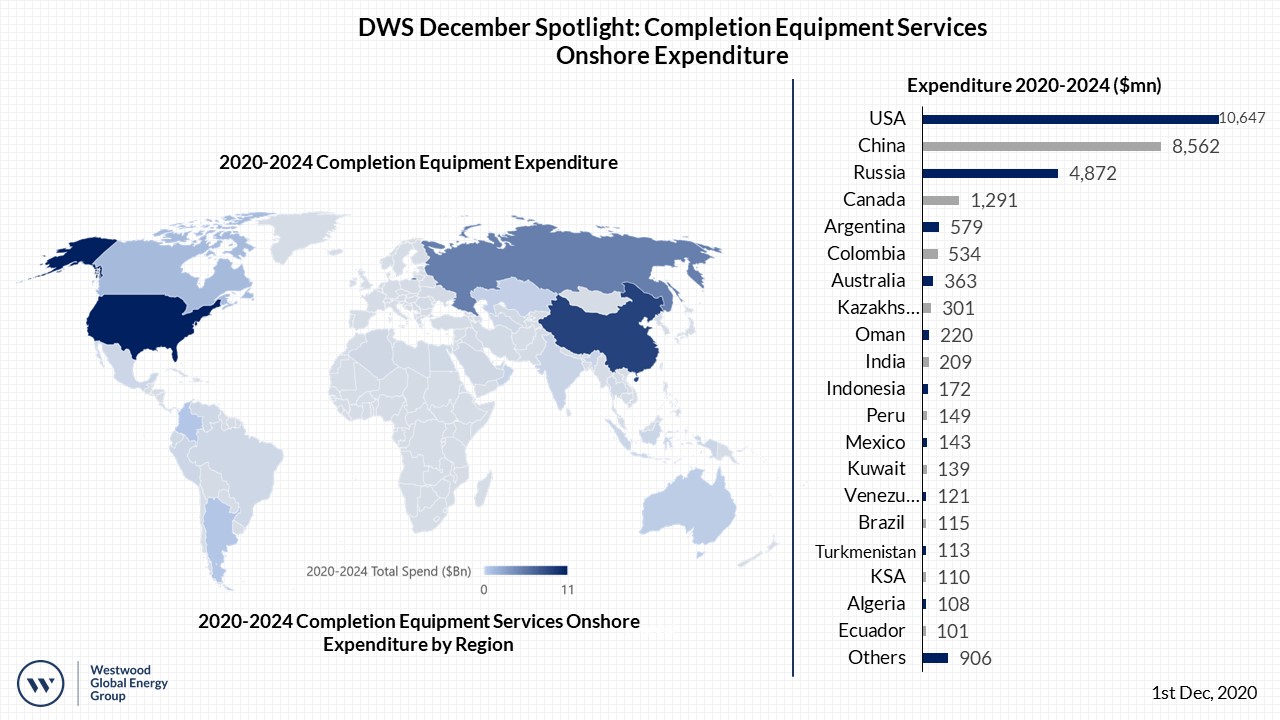

Updated – 1st December, 2020

- As of December 2020, Westwood anticipates global onshore completion equipment services will total $30bn over 2020-2024. Expenditure is expected to see year on year increases from the nadir of 2020, with total spend in 2024 expected to be 47% higher, as drilling activity improves in line with an expected improvement in oil price. Crucially, however, expenditure in 2024 is expected to remain 10% below 2019 levels.

- The completion equipment services market is dominated by the world’s biggest drillers, with the USA, China and Russia accounting for 81% of all spend in this service line over the forecast.

Jack Baxter

Analyst, Onshore

[email protected]

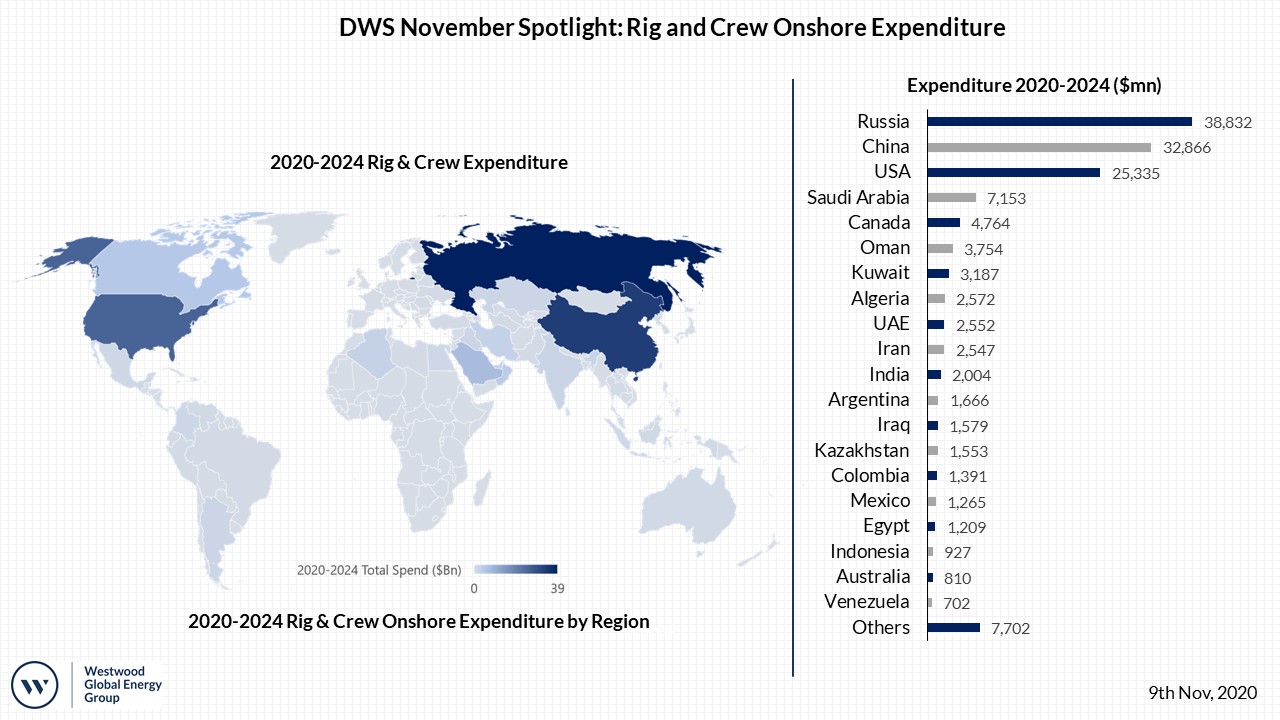

Updated – 9th November, 2020

- As of November 2020, Westwood anticipates global onshore rig & crew will total $144bn over 2020-2024. Expenditure is expected to see year on year increases from the nadir of 2020, with total spend in 2024 forecast to be 36% higher, as drilling activity improves in line with an expected improvement in oil price. Forecasted expenditure is expected to peak in 2024, but is still expected to be below 2019 levels, highlighting the continued economic pressure that is expected to weigh on developments.

- In November 2020, Westwood has revised up drilling expectations to several countries within the wells drilled forecast. Both Colombia and Argentina have seen positive revisions to wells drilled compared to October expectations, due to positive rig data and reports from rig contractors.

- The rig & crew market is largest for the world’s biggest drillers, with Russia, China and the US accounting for 67% of all spend in this service line over the forecast.

Jack Baxter

Analyst, Onshore

[email protected]

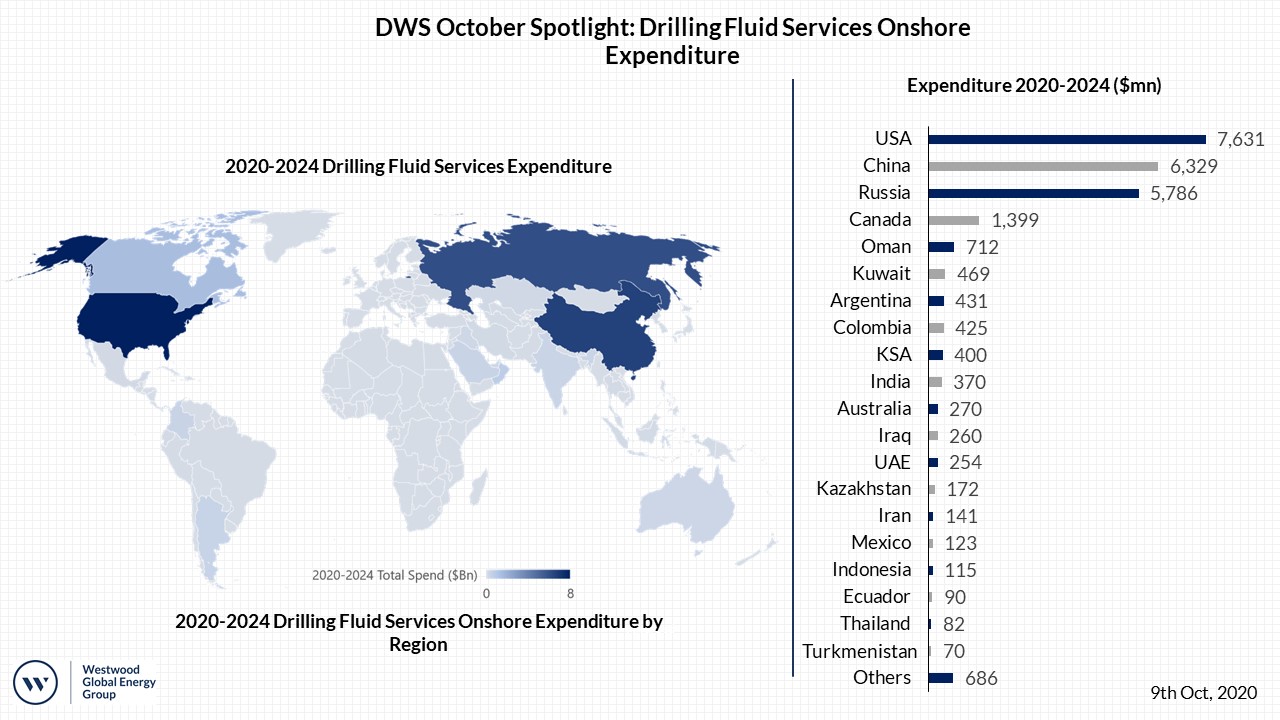

Updated – 9th October, 2020

- As of October 2020, Westwood anticipates that global onshore drilling fluid services will total $26bn over 2020-2024. Expenditure in 2020 was 50% lower than in 2019 and is expected to fall a further 2% in 2021 as continued low oil prices, as well as operator budget cuts, impact drilling activity in key demand countries, especially the USA. However, beyond this point prices are expected to recover, with spend in 2024 expected to be 49% higher than the nadir of 2021.

- Over 75% of global drilling fluid services expenditure comes from the USA, China and Russia, due to the high number of wells drilled in order to maintain production at their assets.

Jack Baxter

Analyst, Onshore

[email protected]