The offshore wind market slowed further in 2025, prompting a shift in behaviours. Governments that continue to support offshore wind are now attempting a more deliberate approach to prioritise project delivery while protecting local industries. At the same time developers and the supply chain are exercising more discipline with their investments. Despite this behavioural shift, overall spending in 2026 is expected to rise and upcoming auctions will provide the foundations for future growth.

To navigate this evolving landscape successfully over the coming year, market participants should pay close attention to the following five key themes:

1. Balancing industrial and energy policy

In 2026, governments will need to face the growing challenge of balancing rapid offshore wind deployment with maximising economic benefit for local industries. Accelerating projects is critical to delivering secure, affordable energy supplies, and meeting clean-energy targets. It can also support local industrial growth, but often at increased costs and time. This dual objective is becoming harder to manage.

The growing presence of Mainland Chinese supply chain companies in international offshore wind projects – particularly in the turbine OEM sector – has also started to increase tensions. Local suppliers have increasingly called on governments to introduce protectionist measures to preserve local benefits. Developers by contrast have generally seen this development more positively as greater competition gives them more choice and stronger negotiation leverage.

The dilemma of whether to focus on rapid project delivery or protecting (and growing) local suppliers is taking centre stage. How governments resolve this trade-off will influence investment decisions, project timelines, and the overall pace of offshore wind growth.

2. Strategic shifts to capture more value

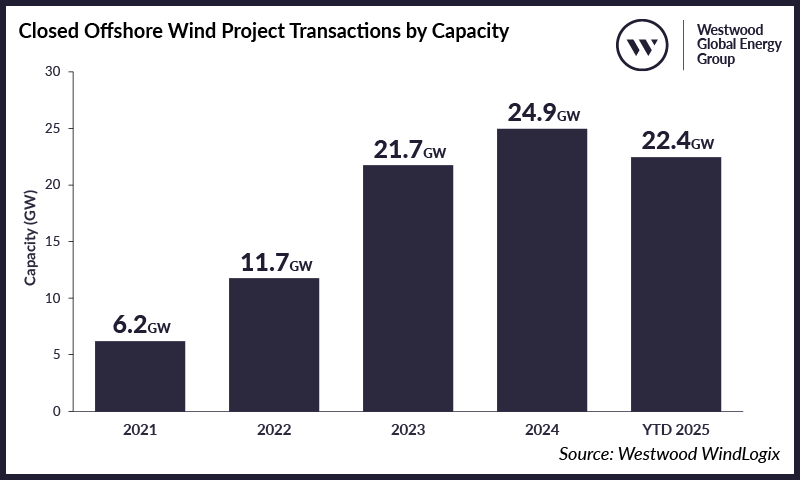

As the offshore wind market has slowed, developer strategies have shifted from growth at all costs to ‘value over volume’. This has resulted in developers increasingly divesting stakes in projects and shifting to partnership structures to manage risk and capital exposure. This shift reflects a broader move toward collaborative development that enables financial flexibility and operational resilience. Westwood expects divestments to continue in 2026 with some companies exiting the sector, while others look to secure value from more advanced projects (especially those with offtake agreements), or reduce exposure to higher cost / risk developments such as floating wind or projects in newer markets.

Closed Offshore Wind Project Transactions by Capacity

Source: Westwood WindLogix

Other ways that developers may seek to capture more value is through the increased focus on service offerings. An example of this includes Orsted entering into a preferred supplier agreement to supply its Osonic technology to Luxcara. Under the agreement, Orsted will also provide engineering, procurement, and construction consultancy services. Orsted’s decision to license its low-noise monopile installation technology highlights a new opportunity: developers can generate additional revenue as a direct technology supplier.

At the same time, supply chain players are moving beyond traditional roles, potentially becoming equity stakeholders in projects. Ming Yang illustrates this trend as it looks at opportunities outside Mainland China, including reported interest in ScotWind projects and a collaboration with BuhaWind on a 2GW offshore wind farm in the Philippines. These moves suggest a desire to be more directly involved in projects, but likely as a means to secure turbine orders and gain exposure to new markets rather than becoming a long-term operator. With developers increasingly selling down stakes, an opportunity is emerging for supply chain companies to step in as co-investors and take direct equity positions.

3. Finding opportunity in the supply chain

After four years of cost inflation, failed auctions and cancelled projects, the industry as a whole has shifted to a more selective and cautious approach. Developers are sharpening their geographic and financial focus, resulting in fewer projects reaching FID, and a more uneven and unpredictable pipeline.

The supply chain is responding in kind, pulling back from or pausing large-scale expansion. Major OEMs are no longer pursuing aggressive manufacturing build-outs: Siemens Gamesa shelved its nacelle plant in Denmark, citing the need for greater market clarity, while Vestas has put its planned blade factory in Poland on hold, reflecting weaker-than-expected European offshore demand. Fabricators echo the same caution. Sif reported a slowdown in tendering activity and project awards being postponed or cancelled, highlighting how hesitancy at the developer level cascades through the entire value chain.

With the US market stalled, APAC cooling, and European auction timetables slipping, suppliers increasingly prefer to concentrate on fewer, higher-certainty projects rather than spreading themselves thin. The result is a leaner, more disciplined supply chain that carefully allocates capital. For 2026, this creates a tighter, more competitive supply chain environment where only projects with strong policy backing, and clear revenue visibility will be able to secure supply chain commitment and move forward at pace.

4. Financial support – In with the old and in with the new

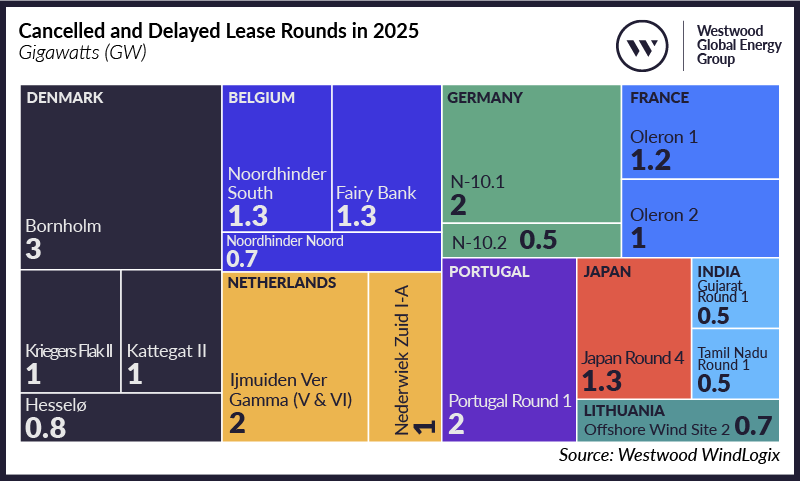

There have been numerous failed offshore wind subsidy and lease auctions across the world in the past 18 months. The precise circumstances have varied by country, but the same challenges have been cited repeatedly: a challenging cost environment, market uncertainty and, above all, insufficient financial support from governments. 2026 will be in part defined by the actions that governments take to reverse this trend.

Cancelled and Delayed Lease Rounds in 2025

Source: Westwood WindLogix

In markets where offshore wind has strong political support, governments have already begun to respond by going ‘back to the future’. That is, reintroducing the same financial support mechanisms that they had begun to taper in recent years. The UK, for instance, has significantly increased the financial firepower available to its annual Contract for Difference (CfD) auctions since the failure of the 2023 round, while the Netherlands and Denmark have moved away from the ‘zero-subsidy’ approach and a similar move is under discussion in Germany.

Perhaps more novel is governments’ increasing use of arm’s-length state institutions to provide support to the industry. For instance, the UK has established GB Energy, which seems likely to act as a ‘beachhead’ developer in floating wind. Taiwan has required its state power company to establish demand aggregators to stimulate demand for offshore wind PPAs, and South Korea has created a new bidding category for projects developed by public bodies. How successful these initiatives – and others like them – are may even play a role in determining the extent to which additional direct government support is required.

5. Investment and auction uptick

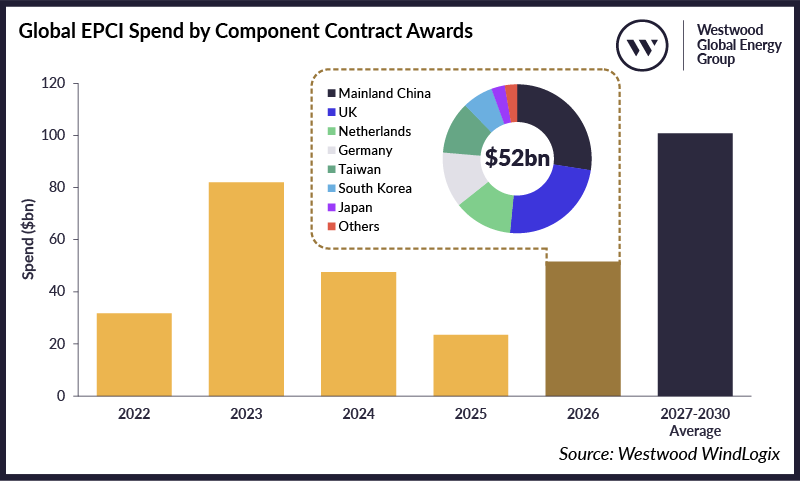

Despite the headwinds that the offshore wind sector has been facing, component spend in 2026 is forecast to be more than double 2025 levels (on a contract award year basis), making it the second highest year for global spending after 2023. Investment in 2026 will act as a starting point for a huge wave of investment that is expected to continue to the end of the decade.

Global EPCI capex spend in 2026 (based on awarded contract values) is expected to reach $52bn, led by Mainland China. Outside of Mainland China, the UK will lead spending, driven by contracts being finalised by projects awarded a CfD in Allocation Round 7 (AR7). The Netherlands, Germany and Taiwan follow closely, with activity centred on projects that are scheduled to come online between 2027 and 2029. Finally, projects in South Korea and Japan which have secured offtakes are also poised to be major contributors.

Global EPCI Spend by Component Contract Awards

Source: Westwood WindLogix

Lease awards in 2026 are also expected to exceed 2025 levels, with up to 48GW forecast, however some of this capacity reflects delayed or re-tendered sites. Several leasing rounds currently in the tendering stage are set to conclude in 2026, including Bass Strait in Australia, A09 in France, and North Sea Central and Hesselo in Denmark. Meanwhile, auctions in the pre-tender stage in Germany, Japan and Belgium, are anticipated to be awarded in 2026.

Offtake auctions will also progress across both mature and emerging markets. The UK’s CfD AR7 results will be announced, while the Philippines plans to award up to 3.3GW of offtakes via the Green Energy Auction 5 (GEA-5), its first offshore wind auction. Most auction activity will remain focused on fixed-bottom projects, though floating wind will feature in select rounds such as A09 and via AR7’s floating wind pot.

Overall, 2026 is set to be a pivotal year for offshore wind. Developers, supply chain companies and governments will all continue to adjust their strategies in an attempt to capture maximum value and growth in what will be a cautious and somewhat unstable market. Nevertheless, significant investment is still expected, and key auction milestones will help to shape the next wave of global project development.

David Linden, Executive Director & Head of Energy Transition

[email protected]

Bahzad Ayoub, Manager – Offshore Wind

[email protected]

Peter Lloyd-Williams, Senior Analyst – Offshore Wind

[email protected]

Hui Min Foong, Senior Analyst – Offshore Wind

[email protected]

Giulia Cannatelli, Analyst – Energy Transition

[email protected]