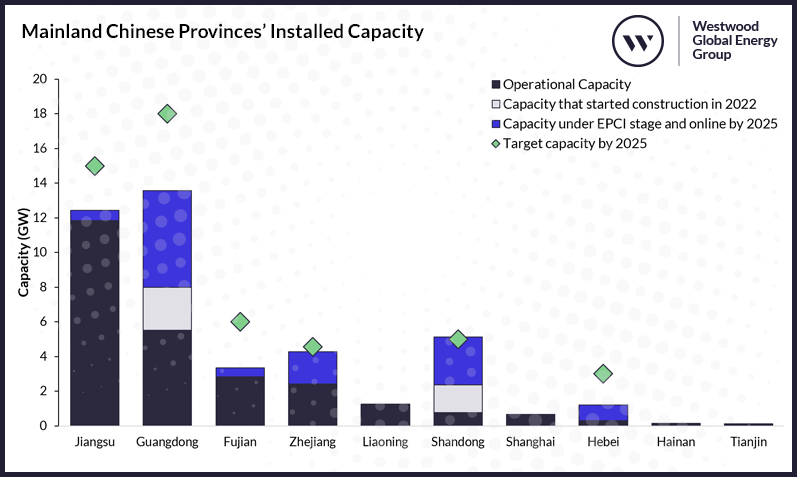

Mainland China’s offshore wind market experienced phenomenal capacity growth in 2021, adding 16.4GW and catapulting to pole position in the global markets. A key driver of the rush to add capacity was the termination of central government subsidies at the end of 2021. The question this raises is whether the lack of central government subsidies will now stifle offshore wind development in Mainland China.

According to Westwood’s WindLogix data for capacity additions this year so far, Mainland China embarked on offshore wind construction (i.e., installed the first turbine foundation) in the first 11 months of 2022 in two main provinces – Guangdong and Shandong. A total of 2.5GW of capacity began construction in Guangdong and 1.6GW in Shandong. Incidentally, these are also two of the three provinces that have some form of provincial subsidies – the third of which is Zhejiang.

Mainland Chinese Provinces’ Installed Capacity

Includes capacity that started construction in 2022, capacity to be installed by 2025, as well as 2025 targets.

Source: WindLogix, Westwood Analysis

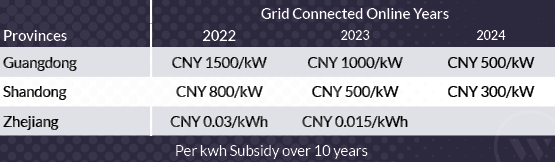

Provincial subsidies for offshore wind

Of the three provinces, Guangdong was first to announce comprehensive subsidies for the province’s offshore wind projects in December 2020. Under this scheme, the Guangdong government will subsidise the offshore wind projects that were approved before the end of 2018 and commissioned between 2022 and 2024. No subsidies will be given for projects coming online after 2025. The Guangdong government will subsidise CNY 1500/kW (US$236/kW) of capacity installed in 2022, CNY 1000/kW (US$ 157/kW) for capacity installed in 2023, and CNY 500 (US$79) per kilowatt installed in 2024.

In the Shandong province, during the period of the 14th Five Year Plan, for offshore wind projects completed and connected to the grid between 2022 and 2024, the province will provide subsidies of CNY 800 (US$126), CNY 500 (US$79), and CNY 300 (US$47) per kilowatt for each year respectively, and the scale of subsidies will not exceed 2GW in 2022, 3.4GW in 2023 and 1.6GW in 2024 respectively.

For Zhejiang province projects grid-connected in 2022 and 2023, the provincial subsidy given standards will be CNY 0.03/kWh (up to 600MW) in 2022 and CNY 0.015/kWh (up to 1.5GW) in 2023. The corresponding subsidy standard shall be determined according to the year the project is connected to the grid at full capacity, and the projects enjoying provincial subsidies shall be determined according to the principle of “first-build, first-served”. The subsidy period for the project is 10 years, starting from the second year after the project is fully connected to the grid, and will be subsidised based on the equivalent annual utilisation hours of 2,600 hours. Projects that have been approved before the end of 2021, and those that do not achieve full-capacity grid connection by the end of 2023 will no longer enjoy provincial financial subsidies.

Provincial Subsidies for Offshore Wind Projects

Source: Guangdong Government (www.gd.gov.cn), Shandong Government (www.shangong.gov.cn), Zhoushan Government (www.zhoushan.gov.cn), Westwood Analysis

A temporary slowdown

The market is undecided on the effectiveness of these provincial subsidies but compared with the original central government’s subsidy of CNY 0.75-0.85/kWh, the provincial subsidy is relatively small. It is noteworthy that the provinces have chosen a different subsidy approach – Zhejiang has adopted a kWh-based subsidy, while both Guangdong and Shandong have adopted one-off subsidies. These subsidies are only available in these three provinces and notably Jiangsu (with the current highest installed capacity) as well as Fujian, have not announced any subsidy to date.

Many in the industry still believe that local government support will help the development of offshore wind parity in the early stages. Relevant subsidies will increase the profitability of developers and further drive the installation capacity of offshore wind power projects.

Westwood forecasts Mainland China installed offshore wind capacity in 2022 and 2023 to reach 3.5GW and 4.7GW respectively, which is a slowdown from the 16.4GW installed in 2021 but remains higher than the average 2-3GW levels of 2019-2020. This shows the momentum is ongoing, albeit at a slower pace.

Subsidies do not appear to be the main growth driver for Mainland Chinese offshore wind development moving forward.

Targeting offshore wind investment

Mainland China has set itself a target of reaching peak emissions by 2030, which according to Chinese President Xi Jin Ping will see it boost its installed capacity of wind and solar power to more than 1,200GW by 2030, compared to 706GW reported by the National Energy Administration at the end of 3Q 2022.

Guided by central government policy, Mainland Chinese offshore wind developers see these targets as a key motivator for their offshore wind investment strategy. But most importantly, investors see the commercial opportunity in offshore wind – even without government support. Mainland Chinese developer China Three Gorges (CTG) launched an initial public offering for CTG Renewables on the Shanghai Stock Exchange in June 2021 worth CNY 22.5 billion (US$3.48 billion). The company said that fresh capital will go toward building offshore wind farms.

More recently in 2022, operator CNOOC commenced a new campaign for the next three years to 2025 involving investments of CNY 23 billion (US$3.3 billion) in offshore wind and solar projects in the Fujian province. Of the total spending, CNY 20 billion (US$2.8 billion) is earmarked for offshore wind projects.

A resilient supply chain

The offshore wind supply chain also appears to be in better shape than the woes being experienced by their European counterparts.

A prime example of this is the cost headroom available. Turbine prices, the biggest ticket item in offshore wind construction projects, have fallen by 34% from 2020-2022 levels and looks set to remain at that level. Smaller turbine manufacturers like Zhejiang Windey and new turbine manufacturers like CRRC Zhuzhou Electric are throwing in low bids to get back into the game while larger turbine OEMs like Ming Yang Smart Energy and Goldwind are developing larger turbine sizes that can lower project costs.

The supply chain resilience is based on the expectation and acceptance of smaller profits, with the grid parity conditions, believed to be achieved 2024-2025 while striving to lower manufacturing costs.

Targets and cost reductions driving the future

The lack of central government subsidy has brought Mainland China’s offshore wind development back to ‘normal’ growth levels. While provincial subsidies have stepped in, their impact is more limited, both in size and geography. Instead, a resilient supply chain has responded to market needs, continuing to push down costs to support the competitiveness of offshore wind development in Mainland China.

The role that offshore wind can play in achieving peak carbon emissions by 2030 is not unnoticed by developers and the investment community, who are responding by raising money to build more wind farms in Mainland China.

Ruth Chen, Senior Analyst – Offshore Wind

[email protected]