Quarterly Summary

Global land drilling rig activity in 3Q 2023 broadly continued the same path as the preceding two quarters. High levels of both E&A and development drilling were observed in many areas across the globe, especially the Middle East and Asia Pacific. Despite the broadly favourable market conditions, there was a noted reduction in drilling activity in the United States. This was especially clear in natural gas-focused shale plays, as reduced natural gas pricing prompted operators to reduce drilling activities. This underlines the continued caution with which operators are progressing with drilling campaigns, something that is likely to be a key theme of US activity over the next few years.

Numerous mergers and acquisitions (M&A) were announced during the quarter under review, led by activities in North America. At the same time, significant contractual deals continued to flow into the industry, with the Middle East seeing the largest awards in announced contract value.

Oil prices remained strong in 3Q 2023, averaging US$87/bbl, compared to US$79/bbl in 1H 2023, owing to the intervention of OPEC+, especially Saudi Arabia and Russia, who agreed to additional voluntary cuts of 1mmbpd and 0.3mmbpd respectively. This highlights the steps Saudi Arabia is willing to take to ensure oil prices remain above its fiscal breakeven, which should help support pricing at the current range through to the end of 2023.

M&A Activity

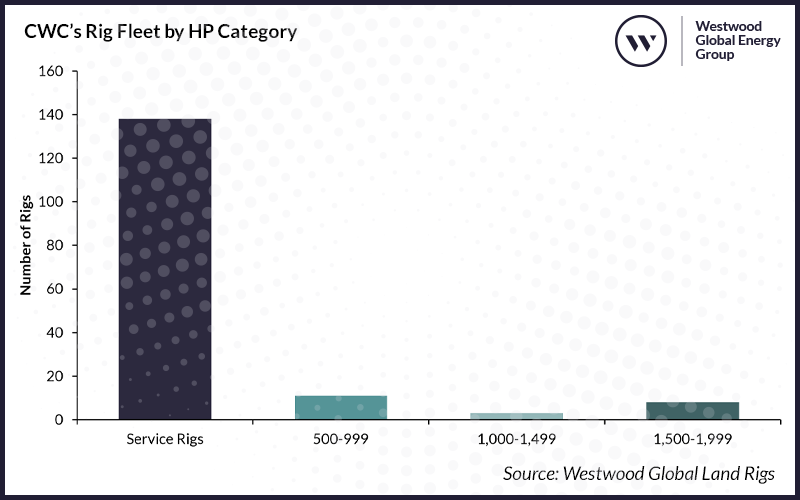

Several new M&A deals were announced this quarter, most of which are focused in North America. In Canada, Precision Drilling is set to acquire CWC Energy. The deal is comprised of CWC’s fleet of 138 service rigs and 22 drilling rigs operating in Alberta and Wyoming and strengthens Precision’s service offering in both Canada and the US. The transaction is expected to complete in 4Q 2023.

CWC’s Rig Fleet by HP Category

Source: Westwood Global Land Rigs

| Seller | Buyer | Country | Value (US$) | Asset | Effective Date |

| CWC | Precision Drilling | Cananda & USA | $141mn | Merger | Q4 2023 (closing date) |

| Ulterra Drilling Technologies | Patterson-UTI | Global | $370mn & 34.9m shares | Merger | July 2023 |

| Rime Downhole Technologies | Cathedral Energy Services | USA | $21mn & 24.6m shares | Merger | July 2023 (closing date) |

| Earthstone Energy | Permian Resources | Lower 48 - USA | $4.5bn | 223,000 acres Permian & 56,000 acres in Deleware | - |

| Chesapeake Energy Corporation | SilverBow Resources | Lower 48 - USA | $700mn | Eagle Ford Assets | February 2023 |

| PDC Energy | Chevron | Lower 48 - USA | Stock | 275,00 acres in Permian & DJ Basins | - |

| Jala Capital Investments | Zenith Energy | Lower 48 - USA | $50,000 | 320 acres in Midland basin | August 2023 |

| Mosman Oil & Gas | 84 Energy Corp | Alaska - USA | ND | Falcon-1 Lease | September 2023 |

| Santos | APA Corporation & Lagniappe | Alaska - USA | ND | Working interest in 148 exploration leases | - |

| Oando | Eni | Nigeria | ND | Nigerian Agip Oil Company | TBA |

*Deals carried out simultaneously

Deals Announced and Completed in 3Q 2023

Source: Westwood Global Land Rigs DailyLogix/Press Releases

Eni’s sale in Nigeria is representative of an ongoing trend of International Energy Companies (IEC) in Nigeria farming down their onshore and shallow water assets in favour of their deepwater interests. For instance, ExxonMobil is in the process of selling its 40% stake in onshore assets, and Shell is seeking to trade in its 30% holding in a joint venture (JV) with Eni , TotalEnergies and Nigerian National Petroleum Co. in the Niger Delta area. As detailed in our August Westwood Insight on Nigeria, these sales could help to grow activity in the onshore sector as domestic players look to invest into their newly purchased assets.

Nigeria Rig Demand Outlook

Source: Westwood Global Land Rigs

Contract Awards

Several multi-billion-dollar contracts have been awarded this quarter, with the Middle East continuing to be a hotbed for contract awards, driven by NOCs across the region investing in projects to increase production capacity.

In the UAE, ADNOC awarded multiple contracts for a raft of projects this quarter, including a 51-month engineering, procurement, construction and management (EPCM) contract for production enhancement works at the Bab and Bu Hasa oilfields. The deal, signed with CPEEC, will raise production from the fields by a combined 191kbpd.

NOC Kuwait Oil Company (KOC) reported that it has awarded US$3.25 billion in contract awards for 91 projects between January and August 2023. The deals, the largest financial value of contracts for several years, according to KOC, are part of a bid to increase production from 2.8mmbpd to 4mmbpd by 2035.

In Saudi Arabia, Saudi Aramco awarded Arabian Drilling a US$799 million contract for 10 newbuild land rigs on five-year contracts, which have been assigned to Aramco’s Unconventional Program. This contract, along with Saudi Aramco’s JV with Nabors (SANAD), which will see 50 land rigs added over a 10-year period, will see a significant increase in Saudi Arabia’s rig fleet. In its 2Q update, Nabors reported that the third rig of its newbuild programme had entered operation, with a further two expected by the end of 2023. Aramco is also deciding on three bidders for Phase 2 of the gas processing infrastructure on its US$100 billion Jafurah project, which is expected to be awarded in October.

KCA Deutag announced a raft of land drilling contracts and extensions in September. In Saudi Arabia, contract extensions for four rigs, amounting to a total of 23 years of additional work, have been awarded. The deal also includes an equipment upgrade project for the delivery of mechanised catwalks on two rigs. The contracts had a combined value of US$292 million. In Oman, deals worth a total of US$78 million were signed. Two existing contracts have been extended for two and one year, respectively, while a third stacked rig has been awarded a three-year contract with options to extend this to five years. A further rig in Pakistan has secured a new one-year contract with a value of US$9 million.

NESR also announced multiple contracts and extensions across the GCC and North Africa in its drilling and evaluation (D&E) and production services (PS) segments from National Energy Services Reunited (NESR) worth US$175 million.

Lease Sales

A series of lease sales and licensing rounds have been announced in 3Q. In Israel, Zion Oil and Gas was awarded a new exploration license, Megiddo Valleys 434, measuring approximately 302sq.km. The license is valid till 13 September 2026, with the potential for four one-year extensions for a total of seven full years until 13 September 2030. Whilst in Egypt, 23 onshore and offshore blocks are on offer, with 11 blocks located in the Westen Desert. The deadline for offers is set for 25 February 2024.

In Indonesia, two onshore exploration blocks, Akimeugah 1 and 2, are on offer for a three-year exploration and drilling term by the Indonesian Ministry of Energy and Mineral Resources as well as Genting offering an EPC tender for early production facility at its Asap, Kido and Merah (AKM) gas fields development.

In North America, the Alaskan Department of Natural Resources (DNR) announced a lease sale of 3.9 million acres of onshore oil and gas areas. Wells have been drilled in the area, but no commercial amounts have been discovered to date.

Drilling Activity

Africa

In South Africa, Kinetiko Energy subsidiary, Afro Energy, and the Industrial Development Corporation of South Africa (IDC) secured a non-binding Term Sheet agreement constituting South Africa’s largest onshore liquified natural gas (LNG) project in a bid to exploit 2tcf of gas reserves in South Africa. The two-stage deal will see the appraisal and production of five wells in a 10-well development.

Invictus Energy spudded the Mukuyu-2 well in Zimbabwe, Africa, using the Exalo 202 1200 HP rig, and drilling continues to a planned depth of 3,750 metres. In Angola, meanwhile, Sonangol has spud the Tobias-13 exploration well on the Kon 11 block, targeting 6mmbbl at 750 metres. This well is the first to be spud on the block since 1996.

In addition, this quarter, TotalEnergies commenced drilling its debut well at the Tilenga project with the expectation to drill a further 12 developmental wells this year using three rigs, including Sinopec’s 1,500 HP, 1501 land rig. In Morrocco, Chariot Oil and Gas raised US$15 million for a license to drill seven wells over the next 18 months as part of a gas drilling campaign.

Latin America

In Latin America, Melbana Energy reported the successful appraisal of the Alameda-2 well in Cuba using Sherritt International’s Rig 1. The Sherritt International rig was subsequently moved to the Alameda-3 well site, with spudding scheduled for 4Q. Following the success of the drilling prospects in Cuba, NOC Cupet reported increased interest in exploration wells with Petro Australis Energy set to spud a well in Block 21A-P to a final drilling depth of 4,200 metres as well as possibly spudding three wells in Block 14 with drilling scheduled for 2025. Sherritt International has also identified a drillable prospect in Block 6A, but no drilling plans have been released.

Moreover, in Colombia, Arrow Exploration has reported plans to drill new wells, including a multi-horizontal well project and a follow-up in the Gacheta formation field following the success of the Carrizales Norte-3 well (CN-3 well) using Petrowork’s PW-160, 1,500 HP rig. The unit will be used for all drilling activities in the project.

Colombia Rig Fleet by Contractor

Source: Westwood Global Land Rigs

Furthermore, a new natural gas field was discovered at the site of the Remanso-1X exploration well in Bolivia, unveiling a find of an estimated 700bcf and 52mmbbl of liquids. The discovery is part of a 29-well intervention campaign at mature or closed fields to help boost the country’s waning production.

A referendum held on 20 August 2023 saw the Ecuadorian electorate vote in favour of a ban on further drilling and production in protected areas of the Amazon rainforest. This includes activity at the ITT development, where 230 wells are currently in service and responsible for 10% of the nation’s oil output. Activity is expected to be curtailed over 12 months from the result announcement. As a result, drilling activity within the country is expected to contract in the coming years.

North America

Lower 48 Rigs Operational by Basin

Source: Westwood Energent

In the US, there was a further drop in rig activity in 3Q, representing a continuation of a trend that began in 1Q 2023. Rig activity averaged 633 rigs in 3Q 2023, down from 757 in 4Q 2022 and 9% lower than 2Q 2023. This was a direct reaction to lower natural gas pricing, highlighting the continued focus of capital discipline from operators who are utilising the short-cycle nature of shale barrels to respond to market conditions and requirements.

The Permian, by far the biggest shale play in terms of rig activity, has not been immune to this, seeing a degree of deceleration after strong levels of activity in 2022. Several companies have announced a pause to gas-centric drilling in the Permian, including Apache, who stated that they would pause drilling activities in the Alpine High area for the rest of 2023.

Activity in 4Q is expected to continue to decline, in line with the expectations of major US rig contractors. Dayrates were reportedly as high as US$40,000 a day at the beginning of 2023, have regressed, with super-spec units closer to US$30,000.

Ben Wilby

Senior Analyst, Onshore Energy Services

[email protected]

Deborah Yamba

Research Analyst, Onshore Energy Services

[email protected]

The Global Land Rigs Newsletter highlights key takeaways for the quarter. Full access to daily news updates on the global onshore drilling industry is available to subscribers of Global Land Rigs.