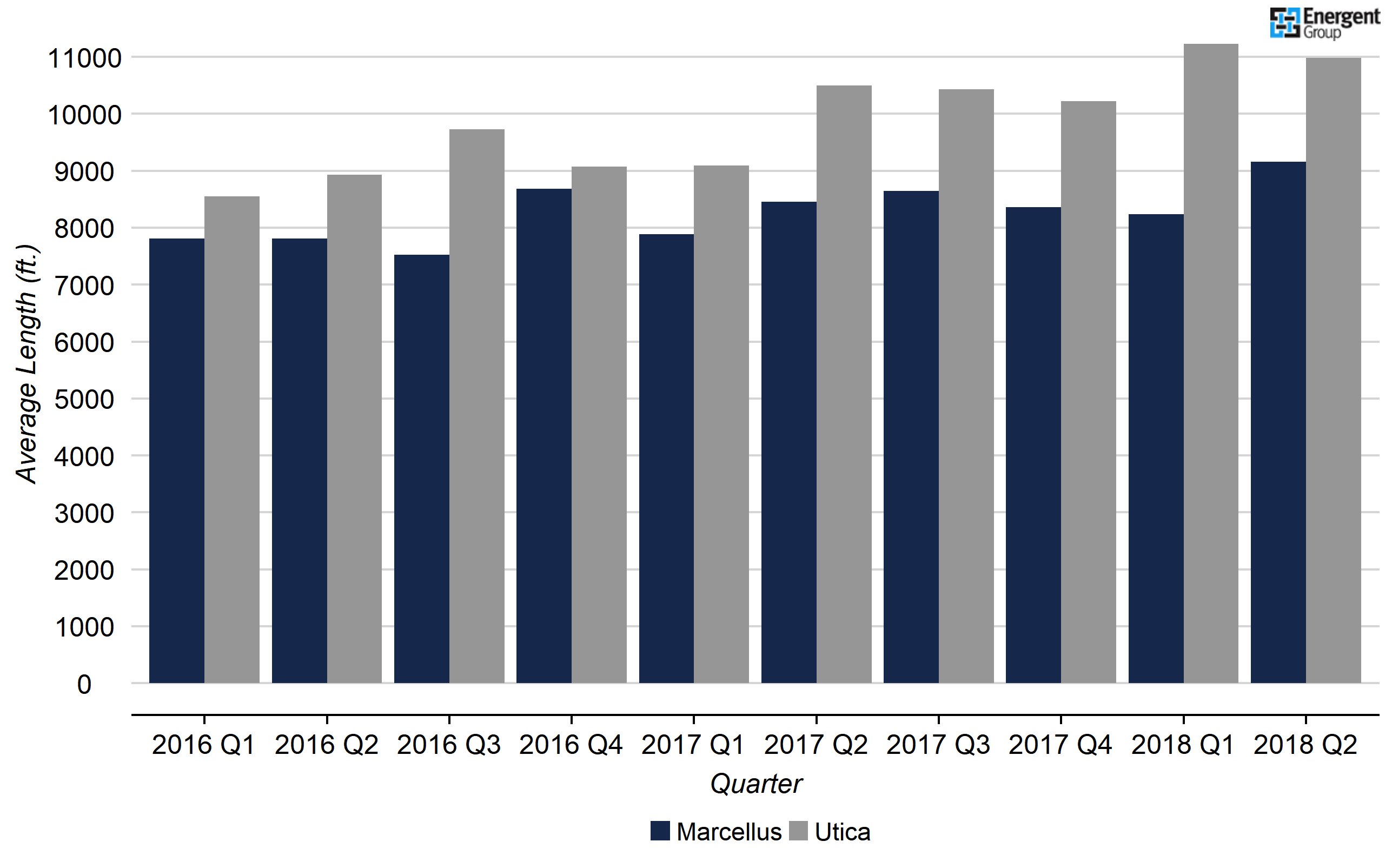

Operators across the Lower 48 are continuously enhancing their drilling and completion techniques to extract the most out of any given well. While lateral length trends vary in each basin, operators in the Marcellus and Utica in the US Northeast are testing some of the longest laterals in the country—beyond 20,000’ in some cases—and are showing no signals of slowdown. Operators in the Marcellus and Utica are drilling 9,035-foot average laterals in 2017. Year-to-date in 2018, the average lateral length has jumped to 9,542’, thanks in part to a recent ramp in Marcellus lateral lengths. Overall, the Utica formation outpaces in terms of lateral length (figure 1).

Figure 1: Average Lateral Length by Quarter in Marcellus and Utica Source: Energent Group

Utica Leads the Way with Longer Laterals

Within the Utica, Eclipse Resources, a pure-play Appalachian producer and deemed pioneer of the “super-lateral,” plans to increase the average lateral length by 24% in 2018, with roughly 73% of the wells expected to exceed 15,000’. Eclipse says it’s super lateral strategy reduces costs and increases ROR when compared to short lateral length wells.

The operator says it has yet to reach a “technical limit” on how far it can drill out these wells in the dry gas Utica formation. The company drilled out its first Utica super-lateral well, Purple Hayes 1H, in 2016, with a lateral length of 19,477’ under 18 days. Since then, the company’s drilled 13 more wells greater than 15,000 lateral feet, in total averaging 18,946’—all in the Utica.

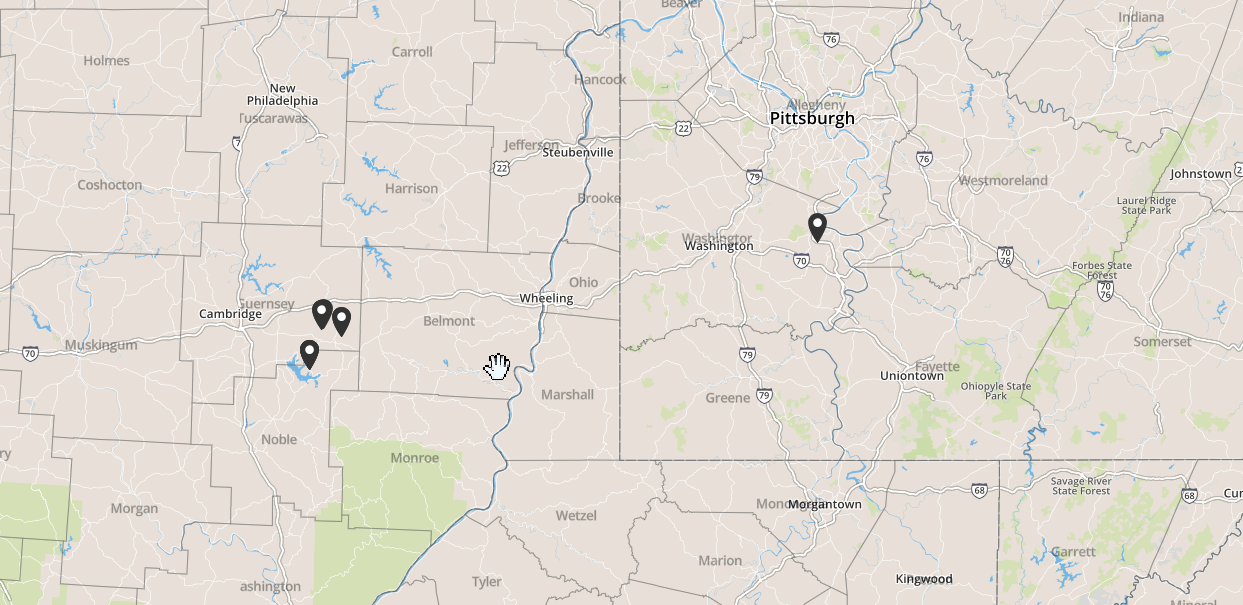

Drilling longer laterals in the Utica is achievable given the play’s less hazardous geographic structure compared to the Marcellus. Nine of the top 10 longest completed lateral wells in the Appalachian region are located in the Utica dry gas and condensate windows, concentrated around Guernsey and Noble counties (figure 2).

Figure 2. Marcellus and Utica Long Lateral Wells Source: Energent Group

Marcellus Operators – Range and EQT – Follow Suit

However, operators like Range and EQT are pushing the borders on Marcellus drilling in Q1, with Range drilling two of its longest laterals ever in the play at 17,875’ and 18,129 (coming online in Q3) and EQT drilling the longest lateral to date in the basin at greater than 18,000.’

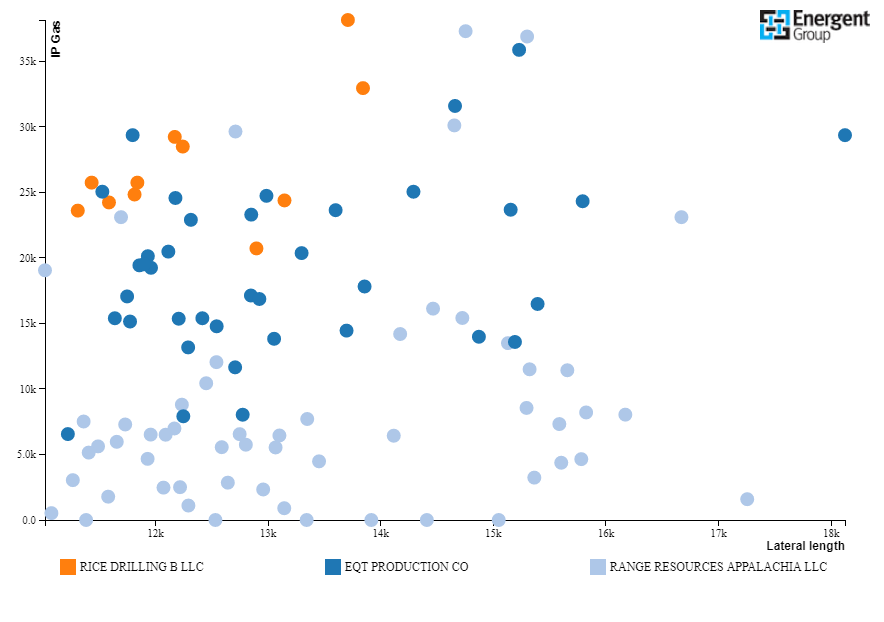

Marcellus data over the last two years show’s larger drilling jobs translating to increases in IP24 rates for gas production (figure 3). IP rates for wells drilled longer than 15,000’ in the Marcellus were roughly 5% greater than wells drilled between 11,000’ and 15,000’ for EQT and Range combined. That same calculation jumps to 8% in the Utica when examining that longest lateral drillers, Eclipse and Antero.

Figure 3. Rice, EQT, and Range Resource IP rates for Longer Laterals Source: Energent Group

EQT’s longest producing lateral in the Marcellus, Haywood H19, has been online for 120 days and is producing at a type curve of 2.4 Bcfe/1,000’ with the company expecting an EUR of close to 42 Bcfe, all while reducing normalized costs. Range says it’s longer lateral Marcellus wells are expected to improve normalized well costs and returns by about 17%.

In its 1Q18 earnings call, Range Resources said its ability to test longer laterals is benefited by its contiguous acreage position, a factor that holds true for Rice and EQT as well. The three operators rank in the top five of the Marcellus’ total permitting activity.

The question still remains as to how far these operators can drill while still preserving production. Does a 5-mile lateral represent the technical limit and the well productivity limit for Appalachia? Eclipse Resources, Range Resource, and EQT are positioned to challenge the limits.