2023 was a year of recovery in the wake of the Ukraine conflict and subsequent impact on energy prices. Norway continues to play a vital role in contributing to Europe’s energy security and saw a record volume of project approvals and planned investment. In the UK, political uncertainty combined with inflation, price volatility and fiscal stability all added to the mix of challenges for the UK sector in 2023. Despite this, merger and acquisition (M&A) activity was buoyant and some key field developments are moving forwards.

UK E&A activity to be maintained in 2024, with eight planned exploration wells targeting 325 mmboe

It was a successful year for exploration and appraisal (E&A) in the UK, with five potentially commercial discoveries from nine exploration well programme completions, with combined resources of c.140 mmboe. Over half of the discovered resource was from the largest discovery of the year, at Pensacola in the Southern North Sea (SNS). Drilling was spread across all basins with a return to drilling in the SNS and West of Shetland (WoS), which had seen no activity since 2019. Shell was the most active explorer, participating in three wells and was operator of two of the five commercial discoveries of the year, including Pensacola.

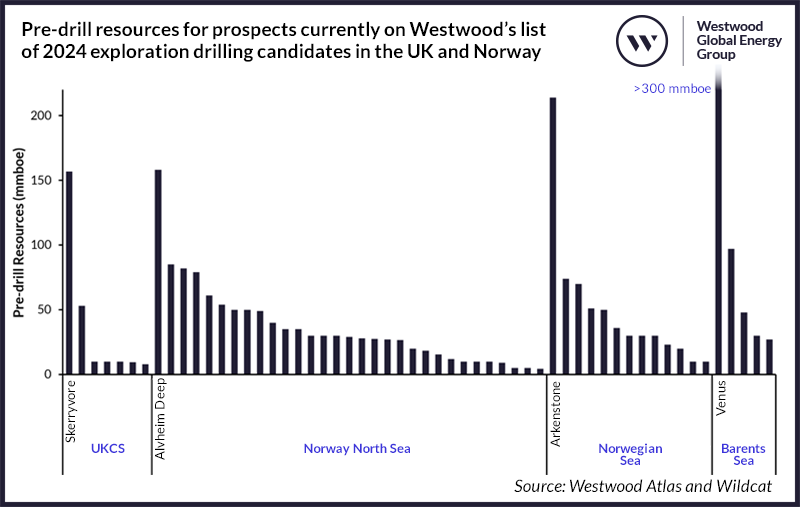

UK E&A activity is expected to be maintained in 2024. There are seven exploration wells currently on Westwood’s list of 2024 wells with pre-drill resources of c.325 mmboe (Figure 1), and a further three appraisal wells. All wells are infrastructure-led exploration (ILX), with one well also considered high impact at Skerryvore, targeting pre-drill resources of 155 mmboe. There are 13 companies expected to participate in E&A drilling in 2024, with NEO Energy and Harbour Energy being the most active.

High levels of Norway E&A activity to continue in 2024, with 49 planned exploration wells targeting 2.2 billion boe

2023 was also a successful year for E&A in Norway, with 15 commercial discoveries from 29 exploration well programme completions, with combined resources of c.440 mmboe. The largest discoveries recorded were Carmen, Øst Frigg Beta/Epsilon, Norma and Røver Sør, all in the Northern North Sea (NNS). All wells were ILX, with only four also being high impact, highlighting that companies are focusing on adding volumes to existing infrastructure, rather than drilling potentially higher risk wells. The NNS was the most targeted basin with 18 wells and was also the most successful, with c.378 mmboe in discovered resource. Only one well was drilled in the Barents Sea, the lowest since 2010. Equinor continues to be the most active explorer, participating in 21 wells and operating seven of the 15 commercial discoveries of the year.

High levels of E&A drilling are expected to be maintained in 2024. There are 49 exploration wells currently on Westwood’s list of planned wells with pre-drill resources of c. 2.2 billion boe (Figure 1), and a further six appraisal wells. The NNS will again see the most drilling, but an increase in Barents Sea activity is expected with five wells, three of which are in the Wisting area. While Equinor is likely to participate in the most wells in 2024, Aker BP and Vår Energi are both also expected to be active across all basins.

Figure 1: Pre-drill resources for prospects currently on Westwood’s list of 2024 exploration drilling candidates in the UK and Norway (note: only high impact wells are labelled where resources are >100 mmboe or targeting a frontier basin). Source: Westwood Atlas and Wildcat

2024 could be a key year for long-stranded UKCS discoveries to move forward for development

Following a change to the Energy Profits Levy terms in October 2022, some companies reacted by reducing investment plans. TotalEnergies, Apache and Harbour Energy were particularly outspoken. Despite the backdrop of political and fiscal uncertainty in the UK, there were 20 M&A deals, three fields started production and six fields were sanctioned for development with associated reserves of c.380 mmboe, including the long-awaited Rosebank project sanction.

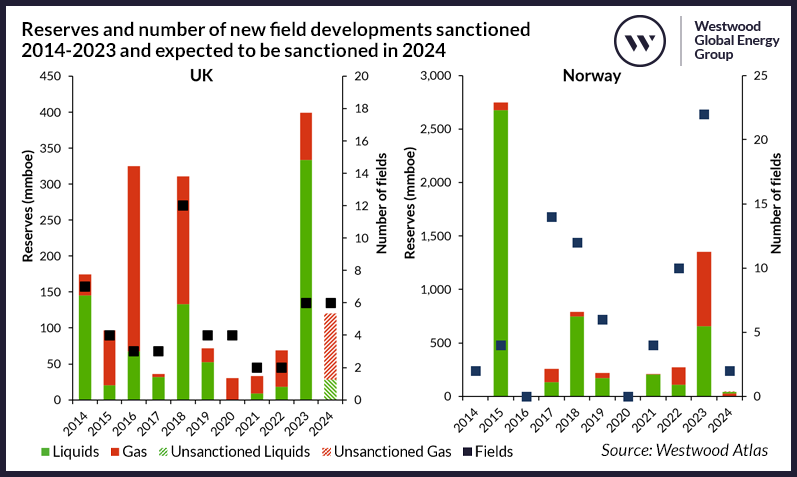

In 2024, four fields are expected to be brought onstream including the much-awaited Penguins Redevelopment, which has experienced delays to the FPSO delivery. Industry uncertainty is slowing the progression of FDP submissions and with the DESNZ review process taking longer, the number of project sanctions in 2024 is unclear (Figure 2). With only one draft FDP submitted in 2023 (for Anning & Somerville), other 2024 sanctions include fields slipping from being sanctioned in 2023 or have been included in earlier Environmental Statement submissions. FDP and Environmental Statement submissions are, however, expected for several long-stranded discoveries where asset acquisitions in 2023 have significantly increased the chance of them being brought forward for development e.g. Buchan Redevelopment, Anning & Somerville and Pilot. A key milestone for Ithaca’s Cambo development could also be reached, with the licence renewal decision by the NSTA on 31 March 2024. Ithaca could take FID in 2024 to hold onto the licence.

A General Election is expected to be called in 2024, which could see companies re-assess their individual positions in the UK E&P sector. The UK is a buyer’s market with a range of acquisition opportunities but a small pool of potential buyers. Some deals to watch include the conclusion of the Shell and ExxonMobil SNS portfolio sale, TotalEnergies rationalising its UK portfolio (e.g. sale of Laggan Tormore), and farm-out processes for Rosebank and Cambo.

Following a record year of project sanctions, Norway continues to offer growth opportunities in all aspects of the oil and gas value chain

2023 saw an enormous amount of project activity in Norway, with several field developments being brought onstream ahead of schedule and a record number of project sanctions. Seventeen PDOs, comprising 22 new field developments and four field extensions, were approved in 2023 (Figure 2), with combined reserves of c.1.6 billion boe, and estimated total development capex of c.US$26 billion. The strength of Norway’s development hopper demonstrates how effective the temporary tax breaks have been in ensuring resources are being progressed to reserves. There is a healthy level of reserves replacement over the coming years with a pipeline of field start-ups through to the latter stages of the decade. Cost management will be key during a period of continued global inflation and supply chain pressures.

Increased development in the Barents Sea has been hampered by a lack of proximity to infrastructure, and development growth will be dependent on an export route. However, there is vast resource potential identified and a desire by the Norwegian Offshore Directorate to seek commercial development solutions for existing discoveries with improved export solutions.

Although the number of M&A deals announced in 2023 was lower than 2022, the total value was significantly higher. Harbour Energy concluded the year announcing an US$11.2 billion deal to acquire Wintershall Dea, expanding its existing UK-focused portfolio and demonstrating its international growth ambitions (note: Norway accounts for c.50% of the acquired portfolio). The outlook for M&A activity in 2024 is expected to remain tight. Norway has a relatively low number of companies in operation on the shelf, with fewer opportunities coming onto the market than other countries in the region, such as the UK where the maturity of the basin and a higher number of players leads to a greater number of opportunities. Some larger players, however, could rationalise their portfolios; Equinor may continue to sell its equity in its higher emission assets, Aker BP could look to reduce its non-core assets, and PGNiG and Sval Energi are likely to continue searching for incremental growth opportunities as they build their Norwegian portfolios.

Figure 2: Reserves and number of new field developments sanctioned 2014-2023 and expected to be sanctioned in 2024 (note: Westwood holds c.320 mmboe over both phase 1 and phase 2, aligned with Equinor Environmental Statement). Source: Westwood Atlas

Emma Cruickshank, Head of NW Europe

[email protected]